Inventory selecting providers are helpful instruments for traders in search of applicable investments and timing their market entry and exit.

These providers are significantly engaging to inexperienced persons in inventory buying and selling and traders with restricted time.

This information outlines the eight greatest inventory selecting providers for 2025. Our analysis standards embody previous efficiency, status, pricing, and goal markets.

8 Finest Inventory Choosing Companies

Listed here are the most effective inventory selecting providers that will help you beat the market at the moment:

1. The Motley Idiot Inventory Advisor

Restricted Time Promotion: Get 50% off to obtain a one-year subscription for $99.

- Designed For: Purchase-and-hold traders

- Price: $199/yr

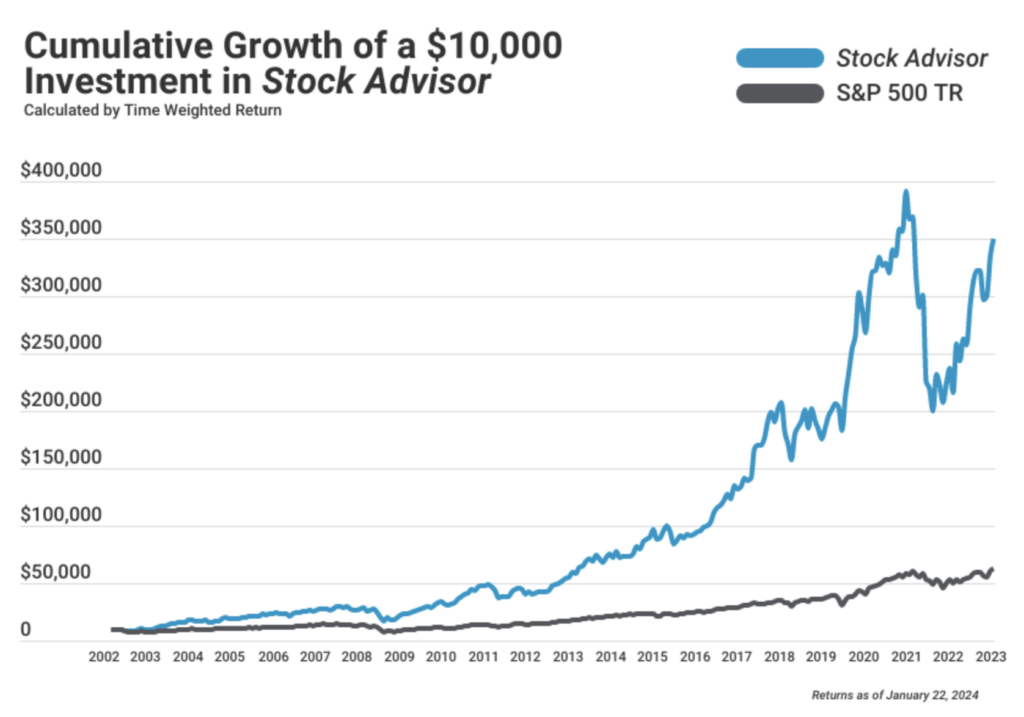

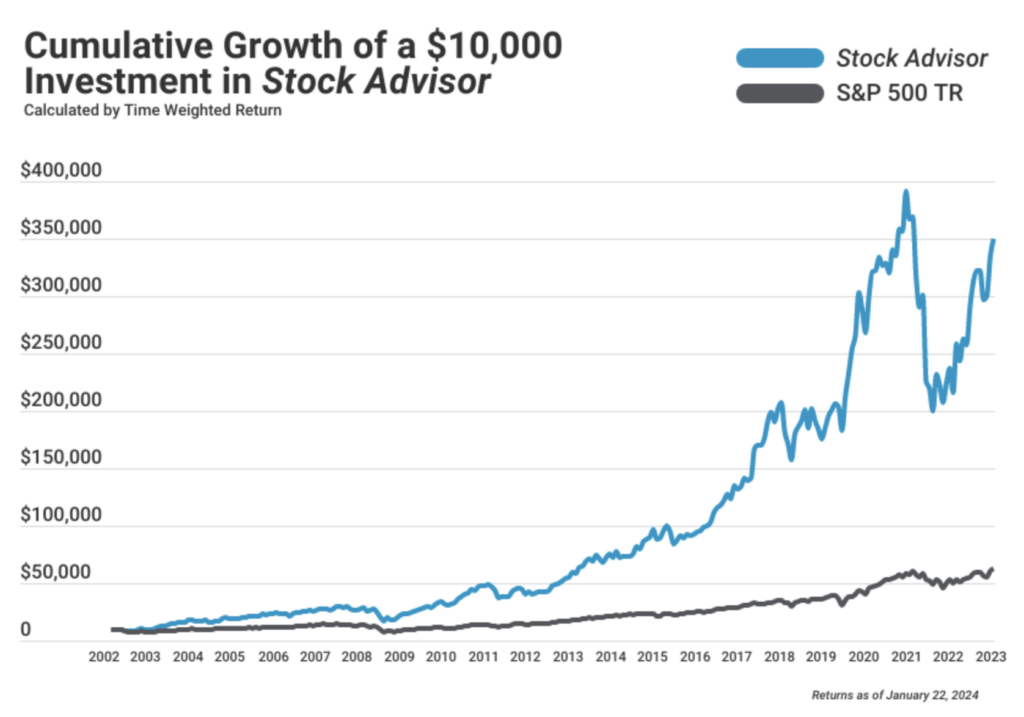

- Previous efficiency: Returns 815% versus S&P 166% (as of November 5, 2024)

The Motley Idiot has been round for roughly three many years and has earned its place on the head of the desk amongst long-term inventory pickers.

The Motley Idiot showcases that their Inventory Advisor picks have delivered practically 4 instances the returns of the S&P 500 since their inception. That’s a cumulative return of 815%, far larger than the S&P (166%). That makes for a reasonably spectacular visible:

Additional reinforcing the integrity of their strategy, they urge you to commit to a few investing rules while you enroll:

- Personal no less than 25 shares.

- Maintain your shares for no less than 5 years.

- Anticipate market downturns each 5 years.

