Investing $100 in Bitcoin in the present day generally is a thrilling but unsure enterprise, given its unstable nature and the continuing debate surrounding its worth. Whereas Bitcoin has seen staggering development, it stays a dangerous asset, and learners ought to tread cautiously, making certain they will stand up to the potential ups and downs of the cryptocurrency market.

Bitcoin is the oldest and best-known of the trendy crop of digital currencies. It’s a cryptocurrency, or digital forex, not backed by any authorities. That makes it very completely different from the US greenback, and it comes with distinctive dangers that would make Bitcoin a great or dangerous funding, relying in your distinctive funding targets.

For those who’re trying into cryptocurrency for the primary time, it’s possible you’ll be questioning, “Can I begin by investing $100 in Bitcoin?” The reply is certainly sure. However earlier than you make your first funding, there are some things you must learn about crypto.

Right here’s a better have a look at what investing $100 in Bitcoin in the present day seems like for brand spanking new traders and veterans alike.

What Is Bitcoin?

Bitcoin is a digital forex that exists solely on the Web. But when you consider it, a lot of the cash you have got in the present day solely exists on the Web. For those who’re paid with direct deposit, you will have cash coming out and in of your accounts with out ever touching a bodily greenback invoice.

With that in thoughts, Bitcoin provides a very new tackle forex, and it’s controversial for among the options that additionally make it so fascinating (we’ll get into that later).

Bitcoin was created in 2009 by a mysterious determine who goes by the pseudonym Satoshi Nakamoto. However whereas Nakamoto is named the forex’s founder, it’s not managed by any single particular person. As an alternative, Bitcoin is a decentralized forex that operates via a community of computer systems worldwide often called cryptocurrency miners.

Cryptocurrencies, together with Bitcoin, depend on a expertise known as blockchain.

Each single Bitcoin transaction that has taken place is tracked on this public database. As a result of many computer systems world wide have a replica, this file is extraordinarily arduous to govern.

Anybody with an Web connection can take part within the cryptocurrency economic system. To purchase and maintain bitcoin you should utilize a cryptocurrency pockets, like one from Ledger, Trezor, or MetaMask. It’s also possible to purchase and maintain your forex via a central trade like Coinbase or Gemini.

Whereas it’s pretty straightforward to purchase bitcoin, particularly if you happen to’ve ever invested within the inventory market, that doesn’t imply it’s proper for everybody. When investing in Bitcoin and different cryptocurrencies, it’s sensible to keep away from investing greater than you may afford to lose. We’ll take a better have a look at why within the subsequent part.

What Is Bitcoin Value?

The worth of a bitcoin goes up and down continuously; a lot of its volatility is because of the controversy round Bitcoin’s price. When it first launched in 2009, a single bitcoin was solely price a number of cents, however at its peak, it was price round $60,000. As of this writing, a single bitcoin is valued at round $30,000.

As you may see from these numbers, early Bitcoin traders who held on via the crypto’s ups and downs probably made a fortune. For those who purchased $100 of bitcoin when it was price a number of cents and held it till it was price greater than $50,000 apiece, you can have simply made thousands and thousands of {dollars}.

The worth of Bitcoin has been extraordinarily unstable over time. Right here’s a 10-year value historical past from the cryptocurrency monitoring website CoinMarketCap.

However the controversy comes from the numerous detractors who say Bitcoin and different cryptocurrencies are successfully nugatory. These embody some high-profile Wall Road CEOs, analysts, and authorities officers. If they’re proper, Bitcoin will finally fall to a worth of zero or very near it.

With fanatics saying Bitcoin value will go “to the moon “ and others saying it can go to zero, what’s its true worth? At this level, not like shopping for shares, it’s considerably tough to say precisely what a bitcoin is price.

Bitcoin is in restricted provide. There’ll solely ever be 21 million created (about 19 million exist as of December 2023). The shortage drives up the worth and makes it helpful as a retailer of worth on-line, considerably like a digital model of gold. But when it seems to be fools gold, an enormous funding in Bitcoin could turn into an enormous mistake.

Can Newbies Put money into Bitcoin?

If you’re model new to the world of investing and have by no means purchased shares, mutual funds, exchange-traded funds, or different kinds of investments—as an illustration, a retirement account via your office—it’s possible you’ll wish to skip Bitcoin for now and begin investing with the inventory market. The inventory market is much more established with lots of of years of historical past and clearer strategies of deciding the worth of an asset.

Nevertheless, if in case you have a bit of investing expertise, you may completely put money into Bitcoin.

