In direction of the top of final week, US-based fintech, cred.ai, launched an entire new sort of bank card expertise. Not heard of cred.ai? That’s not shocking, as the corporate claims to have been in “stealth mode” for the previous three years. Now although, it’s able to launch its revolutionary bank card to the lots. Or to beta customers, no less than.

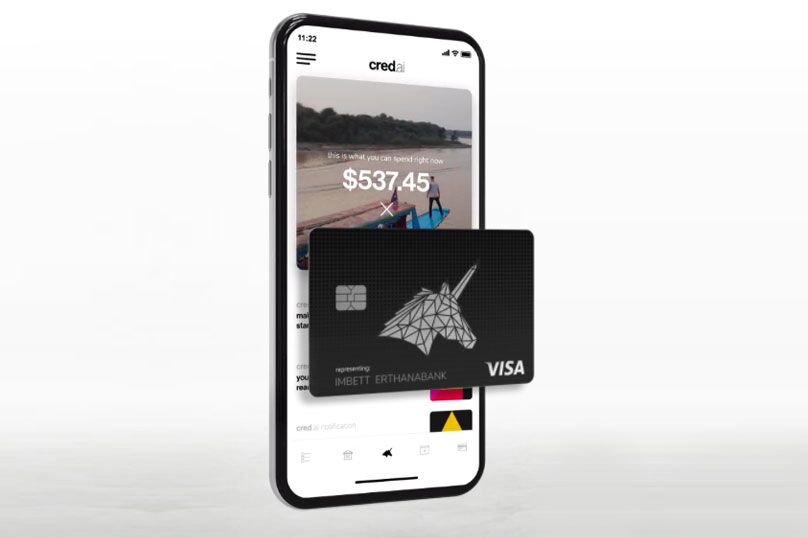

On the core of cred.ai’s providing is the Unicorn Card Visa bank card, which, when used together with an FDIC insured deposit account and the cred.ai cell app, is designed to “give customers first-of-their-kind controls, comfort, and automated credit score rating optimisation”. Sounds fairly neat. So how does it work – and what precisely does it provide?

In keeping with the corporate’s website,

“credit score.ai is a high-tech and premium on a regular basis card spending expertise, 100% cell with a free steel card. With the cred.ai assure you by no means pay charges or curiosity, by no means overspend, construct credit score routinely, and spend your paycheck early, with innovative tech you may’t get wherever else.”

Let’s begin unpacking all that then.

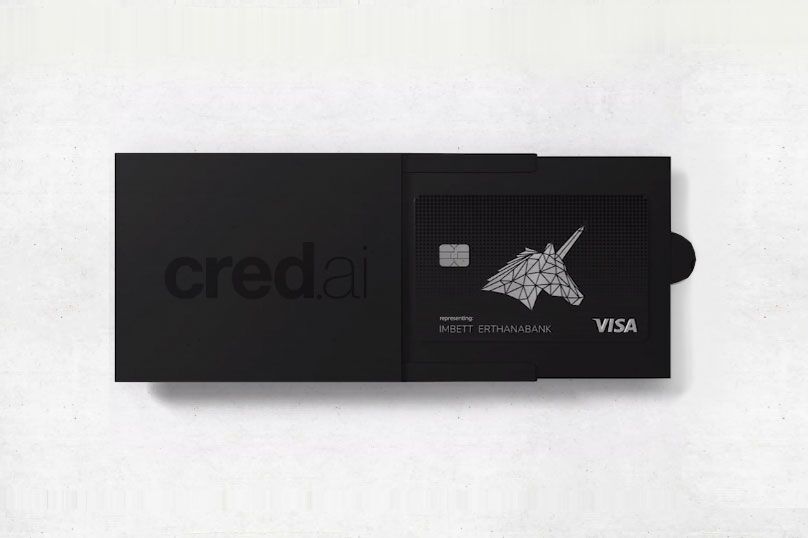

Picture credit score: cred.ai.

