Searching for Alpha and The Motley Idiot each supply intensive funding concepts for particular person shares. Both service may help you turn out to be a greater investor with free and premium analysis.

Nonetheless, one platform may be a greater match to your funding technique than the opposite. My Searching for Alpha vs. The Motley Idiot comparability may help you determine which one is right for you as I share my insights as a subscriber to each companies.

How the Companies Work

When evaluating these two platforms, understanding the fundamentals is necessary. Right here’s a breakdown of how every service works.

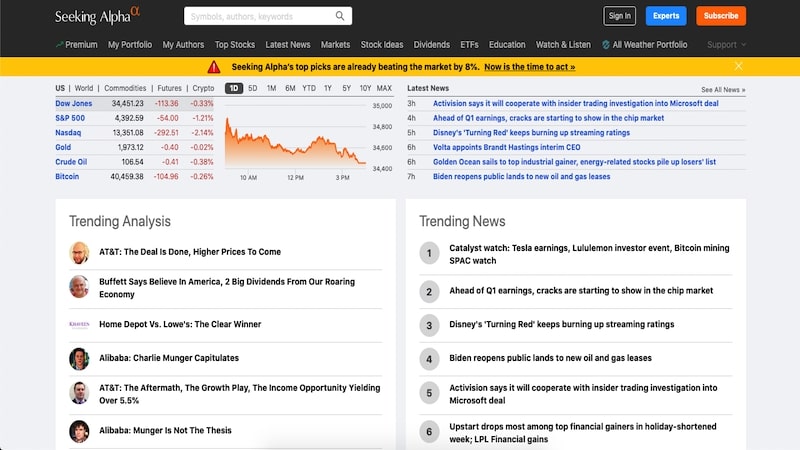

Searching for Alpha

Searching for Alpha options bullish and bearish funding commentary from impartial authors with investing expertise. I feel it’s greatest if you wish to analysis a number of shares and ETFs as an alternative of ready for the analyst group to furnish inventory picks and being restricted to a mannequin portfolio.

The service additionally publishes a number of complimentary newsletters that spotlight the newest inventory market information and funding traits. These articles cater to many funding methods, together with short-term buying and selling and long-term holds.

It’s attainable to learn a restricted variety of free articles every month, however a paid membership is critical for limitless entry.

A Searching for Alpha Premium membership offers instruments like:

- Unique inventory rankings

- A portfolio tracker

- 10+ years of monetary studies and earnings transcripts

- A inventory screener

Paid subscribers may observe authors, obtain member-only funding suggestions and get a mannequin portfolio.

Be taught Extra: Searching for Alpha Assessment

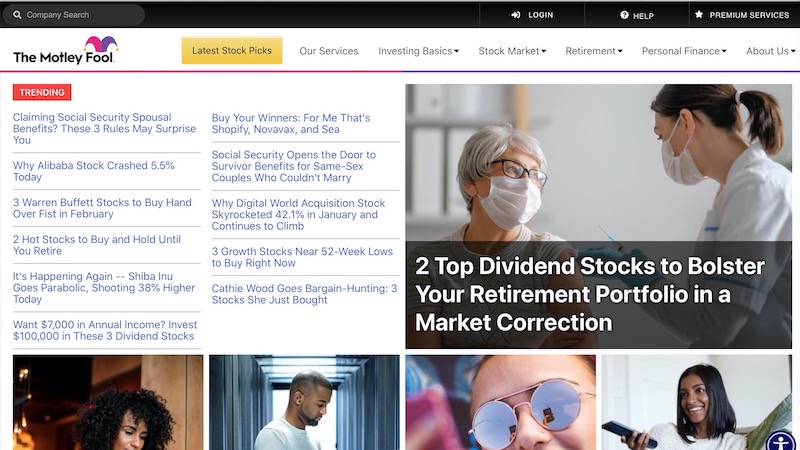

The Motley Idiot

The Motley Idiot publishes free day by day articles concerning the inventory market and single shares and funds. You may learn many articles at no cost and not using a month-to-month restrict.

Like most funding analysis companies, in-depth analysis and the very best funding concepts could be present in premium newsletters.

Companies comparable to The Motley Idiot Inventory Advisor present two month-to-month inventory picks. You may also view the mannequin portfolio and the funding efficiency of earlier suggestions. The screener allows you to type concepts by cautious, average, and aggressive threat technique.

Whilst you can simply discover a number of funding concepts from the free and premium analysis, the content material focuses on a long-term “purchase and maintain” funding technique. The Motley Idiot inventory picks have a median holding interval of three and 5 years.

This platform additionally publishes private finance content material that will help you be taught extra about retirement and different monetary choices moreover investing.

