Most of us already know by now the significance of outsourcing our largest monetary dangers in life i.e. to an insurer. Nevertheless, the dilemma as to what to purchase and from who nonetheless stays a puzzle, particularly when the knowledge stays principally opaque, and the advantages and phrases of insurance policies hold altering over time.

The scenario at present

Everyone understands the significance of insurance coverage, however most individuals simply don’t just like the shopping for course of due to worry of being oversold, pressured, or misled. We now have additionally gotten used to acquaintances calling us up out of the blue within the guise of eager to “catch up”, just for the session to be a gross sales pitch to try to get us to purchase insurance coverage from them.

These are very actual ache factors of shoppers at present, usually arising from the conflicts of curiosity as a result of fee mannequin of the business. Until an agent sells one thing to you, they don’t earn something, so there’s at all times an incentive to get you to decide to a coverage, particularly those who pay a better fee of fee.

Since 2014, I’ve lengthy advocated on this weblog that one ought to use insurance coverage primarily for cover, moderately than for financial savings or funding. What’s extra, we ideally need to pay the bottom premiums attainable whereas securing as a lot protection as attainable.

Nevertheless, the issue is that not each insurance coverage salesperson at present shares these identical beliefs. Not everybody joins the insurance coverage business wanting to guard lives and assist folks; some are in it for the cash, whereas others are drawn by the incentives as seen on social media – suppose lavish existence, normally within the type of a abroad journeys for the adviser and their accomplice, enterprise class flights or a brand new, shiny automobile.

As a substitute, brokers who promote insurance policies producing essentially the most income for the corporate are those get rewarded and clinching MDRT, COT and even TOT titles*. Is it any surprise that complete life insurance policies, endowment financial savings and investment-linked plans are repeatedly offered 12 months after 12 months to ignorant clients? The business’s present enterprise mannequin rewards those that promote essentially the most, however that may shortly line the agent’s pockets to allow them to give their households a greater life, this will usually come on the expense of the patron.

MDRT = million greenback roundtable; COT = court docket of the desk (3x MDRT); TOT = prime of the desk (6x MDRT).

Many shoppers don’t realise that though they get “free” monetary recommendation, the “recommendation” given to them is usually swayed by commissions and layers of gross sales incentives that they aren’t aware about (learn this submit to grasp). The result is that unbeknownst to them, the overwhelming majority of shoppers find yourself paying excessive charges over the following few many years on their subpar insurance policies (due to the hidden and embedded commissions)…whereas nonetheless ending up with an inferior plan that doesn’t totally cowl their safety wants.

Lately, paying an upfront price for monetary recommendation (i.e. the fee-paying mannequin) has began to realize traction abroad. International locations just like the UK and Australia now have a lot of fee-paying advisors, and over within the US, my pal Jeremy not too long ago launched his insure-tech agency Nectarine, the place you pay a median of $150 – $250 per hour to ebook licensed monetary planners in the US to get recommendation, significantly on insurance coverage and investing.

Nevertheless, in Singapore, the fee-paying mannequin has but to take off, and there is just one agency that practices this mannequin: Providend.

Sadly, Singaporeans have gotten so used to getting “free” recommendation from insurance coverage brokers (who now go by the title “monetary advisors”) that we’re most likely a number of many years away earlier than the commissions-model declines and fee-paying fashions turn out to be mainstream. Sadly, the “free” recommendation you get shouldn’t be actually free, as a result of the salesperson is getting paid by the insurer, the dealer, or the fund home benefiting from the coverage; this fee is taken out from the cash that YOU pay.

For so long as this mannequin doesn’t change, then we shoppers want a greater means to have the ability to distinguish between the black sheep and the great brokers. I’ve written right here about some starter inquiries to ask your insurance coverage agent, however even then, that’s hardly sufficient.

Is Havend the answer for higher, unbiased insurance coverage recommendation?

After my latest article the place I revealed how insurance coverage commissions can affect the “recommendation” that you just’re getting out of your agent, the oldsters over at Havend reached out to me for a chat and shared about their enterprise mannequin and philosophy.

