Typically we see polarization among the many investing public between people who make investments and focus their monetary planning primarily within the liquid securities markets and people who make investments primarily in actual property. Our view is that beneath sure circumstances, liquid securities investing and illiquid actual property investing could be complementary. Nonetheless, the important thing to navigating between these areas is having an applicable framework for a way to consider investing in actual property within the context of private planning targets, danger administration, liquid investing, tax planning, and property planning. Admittedly, we’re not each day actual property investing specialists, however listed here are some concerns in relation to actual property investing within the context of your private monetary planning.

Consider Your Total Steadiness Sheet As You Think about Actual Property

Earlier than transferring ahead with allocating a big portion of 1’s web price into actual property, we suggest having a monetary plan across the optimum mixture of belongings in your steadiness sheet. Belongings on one’s private steadiness sheet can usually be divided into three classes and every of those classes can allow the achievement of specific targets: 1) security belongings like money in checking accounts and your private residence are meant for important targets like dwelling bills and shelter; 2) market belongings like shares and bonds are earmarked to attain must-have targets like retirement and school schooling funding; and three) moonshot belongings like non-public fairness, cryptocurrencies, fairness compensation inventory choices, and funding actual property are supposed to fund aspirational targets like funding early monetary independence or shopping for a second residence.

It is necessary to do not forget that when one strikes from belongings predominantly held within the security and market buckets to the moonshot bucket, one is taking over extra danger with diminished diversification and illiquidity. The optimum steadiness between these three buckets is very dependent in your private circumstances, however a prudent combine in your 50’s could possibly be one-third in every bucket.

As you allocate between the three asset buckets, your moonshot bucket and market bucket belongings shouldn’t be framed as zero-sum trade-offs between one another, they really complement one another. The inventory belongings in your liquid bucket could possibly be a supply of capital or collateral in case of an unexpected capital enchancment outlay wanted in your actual property portfolio. Alternatively, your actual property portfolio can function a hedge by having accelerating rental revenue (I’m you, New York Metropolis rental actual property in 2023) to offset inflationary stress and elevated volatility in your inventory portfolio.

Pin Down Your Actual Property Objectives, Funding Thesis, And Comparative Benefit

When you’ve determined the optimum quantity of actual property in your steadiness sheet, having clear actual property targets, a strong funding thesis for every potential funding property, and growing the particular comparative benefits wanted to execute may help maximize returns over the long-term. Are you in search of long-term value appreciation to fight inflation by shopping for undervalued single-family residential properties in communities with surging favorable long-term demographics by elevating capital by way of household and pals? Or maybe you’re seeking to accumulate revenue in retirement by shopping for a portfolio of modestly priced multi-family items which you’ll be able to handle at low price relative to different traders with a community of actual property assist professionals and low price financing? Every of those methods requires disparate abilities and focus to guage investments, determine which properties you deploy capital in, execute ongoing administration, and at some point profitably exit. Being clear on what your particular technique is and the way you execute on that technique is vital to monetary planning success.

Whereas diversification is a key tenet of profitable investing, dabbling between numerous varieties of actual property investments can decrease your probability of success. Reasonably than shifting the strategic focus between many various property varieties with the goal of diversification, we propose garnering portfolio diversification by complementing a centered actual property technique with a diversified portfolio of liquid shares and bonds.

Gauge Your Private Suitability For Actual Property Investing

Many individuals are drawn to actual property investing with the purpose of “passive revenue”, however the actuality is that profitable actual property investing often takes a major period of time and data to implement persistently. We’ve seen purchasers spend years increase a worthwhile portfolio of funding properties with the goal to fund a cushty retirement of passive revenue, solely to change gears and rapidly monetize the portfolio after rising bored with managing repairs and amassing checks. Private preferences and style can derail a wonderfully conceived and executed monetary plan.

Whereas actual property is “passive revenue” from an IRS perspective, actual property funding and administration for a lot of is something however a passive expertise. Because it’s expensive to change on and off a long-term actual property funding technique resulting from transaction prices, we suggest beginning small and constructing over time to gauge your private tolerance and aptitude for investing the suitable quantity of effort and time vital to enrich your total wealth administration technique with actual property. Clearly, there are administration corporations that you may interact to take among the administrative burden of actual property investing. The standard and price of those companies can range extensively, so it’s necessary to tread rigorously.