Be taught Extra: Motley Idiot Assessment

How Motley Idiot and Searching for Alpha Are Comparable

Each platforms present these options to assist analysis shares shortly.

Investing Concepts

You’ll find long-term funding concepts, primarily for shares. Each platforms additionally supply protection for ETFs.

The articles and analysis studies spotlight progress shares in these asset courses:

- Banking

- Client staples

- Insurance coverage

- Vitality

- Tech

- Medical

- On-line retail

- Valuable metals

- Actual property

- Transportation

Each companies use basic evaluation to research potential investments.

Mannequin Portfolios

A paid subscription with both service may help you view mannequin portfolios for a selected funding technique. These concepts can streamline your analysis course of and supply centered funding concepts.

For instance, a paid service specializing in established large-cap firms could keep away from shares that may be too risky to your threat tolerance however can attraction to aggressive traders.

The Motley Idiot follows a extra conventional e-newsletter publication method by providing a number of companies with month-to-month inventory picks. I like this method should you don’t have time to analysis or need hands-on insights.

You may be part of one or a number of newsletters for a yearly payment to entry new month-to-month suggestions and an inventory of foundational shares that may be a superb purchase anytime.

Searching for Alpha theoretically offers extra subscription alternatives as many authors have a portfolio and unique concepts behind the paywall. You may observe a number of authors together with your premium subscription.

Podcasts

You may take heed to free investing podcasts to assist cowl extra floor should you want one thing to take heed to whilst you commute, train, or backyard.

The Motley Idiot Cash and Searching for Alpha’s Wall Road Breakfast are the flagship productions for every service. Every day by day podcast critiques the newest market headlines and will present an evaluation of particular shares and funds.

Each platforms additionally supply weekly podcasts about centered methods. Plus, after listening to a podcast, you’ll be able to search the respective web site for in-depth commentary.

Search Capabilities

You may search both platform by firm title or inventory image to seek out analysis when constructing a inventory watchlist.

Along with studying the newest protection, you can even dig up outdated articles to gauge the accuracy of the writer’s opinion. These articles may allow you to be taught extra concerning the potential funding.

Every service additionally has a inventory screener to filter shares by particular rankings.

Listed here are the search capabilities out there to subscribers:

| The Motley Idiot | Searching for Alpha | |

| Search Bar | Lists free and premium analysis articles plus offers primary monetary information | Shows current articles, monetary historical past and rankings |

| Inventory Screener | Filter advisable shares to your lively e-newsletter subscriptions(Paid members solely) | Contains shares and funds with Searching for Alpha and writer rankings |

| Portfolio Tracker | “My Watchlist” allows you to monitor the efficiency of present holdings and potential investments(Paid members solely) | Monitor the efficiency and rankings of your present holdings |

Each companies allow you to carry out primary analysis, together with researching the inventory worth historical past and monetary valuation. A paid subscription is critical to view in-depth evaluation and rankings.

How Motley Idiot and Searching for Alpha Are Completely different

Whereas they’ve similarities, every platform has some variations that can make one higher than the opposite relying in your funding analysis wants.

How Companies are Provided

These companies supply funding concepts in several methods. Right here’s how they differ.

Mannequin Portfolios

Searching for Alpha doesn’t average mannequin portfolios like most funding newsletters. As a substitute, you will need to normally observe a sure writer and await their commentary.

The Motley Idiot has specialised mannequin portfolios for each paid e-newsletter. Nonetheless, you will need to pay a separate annual payment for every premium service.

Analysis Articles

Whereas the analysis high quality is comparable between companies, the funding commentary could attraction to completely different traders.

For instance, The Motley Idiot articles usually are extra informal and are for long-term traders. Because of this, they could be higher for newer traders and those that desire primary particulars.

Searching for Alpha articles are extra skilled, which skilled traders could desire. These articles may present technical particulars and current a bullish and bearish case. Its analysis is extra intensive since there’s protection for almost each publicly-traded inventory and plenty of ETFs.

