There’s a well-known New Yorker cartoon that we don’t have permission to breed. It exhibits a cheerful government talking from a lectern in a convention room.

And so, whereas the end-of-the-world state of affairs shall be rife with unimaginable horrors, we imagine that the pre-end interval shall be full of unprecedented alternatives for revenue!

Welcome to the case for infrastructure investing in a world the place the worldwide local weather has been allowed to turn out to be more and more hostile to human life.

Local weather change as a catalyst for infrastructure investing

The underlying argument is easy.

- Infrastructure is the umbrella time period for all of these creations which make fashionable society potential: roads, harbors, consuming and wastewater programs, the internet-of-things, gasoline pipelines and energy grids, and so forth.

- Our infrastructure, a lot courting to the early 20th century, was by no means designed for the world we’ve created. Within the easiest instance, rising sea ranges drive rising groundwater, which floods buried infrastructure – water, fuel, electrical, telephones – that was designed to take a seat nicely above the water desk.

- Politicians can ignore international local weather change. And have.

- Politicians can’t ignore infrastructure collapses. Whereas local weather change is distant, summary and any individual else’s downside, the collapse of a metropolis’s water therapy is an existential risk to state and native politicians. They will

Up till now, our infrastructure has suffered benign neglect. Bridges that haven’t but collapsed get repainted moderately than rebuilt. US consuming water programs that haven’t been maintained lose about 2.1 trillion gallons of water annually, however principally the faucets nonetheless work so we’ve ignored the necessity for $500 billion in water-related investments (Report Card for America’s Infrastructure, 2021). Victorian-era sewage programs are frequent and are liable to failure throughout more and more frequent “as soon as in 500-year” storms (“Local weather change may overwhelm our sewers,” The Dialog, 12/17/2024). The variety of weather-related energy outages has elevated by 80% since 2000 and the size of the typical outage has doubled. The US Division of Vitality locations the price of outages at $150 billion / 12 months. The excellent news is that the US spends about $27 billion / 12 months to keep up its grid. The unhealthy information is that we have to spend $700 billion to steadiness rising demand with historical failing gear.

Local weather change has the potential to set off cascading failures that can transfer trillions from the “sometime” record to the “immediately” record. Amrith Ramkumar, writing for the Wall Road Journal, made the case succinctly:

Efforts to deal with the reason for local weather change have fallen brief to date. That’s resulting in an enormous push to deal with the signs.

Authorities and personal cash is pouring into plans to manage flooding, deal with excessive warmth, and shore up infrastructure to face up to extra extreme climate attributable to local weather change.

For personal-sector traders, placing cash into adaptation is a wager that mitigation received’t totally deal with local weather change or will take longer than anticipated. The price of adaptation is immense, notably if mitigation efforts are delayed. The longer society waits to deal with local weather change, the extra it would spend to fend off the influence of hotter, wetter climate, researchers say. (“Local weather Money Pivots to New Actuality of a Hotter, Wetter Planet,” WSJ.com, 8/1/2024)

More and more, traders suspect that “the pre-end interval shall be full of unprecedented alternatives for revenue.” Ed Ballard studies,

One other set of climate-change investments is now coming into focus: the companies that can assist us reside on a warmer planet. For traders, adaptation and resilience have been an afterthought. …However web zero is a good distance off, and heatwaves, storms, and wildfires are intensifying. Governments are below rising strain to shut an adaptation funding hole tallied within the trillions.

Buyers are on the lookout for corporations that can earn cash if the hole is closed. A report by BlackRock printed in December pointed to rising demand for services and products that construct resilience to local weather change, like air filters that assist throughout wildfires and monetary derivatives that enable for hedging climate danger.

“We predict markets possible underappreciate the extent of that progress,” BlackRock wrote. (“May Adaptation Be the Subsequent Local weather-Finance Gold Rush?” Wall Road Journal “Local weather and Vitality” e-newsletter, 3/14/2024)

Sectors that present compelling funding alternatives

The place would possibly these alternatives middle? Local weather instability might drive extra or accelerated spending in quite a few areas.

- Addressing getting old and susceptible infrastructure: Many US infrastructure programs are getting old and more and more susceptible to local weather impacts. There shall be a necessity for main investments to restore, improve, and modernize vital infrastructure like roads, bridges, water programs, and {the electrical} grid to make them extra resilient to excessive climate and altering local weather circumstances.

- Bettering resilience to excessive climate: Extra frequent and intense storms, floods, warmth waves, and different excessive climate occasions are damaging infrastructure. Vital investments shall be wanted in flood safety, stormwater administration, heat-resistant supplies, and different resilience measures.

- Transitioning to wash vitality: The Bipartisan Infrastructure Regulation gives over $65 billion for clear vitality transmission and grid upgrades to facilitate the enlargement of renewable vitality. This represents the largest-ever US funding in clear vitality transmission. It appears unlikely that the incoming administration will rescind funds beloved by its company mates.

