After the sturdy efficiency run of progress versus worth investing lately, many traders have began to query the validity of the latter funding model, significantly after the newest few months. Worth shares underperformed when the markets had been on the best way down in March, and so they’re lagging different investments with the markets on the best way up.

By means of many discussions I’ve had with the diligent worth disciples on the market, I can see that their endurance is beginning to run skinny. The centerpieces of the worth argument are enticing valuations and imply reversion—the speculation that asset costs and returns will revert to their historic averages. But many market individuals are discovering it more and more troublesome to abdomen the disparity in efficiency between progress and worth investing, which continues to develop by the day, quarter, and 12 months. To the worth diehards, although, the reply is easy: imply reversion has labored up to now, overcoming durations of volatility, and this market setting isn’t any totally different. They are saying endurance is the reply, as a result of the worth premium will all the time exist.

The Worth Premium Argument

The worth premium argument has been without end linked to Eugene Fama and Kenneth French, two teachers who revealed a groundbreaking research in 1992 stating that worth and dimension of market capitalization play a component in describing variations in an organization’s returns. In line with this principle, Fama and French recommended that portfolios investing in smaller corporations and firms with low price-to-book values ought to outperform a market-weighted portfolio over time. The aim of this strategy is to seize what are generally known as the “worth” and “small-cap” premiums.

“Worth” may be outlined because the ratio between an organization’s e-book worth and market worth. The worth premium refers to returns in extra of the market worth. The small-cap premium refers back to the greater return anticipated from an organization with low market worth versus that of an organization with giant capitalization and excessive market worth.

Worth Versus Progress

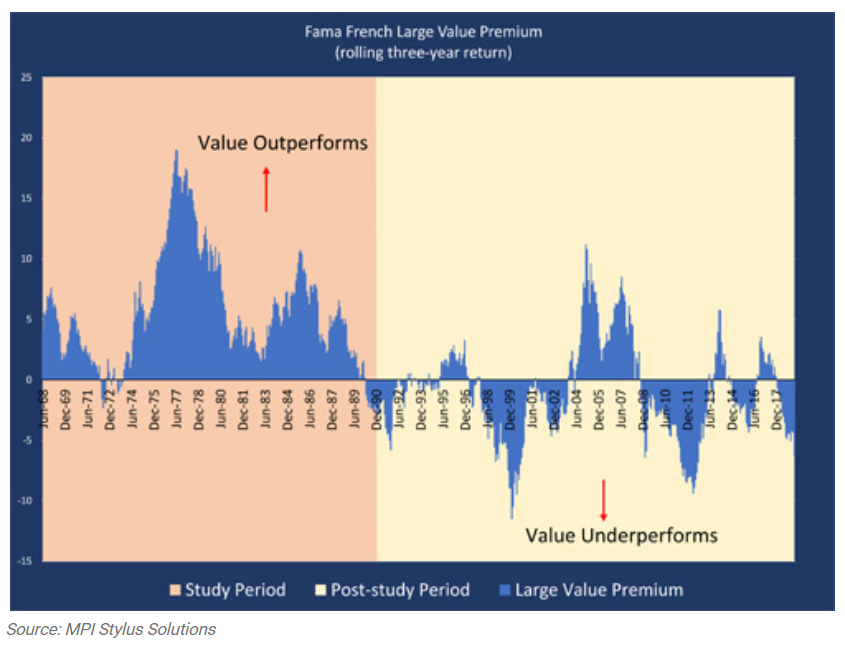

The pink-shaded space within the determine under reveals the efficiency of the worth premium (with worth outperforming progress) over the research interval from 1963 to December 1990 on a rolling three-year foundation. Knowledge from the put up–research interval of January 1991 till the current is proven within the yellow-shaded background.

Observe that there are two very totally different return patterns pre- and post-study. Within the pre-study interval, worth outperformed progress 92 p.c of the time, and this knowledge was the premise for the 1992 research’s findings. Within the post-study interval of the previous 30 years, nonetheless, progress outperformed worth 64 p.c of the time. The longest stretch of worth outperformance up to now 30 years got here in the course of the financial and commodity growth of 2000 to 2008. In different years, the worth premium has been largely nonexistent.

Does the Worth Premium Nonetheless Exist?

In January 2020, Fama and French revealed an replace of their work titled “The Worth Premium.” On this report, the 2 authors revisit the findings from their authentic research, which was primarily based on practically 30 years of knowledge that clearly confirmed the existence of a big worth premium. In it they acknowledge that worth premiums within the post-study interval are relatively weak and do fall from the primary half of the research to the second. It’s additionally notable that different research have come out through the years making comparable claims (Schwert, 2003; Linnainmaa and Roberts, 2018).

What can we take away from the information offered by Fama and French? To me, it appears cheap to ask, if the roughly 30 years of pre-study knowledge was ample to conclude that the worth premium existed, shouldn’t be the 30-year post-study interval (throughout which worth clearly underperformed) sufficient time to counsel the worth premium has diminished or not exists?

When contemplating this knowledge, traders could want to query whether or not imply reversion ought to proceed to be a centerpiece within the value-growth debate. They may additionally ask whether or not strategically allocating portfolios to seize a seemingly diminishing premium is sensible. In line with the information, we have now a number of causes to think about why progress may grow to be the dominant asset class for a lot of traders. When doing so, nonetheless, it’s necessary to bear in mind the potential dangers of progress shares, which can be inclined to massive worth swings.

All this makes worth versus progress an fascinating matter, which I’ll tackle additional in a future put up for this weblog. Within the meantime, if you happen to’d like to have interaction in a dialog about worth versus progress, please remark within the field under. I’ll be comfortable to share my ideas and perspective.

Editor’s Observe: The authentic model of this text appeared on the Unbiased Market Observer.