The Motley Idiot was based in 1993 by two brothers, David and Tom Gardner. Within the many years since, the 2 brothers have written 4 bestselling books, partnered with NPR for investing radio segments, and launched a collection of wildly in style podcasts.

With over 1,000,000 subscribers, their Inventory Advisor service has carried out spectacularly by any commonplace.

The service consists of 4 month-to-month newsletters, beginning on the primary Thursday of the month after which arriving weekly.

The primary and third newsletters include a brand new inventory advice, and the second and fourth Thursday newsletters include 5 New Finest Purchase Now inventory picks. The latter comprise earlier picks that they nonetheless suggest as sturdy buys.

When market situations change, subscribers obtain “promote” advice emails in real-time. Subscribers additionally get entry to Idiot’s “Prime 10 Finest Inventory to Purchase RIGHT Now” report and their “Prime 5 Starter Shares” that they suggest for all new traders.

The Inventory Advisor subscription prices $199 per yr. However for a restricted time you will get 50% off to obtain a one-year subscription for $99. With its 30-day money-back assure, you’ll be able to attempt a complete month-to-month cycle earlier than deciding whether or not to proceed.

For extra data, see our full evaluate of The Motley Idiot Inventory Advisor and its providers.

2. Searching for Alpha Premium

- Designed For: Purchase-and-hold traders, day merchants

- Price: $239 per yr

- Previous Efficiency: Beats the S&P 500 yearly

Restricted Time Supply: New Searching for Alpha Premium subscribers can obtain $25 off

Searching for Alpha Premium is a robust package deal of market intelligence instruments designed that will help you change into the most effective investor or dealer — or each — you’ll be able to probably be.

