If you promote an funding, shares, Mutual Funds(Debt and Fairness), actual property, gold you may get Capital Features or Capital Loss. These are taxable and need to be reported in ITR within the monetary yr once you made the sale. To assess your tax legal responsibility and file your tax returns accurately, you could know what capital beneficial properties you earned throughout the monetary yr. For Fairness, Debt Mutual Funds you may get it from the Capital Achieve Statements by the Registrar and Switch Brokers or Mutual Fund corporations. This submit is about easy methods to get your Capital Features assertion when you’ve got your e-mail id registered in your Mutual Fund folios.

Capital Features of Mutual Funds, Tax, ITR

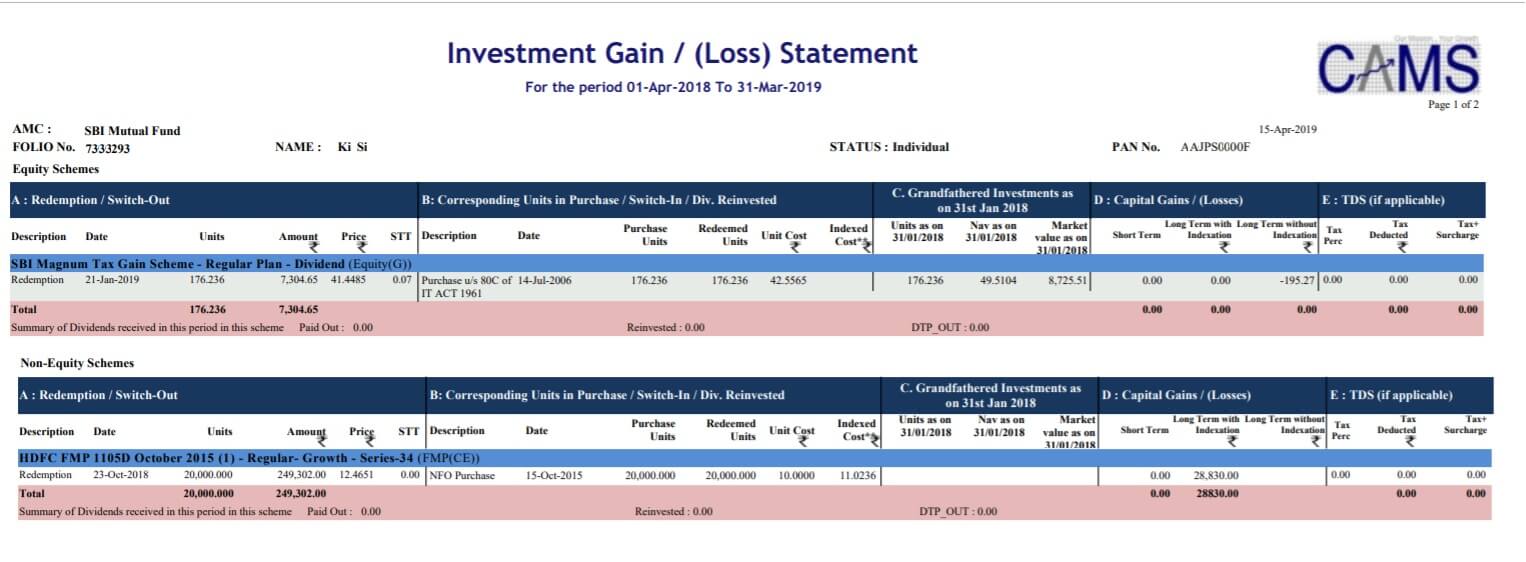

Capital Achieve Assertion is required for each Common and Direct Plans. Pattern Capital Achieve Assertion for Fairness(which incorporates grandfathering) and Non Fairness/Debt Mutual Funds(which incorporates Long run capital Achieve with Indexation) is proven beneath. Is also proven a picture exhibiting Capital Achieve in Debt Mutual Funds in ITR

Capital Features and Mutual Funds

Each short-term and long-term are outlined in numerous methods for various asset courses (see the picture beneath to grasp this higher). Not solely is short-term totally different for various property, however the tax charges additionally fluctuate too.

- Mutual funds are taxed primarily based on asset categorization and period of the funding.

- Fairness oriented mutual funds have a short-term capital beneficial properties tax of 15 per cent for a holding interval of as much as 12 months. Past that, long-term capital beneficial properties tax of 10 per cent is relevant for beneficial properties (from fairness oriented mutual funds and fairness shares) over ₹1,00,000.

