Y’all – after years of purposely ignoring this for causes not even value mentioning (they’re all lame) I lastly froze my credit score AND IT WAS SO EASY!!

It actually took me below 5 minutes to do it and I really caught myself muttering out loud: “Gosh I’m an fool… shoulda simply achieved it sooner.” However, with all issues boring and unimportant till they change into vital (!), freezing credit score was simply by no means a precedence as a result of nothing unhealthy ever occurred up to now with out doing it.

After which all these main knowledge breaches occurred, and effectively, as Jonathan from My Cash Weblog just lately put it:

“The stability between the assured problem of sustaining a credit score freeze and the potential problem of coping with an id theft try has lastly shifted sufficient in direction of simply having them frozen as a default place.”

I star’d this a month in the past for Future Jay to cope with, after which I began getting dinged left and proper with alerts final week telling me my knowledge is now public to the world (which I already assumed it was, as a result of man – we do EVERYTHING on-line!) and one thing about seeing it *in writing* lastly prompted me to take motion.

And similar to that my virginity was unfrozen (see what I did there?!)

And it actually was that simple to do!! Below 5 minutes at every bureau – no joke. Should you’ve been placing it off and know it’s essential to do it, simply cease studying this proper now and get it achieved.

Listed below are the three locations it’s essential to go to:

- Experian.com/freeze/middle.html

- Transunion.com/credit-freeze

- Equifax.com/private/credit-report-services/credit-freeze

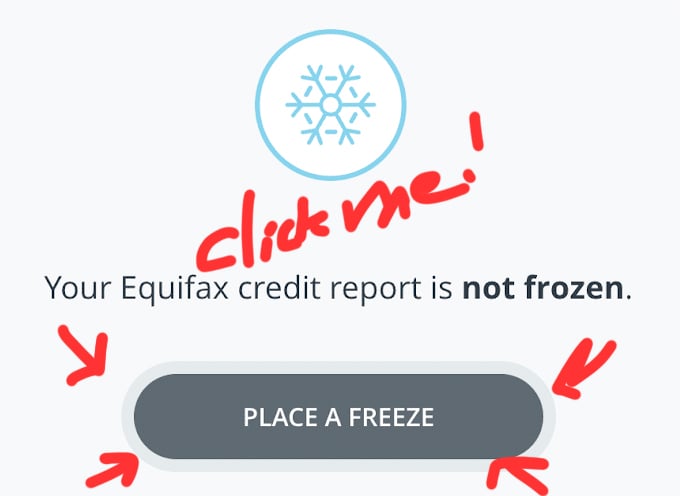

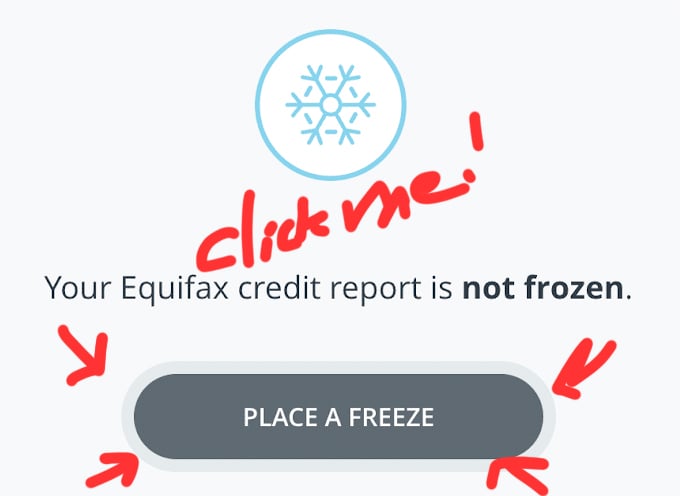

Create an account, fill in some private knowledge, after which click on that magical “freeze my credit score” button and BOOM – you’ll really feel superb.