Along with understanding your private suitability for actual property, we suggest that traders perceive their private “why”, in order that their investments can dovetail with their values and targets. It’d make sense to do a worth train with purchasers the place you write down a broad array of values (household, influence, freedom, and so on.), after which slim down crucial values all the way down to 10 after which to five. Consequently, as soon as values are outlined, traders can extra simply set monetary targets and allocate capital amongst investments that align with their values. For instance, you probably have a purpose of dwelling abroad in retirement, you may wish to assume twice earlier than constructing a big rental actual property portfolio domestically given the complexities of managing that portfolio overseas. Furthermore, in that state of affairs you’d have a forex mismatch danger as you earn {dollars} from actual property and pay for bills in a international forex.

Perceive the Commerce-offs between Actual Property and Liquid Investments

Oftentimes we see traders consider the deserves of potential funding actual property alternatives purely towards the relative return they’ll obtain from liquid investments. This strategy could be harmful given the variations between liquid and illiquid investments. One may estimate that an actual property property could have an estimated inner fee of return (IRR) of 12%, so they may transfer ahead with the funding since that exceeds their anticipated inventory market return hurdle of maybe 8% or an anticipated diversified portfolio hurdle fee of shares and bonds of 6%. We might argue that traders ought to take into account a number of changes when evaluating actual property investments relative to liquid investments. For instance, you may add 4% to your hurdle fee as an “illiquidity premium”, add 3% to your hurdle fee since actual property investments have a diminished skill to simply diversify given the excessive required minimal sizes, and add one other 2% to compensate you to your time and private legal responsibility. On this instance, as you mannequin a possible actual property funding, you may require a minimal 17% inner fee of return (8% + 4% + 3% + 2%) to allocate capital away from liquid investments.

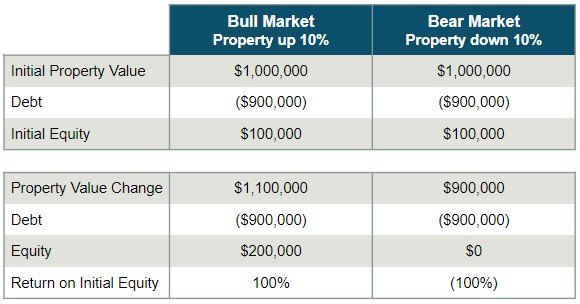

One of many distinctive options of actual property investing is the power to leverage investments at a degree a lot increased than liquid investments like conventional shares or bonds. Because of this, actual property gives traders the power to boost returns by way of leverage, nevertheless it additionally opens the door for probably considerably extra danger. For instance, should you purchase a property for $1,000,000 with solely 10% down, your return on capital invested if the property goes up 10% and also you promote and repay the debt is 100%. On the flip aspect, you lose 100% if the property goes down 10% on this situation. With this in thoughts, it’s necessary to guage actual property tasks on their benefit on a leverage adjusted foundation. A ten% IRR undertaking with no leverage could possibly be a greater debt-adjusted undertaking than a 15% IRR undertaking with leverage.

A Lengthy-Time period Time Horizon Can Mitigate Actual Property Danger

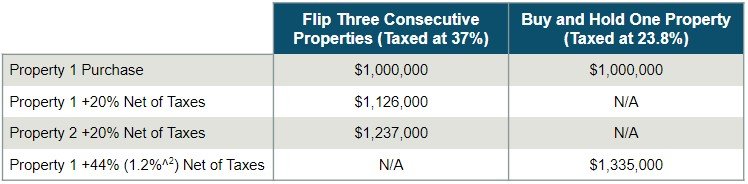

Identical to within the inventory market, a long-term time horizon can mitigate among the dangers in actual property, significantly with leverage. The various months from the time one decides to promote a property to truly having the money readily available, may help keep away from emotional promoting that we regularly see with many inventory traders. Compelled promoting with excessive leverage is a recipe for catastrophe, so having a long-term time horizon to keep away from promoting throughout actual property market pullbacks may help mitigate danger and facilitate efficient wealth administration. Furthermore, given the excessive transaction prices of buying and promoting actual property, amortizing these bills over a few years can enhance your probabilities of a better return. Most of the favorable tax advantages traders are enabled by a long run time horizon. For instance, long-term capital positive aspects charges between 0% and 23.8% await actual property traders after they promote properties held for longer than one yr, whereas short-term actual property flippers may face Federal tax charges as much as 37% and even increased if the legal guidelines aren’t modified earlier than 2026.