- Increasing sustainable transportation: Main investments are deliberate for public transit, rail, electrical automobile charging networks, and energetic transportation infrastructure like bike lanes and pedestrian services to scale back emissions from the transportation sector.

- Defending coastal areas: Rising sea ranges and extra intense coastal storms will drive funding in pure and constructed coastal defenses, managed retreat from high-risk areas, and upgrades to coastal infrastructure.

- Addressing environmental justice: There shall be a give attention to directing infrastructure investments to deprived communities which might be typically most susceptible to local weather impacts. Lest you suppose that is the useless fantasy of a liberal regime, “crimson” states are more likely to face the best financial dangers from local weather change. Regardless of their populations and elected officers being much less more likely to acknowledge the risk, the impacts are more likely to be disproportionately felt by the poorest areas inside these states. Inside migration to Florida has already collapsed, with the state’s inhabitants progress dependent virtually fully on worldwide migrants (hah!). Texas faces extra billion-dollar climate occasions than some other state: from 1980 – 2000, about three occasions a 12 months (CPI adjusted {dollars}) which has spiked to 12 disasters a 12 months prior to now 5 years.

- Implementing pure infrastructure: Many anticipate elevated use of pure programs like wetlands, forests, and inexperienced areas to offer flood safety, warmth discount, and different local weather resilience advantages.

- Upgrading water infrastructure: Investments in water conservation, reuse, flood administration, and resilient water provide programs to take care of droughts, floods, and different climate-driven water challenges. The EPA estimates the wanted upgrades at north of $20 billion / 12 months, just about perpetually.

How does Mr. Trump play into all this?

Be danged if I do know. The incoming Trump administration’s possible actions current each alternatives and challenges for infrastructure investing in 2025 and past. Listed below are key methods the administration might strengthen or weaken the case for infrastructure investments:

Continued Authorities Spending

The Trump administration is anticipated to keep up important infrastructure spending, with almost $294 billion of the Infrastructure Funding and Jobs Act (IIJA) funds nonetheless to be allotted. This ongoing federal funding gives a powerful basis for infrastructure progress and improvement throughout varied sectors.

Streamlined Rules

Trump’s pledge to scale back bureaucratic crimson tape and expedite infrastructure initiatives may speed up the development and restore of vital programs. This streamlining of rules, notably focusing on the environmental influence assessments required by the Nationwide Environmental Coverage Act (1970), might result in sooner mission approval (suppose “nuclear energy crops”) and probably larger returns for traders.

Deal with Vitality Infrastructure

The administration is more likely to prioritize increasing and modernizing vitality infrastructure, together with pipelines, refineries, and distribution networks. This focus may create substantial funding alternatives within the vitality sector, notably in fossil fuel-related infrastructure. (sigh) Trump’s administration might reallocate funds away from public transportation, high-speed rail, and electrical automobile infrastructure. (Sorry, Elon.)

Emphasis on Public-Non-public Partnerships (P3s)

Regardless of previous skepticism, the Trump administration might embrace P3s as a way to modernize infrastructure and scale back federal debt. This strategy may open up extra alternatives for personal traders to take part in infrastructure initiatives.

Commerce insurance policies are a wild card since a lot of what we have to accomplish is reliant on imported supplies, applied sciences, and staff. (Relying on area and specialty, immigrant staff account for 30-50% of all expert and unskilled building laborers within the US). Republican-led budget-cutting measures may result in lowered federal funding for some infrastructure initiatives which might improve reliance on state and native funding, probably affecting the dimensions and scope of sure infrastructure investments.

Even with out local weather change serving as an accelerant, infrastructure funds have produced aggressive and uncorrelated outcomes over the previous 15 years. Benjamin Morton, head of worldwide infrastructure at Cohen and Steers highlights the group’s traits:

Listed infrastructure has little overlap with broad fairness allocations, accounting for simply 4% of the MSCI World Index, and gives entry to subsectors and funding themes which might be sometimes under-represented in broad fairness market allocations.

Efficiency knowledge over the previous 17 years signifies that listed infrastructure provides the potential for:

- Aggressive efficiency relative to international equities, with complete returns averaging 7.2% per 12 months

- Decrease volatility, supported by the comparatively predictable money flows of infrastructure companies

- Improved risk-adjusted returns, as measured by the next Sharpe ratio

- Resilience in down markets, with infrastructure traditionally experiencing 74% of the market’s decline, on common, in durations when international equities retreat

In 2022, in an atmosphere characterised by slowing progress, rising rates of interest, and excessive inflation, infrastructure considerably outperformed broader shares. This was according to infrastructure’s historical past of resilience and relative outperformance in most fairness market declines. (Important property: The case for listed infrastructure, 10/2023)

Funds for infrastructure traders

You should contemplate two components earlier than creating your shortlist of potential portfolio additions:

- Lively or passive? The argument for energetic administration revolves across the excessive diploma of uncertainty concerning the course of the Trump administration’s insurance policies, each these instantly geared toward infrastructure but additionally these impacting worldwide currencies and commerce.

