Amidst issues over the cost-of-living, there has additionally been extra authorities help and money payouts this 12 months. Have you ever used up your advantages but?

As a part of the sandwiched era having to help a number of dependents, I’ve been paying attention to the varied advantages that I get this 12 months, significantly within the following areas:

- To assist battle inflation

- To buffer towards rising healthcare prices

- To stay aggressive within the workforce and upskill

- For my household, the younger and the outdated

The simplest technique to test your advantages can be to make use of this Assist for You Calculator to calculate the overall estimated advantages that you just and/or your family could obtain from the Authorities.

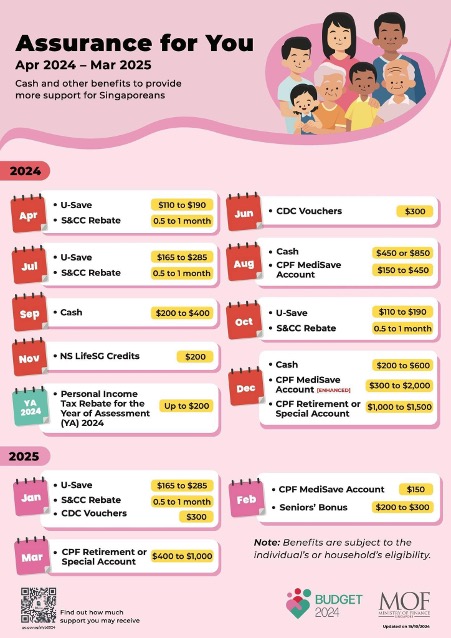

Advantages for households

Dwelling in a HDB flat implies that we obtain U-Save rebates each quarter. With extra rebates given in 2024, we may get between $550 to $950in whole to offset our utilities payments. In keeping with the federal government, in Monetary Yr 2024, the U-Save rebates will on common, cowl about 8 months of utilities payments for these dwelling in 1- and 2-room flats, and about 4 months of utilities payments for these dwelling in 3- and 4-room flats. In fact, being aware of your electrical energy and water utilization will assist too.

HDB households can even obtain as much as 4 months of S&CC rebates altogether in 2024 to offset our S&CC payments.

We’ve additionally used our $800 CDC vouchers – which have been disbursed in January and June this 12 months -to pay for our meals at collaborating hawker stalls, in addition to for groceries at collaborating supermarkets and heartland retailers.

Psst, your $800 CDC vouchers expire on 31 December 2024 so don’t overlook to say and use them in case you haven’t already finished so! Singaporean households may stay up for one other tranche of $300 CDC vouchers that can be disbursed in January 2025!

Below the Assurance Bundle Money payouts, my husband and I every acquired $200 by way of PayNow, whereas our dad and mom acquired $600 every as an alternative as they earn a decrease revenue.

Advantages for households

My children attend full-day childcare at MyFirstSkool (an anchor operator), so I’m definitely trying ahead to paying decrease childcare charges subsequent 12 months (which we’ve already acquired the notification for)!

Beforehand, I used to be unable to say the Guardian Reduction on my dad, as he labored part-time and had an annual revenue of $4,800. The annual revenue threshold for all dependant-related tax reliefs, together with the Guardian Reduction, has now been elevated from $4,000 to $8,000. Which means for these of you supporting dependant members of the family who’re doing part-time work, this could enable for extra of you guys to say the tax reduction.

To assist buffer towards rising healthcare prices, there are the CPF MediSave top-ups from Price range 2024 and now we have additionally made additional voluntary contributions by ourselves.

My husband and I are supporting aged dad and mom of their 60s – 70s, who every acquired the Retirement Financial savings Bonus (as a part of the Majulah Bundle) of $1,000 or $1,500. And since 3 of our elders are nonetheless working, they are going to profit from the Earn and Save Bonus to get $400 to $1,000.

Assist for mid-careerists to reskill

In case you’re aged 40 and above, you need to use the $4,000 SkillsFuture Credit score (Mid-Profession) top-up for round 7,000 chosen coaching programs that meet trade and employment wants. The wide selection of programs contains each part-time and full-time programmes.

The SkillsFuture Mid-Profession Enhanced Subsidy additionally provides increased subsidies of as much as 90% in fact charges for a further publicly funded diploma.

If you’re seeking to make a profession change and pursue full-time coaching, you possibly can try the brand new SkillsFuture Mid-Profession Coaching Allowance, which offers a coaching allowance of as much as $3,000 a month for a most of 24 months over a person’s lifetime (computed as 50% of your common month-to-month revenue, based mostly on the most recent accessible 12-month interval of revenue knowledge).