(And sure – it’s silly it’s a must to go to 3 (!) completely different bureaus and create three (!) completely different accounts, however you’ll be able to’t do something about it so don’t even waste your vitality. Methodically transfer by every certainly one of them after which test it off your checklist as soon as and for all! Imagine me once I inform you it’s oddly satisfying clicking that freeze button!! 😂)

You’ll really feel good for not having to consider it anymore, however much more importantly – you received’t have to fret about dummies attempting to open credit score traces or loans below your identify anymore too! Or no matter else these lame hackers love to do with their wasted abilities, ugh…

Why don’t they put it to GOOD use???

And FYI: you’ll be able to unfreeze them simply as simply at any level too. Additionally free! Simply log again in and click on “unfreeze” – and voila! So even if you happen to suppose it’s possible you’ll want entry to your credit score within the close to future, freezing it now received’t maintain you up later within the course of. Simply keep in mind to return again later and log again in!

I may have sworn all this used to value like $10 or $15 a shot again within the day, including but another excuse to not be bothered by it, however in some unspecified time in the future alongside the best way I assume they nixed that and now you are able to do it with out even lifting your pockets. Or this publish wouldn’t have ever been written, as unhappy as that’s, lol…

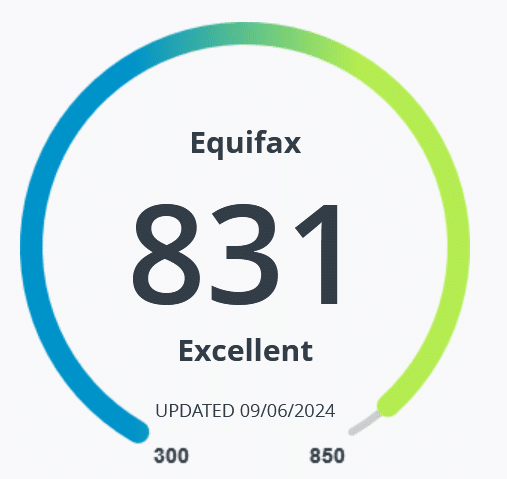

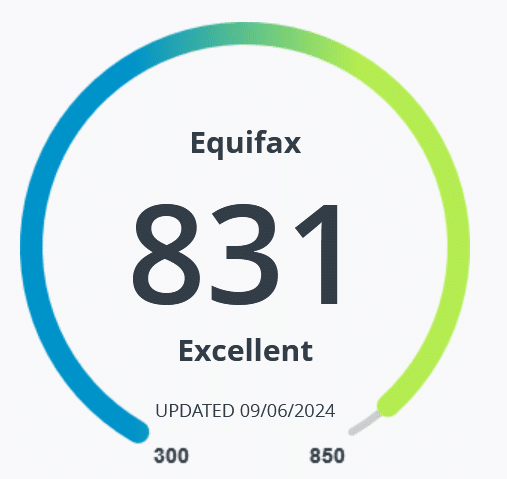

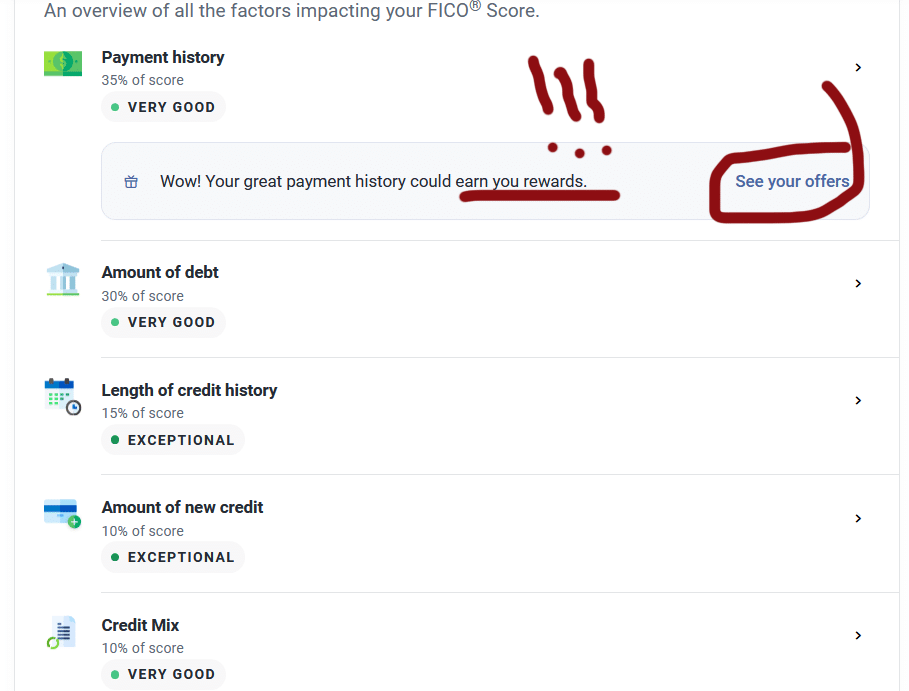

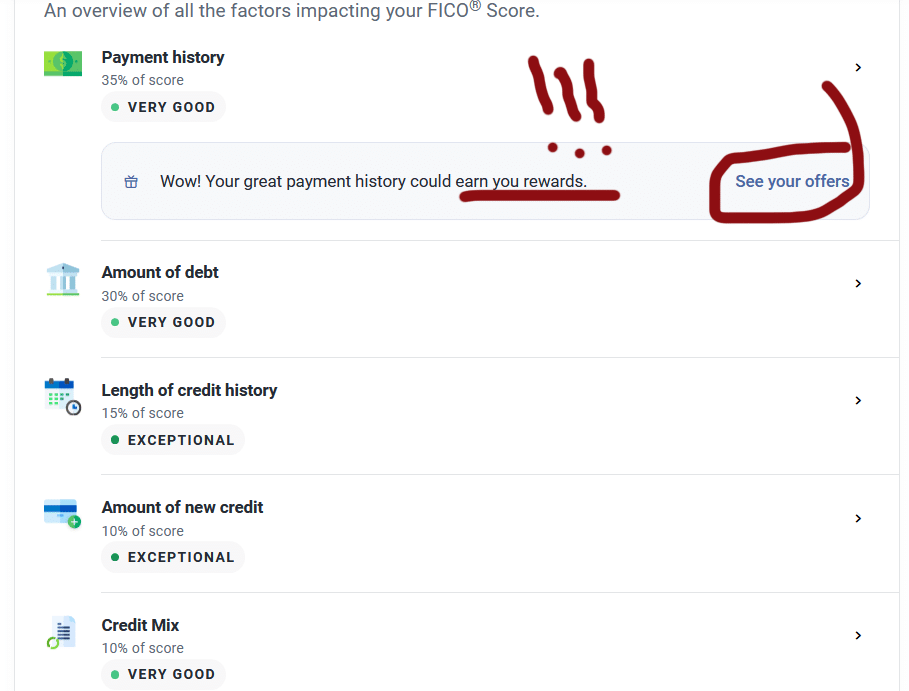

When you’re achieved freezing all of the credit, you’ll be able to then nerd out even *extra* by grabbing your credit score SCORE and credit score REPORT too! Additionally free at most bureaus!

I really spent far more time on the websites doing this than inserting my credit score freezes, lol…

Right here’s what I discovered:

(My Vantage 3.0 rating)