- Debt mutual funds are taxed as per your earnings slab for investments held for as much as 36 months. After that, long-term capital beneficial properties tax of 20 per cent applies, after adjusting for inflation.

- Fairness-linked financial savings schemes are eligible for tax deduction as much as ₹1,50,000 every year

- Dividends are taxable within the fingers of buyers.

- TDS @10% for resident investor and @20%(plus relevant surcharge and cess) for non-resident investor shall be deducted by the mutual fund on dividend distributed

Following is the tax remedy for Capital Features on mutual funds:

Note: Within the instances of Debt Mutual Funds, Floater Funds, Conservative Hybrid Funds, and Different Funds (the place Fairness funding is <=35%), that are bought on or earlier than thirty first March 2023, the long-term capital beneficial properties will probably be taxed at 20% with Indexation.

| Kind of Mutual Fund | Brief-Time period Capital Features | Lengthy-Time period Capital Features |

| Fairness Mutual Funds (funds which make investments >65% in Fairness) |

15% beneath part 111A | Upto INR 1 lakhs- NIL Above INR 1 lakhs – 10% beneath part 112A |

| Aggressive Hybrid Funds (the place Fairness funding is 65% to 80%) |

15% beneath part 111A | Upto INR 1 lakhs- NIL Above INR 1 lakhs – 10% beneath part 112A |

| – Debt Mutual Funds – Floater Funds – Different funds (which make investments <=35% in Fairness) |

Slab charges | Slab charges |

| Conservative Hybrid Funds (the place Fairness funding is 10%-25% and Debt is 75%-90%) |