In case you’ve by no means heard of Havend, they’re fashioned by the identical crew that introduced you DIYInsurance, which was Singapore’s first life insurance coverage comparability portal began in 2014 (even earlier than MAS launched compareFIRST). DIYInsurance gave shoppers the flexibility to get the insurance coverage they wanted at a decrease value, with out having to undergo an agent, and the portal did very effectively earlier than it was acquired by MoneyOwl, in a three way partnership with NTUC Enterprise. The unique of us behind DIYinsurance went again to Providend (the unique “mum or dad” firm), and has now branched out as a subsidiary generally known as Havend.

I’ve labored intently with Providend, DIYInsurance and MoneyOwl on a number of events earlier than, so I’m acquainted with their work ethics and their philosophy in the direction of insurance coverage. So when the crew at Havend invited me all the way down to overview their providers for myself and provides my suggestions, I mentioned sure.

And because it turned out, I loved my expertise a lot that I’m now happy to share I can wholeheartedly suggest you guys to go and test them out for a overview, too.

Assessment: My expertise with Havend

I’ve been managing our household’s insurance coverage insurance policies all this whereas, consulting with 3 trusted advisors-turned-friends each 1-2 years as I overview our family protection. Because it stands, I’m normally the one proactively reaching out to them with my questions, or to ask for a overview – particularly every time we cross a brand new life milestone (reminiscent of after we grew to become mother and father, or when my children have been born).

My insurance coverage brokers usually inform me I’m one in every of their few shoppers who method them for a overview moderately than the opposite means spherical, lol. It ain’t simple to realize Funds Babe’s belief, a lot much less her enterprise – provided that my work exposes me to lots of of insurance coverage brokers whom I may select to work with at anytime!

Nonetheless, I used to be open to see what recommendation Havend’s insurance coverage specialists would give me on our portfolio, so I went down for a InsureWell evaluation to listen to their skilled opinion.

Previous to the session, I used to be requested to (i) undergo a Goalsmapper evaluation on-line, and (ii) refill an Excel spreadsheet with particulars about our insurance coverage insurance policies. These have been despatched to the insurance coverage advisor(s) assigned to our case to overview earlier than giving us any suggestions or recommendation.

We opted for an in-person session, which began with an introduction to Havend’s insurance coverage philosophy – one I used to be glad to see aligned very a lot with my beliefs. Then, they went into their 3 Ps framework: Function, and Payout vs. Premiums. I used to be requested about my Function(s) then for selecting the plan(s) we had, whereas Havend suggested on the worth i.e. Payout vs. Premiums.

After assembly with numerous of brokers who’ve tried to speak me out of time period insurance coverage (vs complete life) and persuade me into getting an ILP (learn: why I cancelled my ILP), it was a breath of contemporary air to fulfill with Si Jin and Mike, who didn’t attempt to pull any tips on us.

As somebody who does most of my household’s insurance coverage planning myself, it was reassuring to see that even the consultants at Havend agreed with my method and techniques. And even after we disagreed on the 3Ps for some plans – reminiscent of how our Private Accident plans value us double of what Havend may get for us on a unique insurer – the specialists at Havend took the time to listen to us out and agreed that there was a case for paying greater premiums so long as we have been glad and getting worth out of it.

As an example, whereas I’ve at all times recognized that placing our household underneath AIA’s Private Accident plans value us much more than if we had caught with Sompo (which we had up until 2021), this resolution was not made frivolously – however we felt the upper premiums was price it as a result of our AIA agent is nice at what he does, and has helped us declare for a number of lots of of {dollars} yearly with out fail.Our AIA agent (Bran) takes the trouble to comply with our lives on social media and is usually within the know when our kids get unwell or my husband will get into a motorbike accident. Throughout a 2-week episode final 12 months when HFMD struck each our children and my husband, we have been too frenzied to even keep in mind that our PA plan covers for HFMD. If not for our agent, who messaged us to remind us to ship him our medical receipts and filed the claims, we'd most likely have gone via all the season with out getting a payout…as a result of we have been too caught as much as keep in mind our entitlements. Because of this we're keen to pay (a better) premiums for our household’s PA plans, so long as it continues to be serviced by him.