Who Is cred.ai?

Even dwelling in Australia, many people have heard of the large banks that decision the US dwelling. JP Morgan-Chase, Financial institution of America, Wells Fargo. What we’ve not heard of, nevertheless, is cred.ai. So, the place did this group of self-confessed oddballs come from?

Together with David Adelman, CEO Ry Brown based cred.ai three years in the past, drawing collectively a staff of hackers, artists, scientists, and a few “recovering bankers”, who simply so occur to be the founders of ING Direct.

Realizing that the banking business was notoriously troublesome to innovate in, Adelman and Brown wished to push the boundaries to create one thing that was new and modern. “Banking is so regulated, so antiquated, so daunting, it’s comprehensible why shopper card merchandise have barely modified over the previous decade,” Brown says.

But it surely appears cred.ai was as much as the problem. “Our outsider perspective has been one among our biggest belongings. We’re not imprinted with conventional ideas of what’s attainable or anticipated, so we get to consider we are able to sort out any concept we dream up, so long as we have now sufficient espresso.”

How Does It Work?

Except for Apple Card, launched final yr, there was little or no innovation within the bank card business in recent times. So as a substitute of searching for to observe what already existed there, cred.ai’s founders seemed to monetary know-how firms equivalent to PayPal and Venmo for inspiration.

“We realised early on, that if you wish to construct one thing that adjustments folks’s lives, you have to really construct,” cred.ai chief banking officer Lauren Dussault says. “The explanation each financial institution and fintech card gives such sparse, an identical options is as a result of they’re mainly white-labelling the identical inventory platforms with a distinct emblem.”

Effectively then, how does cred.ai’s providing work? To get began, you join cred.ai’s bank card – the Unicorn Card Visa – issued by WSFS Financial institution. From there, you conform to let the corporate’s AI handle your spending. Because of this, the corporate guarantees you’ll by no means pay charges or curiosity, and it’ll routinely make it easier to construct your credit score rating.

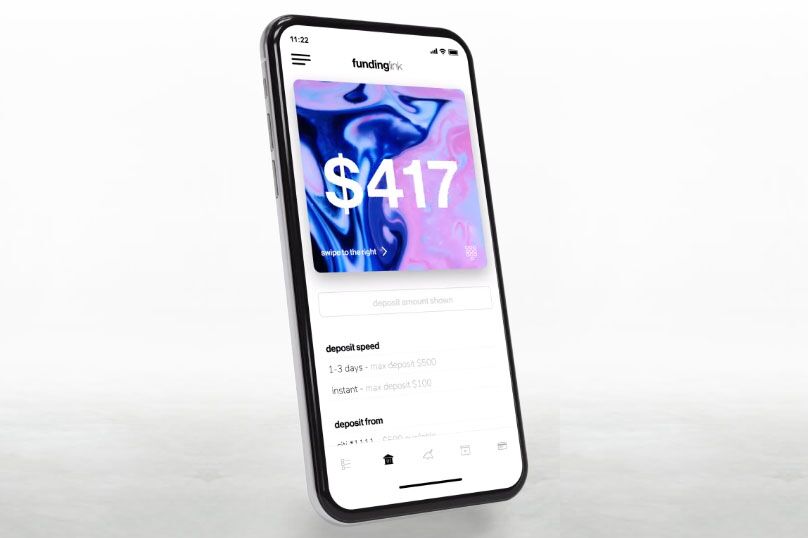

Picture credit score: cred.ai.

Like Apple Card, the Unicorn Card is steel, which in itself feels fairly good. However, what’s on provide right here goes manner past appears to be like. What’s most spectacular concerning the card is its companion app, which mainly permits you entry to the cardboard’s many futuristic options.

Opening the app, you see one massive quantity. That is the money you’ve got out there to spend. It’s not your entire cash, or your entire out there credit score. As a substitute, it’s the cash that, after bearing in mind your common upcoming bills, the corporate’s AI believes you may safely half with. So, even should you don’t have a head for budgeting, your bank card does.

