ezTaxReturn takes the ache out of tax submitting…for some filers. Nevertheless, some might discover they will’t use the software program as a result of its limitations. Whereas we advise you’re doubtless higher off elsewhere, we’ll go into the small print about how ezTaxReturn works for these contemplating it for his or her subsequent tax submitting.

For many who can use ezTaxReturn and do not qualify for the free tier, the pricing is not aggressive in comparison with comparable tax return software program packages. Yow will discover higher choices totally free and a lot better person experiences at an identical value.

On this ezTaxReturn.com overview, we’ll discover how the app compares to different prime tax software program choices.

ezTaxReturn – Is It Free?

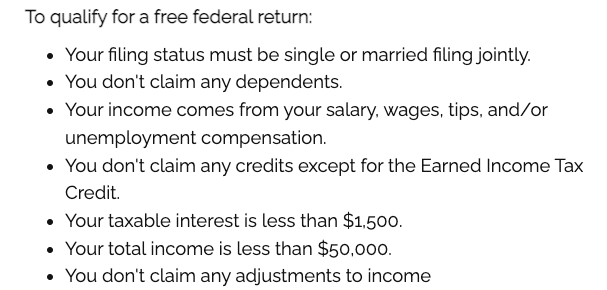

ezTaxReturn advertises a free tax return for “easy filers,” however those that qualify are extraordinarily restricted. Additional, you continue to must pay $24.99 for a state return, so until you reside in a state with no state revenue tax return requirement, you’ll must pay to make use of ezTaxReturn regardless of the way you file.

ezTaxReturn is sort of strict about who qualifies totally free federal returns. It’s essential to meet the next standards:

- Earn lower than $50,000 per 12 months

- Don’t have any dependents

- Have taxable curiosity revenue underneath $1,500

The one credit score customers can declare with the free tier is the Earned Earnings Tax Credit score (EITC). The free possibility additionally solely helps W-2 revenue and unemployment revenue. Further 1099 types and people with HSA contributions should improve to the paid model. As a consequence of these many restrictions, most individuals gained’t qualify to file totally free.

You may see our picks for the greatest free tax software program right here.

What’s New In 2025?

Probably the most vital updates for 2025 targeted on adjustments to the tax code from the IRS. The federal government applied new brackets and limits for a lot of deductions and credit, and ezTaxReturn made the required adjustments to maintain up. You’ll additionally see updates for brand spanking new 1099-Ok necessities for on-line sellers.

The app expanded to help a bigger listing of states, making it an possibility for extra households. However state submitting costs additionally went up this 12 months, with the price of state returns rising by about $5 per state.

Chances are you’ll discover a most refund and accuracy assure on this and different tax software program. These are {industry} requirements, as your tax outcomes needs to be practically equivalent regardless of the way you file so long as you enter your tax particulars accurately.

Does ezTaxReturn Actually Make Tax Submitting Simple In 2025?

When you fall into the tier of customers who can file their federal return totally free, you will see a comparatively easy expertise. ezTaxReturn has an intuitive person expertise that makes submitting straightforward for tax filers with easy conditions. Nevertheless, it doesn’t provide imports on your tax types or W-2 knowledge.

ezTaxReturn is not best for extra complicated tax submitting eventualities, together with anybody with funding accounts. It additionally doesn’t have built-in depletion or depreciation calculators, so actual property traders should do calculations elsewhere. Due to this shortcoming, we advise actual property traders look to extra sturdy choices like TurboTax, H&R Block, and different premium tax preparation corporations.

Self-employed retirement plans are additionally not properly supported. ezTaxReturn doesn’t enable customers to say contributions to sure self-employed retirement plans, corresponding to Keogh or SEP accounts.

ezTaxReturn Options

Though ezTaxReturn doesn’t help all tax conditions, it has just a few constructive options making it value consideration.

