Supply: The School Investor

This is our monetary guidelines of the perfect cash strikes you may make by the tip of the yr to maximise your financial savings and investments, whereas minimizing your taxes.

The tip of the yr is usually a whirlwind. However the actions you are taking over these remaining months can have giant impacts in your tax invoice subsequent April and your long-term monetary well being.

By taking proactive steps now, you possibly can make sure that your monetary life is organized and primed for fulfillment as you head into the brand new yr.

Questioning which objects are most necessary so as to add to your finish of yr monetary to-do record? Under are 9 cash strikes to make earlier than the brand new yr to spice up your backside line.

1. Modify Payroll Contributions To Your 401(okay)

Most 401(okay) plans require staff to finish their retirement contributions by December thirty first. This yr, you possibly can contribute as much as $23,000 (plus a further $7,500 in catch-up contributions for these over age 50).

For those who can deal with a small discount to your paycheck, contemplate boosting the contribution to your 401(okay) plan. Even a 1-2% improve in contributions can yield long-term advantages.

Some firms subject year-end bonuses. For those who’re slated to obtain one, contemplate earmarking a portion in your 401(okay). This will help you increase your financial savings charge with out dipping into your common money move.

Associated: Finest Low-Value Small Firm 401(okay) Suppliers

401k Contribution Limits. Supply: The School Investor

2. Evaluation Account Beneficiaries

So long as you’re logging into your 401(okay) account, examine the beneficiary on the account. That is particularly necessary in the event you received married or divorced within the final yr. Nevertheless it’s an necessary job for everybody to incorporate on their finish of yr monetary to-do record.

A couple of years in the past, I went via my accounts to examine beneficiaries. Throughout the course of, I spotted that my mother was nonetheless listed because the beneficiary on one small account, regardless that I’ve been married for a decade.

Associated: Key Property Planning Paperwork

3. Spend It If You’ve Bought It!

Over the previous yr, many firms have instituted well-being accounts or allowances to assist staff cowl some work-from-home prices. These accounts could expire on the finish of the yr, so spend that cash if it’s accessible to you. Moreover, be sure you request reimbursement promptly to make sure you obtain this profit.

On prime of those new accounts, many staff have entry to Versatile Spending Accounts.

