Earnings Tax Division has part AL from AY 2-16-17 referred to as Asset and Legal responsibility ,Schedule AL ,in ITRs which is relevant in circumstances the place the entire revenue exceeds Rs 50 lakhs. This text talks about Schedule AL or Asset and Legal responsibility In ITR.

Schedule AL, Asset and Legal responsibility Part in ITR

From AY 2016-17 or FY 2015-16, Any particular person or Hindu undivided household (HUF) with complete revenue of greater than Rs.50 lakh in a yr has to stick to the brand new disclosure clause. The revenue tax division desires to maintain a tab on the revenue and belongings of these with revenue above 50 lakhs. It’s to test whether or not the belongings that the assessee owns are in step with the revenue of the assessee or are disproportionate to the revenue. So Schedule AL was launched From AY 2016-17 or FY 2015-16. For a person ,Schedule AL, is within the varieties equivalent to ITR2 ,ITR3 and ITR4.

‘Tax evasion a lifestyle’: Solely 76 lakh Indians confirmed revenue of over Rs 5 lakh, mentioned Our Finance Minister Arun Jaitely in 2018.

Earlier than AY 2016-17 Schedule AL was already in ITR3 and ITR4, used for enterprise revenue, so most of those belongings, investments have been proven as enterprise belongings or investments in Monetary Statements of a taxpayer. However now, even the salaried individual has to declare it if his complete revenue exceeds Rs. 50 lakhs throughout monetary yr.

What’s Schedule AL, Asset and Legal responsibility in ITR?

In keeping with the brand new norms, beneath Schedule AL, an assessee has to reveal the worth of belongings and liabilities that he owned as on 31 March 2019, whereas submitting ITR for evaluation yr 2019-20. The data that must be disclosed is just like what one needed to disclose earlier whereas submitting wealth tax returns.

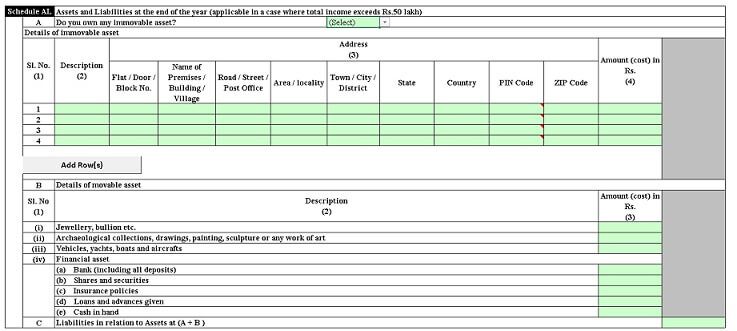

People and entities coming beneath this revenue bracket can even have to say the entire price of such belongings. So, whereas immovable belongings like land and constructing should be furnished beneath the brand new ITR regime, movable belongings like money in hand, jewelry, bullion, autos, yachts, boats and plane can even should be disclosed .One additionally has to explain their “Legal responsibility in relation” to those excessive worth objects. The schedule AL, for ITR1, ITR2,ITR2A is proven in picture under

Complete revenue of fifty lakh is with or with out deductions?

Earnings will not be the Gross Complete Earnings however revenue arrived by deducting the tax saving deductions. If complete revenue of taxpayer coming precisely Rs. 50 lakhs, then Schedule AL will not be relevant.

For instance throughout F.Y. 2015-16, Gross Complete Earnings of Mr. Sharma is Rs. 52 lakh. He has executed tax saving beneath part 80C of 1.5 lakh(EPF,PPF, life insurance coverage premium ) and contributed Rs. 50,000 to Nationwide Pension Scheme(NPS). then as Complete revenue of Mr Sharma is 50 lakh(52-2), it doesn’t exceed 50 lakh so Mr. Sharma doesn’t have fill Schedule AL.

What number of of revenue tax payers earn above 50 lakh?

In keeping with the Earnings Tax Division, just one.5 lakhs ultra-rich people whose complete revenue could be above Rs. 50 lakhs are required to fill this schedule in ITR Type and therefore 99.5% of taxpayers usually are not affected by this requirement.

What particulars are required to be disclosed in schedule AL?

Individuals who’re required to fill this schedule must report the next particulars. The belongings does not embody private equipment i.e. sporting attire, furnishings held for private use by the taxpayer or dependent any member of the family.

- Immovable Property- Price of Land and Constructing owned.

- Movable Property- Money in hand, price of Jewelry, bullion, plane, autos, yachts, boats.

- Legal responsibility (loans) in relations to the above-mentioned belongings, investments.

Easy methods to declare the Price of assorted belongings for Schedule AL or Asset and Legal responsibility in ITR?

You’re required to fill the entire quantity of COST of the belongings. But when such belongings have been acquired by means of reward, will or inheritance, then Price would be the Price incurred by earlier proprietor and any enchancment price is any.

Notice that you need to fill the entire price. For instance for those who personal land, It’s a must to fill in complete price of all of the lands (within the type of plots, agricultural land and so on.) owned by you. or fill in complete quantity of Mounted Deposits, Recurring Deposits and Saving/Present Account Balances with all Banks.

In keeping with the disclosure guidelines one has to declare solely the price of the belongings should be disclosed and never the market worth . Which means that for those who owned, say, a home on 31 March 2019, which you had purchased in 2010 for Rs.50 lakh, then you want to write Rs.50 lakh beneath the immovable belongings column, no matter what the market worth of the home was because the final day of March 2019.

Price of Property, Gold

Nevertheless, in lots of circumstances,one might not know the price of the asset, for instance, an inherited ancestral property, or jewelry or gold obtained as presents.

- For an ancestral property purchased earlier than 2001, one can take the honest market worth in 2001 as price.

- For a property purchased after 2001, one has to know the fee paid by the earlier proprietor to amass it,

- In some circumstances, if price of buy will not be assessable, one can even put the present insured worth as the fee

- One choice is to get the property/asset valued by a valuer. Although acquiring a valuation report would add to the annual compliance burden however you want it anyway while you promote the asset.

Price of Mutual Funds in Schedule AL

You may both get the consolidated assertion from R&T brokers like CAMS, Karvy or NSDL CAS. Sure, it’s painful however take it as the chance to see how your investments.are, doing.

Price of Shares in Schedule AL

For this, you need to get assertion from the dealer and get the COST of all of the shares.

Price in Banks in Schedule AL

Financial institution stability as on 31 Mar 2019 and all Mounted Deposits and Recurring Deposits.

Legal responsibility in Schedule AL, Asset and Legal responsibility in ITR

One additionally has to fill within the quantity of loans/liabilities borrowed to buy the Belongings. Make an inventory of all of your loans.

- Automobile/Car Mortgage

- Private Mortgage

- Dwelling mortgage

- and so on

Associated Articles:

Regardless of the issues anticipated, many consider the step is in step with the federal government’s goal to curb black cash and tax evasion. Do you assume so such declaration will assist?