A reader asks:

Which presidential candidate is extra more likely to trigger a recession/bear market: Trump or Harris?

This query clearly got here in earlier than we had the election outcomes however my reply could be the identical no matter who gained.

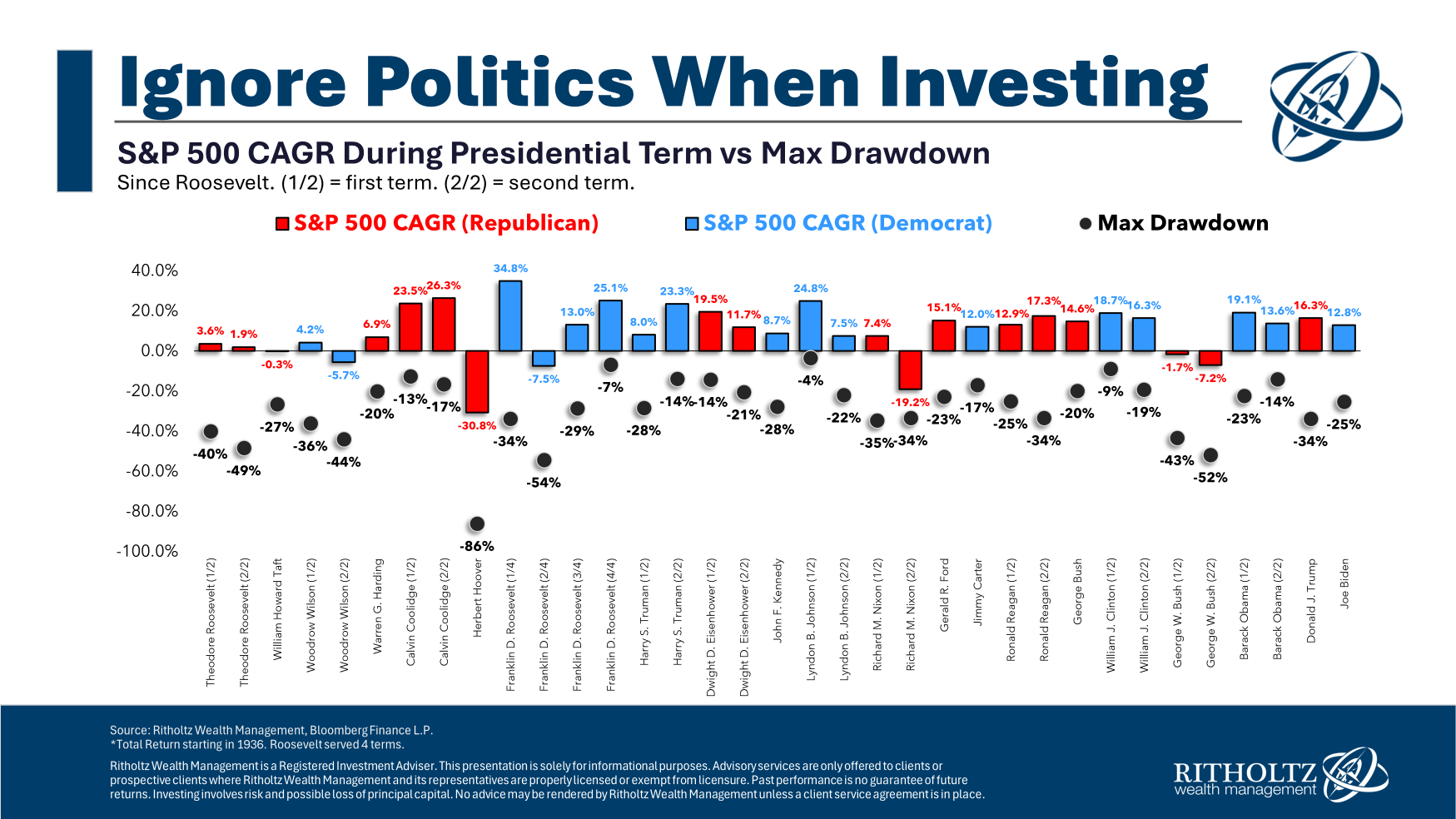

Right here’s a take a look at the max drawdown by presidential time period going all the way in which again to Teddy Roosevelt:

Some are worse than others however it will be onerous to pinpoint any sort of relationship between presidents and inventory market downturns.

I’m fairly assured we can have a giant correction or bear market in some unspecified time in the future over the subsequent 4 years. The president can’t cease the inventory market from taking place. It simply occurs.

