Supply: The School Investor

If you happen to’re on the lookout for passive earnings concepts, you could suppose the entire idea is a fable – there is no manner you could earn cash by doing nothing. It is why passive earnings is extremely wanted, but typically misunderstood.

The reality is, passive earnings streams require an upfront funding and plenty of nurturing at first. After a while and laborious work these earnings streams begin to construct and are capable of keep themselves, bringing you constant income with out a lot effort in your half.

Talking from private expertise, including passive earnings streams to your portfolio can assist you enhance your earnings and speed up your monetary targets in super methods. For instance, beginning a financial savings account and incomes curiosity, or investing in dividend paying shares can all begin including earnings to your life with out having to work! Your cash is working for you!

For instance, you should utilize passive earnings streams that can assist you get out of debt or obtain monetary independence sooner.

Let’s get to the passive earnings concepts!

What’s Passive Revenue?

Passive earnings is unearned earnings derived from investments. This funding is often a financial funding, nevertheless it may additionally embrace an upfront time funding.

Passive earnings is completely different than energetic earnings: your job. The aim is to not need to work straight for the cash you earn. Learn our full information to What Is Passive Revenue?

What It Takes To Earn Passive Revenue

Earlier than we get into the passive earnings concepts I believe it’s a good suggestion to first clear up a few misconceptions. Though the phrase “passive” makes it sound like you need to do nothing to usher in the earnings this simply isn’t true. All passive earnings streams would require at the least one of many following two parts:

1) An upfront financial funding, or

2) An upfront time funding

You may’t earn residual earnings with out being keen to supply at the least one in every of these two. As a result of it is necessary to recollect what passive earnings is NOT. Passive earnings is just not your job, it isn’t freelancing, or working on-line. Passive earnings is doing one thing as soon as, then incomes rewards from it into the long run.

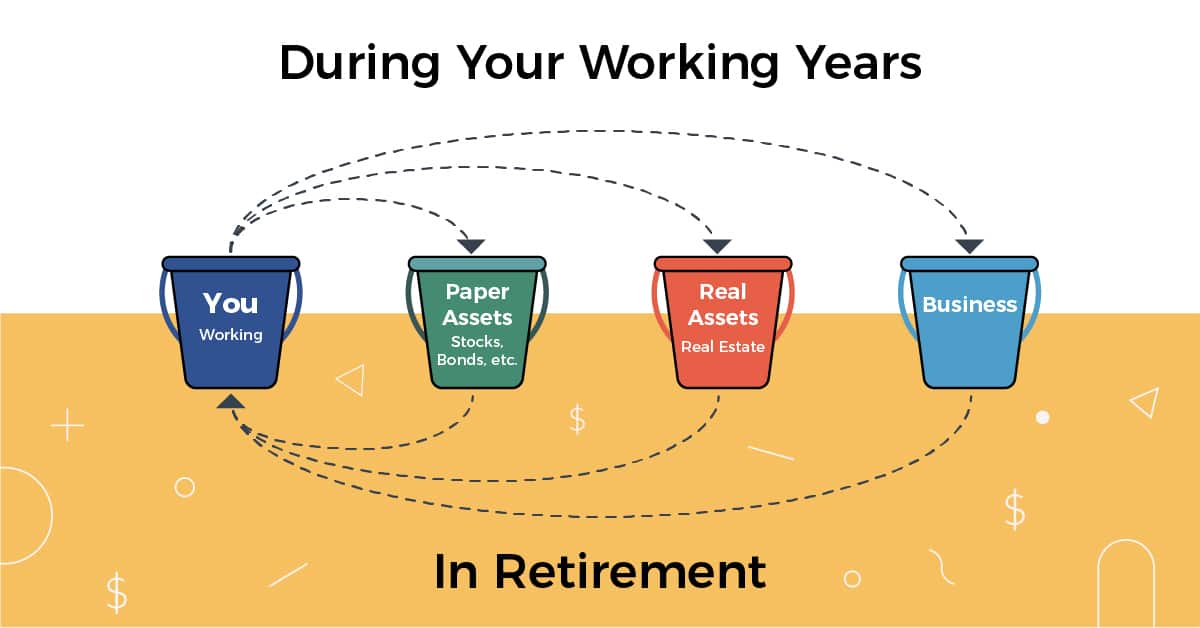

This is an excellent instance of how I view passive earnings and the way it suits into your portfolio of belongings:

Supply: The School Investor

As we speak, I’ve an enormous listing of passive earnings concepts you may attempt whatever the class you fall in.