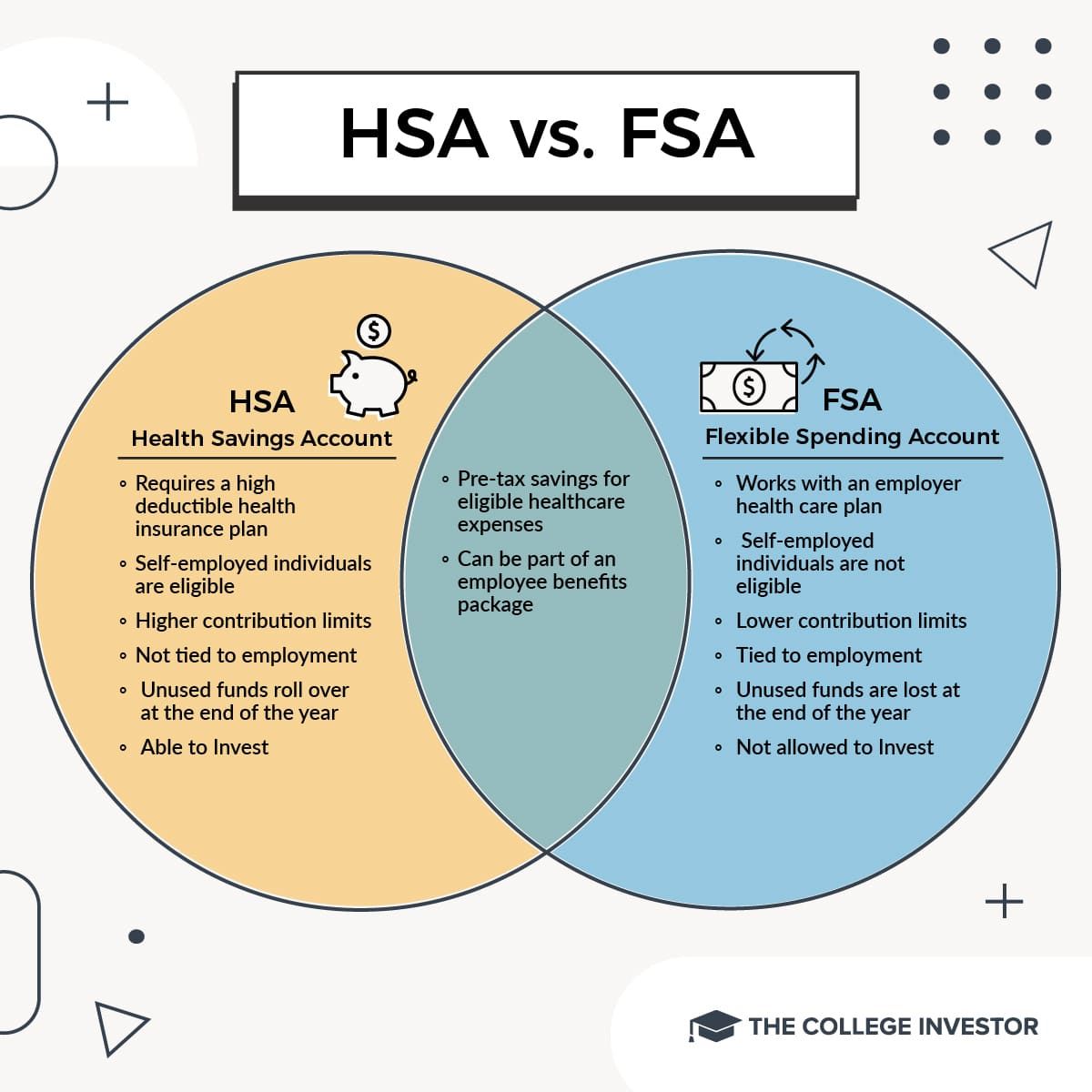

Versatile Spending Accounts (FSAs) are accounts that don’t roll over from yr to yr. Employers can supply Well being FSAs, Adoption FSAs, Dependent Care FSAs, Sometimes, staff who’ve an FSA might want to spend cash by the tip of the calendar yr. Moreover, they might want to request reimbursement shortly after the yr ends.

When you’ve got entry to any of those accounts, spend the cash this yr, and submit receipts as quickly as potential, so you possibly can obtain reimbursement. Bear in mind, this recommendation solely applies to Flex Spending Accounts. Well being Financial savings Accounts can help you save yr after yr.

Associated: Be taught The Variations Between FSAs and HSAs

Supply: The School Investor

4. Enroll In A Well being Plan

Most individuals have to enroll in a well being plan in some unspecified time in the future between October and November of this yr. In case your employer affords medical health insurance, overview the choices. If potential, overview choices along with your partner to see which employer affords the perfect insurance coverage on the lowest costs. Don’t overlook to enroll your kids as effectively.

Open Enrollment for Healthcare.gov begins November 1st and runs via December fifteenth. That is the perfect time to enroll in a medical health insurance plan if it’s worthwhile to purchase one via the alternate. Many individuals who don’t have medical health insurance via work can qualify for sponsored medical health insurance once they purchase via the exchanges.

Associated: Finest Self-Employed Well being Insurance coverage Choices

5. Evaluation Your Credit score Report

Annually, you’re entitled to a free credit score report from every of the three main credit score bureaus. That makes it a fantastic project to incorporate in your year-end monetary to-do record.

Credit score experiences present each inquiry and each excellent debt. Reviewing a report is especially necessary you probably have delinquent money owed which have been offered to different collectors.

You’ll be able to simply obtain your report from AnnualCreditReport.com or use a free service like CreditKarma.com to get your free report and insights that may provide help to perceive the report.

Associated: Finest Credit score Monitoring Providers

6. Plan Charitable Giving

The 2024 deduction limits for items to charities, together with donor-advised funds, is 60% of adjusted gross revenue (AGI) for contributions of non-cash belongings, if the belongings have been held multiple yr, and 60% of AGI for contributions of money.

Individuals with bigger charitable giving targets could profit from extra superior planning. Some givers select to present each few years in order that they’ll itemize their tax deductions. Assembly with a CPA by the tip of the yr will help givers resolve on the perfect timing for his or her giving.

7. Begin Monitoring Enterprise Bills

It’s not fairly tax-time, however you will get a soar on enterprise taxes by beginning to monitor your corporation bills, and categorizing previous bills. Discovering an app like Keeper Tax, Everlance or Hurdlr will help you monitor and categorize your corporation bills. All of those apps have downloadable experiences that make tax submitting simpler.

8. Make An Estimated Tax Fee

For those who’re self-employed (or a facet hustler), you are prone to owe tax cash to the IRS. To keep away from a giant tax invoice, it’s possible you’ll wish to make a quarterly estimated tax cost. Even a single cost will help relieve among the monetary burdens that include paying a yr’s price of taxes in April.

This recommendation comes from my first side-hustle expertise as a working grownup. In my first yr hustling, I earned over $10,000 from numerous gigs. I paid no estimated taxes and I didn’t modify my withholding at my W-2 job.

The outcome was a $2,500 tax invoice which took a month and a half of hustling to cowl. Don’t be like me. Make not less than one estimated cost earlier than determining your full tax burden for the yr.

9. Execute Backdoor Roth Conversions

A high-income earner could not qualify for a standard Roth IRA contribution. However the backdoor Roth is a tax loophole that enables high-income earners to get cash right into a Roth account. As soon as the cash is contained in the account, it is protected in opposition to future taxation.

On the whole, it is best to execute a backdoor Roth conversion when the calendar yr matches the tax yr. So add this job to your finish of yr monetary to-do record and attempt to full it earlier than December thirty first.

Have Further Time? Use It To Stage Up Your Funds

When you’ve got just a few quiet days to replicate and plan on the finish of the yr, there are some workout routines which will assist. First, examine your numbers. A couple of of the important thing numbers to know are your credit score rating, the overall quantity of debt you owe, your web price, your revenue, and your spending. You may additionally wish to share these numbers along with your accomplice to normalize conversations about cash.

Second, set one monetary goal. It is simple to get swept up within the recent begin of a brand new yr and overwhelm ourselves with targets for a dozen good intentions. However as a substitute of a burdensome load of targets, strive beginning with one monetary aim for the yr forward. It is going to provide help to keep centered. And in the event you accomplish it early within the yr, you possibly can all the time set a brand new aim to work in direction of!

Lastly, plan bills for subsequent yr. For those who hate particular month-to-month budgeting strategies, strive a brand new one. Additionally, attempt to map main bills which will come up within the subsequent one to 3 years. Writing down these bills together with the anticipated worth tags will help you arrange financial savings plans to cowl these prices with out debt.