Searching for Alpha Premium delivers:

- Limitless entry to premium content material created and curated by Searching for Alpha’s deep secure of knowledgeable contributors

- Searching for Alpha Writer Rankings and Writer Efficiency Metrics

- Proprietary quant scores can be found nowhere else

- Limitless earnings name audio and transcripts

- Highly effective inventory screeners

- Article sidebars with key knowledge, charts, and scores

- Monitoring for every funding thought’s efficiency

- And rather more

3. Commerce Concepts

- Designed For: Day merchants

- Price: $84/month – $167/month

- Previous efficiency: Common returns of 20% yearly

The software program platform Commerce Concepts makes use of a synthetic intelligence named “Holly” to generate real-time commerce suggestions for subscribers. Made up of greater than 75 proprietary algorithms, Holly runs greater than 1 million simulated trades every evening earlier than the buying and selling day begins.

She then proposes inventory commerce picks in real-time, together with beneficial entry and exit factors. That delivers a whole day buying and selling plan for every decide.

Commerce Concepts additionally options its personal inner dealer, so you’ll be able to authorize Holly to execute trades in your behalf moderately than shopping for or promoting manually by means of your personal separate brokerage account. You too can hyperlink exterior accounts with Interactive Brokers and E*Commerce to have all of your trades in a single place.

One significantly good function that Commerce Concepts consists of is their simulated buying and selling choice. It permits you to commerce with faux cash and construct your consolation stage earlier than you begin slinging your hard-earned money across the market.

4. Moby

- Designed For: Inventory and Crypto Merchants

- Price: $8.33 per 30 days to $29.95 per 30 days

- Previous Efficiency: Over 250%

Moby Finance was based in 2020 to make complicated investing data accessible and simple.

Content material on Moby is knowledgeable by the experience of former hedge fund analysts, who supply insights which might be suited to starting inventory traders and extra seasoned merchants.

A Moby subscription comes with a complete lineup of providers, together with weekly inventory picks, market alerts, programs and classes, newsletters, and rankings. Moby notes that its common Premium picks have returned over 250%.

It additionally has a superb Trustpilot score and a bunch of optimistic opinions highlighting its straightforward person expertise, partaking reviews, and stable inventory picks. New customers can at the moment get monetary savings by buying an annual subscription for $179.

5. Inventory Market Guides

- Designed For: Swing merchants, long-term traders

- Price: $49/month

- Previous efficiency: Beats the S&P 500 yearly

Inventory Market Guides is constructed on a proprietary backtesting software program that has been used to investigate over 10 million shares and choices utilizing Finhub and EODHD knowledge.

All the platform’s picks have traditionally overwhelmed the typical return of the S&P 500. The typical backtested return for the Pre-Market Inventory Picks and Market Hours Inventory Picks is 72% and 89%, respectively.

When you subscribe to the service and choose your commerce size preferences, Inventory Market Guides will begin emailing you day by day alerts. There’s additionally a e-newsletter that includes buying and selling evaluation, and you may entry commerce alerts out of your dashboard.

Every alert options the historic efficiency of the inventory or choice being beneficial. The platform additionally gives tutorials on totally different buying and selling methods, resembling its specialty, swing buying and selling.

You’ll be able to subscribe to 4 forms of alerts, together with pre-market inventory picks and choice picks, and market hours inventory picks and choice picks. Every one prices $49/month, and you may cancel at any time.

6. Conscious Dealer

- Designed For: Swing merchants

- Price: $47 per 30 days

- Previous efficiency: Common returns 141%

The fantastic thing about Conscious Dealer is that you just don’t want to remain on standby ready for commerce alerts consistently, making it the most effective inventory selecting providers.

The beneficial swing trades take as much as 10 days between shopping for and promoting, so you should buy anytime through the buying and selling day. That’s a vital perk given that the majority of us can’t glue our eyeballs to the display all day ready for alerts to pop up.

Eric Ferguson, the founding father of Conscious Dealer, put many years of inventory market knowledge by means of statistical evaluation to create an algorithm that alerts him — and also you — to high-probability market actions. He consists of inventory trades, futures trades, and choices trades. Extra lately, he additionally added a inventory equal to his futures trades, so you’ll be able to mimic them even for those who don’t wish to trouble with buying and selling futures.