Slab charges | Slab charges |

| Balanced Hybrid Funds (Fairness is 40% – 60% and Debt is 60% – 40%) |

Slab charges | 20% with Indexation |

| Different Funds (the place funding in Fairness is >35% however <65%) |

Slab charges | 20% with Indexation |

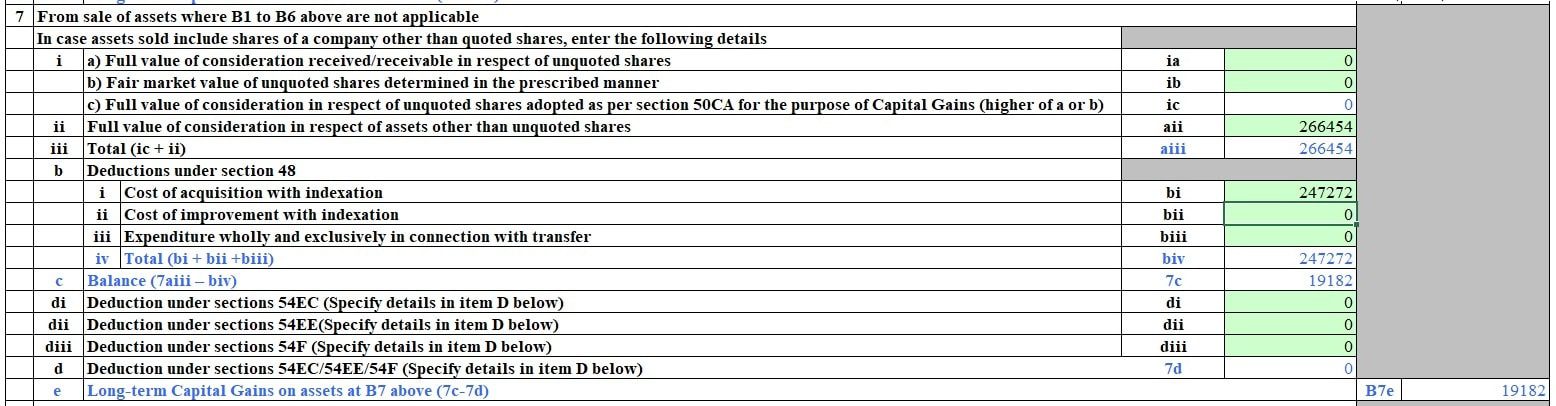

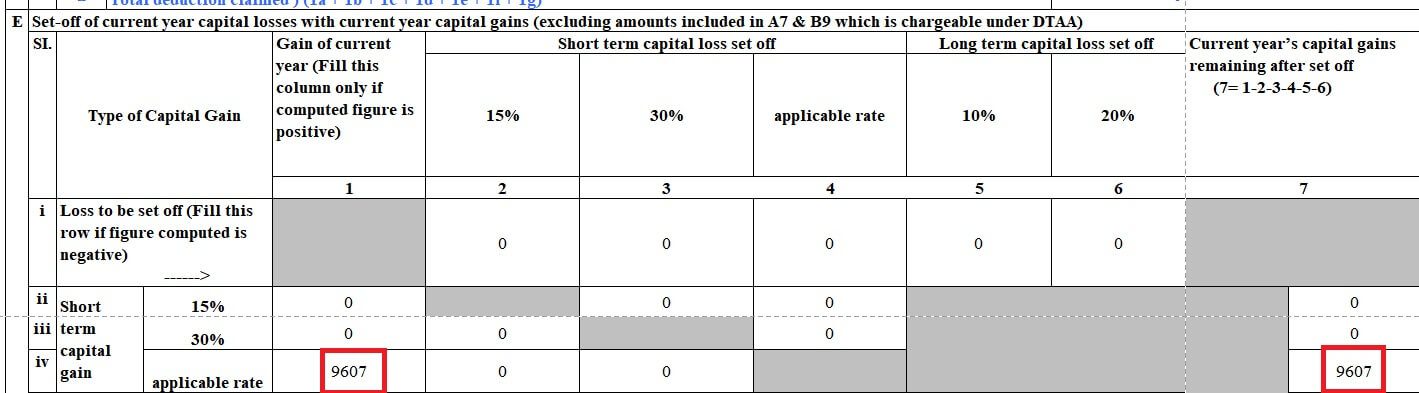

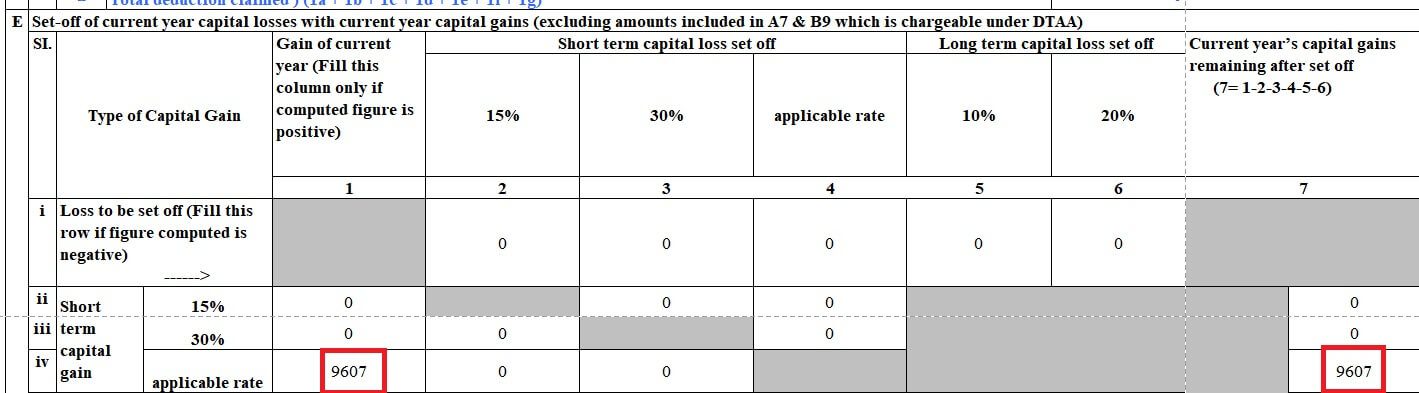

The Capital Features(Each Lengthy/Brief) need to be proven in ITR. The picture beneath reveals how Long run Capital Features of Debt Mutual Funds are reported in ITR. It’s from our article how Long run Capital Features of Debt Mutual Funds: Tax and ITR

Brief Time period Capital Features on Debt Mutual Funds If You promote debt mutual funds inside 3 years, capital beneficial properties on debt funds will probably be handled as quick time period. It is going to be added to your earnings and taxed as per your relevant tax slab. The picture beneath reveals the relevant price on Brief Time period Capital Features on Debt Mutual Funds

in CG Schedule, Part E, Test Brief time period capital acquire for Debt Mutual Funds is as per your earnings slab

R&T Brokers of various Mutual Funds

Registrar and Switch Brokers or RTAs are SEBI accepted intermediaries who deal with the paperwork or back-office operations of Mutual Funds corresponding to folio statements of items purchased and bought by the investor in order that Mutual Funds can concentrate on the funding administration and advertising and marketing components.

