One in every of our favourite methods to redeem transferable bank card factors is to switch them to airline and lodge accomplice applications.

When you can redeem factors by many bank card applications’ journey platforms to e book flights and lodge stays, you may solely get a set redemption worth when redeeming your rewards by the journey platform. For instance, while you redeem Capital One miles by the Capital One Journey portal, you may get a worth of 1 cent per mile.

In the event you needed to e book this one-way flight from New York’s LaGuardia Airport (LGA) to Fort Lauderdale-Hollywood Worldwide Airport (FLL) by the Capital One Journey portal, it could price you $98 or 9,810 Capital One miles.

When you could also be saving your self an out-of-pocket price of just about $100, TPG values Capital One miles at 1.85 cents apiece, per our November 2024 valuations. Due to this fact, as an alternative, contemplate transferring your rewards to an airline or lodge accomplice program the place you may simply receive a worth of greater than 1 cent.

Nonetheless, there’s an important rule to concentrate on earlier than you switch your bank card rewards.

Associated: Final information to Capital One airline and lodge switch companions: Learn how to maximize your miles

Bank card factors and miles transfers can’t be reversed

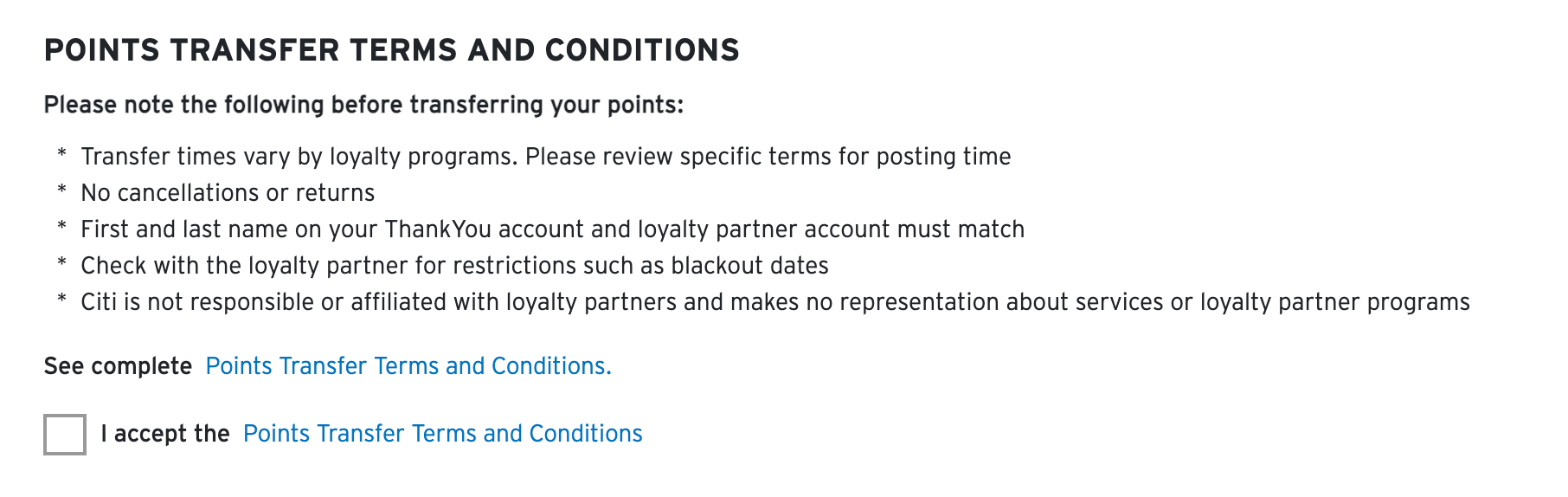

When initiating a factors or miles switch from a bank card program to an airline or lodge accomplice, you will need to comply with the phrases and situations of the switch. These ought to specify, as Citi ThankYou Rewards does, that switch instances range and that transfers can not be reversed.

Due to this fact, in case you resolve to switch your bank card rewards and the flight or lodge availability modifications and/or disappears, you, sadly, can not transfer your factors or miles again to the bank card program you transferred them from. The switch accomplice won’t reverse the switch on request, nor will the bank card program, and the factors might be “caught” in that program.

Associated: Citi switch companions: Maximize your ThankYou factors with these loyalty applications

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

To assist mitigate a few of this switch “threat,” it is best to at all times test award availability earlier than initiating any transfers. We additionally suggest you join airline and lodge loyalty applications effectively upfront of any switch and never the day of, as this will likely scale back the prospect of any important delays. Additionally, you should definitely test that the identify in your bank card and the identify in your airline or lodge loyalty account are the identical.

Whereas now we have discovered that the majority program transfers are instantaneous, some applications take greater than 48 hours for the transaction to be full. Plus, switch instances can range from individual to individual.

Associated: Examine switch instances earlier than initiating factors switch requests

Bank card rewards applications often provide switch bonuses, and it’s possible you’ll be tempted to benefit from these promotional affords even when you do not have a right away redemption in thoughts. Whereas some frequent vacationers are fantastic with stockpiling additional rewards as a result of they know they will use them within the close to future, there’s a threat on this technique. Though it’s possible you’ll improve your loyalty account stability by 20% or 30% by a switch bonus, applications regularly devalue their award redemptions. Plus, discovering availability to make use of these factors or miles could also be onerous to seek out.

Due to this fact, a greater technique could also be to stockpile bank card rewards factors in your account and solely transfer them while you act on a redemption alternative.

Backside line

Whereas we often encourage and advise individuals on one of the best switch choices for his or her bank card factors and miles, we don’t suggest transferring any bank card factors or miles to airline or lodge accomplice applications till you have got a selected use for them. For instance, simply because transferring bank card factors to Air Canada’s Aeroplan program will be an effective way to e book United Airways flights does not imply it is best to switch all of your bank card factors or miles to Aeroplan.

Once more, bank card journey accomplice transfers can’t be reversed.