The session principally validated my thought course of and monetary planning method, and I used to be additionally in a position to focus on my issues with them as as to whether we may be underinsured for essential sickness protection regardless of shopping for a number of extra on-line insurance policies to layer our safety in recent times.

All in a secure area, with none stress to purchase or take a look at new insurance policies.

Actually, the suggestions have been solely despatched to my electronic mail after the session.

How does Havend mitigate the conflicts of curiosity?

To be clear, conflicts of curiosity will at all times exist within the business as a result of nature of insurance coverage gross sales. Regardless that Havend’s advisers are all salaried, paying a month-to-month wage alone can’t solely eradicate conflicts if the worker’s variable pay will depend on how a lot fee or annual premiums they bring about in.

Therefore, Havend has put collectively 5 controls to guarantee that these conflicts of curiosity are strongly mitigated:

| Drawback | Answer |

| Advisers could also be tempted to promote costly plans to you to earn extra commissions | Give attention to lives modified, not gross sales.

The adviser’s variable compensation is predicated on the variety of lives they advise, and never on the commissions they bring about in. |

| Advisers could also be swayed to promote merchandise that pay further incentives along with incomes fee. | Gross sales incentives are retained by the corporate and aren’t given to Havend’s insurance coverage specialists to forestall any product bias. |

| Not figuring out if the product being advisable is appropriate or as a result of it pays plenty of commissions. | Be clear sufficient to inform you how a lot commissions they’ll obtain from the plans advisable to you. |

| With out a clear planning philosophy to anchor on, chances are you’ll find yourself shopping for insurance policies not essentially the most acceptable to your wants however one which pays extra to the advisers. | A transparent insurance coverage planning philosophy: Havend publicly makes recognized why it considers sure insurance coverage merchandise appropriate or unsuitable primarily based on sound ideas, and never on the fee quantity the salesperson may obtain. |

| No assurance if the perfect practices in insurance coverage advisory is being carried out for you as a result of advisers have full autonomy in how they run their advisory enterprise. | Havend has institutionalized a course of the place each shopper receives the identical recommendation, which ensures each piece of recommendation given is constant to the corporate’s course of and insurance coverage philosophy, and isn’t depending on the insurance coverage specialist’s personal desire. |

On prime of that, they’re providing a Cash Again Assure; within the occasion that there’s any overselling of insurance coverage to you, Havend will supply a refund of the surplus insurance coverage premiums you will have over-paid.

Ought to I’m going to Havend for insurance coverage recommendation?

Over time, lots of you guys have come to me looking for insurance coverage recommendation. On account of MAS laws, my response has at all times been the identical: I’m not a licensed monetary advisor and can’t provide you with licensed recommendation.

A few of you will have requested me to affix the business, whereas others have tried to recruit me; it is a “no” for me as a result of I really feel that the worth of the work I do right here on my weblog impacts way more lives than I can if I grew to become an agent. I wouldn’t be capable of write articles like this, this or this, as an example. My agent pals have additionally been informed by their businesses or compliance groups to take away posts they made on their very own social media, together with content material round which bank card is the perfect to make use of for paying your insurance coverage premiums (my reply right here).

After having gone via a Havend advisory session myself, I can wholeheartedly say that the recommendation given by Havend is the very same that I might give to my readers.

