Australian and worldwide expertise corporations are amongst greater than 1,200 organisations which didn’t pay tax within the 2022-23 monetary yr, in keeping with an Australian Taxation Workplace (ATO) report.

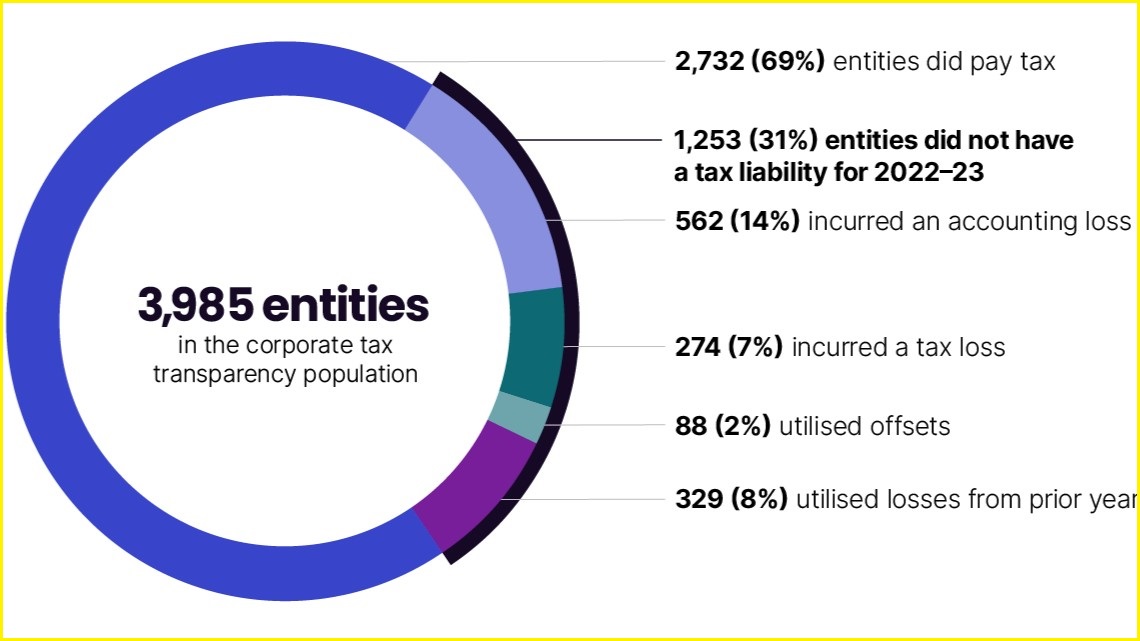

The ATO’s tenth company tax transparency report, launched final Friday, confirmed round 30% of the three,985 entities that lodged tax returns for 2022–23 didn’t pay any tax in Australia that yr.

Large names in expertise which didn’t pay tax for 2022-23 included TPG Telecom (on earnings of virtually $5.9 billion), Sony Australia (which earned greater than $1.5 billion), Netflix Australia (which made greater than $1.1 billion), and Australian design large Canva (which reported greater than $1.4 billion in earnings and $69.9m in taxable earnings).

Smaller names which paid no tax in 2022-23 included cyber safety corporations CyberCX, Pattern Micro, and Tesserant; IT firm Datacom; telecommunications firm Superloop; fintech agency Zip Co; and Chinese language large Huawei Applied sciences.

Search the total record of entities from the ATO report under.

ATO deputy commissioner Rebecca Saint informed ABC Information that the company had “points with the tech sector”, however in a press launch mentioned the ATO had seen continued “enchancment within the tax compliance of huge companies” because it labored to forestall tax avoidance.

“Whereas there are legit the reason why an organization might pay no earnings tax, the Australian neighborhood may be assured we pay shut consideration to those that pay no earnings tax to make sure that they aren’t attempting to sport the system,” she mentioned.

Assistant Treasurer Stephen Jones informed ABC Information on Friday that figuring out multinational tax avoidance was a “large precedence for the federal government”, however some companies rightly didn’t at all times pay tax.

“There’ll be a few of these companies who aren’t paying tax as a result of they’re not making any cash, they’re breaking even, or they’ve made an enormous capital funding and any cash they’ve made is being offset towards the capital investments that they’ve made,” he mentioned.

“So, a few of that’s indicators of wholesome financial exercise, significantly if there’s been an enormous capital funding — we wish that, it’s going to drive productiveness.

“But when it’s avoidance, we’re onto it.”

This ATO graph exhibits what number of entities did (and didn’t) pay tax in 2022-23. Picture: ATO / Provided

Large Tech’s earnings minimisation

The share of organisations that paid no earnings tax has dropped from 36% within the ATO’s first company tax transparency report (2013-14) to 31% in 2022-23.

Nevertheless, main expertise corporations have typically claimed that solely very small quantities of their earnings in Australia are taxable, and have used refined accounting to minimise what they owed beneath Australia’s 30% company tax fee.