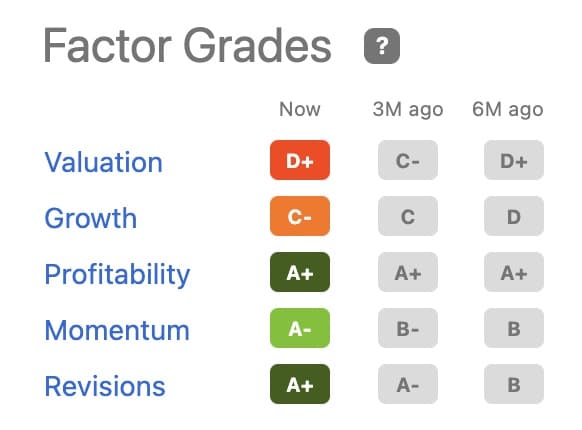

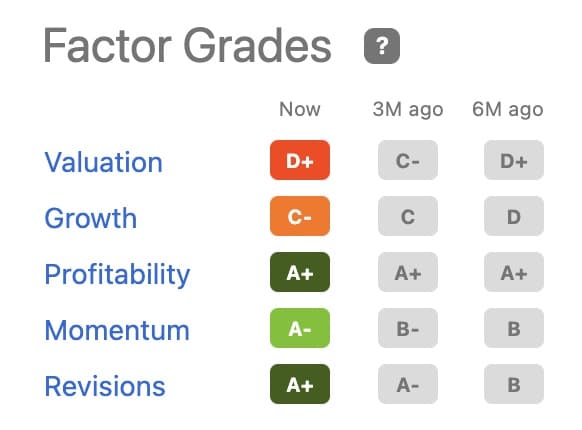

Inventory Rankings

Wanting past the articles, Searching for Alpha affords extra intensive rankings. For instance, you’ll be able to view writer rankings, Wall Road analyst rankings, and the Searching for Alpha Quant Rankings to assist determine if a inventory has bullish, impartial or bearish funding potential.

The Motley Idiot solely offers purchase, maintain or promote rankings for shares inside its paid newsletters. Inventory suggestions even have quant evaluation scores to estimate a good valuation. Sadly, you gained’t see rankings for firms not in its mannequin portfolio.

Neither service offers particular person funding recommendation.

Contributors

One other key distinction is how every platform sources its content material from authors and presents funding suggestions.

Searching for Alpha

Searching for Alpha is extra diversified and has quite a few contributors to the web group. For instance, readers might want to discern whether or not the writer is bullish or bearish and their funding methodology.

A number of authors additionally weave technical evaluation into their commentary and will point out goal buying and selling costs. You may observe a selected inventory or writer to keep away from redundant commentary.

Because of this, Searching for Alpha could be higher should you like the varied number of funding opinions.

The Motley Idiot

The Motley Idiot makes use of workers writers for its premium newsletters. Unbiased contributors generate free content material, however authors don’t charge shares or supply a mannequin portfolio.

Writers keep away from nitty-gritty pricing particulars comparable to “purchase as much as costs” and cease losses to stop market timing. As a substitute, every article adheres to the buy-and-hold funding philosophy.

So long as you keep a long-term funding outlook, The Motley Idiot’s content material can have fewer competing voices. Whereas it may be tougher to seek out bullish and bearish opinions, you’ve got a simple path for studying about an organization.

Funding Philosophy

Each shops cater to long-term traders who need to maintain shares for at the very least one 12 months earlier than promoting. Nonetheless, there are some nuances between the funding methods.

Searching for Alpha authors could encourage a shorter funding interval to maximise market momentum for a selected inventory or asset class. Nonetheless, the technique could be completely different for every contributor.

The Motley Idiot recommends shares they imagine will beat the inventory market over the following three to 5 years. This service doesn’t use cease losses or buying and selling worth ranges to enter or exit a commerce.

Value

The premium companies for both firm are competitively priced if you need an entry-level e-newsletter or a sophisticated service.

Free Trial

One distinction between each companies is the risk-free trial interval.

The Motley Idiot affords a 30-day refund interval on entry-level publications, however you will need to buy an annual subscription upfront. There is no such thing as a month-to-month fee plan out there.

Then again, Searching for Alpha Premium affords a one-month trial interval for $4.95 earlier than paying the total annual payment.

The Motley Idiot

The Motley Idiot has many various newsletters that you would be able to buy.

Listed here are the annual costs for the platform’s newsletters:

| Publication | Annual Price | Key Options |

| Inventory Advisor | $99 for the primary 12 months after which $199 yearly | Flagship service analyzing large-cap progress shares Two month-to-month suggestions Month-to-month updates of the ten Prime-Ranked Shares |

| Epic | $499 | Recommends high-growth shares with extra volatility and dividend shares for a balanced threat tolerance 5 month-to-month suggestions Quant Projections 10 greatest concepts replace quarterly Advised $50,000+ portfolio measurement |

| Epic Plus | $1,999 | 9 month-to-month picks Recommends choices trades Proprietary AI investing portfolio backed my The Motley Idiot’s personal money Advised $100,000+ portfolio measurement |

Searching for Alpha

Searching for Alpha affords a number of paid plans that present completely different member advantages. You may pay month-to-month or buy a reduced annual subscription.