As you employ your card day after day, the cardboard’s AI will routinely repay your purchases out of your checking account. This doesn’t occur immediately, or on the finish of the month. As a substitute, it really works out when it’s finest to pay down your spending, bearing in mind credit score utilisation, that can assist you construct your credit score rating over time.

So, so long as you observe the principles, cred.ai guarantees you’ll by no means pay curiosity or late charges in your bank card. It even goes one step additional, saying that if it calculates your out there spending incorrectly, and also you spend greater than it’s best to, it would cowl the price of that overspend.

After all, this does result in the AI being considerably conservative in its estimations. In keeping with Brown, it acts like “an overbearing father or mother”.

“If it sees you getting in bother and spending greater than you may, it would cease that transaction,” Brown says. “The automation prevents you from stepping into a kind of conditions the place you’d be in bother.”

Chances are you’ll select to show off these AI limiters within the app, nevertheless, should you do, you’ll have to cowl any curiosity that accrues in your spending at a fee of 17.76% p.a.

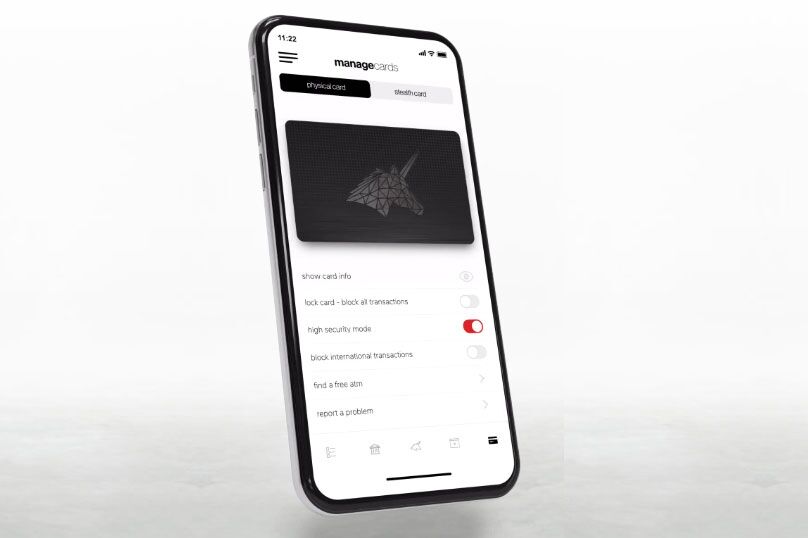

Picture credit score: cred.ai.

What About Options?

Except for credit score optimisation then, what different options are on provide?

Stealth Playing cards

With this characteristic, you may reap the benefits of a self-destructing digital card everytime you want one. Designed for use for dangerous transactions, these stealth playing cards assist you to create a shadow account with a very totally different set of identification numbers, which can be utilized, then routinely deleted. This might are available helpful while you’re shopping for one thing on-line from a service provider you don’t fairly belief, and even while you signal as much as a trial service and wish to keep away from getting auto-billed when the trial interval ends.

Flux Capacitor

Named with Marty McFly in thoughts, this characteristic basically permits you to see into the long run so you may spend – or cease spending – accordingly. Utilizing the characteristic, you will notice future transactions, equivalent to payments that can should be paid, or a paycheque that’s but to clear. “Theoretically, a financial institution can be able to figuring out on Wednesday that an electrical firm will cost you Friday,” Brown says. “They usually allow you to spend the cash and over-withdraw, and your lights are off. We don’t.”

Buddy & Foe

With this characteristic, you may belief or limit transactions with every particular person service provider. This might come in useful in case you have cancelled together with your cellphone or web supplier, however they hold taking funds. Whereas this characteristic is feasible on most bank cards, it sometimes includes an extended cellphone name moderately than a faucet on an app.