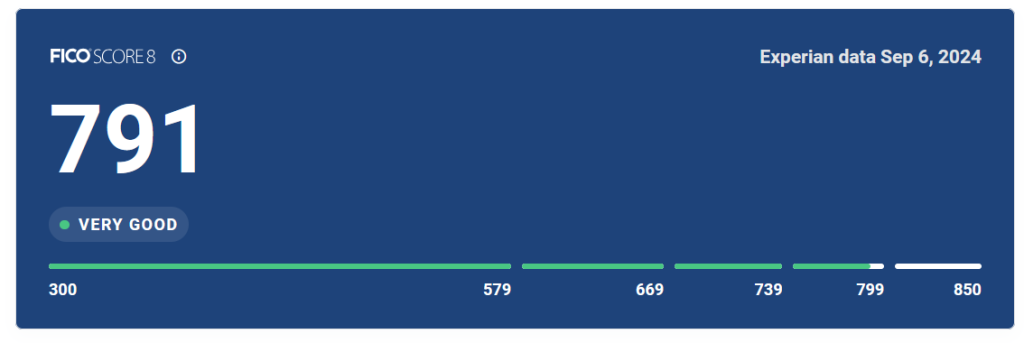

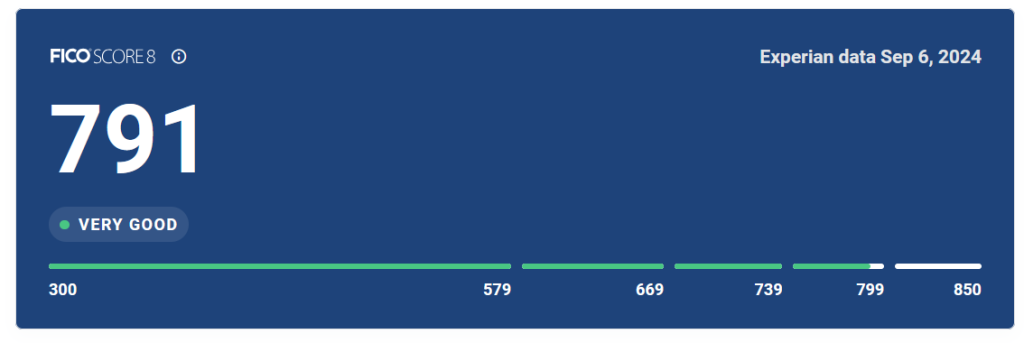

(My FICO® Rating)

TransUnion affords the Vantage 3.0 rating too, nevertheless they cost $0.99 for it so I simply grabbed it from Equifax without cost 😉 (Though weirdly, once I first created my Equifax account it stated you needed to pay to your rating, however once I logged off after which again on later to test one thing completely different, it turned free?! So if you happen to see the identical simply sign off after which again in and hopefully it resets the identical for you too.

Additionally – once we created my spouse’s TransUnion account it wouldn’t allow us to click on the “freeze” button for some cause, so I needed to name and wait on maintain for a bit however then they toggled one thing and it labored simply nice. So don’t let random snags maintain you up within the course of! Simply preserve going!)

You may also simply seize your credit score REPORTS from all three bureaus annually too – without cost. Which is sensible to verify nobody has *beforehand* achieved something along with your id earlier than you could possibly lock the whole lot up.

Now this job takes wayyyyyy longer although, so don’t even get slowed down by it except you’ve already frozen your accounts and have some free hours in your hand 🙂

There’s additionally the choice so as to add “fraud alerts” to your accounts as effectively so that you’ll get notified each time somebody tries to entry your credit score. And thankfully with this one you simply must do it at *one* bureau and so they go alongside the word to the opposite two making it even sooner! We additionally did this as a double precaution.

The alerts solely final a yr although, so that you’ll must renew it later as soon as the time comes once more (there’s additionally completely different sorts of alerts too which are extra in depth it appears, like if you happen to already had your credit score stolen and filed a police report, or if you happen to’re on lively responsibility, however I simply caught with the 1 yr regular alert since nothing unhealthy has occurred but – not less than that I presently learn about! I nonetheless gotta pore over these 3 credit score reviews!!)

Now on the down facet you’ll be able to’t add any freezes or fraud alerts to KIDS’ credit as simply as you’ll be able to your self (anybody below 18). However you CAN do it, you simply must undergo a extra prolonged strategy of exhibiting social safety playing cards and delivery certificates to show who they’re, and who YOU are, after which wait some time for all of it to be verified. I’ve but to undergo this course of (and never trying ahead to doing it 3x over!) however it’s on the checklist as there ought to be NO credit score being opened for years on behalf of any of those guys…