Many of the Mutual Fund corporations have both CAMS or KARVY as their RTA. The exception is Sundaram MF who does it itself i.e. they’re their very own RTAs.

Our article Mutual Funds: Registrar and Switch Agent: CAMS, Karvy explains Who’re Registrar and Switch Brokers? How do Registrar and Switch Agent assist Mutual fund corporations and Mutual Fund buyers by taking good care of the paperwork? Mutual fund buyers do quite a few transactions on any given day corresponding to purchase, promote or change items. They might additionally request for a financial institution mandate change or an handle change.

| CAMS | Karvy | Others |

|

|

Sundaram BNP Paribas Fund Companies

|

Our The best way to promote or redeem Mutual Fund Models: On-line, Exit Load, Lower off, SIP talks about The best way to redeem mutual fund items? on-line or offline? What’s the quantity one will get on redeeming the mutual fund items Redeeming Mutual Funds Models in SIP or Lump Sum, How will you get your cash or redemption proceeds? When will you get the redemption quantity?

Get Consolidated Capital Features Assertion

You probably have invested in Mutual Funds, then you should use Capital Features Reviews mailback service offered by RTAs like CAMS and KARVY. It doesn’t matter when you’ve got invested in Common funds or direct Fund, or you will have invested straight or by means of the dealer, or you will have invested on-line or offline. All it requires is your e-mail id. You may get it from the person Mutual Fund firm too. The benefit right here is that you just get Achieve Assertion for all of the Mutual Funds providers by that RTA in a single place. In case you don’t have any investments with Sundaram, you solely must get the Capital Features report from two locations – CAMS and KARVY.

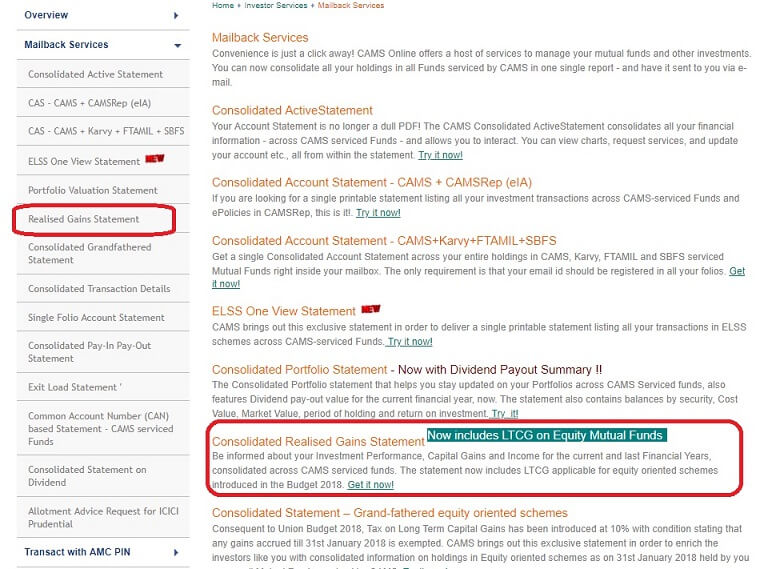

The best way to get Consolidated Capital Features Report of Mutual Funds from CAMS

Step 1. Go to CAMS Investor Mailback Companies right here –

https://www.camsonline.com/InvestorServices/COL_ISMailBackServices.aspx

Step 2. Click on on Consolidated Realised Features Assertion or Realised Features Assertion marked by purple containers within the picture beneath.

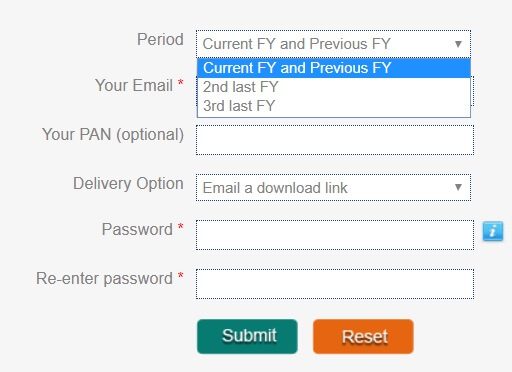

Step 3. You’d see the picture much like one proven beneath. The fields marked with purple star Your E-mail, Password, Reenter Password are obligatory. Fill out the required particulars, For which Monetary Yr, E-mail id, PAN which is non-obligatory as proven beneath.