An actual property funding flipper that invests $1,000,000, earns a 20% return, then reinvests the after tax proceeds incomes one other 20% return in a second property would have $1,237,000 after taxes if taxed at short-term capital achieve charges. A purchase and maintain technique that has the identical gross returns however is taxed at long-term capital capital positive aspects charges would have $1,335,000 after taxes. A purchase and maintain technique vis-a-vis an actual property flipper technique is much more engaging considering purchase and promote transaction prices, significantly in areas like New York Metropolis which have increased than typical actual property transaction prices.

Be Disciplined about Modeling Future Actual Property Returns

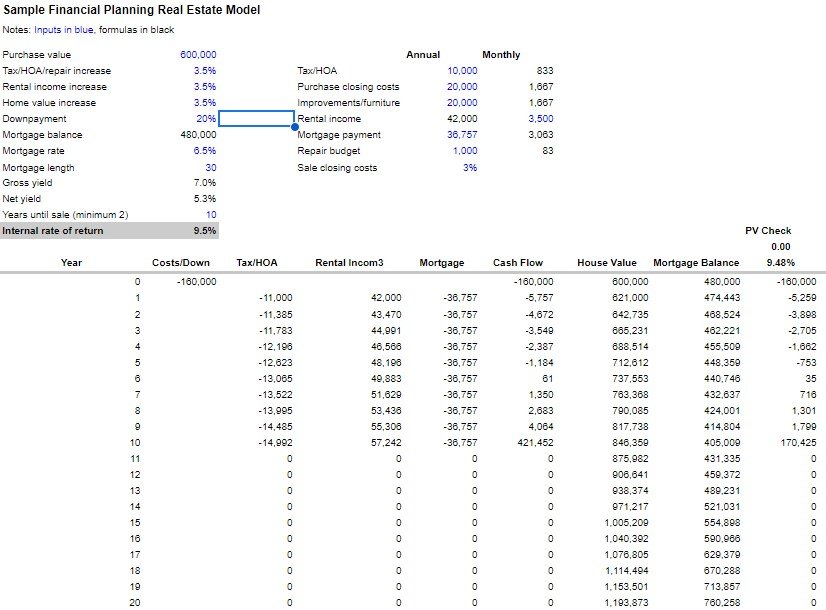

Too usually we see traders establish a property they like, estimate how a lot they’ll lease it out for, get hold of a mortgage quote after which transfer ahead as a result of it’s “money stream optimistic” with out rigorous forecasting about what their anticipated return might be. Alternatively, we extremely suggest traders develop a sturdy monetary mannequin calculating IRR primarily based on rigorous analysis on the undertaking’s assumption. The mannequin ought to have estimates for rental will increase, emptiness, repairs, capital tasks, and different key inputs. Every one in all these assumptions must be adjusted up and all the way down to see how impactful it’s on the IRR. What if the financing fee goes up 2%. What if there’s an enormous renovation wanted in yr 5? Your mannequin ought to be capable to reply these and different questions to find out the attractiveness of the funding. For instance, we’ve discovered that the power to push by way of annual rental will increase, even modest will increase, can have a profound influence in your IRR. For instance, growing month-to-month lease of $5,000 might be $7,241 after 15 years of annual 2.5% will increase, whereas growing the identical $5000 lease by 10% each 5 years leads to a month-to-month lease of $6,655 after 15 years.

Understanding Actual Property Financing Sorts and Their Implications

Optimum financing is a large determinant of actual property investing success, so understanding the trade-offs and implications of various financing constructions and kinds must be a key part of any actual property monetary plan. For instance, shorter amortizations can decrease the general rate of interest prices of a property assuming an upward sloping yield curve, however may put stress on money stream as larger quantities of principal are due sooner. Basically, we’re a fan of long run amortizations that give price range reduction, but in addition give the flexibleness to prepay amortization and basically cut back the amortization time period on the investor’s discretion. The preliminary quantity down on a property can also influence the general success of an actual property funding. Our common desire is to place extra down in increased rate of interest environments and reduce the quantity down in low rate of interest environments. In low rate of interest environments, the unfold between the curiosity price and the chance price is wider. Consequently, if would-be increased down cost quantities could be invested at charges of returns increased than the curiosity prices, the steadiness sheet might be positively affected over the long-term. That being stated, if decrease down cost quantities are sought primarily as a result of a property is out of attain financially, the danger to 1’s total private monetary planning might necessitate avoiding the funding altogether.