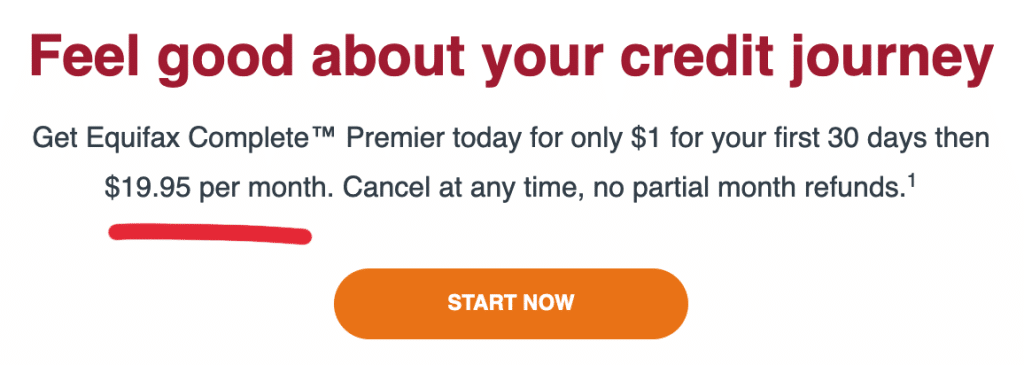

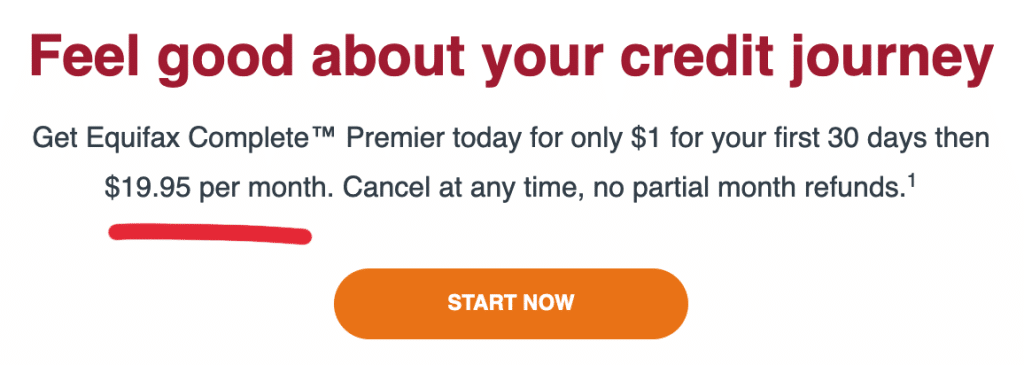

I also needs to word that after you create all these credit score accounts, Experian, TransUnion and Equifax will equally bombard you with promotions and emails attempting to upsell you on a bunch of merchandise (and bank cards!! Which appear counterproductive!). However once more – nothing you are able to do about it besides to unsubscribe and avert your eyes, so don’t let it forestall you from getting the job achieved 😎

Listed below are some enjoyable examples of what’s to return although:

******

******

******

******

******

And on and on and on…

Once more, simply hit “unsubscribe” and also you received’t must cope with it once more.

TL;DR:

Freezing your credit score is free, simple to do, and might prevent a butt ton of time and frustration sooner or later. Spend the quarter-hour (complete) getting it frozen at every of the bureaus after which name it a day. You’ll be able to all the time unfreeze it later with a click on of a button (additionally free).

Listed below are the three hyperlinks once more – do it earlier than you get sidetracked!

- Experian.com/freeze/middle.html

- Transunion.com/credit-freeze

- Equifax.com/private/credit-report-services/credit-freeze

Your buddy and fellow nerd,

UPDATE: I simply discovered you may also *quickly* unfreeze your credit score too (aka “thaw” it lol) for everytime you want entry. You apparently set the # of days the place it’ll re-freeze once more later, that approach you don’t have to recollect to log again in once more – genius! (Thx Invoice and Nikki)

UPDATE II: Right here’s one other nice concept from a fellow reader who simply emailed me: “Hello J. Cash- I’ve been freezing and checking credit score reviews on an annual foundation for 20 years, and one factor I’ve discovered that works for me and may for others too is spreading out whenever you test your free credit score reviews. If it’s your 1st time you test all three bureaus and get them squared up, however then after that simply test one credit score bureau at a time all year long. Verify one in April, one other in August, after which the final in December – or no matter schedule works for you. This has been tremendous useful for me.”

(Visited 545 instances, 15 visits immediately)

Get weblog posts mechanically emailed to you!