With regards to your monetary persona, there are few metrics extra essential than your credit score rating. This quantity can affect not solely your capability to get permitted for prime journey bank cards but additionally the rate of interest you pay on a mortgage, your capability to acquire an auto mortgage and a bunch of different elements of your life.

If you happen to’ve made a New 12 months’s decision to enhance your credit score rating in 2025, listed here are some methods to efficiently do exactly that.

Perceive credit score rating fundamentals

Earlier than entering into the following tips, let’s begin with a fast overview of simply what constitutes your credit score rating. Proper off the bat, it is essential to notice that there are two major credit score scoring fashions: VantageScore and FICO.

Whereas there are just a few minor variations between the 2, they each try to numerically measure the identical factor: your trustworthiness as a borrower.

A decrease rating signifies the next threat of defaulting on a mortgage, thus decreasing the sum of money or credit score a monetary establishment is keen to lend you (or decreasing the probabilities of you being permitted for a mortgage in any respect).

The next rating, alternatively, signifies that you just’re much less more likely to default and thus in a position to deal with bigger mortgage quantities and smaller charges.

Each scores fall on the identical scale (300-850) and use the identical normal standards:

- Cost historical past: What number of funds you’ve got missed or made late throughout your credit score historical past.

- Quantities owed: Continuously known as your credit score utilization ratio, it measures how a lot of your accessible credit score is at the moment getting used.

- Size of credit score historical past: The common age of your accounts throughout lenders.

- New credit score: How a lot new credit score you’ve got lately gained entry to, together with the variety of onerous inquiries.

- Credit score combine: The several types of accounts you’ve got had (bank cards, auto loans, mortgages and so forth.).

By paying shut consideration to those 5 gadgets — particularly the primary two — you could be nicely in your approach to enhancing your credit score rating.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: Your subsequent bank card approval is within the palms of those three companies

Overview your credit score report for inaccuracies

One of the essential issues you must do is evaluation your credit score report for inaccurate data.

In response to a examine carried out by Shopper Experiences, a few third of customers discovered an error on their credit score stories. In lots of instances, these errors aren’t malicious (e.g., identification theft) however somewhat inaccuracies associated to related names or different easy mix-ups.

Thankfully, there is a federally documented course of for eradicating these errors. This text from the Federal Commerce Fee supplies full particulars of those steps, together with find out how to request your free credit score report each week.

As soon as you’ve got recognized an error, submit a dispute letter immediately with the credit score reporting firm; you should use the FTC’s pattern for inspiration. The bureau should examine the criticism, usually involving going to the group that offered the disputed data.

If this does not assist, the following step is to contact the knowledge supplier immediately together with your criticism; once more, the FTC supplies a pattern dispute letter for this function. Be detailed however concise, and embrace copies of any documentation that helps your dispute.

Whereas this course of could be time-consuming, cleansing up your credit score report back to be away from all inaccuracies is a crucial step you may take to instantly enhance your rating — or, on the very least, stop any future drops in your rating associated to errors.

Associated: The best way to examine your credit score rating totally free

Prolong your accessible credit score

One other approach to enhance your credit score rating within the new 12 months is to broaden the credit score line to which you might have entry. This may occasionally appear counterintuitive: absolutely extra credit score means extra money to spend and, due to this fact, extra threat, proper?

Whereas that is true on the floor, do not forget that your credit score utilization ratio makes up nearly a 3rd of your FICO rating (and can also be a key a part of your VantageScore). That is why getting access to further credit score can enhance your credit score rating.

There are two alternative ways to perform this:

- Request credit score line will increase on current accounts: Some issuers make it very straightforward to request will increase on-line, which typically will not end in a tough inquiry in your credit score report.

- Apply for a brand new bank card: Although this can end in a tough inquiry and briefly drop your rating, it could actually nonetheless provide you with a brand new line of credit score (to not point out unlock a doubtlessly invaluable welcome bonus). This may occasionally outweigh the short-term drop within the quick run and can nearly definitely assist in the long term.

Here is an instance of how this is able to work. For instance you might have a single bank card with a restrict of $5,000. Although you pay it off in full each month, the cardboard nonetheless has a median stability of roughly $2,500, as you employ it as your major bank card and can proceed charging purchases to it as your cost due date approaches.

The final rule of thumb is to maintain your utilization below 30%, so on this instance, you are nicely above that (50%).

Now, as an example you request —and are granted — a rise of $5,000. Or perhaps you apply for a brand new card and are given a $5,000 line. With this one motion, you’ve got simply boosted your accessible credit score to $10,000. So long as your stability stays within the $2,500 vary, your utilization drops to 25%, which ought to end in a noticeable improve in your rating over time.

Nonetheless, this solely works if you don’t use the brand new credit score line to spend past your means. So long as your spending stays constant, you are merely spreading that quantity out over a bigger credit score restrict, dropping your utilization and growing your rating. Bank cards should not essentially a surefire approach to get into debt; ensure you maintain your purchases consistent with your revenue.

Associated: What’s the distinction between a tough and tender pull in your credit score report?