- Targeted or diversified? You would possibly select to specific broad optimism for infrastructure investments, otherwise you would possibly discover a motive to focus on notably investments in vitality infrastructure. Inside vitality, you have got the choice of focusing on “next-gen” types of corporations or conventional pipeline ‘n’ energy individuals.

That is all difficult by the truth that the variety of funds that title themselves “Infrastructure” far exceeds the variety of funds (and ETFs) that Morningstar or Lipper place of their infrastructure classes. Lipper, as an example, recorded 92 funds named “infrastructure” however positioned solely 33 within the “international infrastructure” class. Consequently, some “infrastructure revenue” funds reside in “core-plus bonds” whereas others are labeled as utility, international infrastructure, pure assets, or vitality MLP funds. That makes direct comparisons laborious. We screened for each fund with “infrastructure” in its title after which reviewed its efficiency and mission.

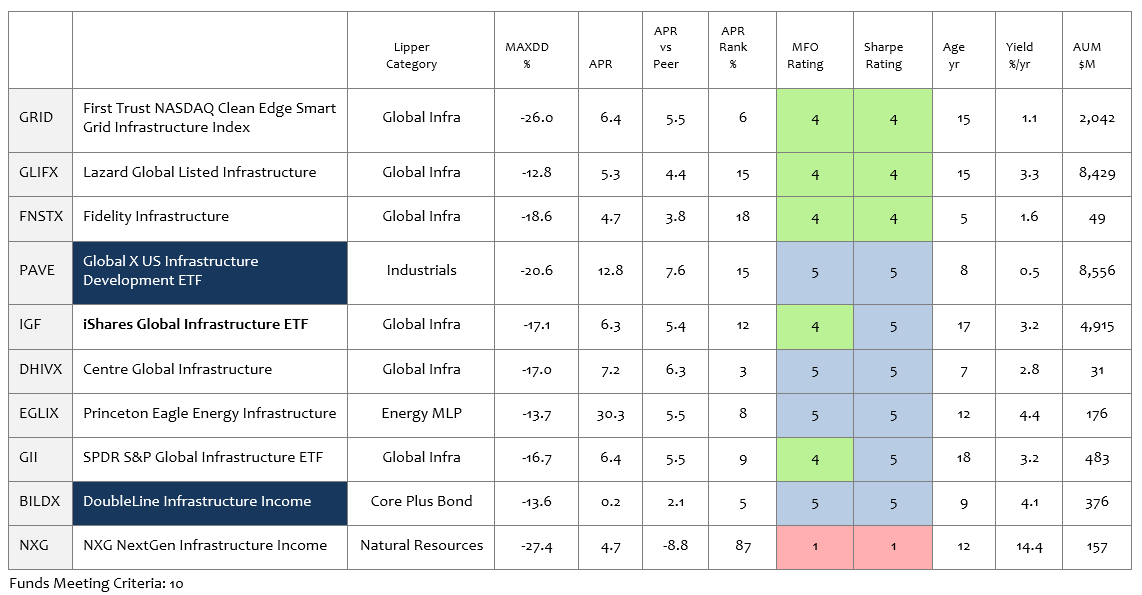

Three-year efficiency and traits of profiled funds

Diversified and energetic

Centre World Infrastructure Fund (DHIVX): DHIVX pursues long-term capital progress and present revenue by investing in infrastructure-related corporations from developed international markets. The fund employs a bottom-up, energetic administration strategy, specializing in what supervisor James Abate deems probably the most enticing infrastructure alternatives. It goals to steadiness publicity throughout telecommunications, utilities, vitality, transportation, and social infrastructure industries. The important thing diversifier right here is the fund’s structural mandate to speculate about one-third of its property in “social infrastructure,” similar to hospitals. Mr. Abate has a concentrated, low-turnover portfolio right here and in addition manages the four-star Centre American Choose Fund. DHIVX was the top-returning infrastructure fund of 2024.

Constancy Infrastructure Fund (FNSTX): This can be a five-year-old fund with simply $50 million in AUM, which is uncommon for Fido. About 70% of the present portfolio are American corporations within the full spectrum of infrastructure industries: airports, highways, railroads, and marine ports; electrical, water, fuel, and multi-utilities; oil and fuel storage and transportation; and communications infrastructure, similar to cell towers. The fund has four-star scores from each Morningstar and MFO.