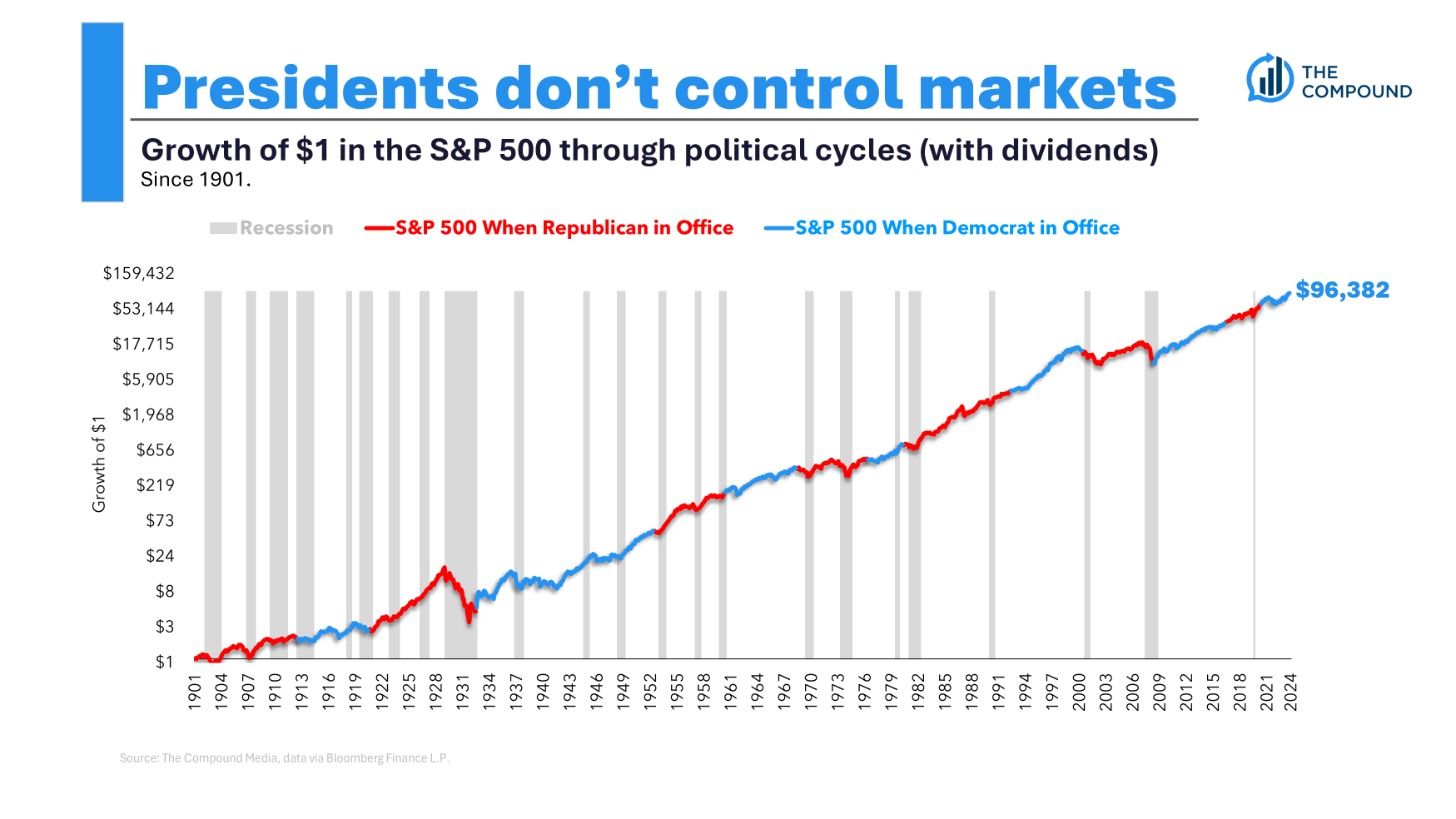

So far as recessions go, right here’s a take a look at how they stack up by administration and the long-term inventory market chart:

There have been clearly much more recessions within the pre-WWII period than extra fashionable financial instances.