Arrange automated funds

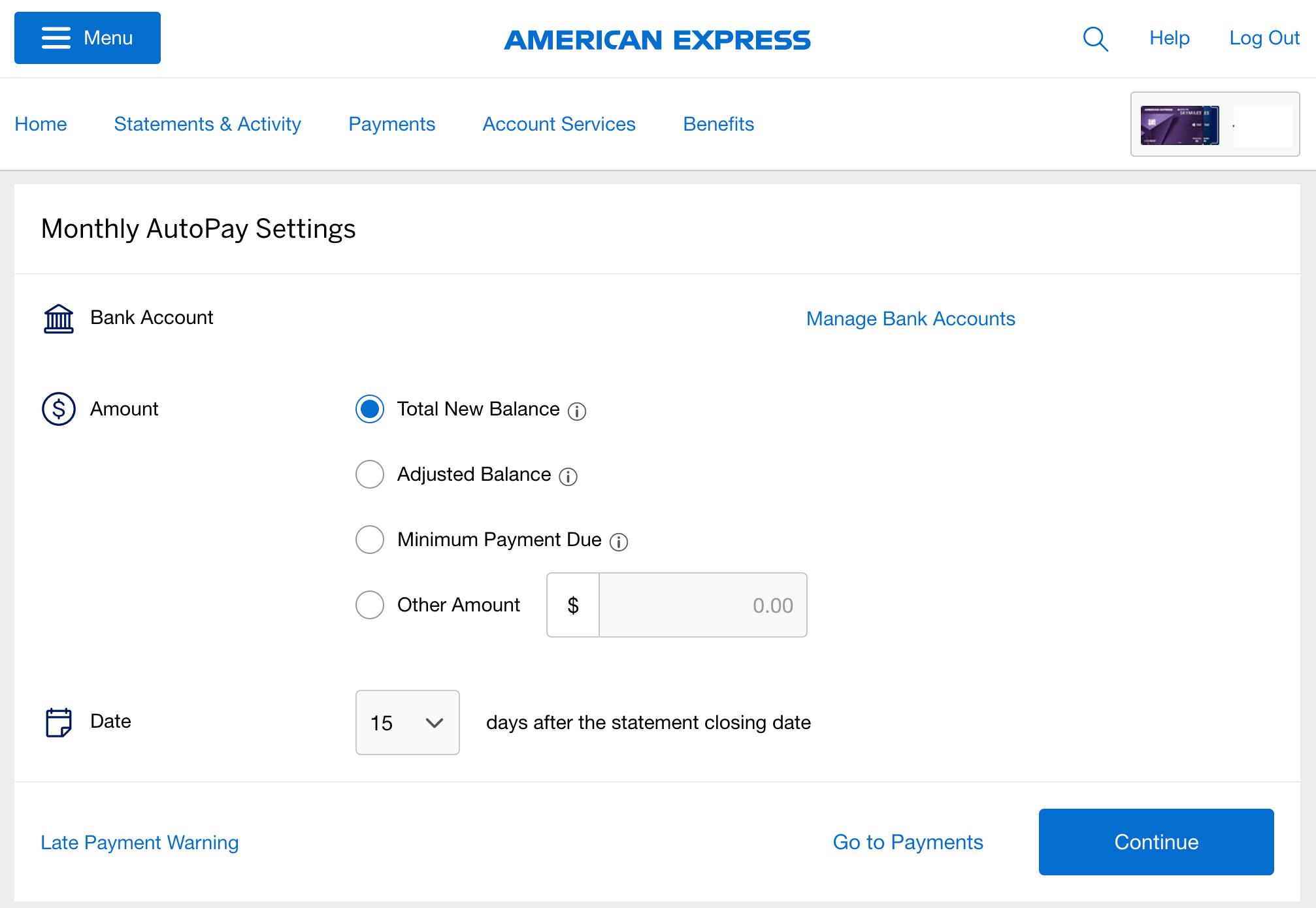

If you happen to’re susceptible to lacking a deadline right here or there, you must a minimum of have calendar reminders on your bank card cost due dates and, at greatest, have automated funds enabled in your accounts.

As famous above, your cost historical past is an important think about figuring out your credit score rating, and even a single late cost can dramatically scale back your rating, because it signifies that you could be be struggling to repay your stability.

By organising reminders or enabling automated funds out of your checking account, you make sure that each cost can be processed on or earlier than your assertion due date.

In fact, this comes with the caveat that you need to preserve sufficient cash in your checking account to cowl the stability that can be paid robotically. In any other case, the overdraft charge might eat away at your earnings and nonetheless end in a late cost.

Associated: The best way to arrange autopay for all of your bank cards

Funds to pay down excellent balances

Our No. 1 commandment for journey rewards bank cards right here at TPG is: Thou shalt pay thy stability in full.

If you happen to carry a bank card stability from month to month, the curiosity expenses that accrue will simply cancel out the worth of the factors or miles you are incomes on the cardboard — after which some.

Nonetheless, you might have an outdated debt out of your freewheeling days as a university scholar, or perhaps you elected to finance a big buy with an introductory 0% annual share fee bank card or deferred curiosity supply on a retailer bank card.