Microsoft’s native knowledge centre enterprise paid no tax in 2022-23 on $1.1 billion of earnings, whereas the corporate’s major Australian arm paid greater than $118 million in tax on $7.5 billion in earnings, virtually $400 million of which was taxable.

Apple paid virtually $142 million in tax in 2022-23 after raking in additional than $12 billion in earnings in Australia — solely $481 million (or round 4%) of which was reported as taxable.

Fb Australia paid virtually $38 million in tax on virtually $1.3 billion of earnings in the identical yr, whereas Google Australia paid $124 million on $2 billion in earnings and its Google Cloud arm paid virtually $9 million on $158 million in earnings.

Samsung Electronics Australia paid greater than $38 million in tax in 2022-23 after making virtually $3.4 billion in native earnings.

A complete of $97.9 billion in earnings tax was paid by giant companies for the 2022-23 monetary yr, up 16.7% from the earlier yr and the biggest quantity since reporting started, the ATO mentioned.

The rise was partly on account of greater earnings from mining, oil, and gasoline corporations.

“Tax paid by the oil and gasoline sector elevated to $11.6 billion in 2022–23, with some oil and gasoline corporations now amongst the biggest taxpayers in Australia,” Saint mentioned.

“This consequence was pushed by a mix of commodity costs, the venture manufacturing life cycle, and ATO intervention.”

The info confirmed that for a second yr in a row, the mining sector paid extra tax than all different sectors mixed.

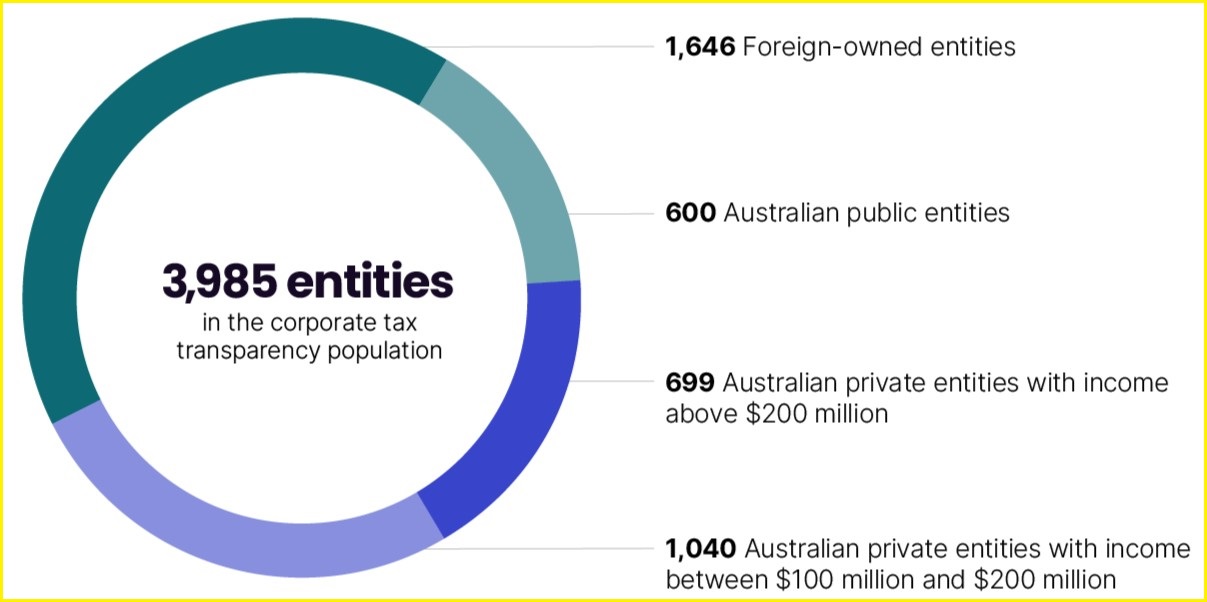

This ATO graph exhibits company entities by their possession section in 2022-23. Picture: ATO / Provided

ATO’s AI-based tax cheats plan

The ATO outlined final week the way it makes use of synthetic intelligence applied sciences to enhance its processes and crack down on tax avoidance.

In a submission to a parliamentary inquiry into the usage of AI programs by the general public sector on 25 October, the company mentioned it used AI “to overview giant portions of unstructured knowledge, generate threat fashions to establish potential non-compliance, present actual time prompts to taxpayers and draft and edit communications”.

In a single instance, pure language processing had been used to course of 36 million paperwork and establish “entities of curiosity and their relationships”, the ATO mentioned.

“Since 2016, this initiative helped elevate greater than $256 million in liabilities and accumulate over $65 million in money as of September 2024,” it mentioned.

AI was used to ship real-time prompts to taxpayers after they had been finishing their tax returns by way of MyTax and will establish taxpayers who had funds due however had been “unlikely to pay on time”, the ATO mentioned.

The company mentioned AI was additionally used for fraud safety, matching data submitted by taxpayers, and figuring out “excessive threat work-related expense claims that warrant a request for substantiation”.

- This story first appeared on Data Age. You’ll be able to learn the authentic right here.