For those who’re comfy utilizing a pc and have your data helpful, you may create an account with most exchanges in about 10 minutes or much less. Then it takes just some minutes to hyperlink your checking account, make a deposit, and fund your cryptocurrency trade account for the primary time. Some exchanges provide the flexibility to immediately purchase Bitcoin and different cryptocurrencies, even when your financial institution’s deposit has not but been cleared.

If all of that sounds overwhelming, there’s no hurt in skipping this explicit asset class. However if you happen to’re enthusiastic about digital currencies and imagine blockchain expertise is an enormous a part of the way forward for finance, it’s possible you’ll discover the dangers of Bitcoin nicely price it.

What Might Occur if You Put money into Bitcoin

An funding in Bitcoin is way from assured. Issues may prove nice, and you can earn your a reimbursement tenfold, possibly much more. Alternatively, your funding may drop right down to zero. Whereas I’d prefer to suppose your odds in Bitcoin are higher than in Vegas, many riskier cryptocurrencies appear to be playing.

Not like government-backed fiat currencies, there isn’t any giant group behind Bitcoin that ensures its worth. I don’t wish to sound like a damaged file, nevertheless it’s necessary to know that you must solely make investments what you may afford to lose when shopping for cryptocurrency.

How A lot Cash Do You Have to Purchase Bitcoin?

It’s not tough to put money into Bitcoin, however preserve it a small portion of your portfolio. You don’t have to purchase a full Bitcoin without delay. Like a greenback is split into cents, bitcoin is definitely divided into smaller slices.

Most cryptocurrency exchanges permit traders to start out very small. You might be able to purchase as little as two, 5, or $10 of bitcoin when getting into a transaction. You probably have a $1000 portfolio and wish to begin with Bitcoin as solely 5% of your investments, it’s straightforward to perform that utilizing most centralized cryptocurrency exchanges.

To make an extended story quick, you don’t want a lot cash to purchase Bitcoin. For those who’re nervous about making your first buy, think about beginning small with round 5 {dollars}. This limits your danger and offers you time to resolve if it’s proper in your funding targets. For those who just like the expertise, you may at all times make investments extra later.

How A lot Would I Have If I Invested $100 in Bitcoin?

Early Bitcoin traders who offered on the prime, and even nonetheless maintain their forex, have probably seen enormous positive factors. For those who purchased Bitcoin early, even in small quantities, you can be a millionaire.

For those who invested $100 in Bitcoin in Bitcoin in July 2013, over 10 years in the past, you’d have purchased 1.47 BTC. At its peak, that was price about $101,500. That’s an unimaginable acquire!

As of this writing, 1.47 BTC is price about $38,743.27.

That’s nonetheless an enormous return on funding.

The place to Purchase $100 in Bitcoin

For those who’re critical about studying the inside workings of cryptocurrencies, it’s possible you’ll wish to use a self-controlled digital forex pockets. However for anybody who doesn’t think about themselves a tech nerd, the simplest place to purchase and promote cryptocurrencies is with a centralized cryptocurrency trade.

Right here’s a have a look at among the most respected cryptocurrency exchanges accessible to traders and merchants in the US:

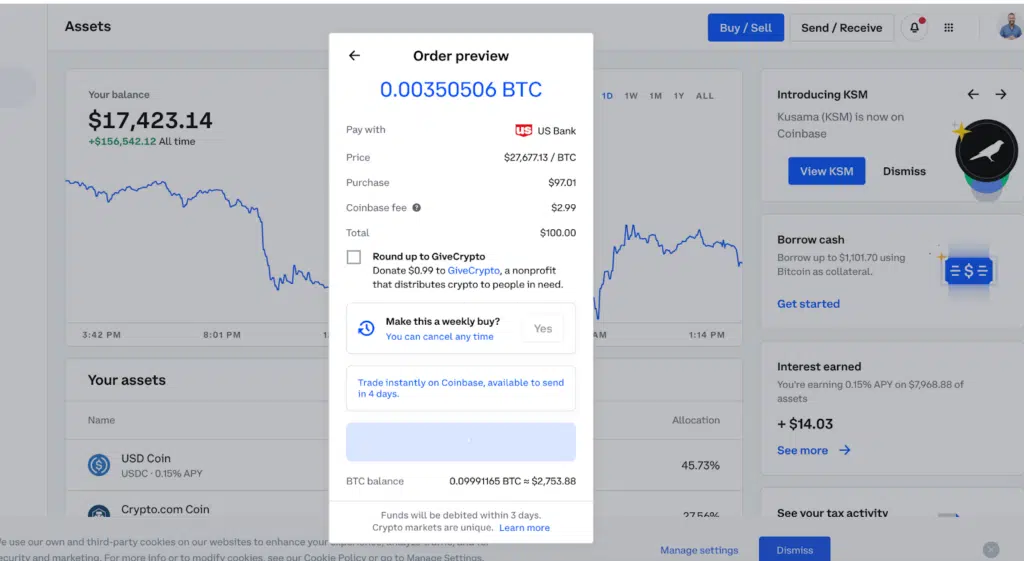

- Coinbase: Coinbase is likely one of the greatest and most acknowledged cryptocurrency exchanges in the US. Whereas it doesn’t include the bottom buying and selling charges, it helps numerous currencies and makes shopping for and promoting straightforward.

- Gemini: Gemini is one other giant cryptocurrency trade based mostly within the US. The Winklevoss brothers of Fb infamy based this trade. Gemini is a critical cryptocurrency trade with many bank-like options, together with the flexibility to earn curiosity from most cryptocurrencies held in your account.

- Binance.US: Binance.US is the arm of Binance centered on American merchants. Binance is by far the most important international cryptocurrency trade. Nevertheless, the expertise for customers in the US shouldn’t be precisely the identical as in the remainder of the world attributable to US securities laws. Regardless of these limitations, aggressive pricing and entry to a big checklist of currencies might make Binance.US a great house in your crypto.

- Kraken: Kraken is a cryptocurrency trade which may be higher for these with extra cryptocurrency data. Kraken provides a large checklist of currencies, low, aggressive charges, and an excellent earn function the place you may obtain beneficiant rewards for staking or holding a number of currencies.

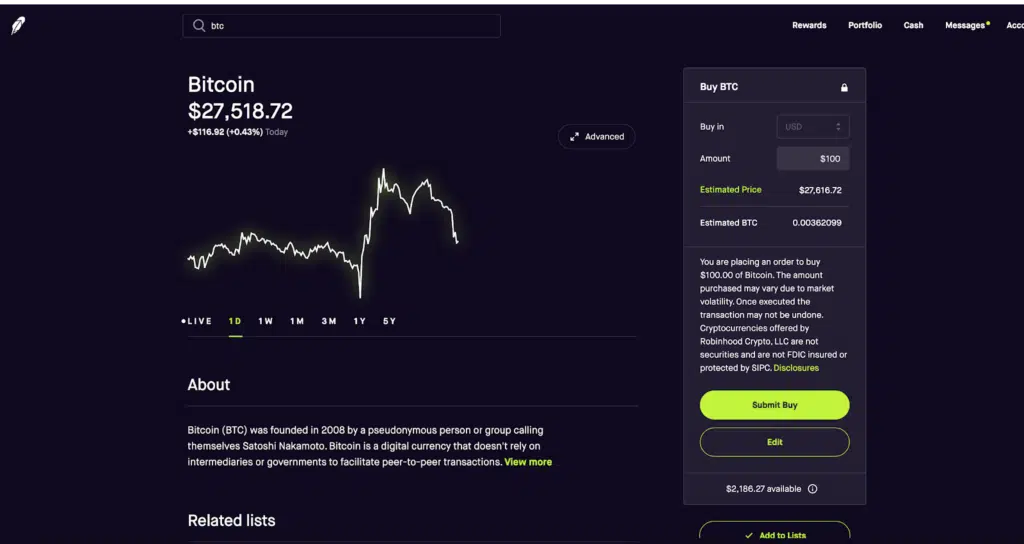

- Robinhood: Robinhood provides utterly commission-free cryptocurrency trades. Whereas it solely helps a brief checklist of cryptos, the low price may be very enticing. Additionally notice you can’t withdraw cryptocurrency from Robinhood to an outdoor pockets, although that function could also be coming with Robinhood’s new pockets product.

- Webull: One other commission-free buying and selling app, Webull is constructed for energetic merchants and helps as much as 41 currencies relying in your location. The low prices are enticing, however once more you may’t withdraw cryptocurrency holdings to outdoors wallets or accounts.

- Public: Public is one other brokerage that began with shares and grew to assist cryptocurrencies. The general public helps 30 cryptocurrencies. Whereas there are not any commissions, a 1% to 2% markup is included within the commerce value as a price.

How A lot Are Charges to Purchase $100 of Bitcoin?