Verify Please

Utilizing this characteristic, you may authorise a transaction prematurely to keep away from a possible card decline, eliminating the embarrassment that often goes together with that.

Picture credit score: cred.ai.

Excessive Safety Mode

This safety characteristic permits you to generate safe finite authorisation home windows, permitting transactions to solely be authorized inside that given timeframe.

Boring However True

Options cred.ai phrases “boring however true” embrace 24/7 cellphone assist “answered by people”, entry to greater than 55,000 free ATMs, immediate deposits, cell cheque seize, payroll and different direct deposits two days early, and an on-boarding course of that permits customers to start out spending inside minutes of making use of.

Some issues to notice right here embrace the truth that utilizing a bank card at an ATM to make a withdrawal is outlined as a money advance, which usually comes with charges and the next fee of curiosity. Nevertheless, in keeping with the cred.ai website, “you’ll not pay any curiosity on these money advances for so long as you’ve got a sound cred.ai assure”.

As for accessing direct deposits two days early, it will rely on the timing and schedule of when the payer submits the deposit. The cred.ai website says, “We usually will assist you to entry the spending energy of these deposits on the day the deposit file is obtained, which may very well be as much as two days previous to the scheduled cost date”.

When it comes to new options, cred.ai says it’s always updating and releasing options, permitting customers entry to one of the best in new know-how – simply as quickly as they excellent it.

What About Rewards?

Over within the US, as in Australia, bank card rewards are massive enterprise. So, will cred.ai provide customers the chance to earn rewards?

“Millennials don’t care about meaningless factors and lounge entry hiding amongst a whole lot in charges”, cred.ai investor Tim Armstrong, Founding father of the DTX Firm and former CEO of AOL, Oath, and President of Google America says. “They care about turning into financially stronger, know-how and options on the innovative, and corporations with values they align with.”

Catering to the Millennial market is essential for cred.ai. So, whereas there are plans within the pipeline to supply ongoing bank card cashback and rewards alternatives, these is not going to be geared toward factors aficionados.

“Our customers know that conventional cashback is a karma entice,” Brown says. “For a mean person, the precise cashback earned winds up being very small, and will get outweighed by charges and curiosity. However the actual problem is that these flashy rewards are supported and subsidised by way of the struggling of that financial institution’s decrease earnings clients. It’s wealth redistribution within the flawed path.”

How Does cred.ai Profit?

Provided that very ethical stance – and the truth that the corporate says customers can pay no charges or curiosity – chances are you’ll be questioning how cred.ai plans to make any cash from its providing.

Like all bank card firms, cred.ai takes a tiny piece of each transaction customers make, billed to the service provider, which within the case of the Unicorn Card comes from Visa. Within the US, Visa’s present fee ranges from 1.51% to 2.4%, plus $0.10, per transaction. Nevertheless, sooner or later, the corporate plans to increase its providing to incorporate massive ticket objects, like mortgages.

It additionally has plans to make cash from the banking know-how and compliance basis it has constructed and developed. Its platform consists of full compliance administration, and was constructed modularly in order that it will also be licensed to offer “bank-in-a-box” operations for small banks and types.

“After we constructed ING Direct, our objective was to leverage know-how to function with 10% of the sources a conventional financial institution would use,” stated Jim Kelly, chairman and co-founder of cred.ai, and founding COO of ING Direct. “With what we’ve constructed at cred.ai, I believe we get that all the way down to 1%.”

This, after all, makes it sellable.

“We don’t view infrastructure as merely a way to an finish,” cred.ai Co-Founder and COO Todd Sandler says. “We see it as one other alternative to construct an outstanding product, the place we ourselves are the primary buyer. Working like that permits us to iterate our shopper product quicker, and derive worth immediately from the know-how itself.”

The Future For cred.ai

As of final week, US customers can apply to be a part of cred.ai’s beta program. On utilizing the cardboard, these beta testers will likely be given the chance to share their view on how superior monetary know-how would affect their life targets. Of the customers that share their tales, some will likely be chosen to obtain US$10,000 from cred.ai to assist them attain these targets.