Eric updates his web site for logged-in subscribers when he executes a commerce, so you are able to do the identical in your personal brokerage account. He makes nearly all of his trades throughout the first half hour of the markets opening every single day, so you’ll be able to merely examine the positioning as soon as day by day. These swing trades aren’t practically as time-sensitive as sooner day trades.

I additionally just like the backtest evaluate of Conscious Dealer’s hypothetical returns. Over the past 20 years, Eric’s buying and selling system would have yielded a median annual return of 141%. You’ll be able to view the year-by-year return breakdown right here.

I’ve personally been following Eric’s trades for round 9 months now. Throughout that point, I’ve earned an annualized return of 31.2%.

That doesn’t imply you received’t have losses some months. All merchants know the stomach-dropping feeling of a string of shedding trades. In Eric’s backtests, the median account drawdown was 24%.

That’s nothing to take calmly. I can personally attest to how jarring it’s to go from hundreds of {dollars} up for the month to hundreds of {dollars} down, all inside a window of only a few days.

Conscious Dealer costs a month-to-month subscription payment of $47. Though not low cost per se, it’s cheaper than many opponents. The month-to-month billing interval means you’ll be able to attempt it for a month or two after which cancel with out shedding a fortune for those who don’t just like the buying and selling fashion.

7. WallstreetZen

- Designed For: Half-time traders

- Price: $19.50 per 30 days billed yearly

- Previous Efficiency: not disclosed

WallstreetZen is for the intense investor who isn’t fairly a monetary knowledgeable. Past merely shoving knowledge in your face, WallstreetZen breaks it down, making it helpful for on a regular basis traders.

Traders have entry to Zen scores, that are firm scoring fashions made straightforward. Primarily based on 38-data factors, WallstreetZen helps traders discover corporations with nice stability sheets, vibrant futures, and excessive yields.

Traders get entry to one-line explanations of a inventory’s efficiency, permitting you to make intuitive and quick investing choices. You too can filter analysts, solely seeing reviews from analysts you belief and with a confirmed historical past. Get as detailed as seeing an analyst’s previous efficiency historical past to find out the validity of what they recommend.

Different advantages embody:

- Intuitive inventory screener

- One-sentence explanations about inventory strikes

- Entry to analysts with confirmed observe data

8. Zacks

- Designed For: Technical merchants

- Price: $249/yr to $2995/yr

- Previous Efficiency: 24.32% per yr

Zacks Funding Analysis is without doubt one of the most well-known inventory selecting providers. They supply technical and basic analyses and entry to inventory analysis reviews, earnings estimates, and portfolio administration instruments.

The founder, Len Zack, created a scoring system that ranks shares on a scale of 1 to five primarily based on 4 components:

- Settlement

- Magnitude

- Upside

- Shock

Zacks covers shares, mutual funds, and ETFs, masking over 10,000 shares. Zacks has a free plan that gives entry to restricted articles, e-mail alerts, and Zank Ranks and Types Scores.

The paid variations present entry to inventory screeners, suggestions, and Zack’s rating record. Nevertheless, Zack’s doesn’t present customized suggestions, and the platform is just for analysis; it doesn’t work with any platforms, so you should execute the trades your self in your chosen platform.

What are Inventory Choosing Companies?

Inventory-picking providers do precisely what they sound like — they decide particular shares they consider will outperform the broader inventory market. They suggest that you just act on or ignore these shares as you see match.

They sound simple, and they’re, however many new traders confuse them with similar-sounding providers.

For instance, inventory screeners are instruments that make it easier to filter down the hundreds of accessible shares to a manageable few primarily based in your exact standards.

Inventory scanners, whereas associated, are one other kind of on-line investing instrument that streams stock-related knowledge and alerts in real-time.

And, in fact, on-line stockbrokers supply the precise mechanism for getting and promoting shares on-line.

Remember these providers typically overlap. Most stockbrokers supply inventory screener instruments. Some inventory screeners supply real-time inventory scanning.

What to Search for in Inventory Choosing Companies

As with all the pieces else, some stock-picking providers are higher than others, and everybody has totally different causes for his or her selection of the most effective stock-picking service.