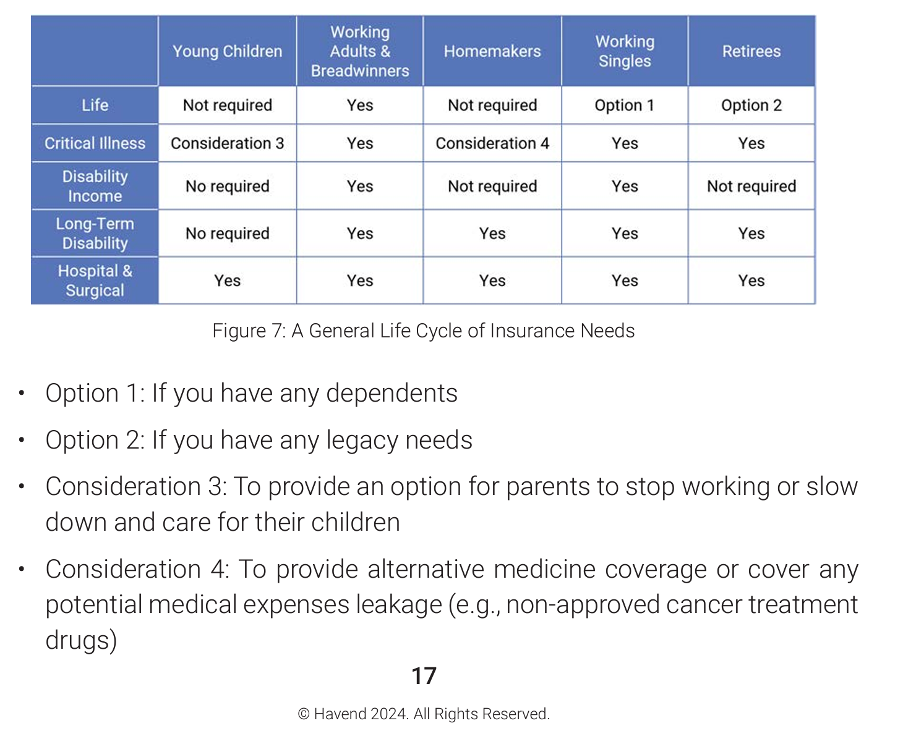

Their insurance coverage philosophy first focuses on insuring us towards 5 core areas of monetary dangers:

Adopted by a dialogue into your private circumstances, wants and price range, in order that what you must have or whether or not some plans are pointless. This follows the institutional framework adopted by their mum or dad firm, Providend, which principally serves the wealthier teams as a trusted adviser to get a second opinion.

At this time, at Havend, the common man on the road can now profit from the identical institutional advisory course of.

If you select Havend, you’ll be able to anticipate

- a reliable insurance coverage advisory expertise and belief that you just received’t be oversold.

- Get dependable recommendation on tips on how to be adequately lined, with out having to overpay.

The second level is an enormous drawback for many shoppers in Singapore, and whereas many brokers are fast to level out to you about how being under-insured can shortly result in monetary smash ought to a life disaster strike, fewer will admit to you that you just may be over-insured.

Being over-insured additionally comes at a worth – the premiums you pay are consuming into monies that might have in any other case been invested in your future wealth or retirement.

So when you have any of those issues, discuss to the consultants at Havend to get recommendation in your monetary scenario. They may critically overview your insurance coverage insurance policies for you and provide you with their unfiltered tackle whether or not it’s price it or not. And within the occasion that you just disagree with they gave you or really feel they oversold you into any insurance policies, make use of Havend’s Cash Again Assure (and drop me an electronic mail, because it determines whether or not I proceed recommending them to my readers in future).

Havend was created to make sure you and your loved ones are at all times sufficiently and suitably lined. Ought to you will have any doubts or end up not sure about your insurance coverage portfolio, I encourage you to succeed in out to Havend and get a second opinion in your insurance coverage insurance policies.

In partnership with Havend, you should use my referral code SBBTCL01 to get a complimentary InsureWell evaluation.

You’ll additionally obtain $20 cashback for each coverage that you just resolve to bought via Havend after the evaluation.

Disclosure: This text was written in partnership with Havend, however they’d no say in influencing my opinions said right here. In full transparency, you also needs to know that I stand to obtain an introducer price (affiliate) from the corporate within the occasion that you just resolve to buy a coverage via Havend’s advisors.

Editor’s be aware: I overview and replace my suggestions occasionally. In case you go for a Havend InsureWell evaluation and for any cause, really feel that it was unsatisfactory, please electronic mail me along with your suggestions – it will assist me to resolve whether or not to proceed recommending them to my readers. To this point, my expertise (and that of my pals) have been extraordinarily constructive, which is why I agreed to jot down this text and encourage you guys to test them out for your self as effectively.