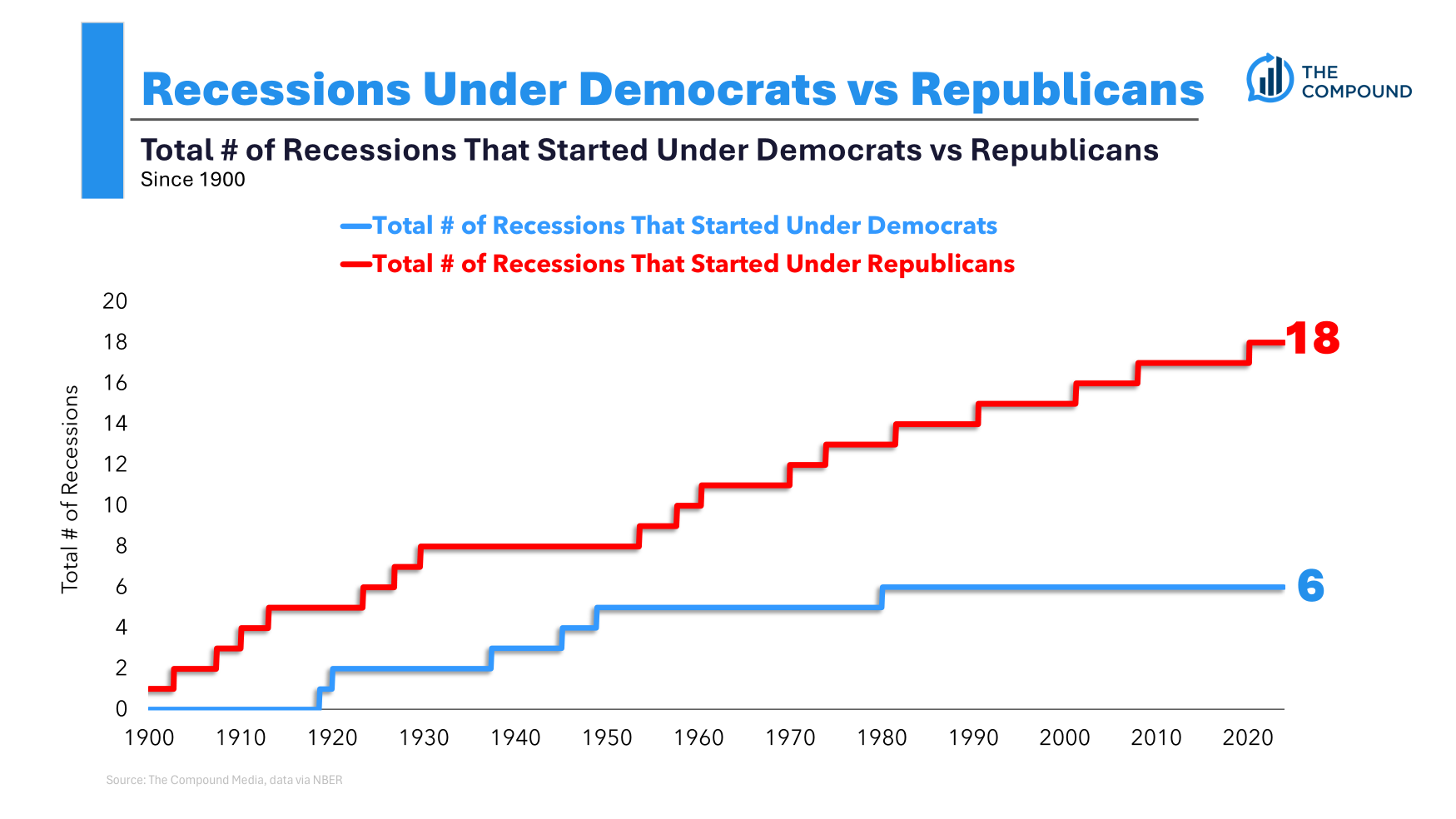

I additionally had our analysis group take a look at the variety of recessions began by the 2 political events:

I used to be stunned right here. There have been far more recessions began throughout Republican presidential phrases than Democrats.

Nevertheless, I don’t suppose this actually tells us something. Context is required right here.

Was Ronald Reagan an financial maestro, or did he take over throughout a interval of disinflation and falling rates of interest?

Was George HW Bush a horrible scholar of finance or did his re-election fall throughout a slowdown within the economic system?

Was Invoice Clinton an financial savant, or did he occur to run the nation throughout a interval of financial nirvana, favorable demographics and the dot-com bubble?

Was George W. Bush dangerous on the economic system or did he occur to take workplace popping out of a two-decade-long bull market and two of the most important bubbles in historical past (shares and housing)?

Have been Obama and Trump masters of finance or have been they presidents coming into an financial restoration, expertise increase and low charge setting?

Did Joe Biden personally push up the inventory market and housing costs or did the pandemic spending binge trigger a increase within the 2020s?

You’ll be able to nitpick in case you’d like and level to sure insurance policies and selections made or not made however the level is these things is cyclical. Typically presidents are merely fortunate or unfortunate relying on the timing of once they come into workplace.

So is Trump going to be fortunate or unlock within the subsequent 4 years?

On the one hand, we’ve had precisely one recession over the previous 15 years and it lasted simply two months. You can say we’re due for a recession (no matter who the president is).

Then again, right here’s a take a look at the present set-up he’s strolling into:

- Unemployment charge 4.1%

- Inflation charge 2.4%

- 10 12 months treasury charge 4.4%

- Actual GDP progress 2.8%

If there may be such a factor as a candy spot for the U.S. economic system, we’re in it proper now. Plus you’ve got the Fed in an easing cycle.

Absolutely, that may’t final ceaselessly after all. Then, there may be the prospect of upper inflation if Trump enacts his tariff plans. However we simply lived by a interval the place increased inflation didn’t result in a recession and spherical and spherical we go.

If the previous three years have taught us something in regards to the economic system it’s that predicting recessions is difficult.

It’s onerous when utilizing financial knowledge. It’s onerous when utilizing the inventory market or yield curve as an indicator. It’s onerous when utilizing vibes. And it’s onerous when utilizing politicians.

Recessions and bear markets are options of the monetary system wherein we function.

You have to take them under consideration in your funding plan.

However that doesn’t imply you must forecast them prematurely.

We talked about this query on this week’s Ask the Compound:

Invoice Artzerounian joined me on this present this week to speak in regards to the election’s impression in your taxes, the downsides of early retirement, tax planning for retirement and when to replenish your Roth buckets for retirement financial savings.

Additional Studying:

Some Issues I Don’t Consider About Investing

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.