Coinbase is likely one of the greatest and best-known exchanges, however trades may be pricey. Utilizing the primary platform, trades are topic to a flat price per commerce plus a variety. The price varies based mostly on the commerce measurement. Anybody can improve to the energetic buying and selling platform with decrease charges.

Robinhood Crypto provides fee-free cryptocurrency trades. Whereas the checklist of supported currencies is shorter than some opponents, you may’t beat free trades!

Can You Mine $100 in Bitcoin?

Earlier on this article, I discussed the idea of coin mining. Whether or not or not you take part in mining, the Bitcoin mining course of significantly impacts coin holders and anybody making cryptocurrency transactions on the Bitcoin blockchain.

Bitcoin miners are computer systems competing towards one another to course of and confirm the subsequent block of transactions. The block—a gaggle of transactions from the identical interval—is the place blockchain will get its identify.

When a miner is first to reach fixing the complicated math to course of a brand new block of transactions, that individual is rewarded with the transaction charges from current customers and newly minted bitcoin. As a result of Bitcoin is so helpful, there are lots of, many miners world wide competing to earn that reward. As soon as all Bitcoin has been mined, rewards shall be diminished to solely transaction charges.

As a result of so many miners compete to earn bitcoin rewards, it’s extraordinarily tough for solo miners to earn something independently.

If you wish to take part in Bitcoin mining, it’s possible you’ll want to purchase costly pc {hardware} and have the in-depth technical data to get all the things arrange and dealing correctly.

To extend their probabilities of successful a reward, some miners pull their sources collectively and collaborate in a mining pool. However whether or not you mine via a pool or by yourself, you might be unlikely to get wealthy with Bitcoin mining nowadays.

Actually, miners could spend more cash on the electrical energy powering their computer systems than they earn from mining rewards. Most individuals are finest off shopping for Bitcoin via a favourite cryptocurrency trade.

Bitcoin Security and Safety

For those who resolve to maneuver ahead and purchase Bitcoin, it’s important to observe on-line safety finest practices. That features utilizing a singular, difficult-to-guess password on each monetary web site, together with cryptocurrency exchanges, banks, brokerages, bank card firms, and different lenders.

Cryptocurrency shouldn’t be FDIC insured, and if a cryptocurrency account is hacked, you’re unlikely to be reimbursed by the trade in your losses. For those who don’t really feel assured protecting your on-line account safe and utilizing sturdy passwords, it’s possible you’ll wish to skip cryptocurrency altogether.

Different Cryptocurrencies to Know In addition to Bitcoin

In fact, Bitcoin isn’t the one cryptocurrency that’s grabbed headlines over the previous few years. Ethereum, Dogecoin, Shiba Inu, Stellar Lumens, Avalanche, Cardano, and Solana are just some of the greater than 10,000 cryptocurrencies on {the marketplace} in the present day.

Nevertheless, it’s necessary to notice that Bitcoin and Ethereum are arguably the most secure and most secure cryptocurrency initiatives in the present day. Investments outdoors of those core currencies include much more danger and volatility.

To be taught extra about different prime cryptocurrencies, take a look at web sites like CoinMarketCap and CoinGecko.

The way to Resolve if Bitcoin Makes Sense for You

Bitcoin has a variety of execs and cons. Whereas it’s nice to consider what would occur if you happen to make an funding that grows tenfold or extra, it’s additionally necessary to recollect the chance of taking main losses.

For savvy traders, diversification is a crucial idea to observe. That would imply including Bitcoin and different cryptocurrencies to your portfolio. For those who’ve carried out your analysis, perceive how Bitcoin works, and nonetheless suppose it is sensible for you, investing your first $100 in Bitcoin could possibly be a great way to dip your toe within the crypto water earlier than making a bigger, riskier dedication.

Ultimate Ideas on What May Occur if You Make investments $100 in Bitcoin At the moment

Investing $100 in Bitcoin can yield substantial positive factors or important losses attributable to its unstable nature and controversial standing. Bitcoin’s distinctive options, like decentralization and restricted provide, set it other than conventional currencies. The cryptocurrency’s worth has fluctuated dramatically, from mere cents to tens of hundreds of {dollars} per bitcoin.

Whereas early traders profited immensely, skeptics argue it might finally turn into nugatory. Newbies ought to solely make investments what they will afford to lose, contemplating the dangers. Bitcoin’s worth stays unsure, making it necessary to analysis and perceive earlier than investing. Diversification is smart, and beginning small can provide publicity to crypto’s potential whereas minimizing danger.