Don’t let these balances go unpaid. If you have not already executed so, sit down and create a funds for the way you may pay these balances off to keep away from (or reduce) your curiosity publicity.

Associated: The best way to consolidate and pay down bank card debt

Join credit score monitoring

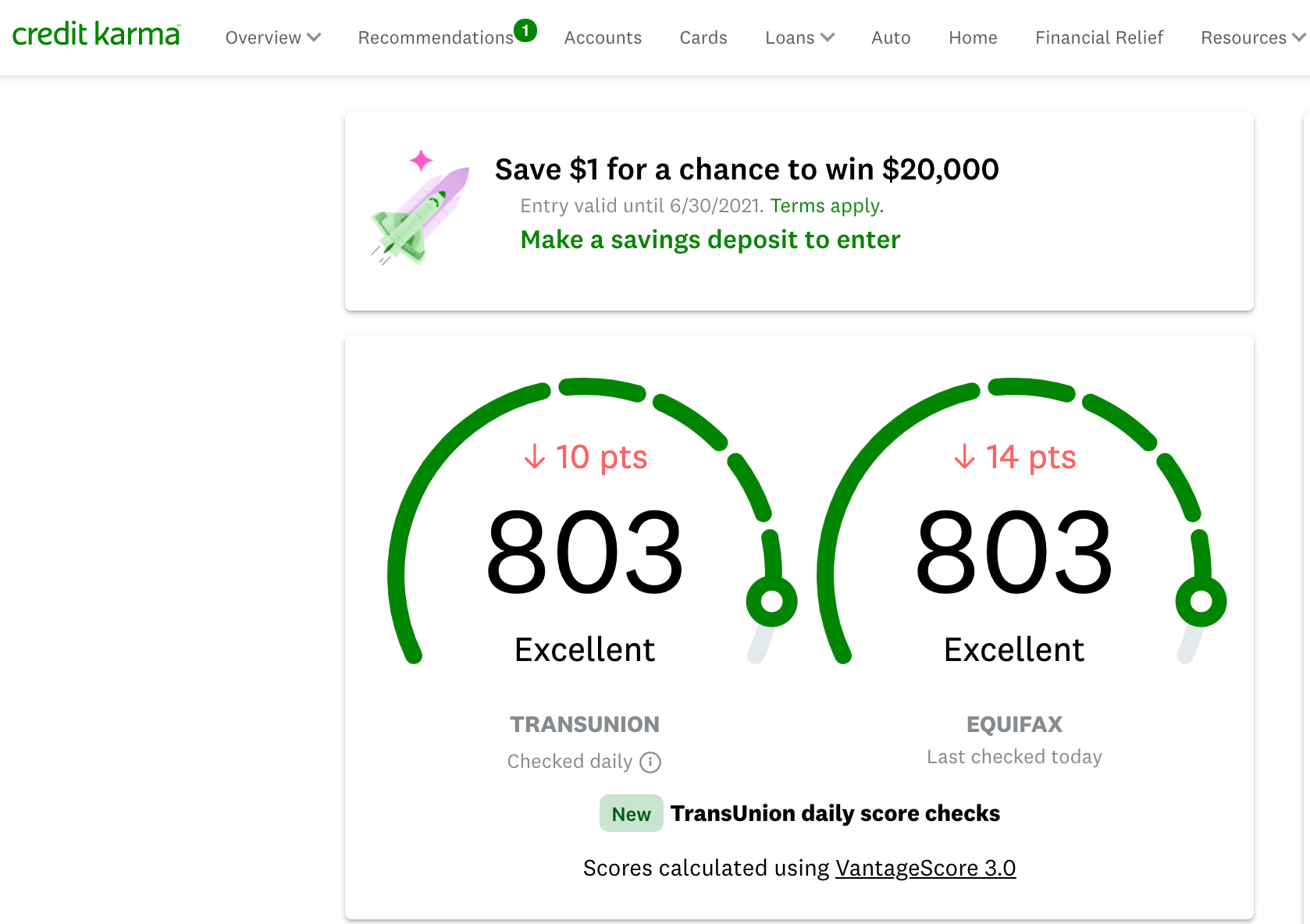

This last suggestion will not essentially end in a right away improve in your credit score rating. Nonetheless, it is a greatest apply to maintain tabs in your rating and rapidly establish any points which will come up: Join a service that displays your credit score profile and notifies you of any modifications.

We like to make use of Credit score Karma, a free service that tracks your TransUnion and Equifax scores and means that you can view your credit score report any time you need. You can too set alerts for varied issues, resembling modifications to your report.

Backside line

Whether or not you are new to the factors and miles interest or have been round for some time, maintaining your credit score rating excessive is without doubt one of the most essential issues you are able to do. This can improve your approval odds for prime journey rewards bank cards, broaden your entry to installment loans and even decrease the rates of interest and costs you’d pay to lenders.

If you happen to’ve made a decision to spice up your scores in 2025, we hope this information has given you some concrete steps to enhance your credit score well being within the coming weeks and months.

Associated: 3 actual methods to spice up your credit score rating in 30 days