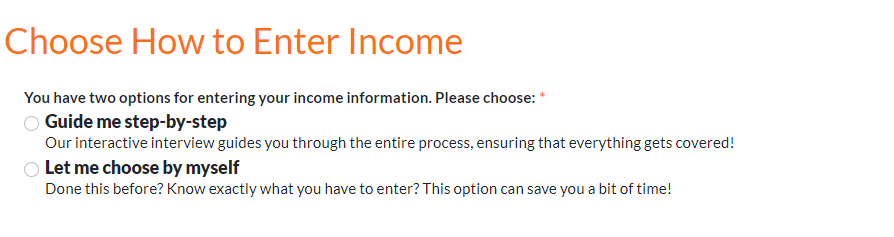

Guided Navigation

ezTaxReturn makes use of questions and solutions to information customers via the software program. The wording of the questions makes it straightforward for filers to reply accurately.

Sturdy Error Detection

ezTaxReturn has built-in error detection to forestall customers from getting into info within the mistaken field or getting into the mistaken worth. The error detection ensures you’ll be able to’t transfer ahead with out first checking on a difficulty. Error messages are descriptive sufficient to assist customers remedy the issue.

ezTaxReturn Drawbacks

Regardless of ezTaxReturn’s easy person interface, the software program has a number of shortcomings.

Restrictive Free Tier

ezTaxReturn’s free tier helps only a few tax filers. And people who qualify will nonetheless must pay for state submitting. When you earn greater than $50,000 per 12 months, have dependents, or have any revenue past your W-2 job and checking account curiosity, you gained’t qualify.

No Depreciation Calculators

ezTaxReturn doesn’t have depreciation or depletion calculators. So landlords and self-employed folks with depreciable belongings can’t declare this official tax deduction via the software program.

Limitations On Submitting

The ezTaxReturn software program solely helps one rental property per return. Landlords with a number of properties can’t use the software program. It additionally doesn’t help choices buying and selling or wash gross sales.

As talked about above, there aren’t any depreciation calculators obtainable, so folks with “difficult” tax submitting conditions might discover that the software program merely will not work for them.

EzTaxReturn additionally has limitations on state submitting. Unsupported states embrace Indiana, Montana, North Dakota, Oregon, Rhode Island, Vermont, and West Virginia.

ezTaxReturn Plans And Pricing

Since ezTaxReturn has a restrictive Free tier – most filers might want to pay. State submitting prices $24.99 no matter which plan you employ. The corporate affords a Federal + State submitting mixture with a package deal value of $39.95.

Customers ought to verify whether or not ezTaxReturn helps tax returns of their state earlier than signing up for the software program.

|

No dependents, W-2 or unemployment, earn lower than $50,000, no credit or deductions. |

||

How Does ezTaxReturn Examine?

ezTaxReturn costs itself close to the center of the pack. Even with its annual enhancements, the software program should not be definitely worth the value.

Money App Taxes and TaxHawk help extra complicated submitting at a cheaper price. This is a more in-depth take a look at how ezTaxReturn compares:

|

Header |

|

|

|

|---|---|---|---|

|

Unemployment Earnings (1099-G) |

|||

|

Solely Returns Ready By EzTaxReturn |

|||

|

Retirement Earnings (SS, Pension, and so on.) |

|||

|

Paid (No wash gross sales or choices) |

|||

|

Paid (no depreciation, just one property supported) |

|||

|

Paid (no depreciation or depletion supported) |

|||

|

Small Enterprise Proprietor (Over $5k In Bills) |

Paid (no depreciation or depletion supported) |

||

|

$0 Fed & |

|||

|

All types and deductions can be found on the Free tier, however customers can improve to Deluxe ($6.99) or Professional ($44.99) to entry Audit Help or recommendation from tax execs. |

|||

|

Cell |

Is It Secure And Safe?

ezTaxReturn makes use of industry-standard encryption know-how to maintain person info protected. It has sturdy password necessities, and customers should use a second type of authentication to log in.

By combining encryption and multifactor authentication, ezTaxReturn affords sturdy protections to forestall knowledge breaches or hacks. The corporate hasn’t suffered main knowledge breaches and has traditionally acquired accolades for its safety protocols.