Right here’s a breakdown of Searching for Alpha’s pricing:

| Plan | Price | Key Options |

| Premium | $269 yearly (Usually $299) | Limitless article entry Monitor writer rankings and efficiency Inventory Quant Rankings 1-month trial for $4.95 |

| PRO | $2,400 yearly ($99 for the primary month) | Unique funding concepts Further analysis instruments Weekly emails VIP customer support No adverts |

Buyer Service and Expertise

Help choices is usually a large issue when selecting between two companies. Whereas every platform affords e-mail and telephone assist in addition to boards, on-line tutorials, and FAQs, there are some key variations.

The Motley Idiot is a extra interactive platform, however Searching for Alpha has a concierge service of their Professional Plan. This provides them entry to buyer assist representatives who may help with their wants.

Who Are They Greatest For?

These summaries may help you select the greatest funding web site to your investing model.

Searching for Alpha

Contemplate Searching for Alpha should you desire open-ended funding analysis from quite a few writer backgrounds. It may be simpler to learn the bullish and bearish insights from a number of contributors.

The inventory screener and score instruments can present extra insights than your brokerage analysis instruments. These options assist present basic and primary technical evaluation for almost any publicly traded inventory and fund.

The Motley Idiot

Lengthy-term traders could discover The Motley Idiot the higher match as every inventory choose has a multi-year holding interval.

You may additionally desire this platform should you discover the abundance of writer opinions and rankings at Searching for Alpha overwhelming. As a substitute, you obtain two month-to-month inventory picks and recurring portfolio updates for extra hands-on steerage.

The decrease annual payment will also be extra interesting should you don’t want entry to the extra Searching for Alpha analysis instruments.

Associated: Motley Idiot Epic Assessment

Which is Greatest General?

When it comes right down to it, every service has its strengths and weaknesses. General, it’s a wash.

Contemplate The Motley Idiot if you wish to primarily depend on the analyst group to advocate shares and have a long-term funding focus.

Self-directed traders preferring in-depth evaluation of shares and funds exterior the mannequin portfolio will profit extra from Searching for Alpha.

As well as, Searching for Alpha is healthier should you’re pursuing a number of funding methods and are an lively investor making common purchase and promote trades.

Opponents

Should you aren’t positive that Searching for Alpha or The Motley Idiot are the appropriate choices, these funding analysis platforms may allow you to analysis funding concepts and monitor your present portfolio.

Morningstar

A Morningstar Investor subscription allows you to learn analyst studies for shares, ETFs, and mutual funds. This service is greatest recognized for its Morningstar rankings for funds.

Further premium options embrace a portfolio analyzer and a inventory screener. Whilst you gained’t essentially have a mannequin portfolio, there are lots of lists of top-rated shares and funds for numerous classes that you would be able to tailor in the direction of your funding technique.

This service prices $34.99 month-to-month or $249 yearly with an upfront fee. You should use a 7-day free trial to make sure it’s the appropriate platform.

Be taught extra: Morningstar Investor Assessment: Is It Price It?

Zacks

Zacks Funding Analysis affords analyst studies for a lot of shares and funds.

It’s the main funding analysis agency specializing in inventory analysis, evaluation and suggestions. Since 1978, they’ve offered unparalleled inventory analysis, evaluation, and suggestions to each novice and skilled traders.

With almost 800,000 members, Zacks additionally offers specialised perception from market specialists who present detailed steerage on reaching monetary success in at present’s inventory market.

Zacks, utilizing its proprietary system – the Zacks Rank, has crushed the S&P by a median of 25.08% over the past 33 years.

By analyzing earnings estimates, the Zacks Rank approximates the likelihood an organization will outperform the inventory market.

Buyers considering a long-term technique will recognize the Focus Checklist. It highlights the highest 50 shares set to outperform the market over the following 12 months.

Each skilled merchants and rookies may have entry to priceless instruments like valuation rankings, inventory screeners, and plenty of different sources (each free and paid) to assist elevate their funding technique.

A Zacks Premium annual membership prices $249 per 12 months, however traders are welcome to attempt it for 30 days completely free.

Be taught extra: Zacks Premium Assessment: Is It Price It?

Verdict: Ought to You Use Searching for Alpha or Motley Idiot?

You’ll find many funding concepts utilizing Searching for Alpha or The Motley Idiot. The higher service for you is determined by which analysis instruments you need in addition to your funding model.

Searching for Alpha allows you to discover funding alternatives and pursue completely different funding methods. Nonetheless, The Motley Idiot could be higher for hands-on steerage because you obtain specialised inventory picks.

No matter which choice you select, each Searching for Alpha and The Motley Idiot may help you uncover new inventory concepts.