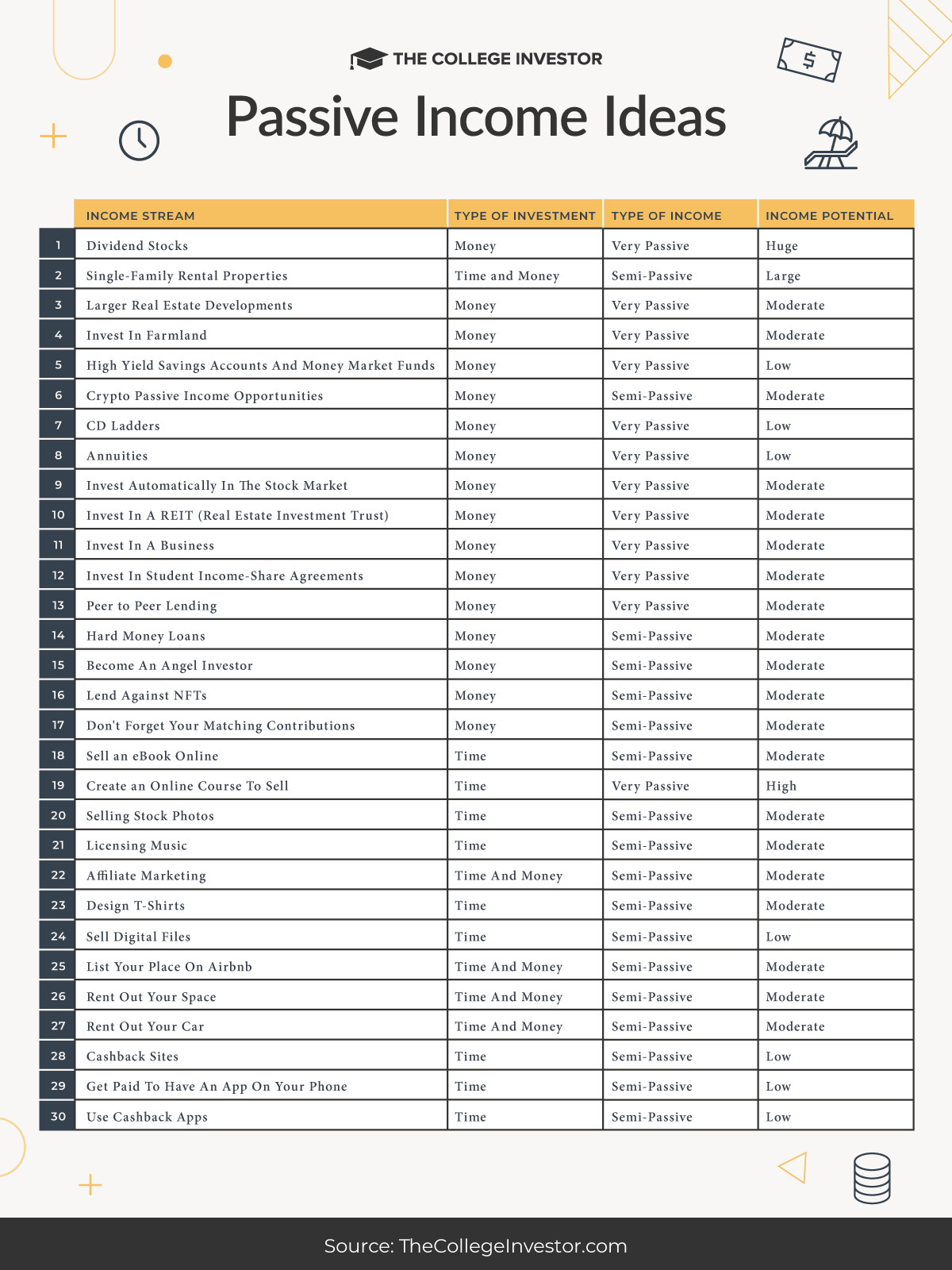

Try this listing of passive earnings concepts right here:

Supply: The School Investor

Passive Revenue Concepts Requiring an Upfront Financial Funding

Most of these passive earnings require you to take a position cash up entrance to generate the passive earnings later. Do not be alarmed although – you can begin with as little as $5 with a few of these concepts, so it is achievable for everybody. For most individuals making a passive earnings technique, placing a bit of cash in investments or financial savings is the perfect place to begin.

1. Dividend Shares

Are Dividend Shares Price It?

Funding earnings is my favourite sort of passive earnings.

Dividend shares are tried and true option to earn passive earnings. You’ll have to do loads of analysis to seek out good shares and make investments a major amount of cash to obtain giant dividend checks. Nevertheless, in case you persistently make investments cash into dividend shares you may amass a pleasant residual earnings over time.

For any of those funding alternatives, ensure you open an account at the perfect on-line brokerage, and get rewards whereas doing it.