And seeking to the long run, as cred.ai strikes on from beta?

“cred.ai will serve totally different functions to totally different customers,” Brown says. “For some it is going to be their resolution to constructing credit score with out worry. Early adopters will see it as their gateway to essentially the most superior options. Stealth Card alone would be the motive many individuals enroll. Some will likely be drawn to our progressive beliefs, and others may simply desire a cool, free steel card. Whatever the motivation, the truth that the product may be prime of pockets for each a university scholar or a rich NBA celebrity, says rather a lot about our mission to construct a premium product for all folks.”

When it comes to product enlargement, Brown says, “Proper now we’re constructing merchandise that assist empower folks financially, however subsequent we may throw in training, well being care, insurance coverage, who is aware of. No matter it’s, we’ll dream it, construct it, after which give it away free of charge.”

And Right here In Australia?

Identical to Apple Card, cred.ai’s providing will not be out there right here in Australia. Nevertheless, there may be hope that the innovation discovered inside these two playing cards may ultimately trickle all the way down to Aussie customers. Whereas it will definitely be good to see a few of cred.ai’s options out there right here, what we might even see first is the enlargement of digital playing cards throughout the private bank card market.

Digital bank cards are presently on provide to companies by way of firms equivalent to DiviPay and Airwallex. In the meantime, some debit card customers at Westpac and P&N Financial institution can reap the benefits of digital card choices once they don’t wish to use plastic. Digital bank cards, although, are but to interrupt the non-public bank card market.

What’s a digital card precisely? A digital card is mainly any card that may be held inside a digital pockets, equivalent to Apple Pay, Google Pay and Samsung Pay. Cardholders then use these digital playing cards to pay on-line, or in-person utilizing a synced gadget. Whereas we might have what we consider digital bank cards that we maintain in our digital wallets proper now, these are linked to bodily playing cards, in order that they at all times have plastic as again up.

Alternatively, some suppliers throughout the enterprise area are providing standalone digital playing cards, designed to supply extra performance, flexibility and options to customers. Like cred.ai’s Stealth Playing cards, these digital playing cards may be disposable, self-destructing after use to offer safety and peace of thoughts to the person.

Digital playing cards additionally profit customers in that they can be utilized instantly. Not like bodily playing cards, which should be mailed and activated, digital playing cards can be utilized right away on approval. There may be additionally the truth that there isn’t a bodily card to lose. So, should you’re on vacation, chances are you’ll lose your cellphone and your pockets, however you possibly can nonetheless achieve entry to your card by way of your pill, or your travelling companion’s cellphone for instance.

As digital playing cards are used and managed on-line, one other profit means management of all settings is immediate. This not solely offers extra performance to the person, it additionally offers the cardboard supplier the choice to supply entry to extra intensive options than could also be out there on a bodily card account.

Final however not least, digital playing cards scale back pressure on the surroundings, with no bodily card to create, ship, and exchange each few years. Given our present pandemic standing, it’s additionally price pointing to the truth that digital playing cards might also be extra hygienic attributable to their contactless nature.

Digital Credit score Playing cards in Australia

So, are you able to apply for a digital bank card right here in Australia? The brief reply isn’t any, not but. The companies talked about above provide digital bank cards to enterprise customers, however there are not any related choices throughout the private card market. Chances are you’ll discover the Freestyle Mastercard provided by MoneyMe should you had been to look on-line, however this isn’t technically a bank card, it’s a line of credit score.

As with so many issues right here within the Fortunate Nation, we’ll merely want to attend for the know-how to seek out its manner right here. Within the meantime, why not take a look at what’s on provide on the earth of conventional plastic, with CreditCard.com.au as your information. Stealth playing cards is probably not an choice, however there are some fairly useful options to reap the benefits of as you watch for extra thrilling extras to cross the Pacific.