Lazard World Listed Infrastructure Fund (GLFOX): This 15-year-old fund is the 800-pound gorilla of the class, weighing in at $9.1 billion. Infrastructure encompasses utilities, pipelines, toll roads, airports, railroads, ports, telecommunications “and different infrastructure corporations” (sigh). The managers goal “most well-liked infrastructure” corporations, mid- to large-caps that are characterised by “longevity of the issuer, decrease danger of capital loss and revenues linked to inflation.” In contrast to the Constancy fund, this can be a primarily worldwide fund with 75% in non-US investments. I’m distinctly unimpressed that solely one in all 4 long-time managers has invested even a penny within the fund.

Diversified and passive

World X U.S. Infrastructure Growth ETF (PAVE): This ETF provides broad publicity to U.S. infrastructure improvement corporations and has proven robust efficiency. PAVE has outperformed its benchmark and class, making it a pretty choice for long-term progress traders. The hot button is that it has each excessive upside seize and excessive draw back seize, with Morningstar giving it a “excessive” in each danger and return. That is the most important infrastructure ETF at $8.5 billion. It has a five-star score from Morningstar and is an MFO Nice Owl Fund which indicators top-tier risk-adjusted efficiency throughout all trailing durations.

iShares World Infrastructure ETF (IGF) and SPDR S&P World Infrastructure ETF (GII) are the kind of Frick and Frack of infrastructure ETFs. Each are passive, fairness, about 50/50 US and worldwide, about 3% yield, about 0.4% bills, with similar Morningstar and MFO scores.

Targeted and energetic

Eagle Vitality Infrastructure Fund (EGLAX): The fund makes long-term investments primarily in vitality infrastructure within the “midstream” transportation and storage phase of the vitality provide chain. These are long-lived, high-value bodily property which might be paid a payment for the transportation and storage of pure assets. It’s structured to attenuate that tax drag typical of MLP investments. The Eagle World group is predicated in Houston, steady, skilled (on common, 18 years), and closely invested within the fund. It has been acknowledged as a Lipper Chief for consistency for the previous 3-, 5- and 10-year durations. It has a five-star score from MFO and a four-star score from Morningstar.

Targeted and passive

First Belief NASDAQ Clear Edge Good Grid Infrastructure Index Fund (GRID): The fund invests in corporations which might be primarily engaged and concerned in electrical grid, electrical meters and gadgets, networks, vitality storage and administration, and enabling software program utilized by the good grid infrastructure sector. It focuses on clear vitality infrastructure and good grid applied sciences. By design, 80% of the portfolio are “pure play” corporations (e.g., the Swiss vitality engineering agency ABB), and 20% are diversified (e.g., Johnson Controls). GRID is appropriate for traders within the rising renewable vitality and good infrastructure sectors. It has a five-star score from Morningstar and a four-star score from MFO.

Infrastructure revenue

These are two very totally different funds for traders anxious to maximise revenue era.

DoubleLine Infrastructure Revenue (BILTX): That is the one bond fund within the infrastructure world, with all different “infrastructure revenue” performs specializing in shares and partnerships. It brings a value-oriented self-discipline to investing in infrastructure-related debt: debt that funds airports, toll roads, and renewable vitality, in addition to debt secured by infrastructure-related property similar to plane, rolling inventory, and telecom towers. The fund has been round since 2016 and has constantly outperformed the US Mixture Bond Index in each trailing interval.

NXG NextGen Infrastructure Revenue Fund (NXG): this can be a closed-end fund that invests in fairness and debt securities of infrastructure corporations, together with vitality infrastructure corporations, industrial infrastructure corporations, sustainable infrastructure corporations, and know-how and communication infrastructure corporations. The best targets are accountable and sustainable investments in corporations which have a excessive diploma of demand inelasticity; that’s, these with predictable, constant revenues whatever the state of the economic system. As a result of it has the flexibility to make use of leverage, yields are within the double digits. It’s in all probability greatest utilized by of us already snug within the wacky world of CEFs, however it’s received an attention-grabbing take.

For monetary professionals with an curiosity within the space and a pretty big AUM, Versus Capital Infrastructure Revenue Fund (VCRDX) provides an intriguing choice. It’s a brand new fund from a agency with an extended monitor file in infrastructure investing. It targets non-public, moderately than listed public infrastructure, investments. It’s structured as a closed-end interval fund with a excessive minimal, which each serves to permit it entry to illiquid investments and to display screen out speculators.

Backside line

At their worst, the diversified infrastructure funds nestle properly within the large-cap, value-to-core fashion field. At their greatest, they provide traders an opportunity to generate above common revenue and probably excessive long-term returns if infrastructure investing does certainly growth, usually with lower-than-average volatility. If we’re to outlive an unstable local weather and transition from a world not constructed for this to 1 that may maintain us regardless of it, they’re price your time.