In case you haven’t been monitoring your payouts and rebates underneath the Price range 2024 Assurance Bundle, right here’s the timeline so that you can monitor again on:

A lookback at 2024

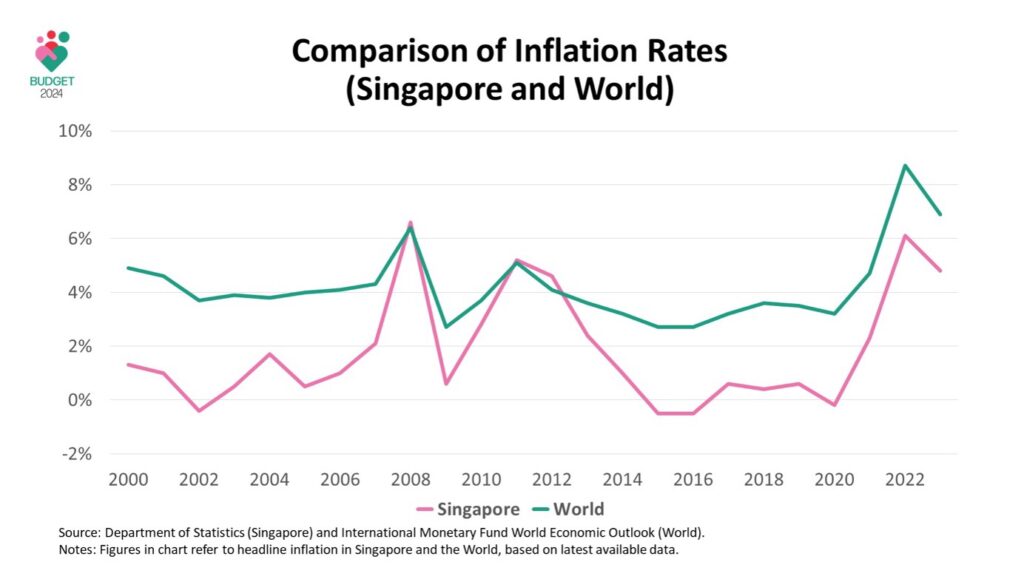

There’s little question that 2024 has been a 12 months of speedy modifications.

Macro components together with international provide chain disruptions and the continuing conflicts in numerous components of the world have led to inflation stress on economies.

And due to this, throughout the board, prices are typically rising, whereas we’re seeing extra job layoffs and retrenchments occur on the similar time. There’s additionally a really actual concern about whether or not synthetic intelligence will take away our jobs within the close to future.

In occasions like these, we are able to make use of assorted authorities help advantages and payouts to deal with increased prices within the quick time period, whereas upskilling ourselves in the long term to make sure our incomes energy continues to climb.

Somewhat than simply depend on authorities payouts, I’ve additionally shared numerous tips about lowering prices comparable to saving with member reductions and chopping down on meals deliveries and snacks, and so on.

What’s extra, I’ve been persistently nagging my readers (on my Instagram) to construct extra sources of revenue by way of aspect hustles to cope with increased prices all through this 12 months. Whether or not it’s from incomes Shopee affiliate commissions or doing paid authorities surveys on CrowdTaskSG, each little bit counts.

It’s now changing into more and more apparent that we must always all begin to look significantly into the right way to equip ourselves with AI in order to stay aggressive and be ready for the altering panorama of labor. I personally signed up for just a few AI courses this 12 months to learn to use instruments like ChatGPT higher, and am seeking to increase my repertoire to extra AI instruments within the close to future.

As I watch my buddies all over the world complain about rising prices of their international locations too, it’s clear that the challenges we face will not be occurring in Singapore alone. My US buddies have additionally quipped that they need they get as many authorities advantages as we do right here, which was an excellent reminder for me to not take what now we have without any consideration.

Whereas the federal government help measures have positively been extra beneficiant this 12 months, I don’t anticipate to at all times be spoon-fed so I’m taking it upon myself to hustle, maintain upskilling and earn extra.

Now, earlier than 2024 involves an finish, don’t overlook to make use of your CDC vouchers earlier than they expire! Declare your CDC vouchers digitally by visiting go.gov.sg/cdcv

Sponsored Message

Discover out the estimated authorities advantages it’s possible you’ll obtain through the use of the Assist for You Calculator!

To test your eligibility for the varied authorities disbursement schemes for Singaporeans, go to this govbenefitswebsite right here!

Disclosure: This text is delivered to you in collaboration with the Ministry of Finance. All opinions are that of my very own.