Actual property traders must be keenly conscious of the implications of debt not simply of their actual property portfolio, however all through their private steadiness sheet. If you happen to’re placing much less cash down in your funding properties, it doubtless doesn’t make sense from a danger administration perspective to run a significant margin steadiness in your brokerage portfolio or borrow out of your 401(okay).

Take Benefit of Tax Financial savings When Shopping for Actual Property

The tax code gives a spectrum of tax alternatives all through the lifecycle of an funding in actual property. A strong workforce advising you possibly can assist cut back your tax legal responsibility probably even in the course of the preliminary actual property buy. For instance, it’s usually advisable for traders to do property renovations after the property has been put into service as a rental. As such, bills incurred in the course of the renovation could possibly be expensed to decrease your taxes within the yr of buy as an alternative of being added to the property’s price foundation. The time worth profit between reducing your taxes by way of expensing renovations immediately versus having the next foundation and consequently a decrease capital achieve once you promote the property down the road could be vital. As nicely, traders ought to examine the evolving property particular tax advantages obtainable, like vitality credit.

Have a Plan to Garner Tax Financial savings Whereas Managing Your Actual Property

As an investor manages their property, it’s crucial that they work with their workforce to guage the varied tax alternatives obtainable. As owners transition into funding actual property, the menu of tax deductible bills expands with insurance coverage, home-owner affiliation charges, repairs, and different bills. Actual property for some turns into a solution to circuitously take away the $10,000 TCJA SALT limitation as funding actual property taxes turn out to be absolutely deductible.

Usually, actual property funding revenue goes to go in your Schedule E, which generally is a large plus since this revenue shouldn’t be topic to FICA taxes. Stable recordkeeping could make your life simpler, and it often is smart to get comfy maintaining data within the expense classes on Schedule E, and figuring out which bills could be expensed and which of them need to be added to your price foundation.

For some traders, actual property generally is a solution to protect non-real property revenue. For instance, rental actual property losses as much as $25,000 could be utilized to abnormal revenue as much as revenue section outs of $150,000 of adjusted gross revenue. Even if you’re above that revenue threshold, actual property means that you can carry ahead losses to different years and offset actual property revenue to decrease your tax legal responsibility in future years. One other solution to offset abnormal revenue, or revenue of your partner, with actual property losses, is to qualify for actual property skilled standing. Nonetheless, the {qualifications} are reasonably stringent as you would need to “materially take part” in actual property actions by spending at the least 750 hours or extra managing the actual property and have actual property administration be your main profession. There are quite a few potential landmines in successfully qualifying for this profit, so work intently together with your workforce of advisors if you’re contemplating this.

Optimize Depreciation Methods to Improve Returns

Arguably essentially the most profound tax profit for actual property traders is depreciation, so it behooves traders to have at the least a novice understanding on this space. Our tax code permits the theoretical “price” of depreciation to be utilized towards precise actual property money stream. In essence this permits for a lot of properties with optimistic money stream to indicate a loss for tax functions, leading to substantial tax financial savings. For instance, a residential actual property rental property bought for $1,000,000 incomes $40,000 in money stream per yr may pay taxes on solely lower than $4,000 of revenue since a depreciation expense of ~$36,000 ($1,000,000 divided by the allowable helpful lifetime of 27.5 years).There isn’t a free lunch although, for the reason that depreciation expense taken alongside the best way is “recaptured” as a taxable expense when the property is bought. Nonetheless, the time worth of delaying that tax legal responsibility by a few years could be positively impactful to the funding’s IRR. We might advise actual property traders to work intently with their CPA and monetary planner to research the professionals and cons of the total spectrum of depreciation alternatives, together with bonus depreciation, price segregation research, and different choices.

Perceive Distinctive Tax Attributes of Brief-Time period Leases

Normally, short-term rental revenue like Airbnb revenue is Schedule E revenue, which advantages from self-employment taxes not being levied towards it. Some folks might conversely choose this revenue captured on their Schedule C since that may enable retirement plan contributions, losses to extra simply offset different revenue, and extra favorable standing with lenders. Nonetheless, Schedule C therapy on short-term rental revenue requires offering substantial companies so it’s finest to debate any short-term actual property revenue together with your tax adviser.