PAN is non-obligatory however in the event you present your PAN quantity then it is going to additionally embrace these investments beneath your PAN the place you will have not registered your e-mail id.

For the interval you may select,

- Present FY and Earlier FY(the default choice). If you get it there can be two Capital Features Assertion (each with the identical password) – one for present FY and one for earlier FY.

- You want Present Finacial Yr for Advance Tax

- You want Earlier Monetary Yr for Earnings Tax.

- 2nd Final FY

- third Final FY.

For e-mail enter the e-mail id registered in your funding folios. The report will probably be despatched to this email-id solely. When you enter the e-mail id you will notice the choices of all Your mutual funds or you may choose the Mutual Fund.

- Choose ‘All My Funds’. (This selection will come after you have entered the e-mail id).

- Supply choice: We favor E-mail an encrypted attachment

- E-mail a obtain hyperlink

- E-mail an encrypted attachment.

- Password: That is the password for opening the attachment. Set it to one thing which you’ll be able to keep in mind. Don’t set it to 12345678.

- Retype the password and hit Submit.

You capital acquire Assertion will probably be emailed to you in a while(round half-hour) to the registered e-mail id you offered. Mail

- You’ll be able to seek for it with sender title ‘CAMS Mailback Server’.

The best way to get Consolidated Capital Features Report of Mutual Funds from KfinTech

Step 2 In Interval, choose the Monetary Yr (FY) as Earlier Yr.

Step 3 Enter your private E-mail handle and PAN. The report will probably be despatched to this e-mail handle.

Step 4 Underneath the Mutual Fund part choose All Funds or Related Fund.

Step 5 Underneath the Assertion Format part, choose Excel

Step 6 Enter a desired password in Password and Verify Password fields. The capital beneficial properties will probably be password protected with the password you enter right here.

Step 7 Click on on Submit. You’ll obtain your capital acquire report in your private e-mail. Obtain the report.

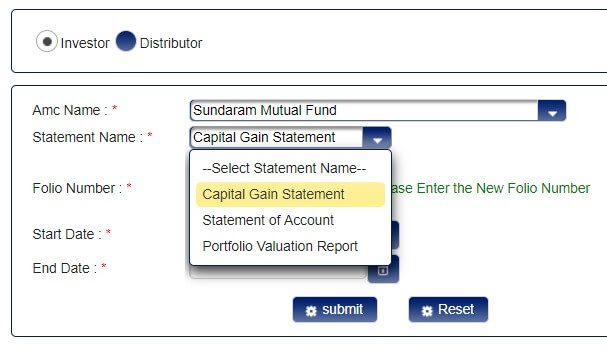

The best way to get Capital Features Assertion from Sundaram Mutual Fund

The method of getting Capital Achieve Statment from Sundaram Mutual Fund Home is similar as that for some other Mutual Fund firm. It’s totally different from that of CAMS and Karvy because it requires the Folio Quantity.

When a mutual fund investor purchases a fund, a folio quantity is assigned by the asset administration firm to your funding. You might be required to cite the folio quantity to search out out the worth of your investments or on the time of any transactions. Nonetheless, there isn’t any restriction on the variety of folios. An investor may also have totally different folio quantity for various funds throughout the identical fund home.

Go to the Mutual Fund web site for instance for Sundaram: https://www.sundarambnpparibasfs.in/net/service/estatements/

Fill within the particulars as proven within the picture beneath.

Associated Articles:

- The best way to promote or redeem Mutual Fund Models: On-line, Exit Load, Lower off, SIP

- Brief Time period Capital Features of Debt Mutual Funds,Tax, ITR

- Capital Achieve Calculator from FY 2017-18 with CII from 2001-2002

- DDT on Dividends of fairness mutual funds, LTCG,Development or Dividend choice

- RSU of MNC, perquisite, tax , Capital beneficial properties, eTrade

- Fundamentals of Capital Achieve

- Mutual Funds: Registrar and Switch Agent: CAMS, Karvy

Hope this helped you to grasp how mutual funds are taxed, easy methods to get the capital acquire assertion of mutual funds from CAMS, Karvy and Sundaram Mutual Funds.