Contact

ezTaxReturn boasts that its software program is “really easy, it is unlikely you will want customer support.” It additionally says that solely about 10% of its prospects attain out for assist. However for those who want help, your choices are way more restricted than competing tax software program corporations.

Proper now, they solely have e mail help (with a one-business-day turnaround time) and an FAQ on their web site. They sometimes have a cellphone quantity you’ll be able to name throughout tax season, however this is not obtainable as of the time of writing.

There isn’t a choice to contact a tax professional. The one technique to contact the corporate’s help workforce is to submit an e mail inquiry.

Who Is This For And Is It Value It?

ezTaxReturn continues to extend its usability however nonetheless has a number of limitations. It isn’t best for landlords nor these with self-employment revenue. Options are additionally removed from best for many traders.

Filers with simpler tax conditions may gain advantage from ezTaxReturn. Nevertheless, the software program’s value continues to be too excessive for what it affords until you qualify totally free federal submitting.

Customers in search of a greater expertise, coupled with mid-range pricing, ought to contemplate Money App Taxes or FreeTaxUSA. These in search of a extra sturdy expertise ought to contemplate TurboTax, H&R Block, or TaxSlayer.

Undecided which software program meets your wants? We’ve acquired you lined with suggestions for software program primarily based in your submitting scenario.

Why Ought to You Belief Us?

The School Investor workforce has spent years reviewing the entire prime tax submitting choices, and our workforce has private expertise with nearly all of tax software program instruments. I personally have been the lead tax software program reviewer since 2022, and have in contrast a lot of the main corporations on {the marketplace}.

Our editor-in-chief Robert Farrington has been attempting and testing tax software program instruments since 2011, and has examined and tried virtually each tax submitting product. Moreover, our workforce has created opinions and video walk-throughs of the entire main tax preparation corporations which you’ll find on our YouTube channel.

We’re tax DIYers and desire a whole lot, identical to you. We work onerous to supply knowledgeable and trustworthy opinions on each product we take a look at.

How Was This Product Examined?

In our unique assessments, we went via ezTaxReturn and accomplished a real-life tax return that included W2 revenue, self-employment revenue, rental property revenue, and funding revenue. We tried to enter every bit of information and use each characteristic obtainable. We then in contrast the consequence to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This 12 months, we went again via and re-checked all of the options we initially examined and any new options. We additionally validated the pricing choices.

Frequent Questions

Let’s reply just a few of the most typical questions that filers ask about ezTaxReturn:

Can ezTaxReturn assist me file my crypto investments?

ezTaxReturn technically helps submitting taxes for crypto investments. Nevertheless, this isn’t made straightforward. Customers should convert all their trades to USD and manually enter every into ezTaxReturn. It is a cumbersome activity that most individuals will need to keep away from.

Most customers with crypto investments will need to use a crypto tax software program that integrates with TurboTax.

Can ezTaxReturn assist me with state submitting in a number of states?

EzTaxReturn helps multi-state submitting, but it surely doesn’t help each state. States that aren’t supported embrace the next: Connecticut, Delaware, Hawaii, Kansas, Maine, Nebraska, New Mexico, Utah, Idaho, Indiana, Iowa, Kentucky, Minnesota, Montana, North Dakota, Oklahoma, Oregon, Rhode Island, Vermont, and West Virginia.

Does ezTaxReturn provide refund advance loans?

No, ezTaxReturn will not be providing refund advance loans in 2025. You may pay your software program payment utilizing your refund for an additional $29.95, which is unquestionably not worthwhile.

Options

|

Out there as a $39.99 add-on |

|

|

Import Tax Return From Different Suppliers |

|

|

Import Prior-12 months Return For Returning Prospects |

|

|

Import W-2 With A Image |

|

|

Inventory Brokerage Integrations |

|

|

Crypto Change Integrations |

|

|

Sure (however (no depreciation and depletion will not be supported) |

|

|

Sure, however just one property could be added per return |

|

|

Refund Anticipation Loans |

|

|

Buyer Service Cellphone Quantity |

|