Tax Financial savings Promoting Actual Property

There’s a continuum of tax saving choices actual property traders have when promoting their property. A Part 1031 change can enable traders to defer cost of capital positive aspects on the sale of an funding property if one other property is recognized and bought inside specified pointers, which may improve your IRR. Nonetheless, we’ve seen many traders overpay on the reinvestment property given the reinvestment time stress, so it’s necessary to not let the goal of decrease taxes facilitate a suboptimal funding. One other different is for traders to defer actual property capital positive aspects till 2027 by way of reinvestment of capital positive aspects into a chance zone fund. As a further profit, subsequent positive aspects are free from taxation should you maintain the funding for greater than ten years. A extra conventional technique to decrease tax legal responsibility when promoting a property is to make use of the installment sale methodology, which acknowledges the capital achieve over a few years. Spreading the achieve over a few years can decrease the capital positive aspects bracket you incur vis-à-vis paying the capital achieve within the tax yr of the preliminary sale, however an installment sale can even introduce credit score danger as the vendor initially basically funds the client’s buy over a number of years. Furthermore, depreciation recapture is due within the yr of the preliminary sale leading to a potential massive tax invoice within the preliminary yr of the installment sale.

Prioritize Danger Administration together with your Actual Property

It may well’t be emphasised sufficient that an efficient actual property funding technique have to be accompanied by a prudent danger administration technique for each the possible and long-tail dangers distinctive to actual property. A large emergency fund, entry to capital, and ample property insurance coverage are desk stakes for an unexpected danger like an pressing renovation on a property’s pipes resulting from a colder than anticipated winter. In an more and more litigious society, traders also needs to have a complete multi-pronged authorized safety technique. Private umbrella insurance coverage overlaying your whole web price is a comparatively low price safety technique for starters. As nicely, you could possibly work together with your lawyer to arrange an LLC for every property you personal. If somebody is injured in your property and sues you, it’s an arduous course of for them to obtain a charging order in your property and to get precise distributions from you beneath this and different constructions. There’s a spectrum of asset safety together with belief constructions, fairness stripping, and different methods, so it’s finest to get the varied members of your workforce, together with your CPA, insurance coverage dealer, monetary planner, and lawyer, participating in strategic conversations to find out the optimum price efficient construction to your circumstances.

Tread Rigorously with Actual Property in an IRA

Whereas some traders advocate for getting actual property in a self-directed IRA, this technique can backfire. There are quite a few limitations and numerous prohibited transactions when implementing this technique, and the IRS may assess massive tax penalties for violating them. Associated occasion transactions, private use of the property, and financing may all be problematic when shopping for actual property in your IRA. It is also difficult to finish required minimal distributions (RMDs) with illiquid actual property in your IRA, particularly since by the point an investor has essential mass to purchase actual property of their IRA, they’re in all probability on the older aspect. Additionally, lots of the basic tax advantages of actual property like depreciation and emphasizing long-term capital positive aspects over abnormal revenue are rendered ineffective in an IRA construction, so that you may wish to take into account different excessive progress belongings to your IRA.

Reassess Your Property Planning When Investing in Actual Property

There are a myriad of concerns and techniques that would influence your property planning once you personal actual property, so it’s necessary to get your property planning lawyer speaking to your CPA and monetary advisor to assume by way of the problems. Efficient switch of your wealth at your passing, minimizing taxes, avoiding probate, implementing asset safety, and maximizing charitable intent may all be affected by your actual property technique. One incessantly used technique includes transferring extremely depreciated (low price foundation relative to market worth) actual property belongings from one technology to the following on the passing of the primary technology reasonably than being gifted throughout their lifetime. This permits for a step-up in foundation to market values at dying and diminishes capital positive aspects for the second technology. One other potential concern that could possibly be averted with correct planning is that properties held in a number of states may necessitate your heirs initiating a number of state probate proceedings, which might trigger extra administrative burdens exactly when the household goes by way of a troublesome time.

Concerning the Writer

David Flores Wilson, CFA, CFP®, AEP®, CEPA helps professionals and enterprise house owners in New York Metropolis obtain monetary freedom. Named Investopedia High 100 Monetary Advisors in 2019 and 2020 and WealthManagement.com 2019 Thrive listing of fastest-growing advisors, he’s a Managing Companion for Sincerus Advisory. His monetary steering has appeared on CNBC, Yahoo!Finance, the New York Instances, US Information & World Report, Kiplinger, and InvestmentNews. David represented Guam within the 1996 Atlanta Olympic Video games, sits on the Board of Administrators as Treasurer for the Decrease East Facet Women Membership, and is lively with the Property Planning Council of New York Metropolis, Advisors in Philanthropy (AiP), the Monetary Planning Affiliation of Metro New York, and the Exit Planning Institute.

Do you know XYPN advisors present digital companies? They’ll work with purchasers in any state! Discover an Advisor.