However inventory pickers don’t merely differ primarily based on high quality. In addition they differ in focus.

Many specialise in serving day merchants or swing merchants, serving to them determine shares poised to leap or drop sharply that day or throughout the next week. Others serve long-term buy-and-hold traders, recommending shares they consider will develop shortly within the years to return.

Initially, search for inventory pickers with a powerful observe report of beating the market. No inventory picker will get each name proper, however the astute ones show to be proper way more typically than fallacious.

Earlier than taking funding recommendation from any inventory picker, confirm their bona fides within the type of a observe report. Examine their picks’ returns to the market at massive every time doable. It doesn’t matter if their picks noticed 30% progress final yr if the market grew by 35%.

The longer that observe report, the higher. Search for expertise in your inventory pickers, as a yr or two of excellent picks might come all the way down to luck. Twenty years of sturdy picks point out talent.

Take an in depth take a look at inventory pickers’ integrity as properly. Moral and clear inventory pickers by no means mislead their viewers by recording commerce wins however by leaving shedding trades open, for instance, and solely reporting the closed wins.

Likewise, they by no means report income earlier than having them executed and in hand. They don’t declare wins for hypothetical historic income they didn’t really earn, saying, “Our system would have earned a 1,000% revenue during the last ten years!”

Search for credibility and transparency indicators like free trial intervals and money-back ensures. It all the time helps to attempt a service earlier than committing your cash completely.

Lastly, ensure you perceive their stock-picking technique. Respected inventory pickers clarify their strategy and the info evaluation they use, so do your homework to grasp the inventory picker’s methodology and guarantee it aligns together with your private investing objectives.

Benefits of Inventory Choosing Companies

Should you aren’t certain if stock-picking providers are best for you, contemplate these benefits.

- Nice for inexperienced persons: Traders unsure the place to begin or what knowledge to make use of can profit from inventory pickers. You observe what the service tells you to spend money on and get a hands-on lesson on investing.

- Passive investing: If you wish to spend money on shares however don’t have the time to be a day dealer, stock-picking providers can assist you select your shares quick, letting your portfolio develop with out an excessive amount of effort.

- Recommendation from consultants: It’s not typically you will get knowledgeable recommendation at a fraction of the price of what it could price to work with them in particular person. With inventory picks despatched on to you, it’s a lot simpler to select your shares confidently, figuring out you have got the backing of the consultants.

Inventory Choosing Methods

The very best stock-picking providers every have their very own stock-picking methods, however listed here are a few of the most typical.

Elementary Information

Elementary knowledge is simple for even the start investor to grasp and focuses on gross sales, earnings forecasts, gross margins, competitor evaluation, and revenue progress. This focuses on a inventory’s true worth. When a inventory’s value falls beneath its worth, stock-picking providers will usually recommend shopping for it.

Sentiment Information

Typically inventory costs are pushed by how society thinks, and that’s why some providers use sentiment knowledge. Whereas this isn’t something technical or basic and shouldn’t be the one methodology used for stock-picking, it could play a task, particularly when the sentiment is excessive, and the inventory has the potential to outperform its predictions.

Technical Information

Technical knowledge is for the skilled investor who needs to get into the nitty-gritty of the inventory’s historic efficiency. It doesn’t concentrate on a inventory’s true worth however as a substitute on its historic patterns and predictions.

Ultimate Phrase

Your chance of success as a day or swing dealer is determined by the standard of your data. Well timed, correct data makes revenue doable for merchants; with out it, beating the market is subsequent to unimaginable.

However past up-to-the-second monetary alerts, merchants and long-term traders alike additionally need assistance narrowing the sector from hundreds of shares to a handful. That’s the place inventory selecting providers come in useful.

And, in fact, they assist in offering training. Buying and selling or investing in particular person shares isn’t passive and simple like index fund investing. It requires deep data and talent, and good inventory selecting providers present not simply alerts and watchlists however a replicable system that any dealer or investor can observe.

The promise is that for those who observe the system, you’ll be able to beat the market.