One in all our favourite locations to take a position is Charles Schwab. You may not have heard of Schwab, nevertheless it’s a FREE investing platform that permits you to construct a portfolio, and spend money on it without cost.

For the reason that platform is commission-free, you may spend money on dividend shares with no buying and selling prices. That is wonderful. Need to reinvest your dividends? That is free too! That is why Schwab was voted the most effective brokerage corporations of 2024

.

Learn our full expertise with Charles Schwab right here.

How To Select The Proper Dividend Shares

- Search for corporations with a historical past of constant dividend funds

- Analysis dividend yield and payout ratios

- Diversify your portfolio to attenuate danger

If you happen to’re unsure about selecting particular person shares, search for excessive dividend paying ETFs or mutual funds.

2. Single-Household Rental Properties

Are Single Household

Leases Price It?

A money flowing rental property is a unbelievable manner to usher in a month-to-month earnings. To make this really passive you may outsource the operating of the properties to a administration firm.

Nevertheless, the web has made investing in rental properties simpler than ever earlier than. There are plenty of methods you may spend money on rental properties relying on what your targets and pursuits are. You is usually a restricted accomplice in giant residential or industrial properties, or you should purchase houses and be a landlord – all on-line!

Make investments In Single Household Properties

If you happen to’re on the lookout for a extra conventional path to actual property funding, try Arrived Properties. This firm permits you to purchase cash-flow optimistic single household leases – on-line! You may enroll and begin looking out properties at the moment. Try Arrived right here.

The beauty of utilizing a platform versus doing it your self is that the earnings is much more passive. Try our full expertise with Arrived right here.

Ideas For Profitable Rental Property Investing

- Select properties in high-demand areas

- Guarantee optimistic money movement

- Think about using a property administration firm

3. Bigger Actual Property Developments

Is Actual Property Investing

Price It?

Do you not need to be a landlord, however nonetheless need actual property publicity and earnings? Then think about being a restricted accomplice in a big improvement. With these choices, you may spend money on multi-family or industrial properties. You get the earnings and tax remedy identical to common actual property possession, however you do not do any of the work!

Our favourite platform for that is RealtyMogul since you get the flexibleness to take a position as little as $1,000, however may take part in REITs and personal placements – usually not supplied to the general public. Traders can fund actual property loans to realize passive earnings or purchase an fairness share in a property for potential appreciation. Their platform is open to each accredited and non-accredited buyers.

Learn our full expertise utilizing RealtyMogul right here.

Advantages of Crowdfunded Actual Property

- Entry to actual property investments with decrease capital necessities

- Diversification throughout a number of properties

- Skilled administration of investments

For Accredited Traders

One in all my favourite methods to get began with rental properties is thru EquityMultiple. Much like LendingClub, you can begin investing in actual property for as little as $5,000 at platforms like EquityMultiple.

This platform has a pleasant mixture of smaller residential to combined use residential and industrial properties. Learn our full EquityMultiple overview right here.

4. Make investments In Farmland

Is Farmland Investing

Price It?

Farmland is not horny, nevertheless it has rather a lot going for it in relation to actual property investing. It is gradual, regular, pays constant hire, and everybody must eat. Plus, in comparison with different forms of actual property its a lot much less unstable. There’s two main corporations that will let you spend money on farmland. FarmTogether and AcreTrader.

We lately did a behind the scenes overview of our personal AcreTrader funding, and you may watch the AcreTrader overview video on YouTube.

Try our critiques and get began:

Advantages of Leasing Farmland

- Regular rental earnings

- Land appreciation potential

- Minimal administration duties

5. Excessive Yield Financial savings Accounts And Cash Market Funds

Are Financial savings Accounts

Price It?

If you happen to do not need to suppose a lot about your cash, however need it to be just right for you, a primary place to place it’s in a excessive yield financial savings account or cash market fund.

The distinction is within the account sort and the place it is situated. Sometimes, excessive yield financial savings accounts are situated at banks, and are FDIC insured. Cash market funds could be situated at each banks and funding corporations, and are solely typically FDIC insured.

Rates of interest have been rising, so placing more cash right into a financial savings account can generate a secure passive earnings stream.

Western Alliance Financial institution at the moment gives a stable yield at 4.46% APY with only a $500 minimal to open! Try Western Alliance Financial institution right here >>

Traits of Excessive-Yield Financial savings Accounts

- Federally insured as much as FDIC Limits

- Accessible and liquid

- Low-risk funding

In order for you the freshest charges on excessive yield financial savings accounts and cash markets, try these lists that we replace the charges day by day on:

6. Crypto Passive Revenue Alternatives

During the last a number of years, crypto financial savings accounts have turn out to be very talked-about – just because they supply the chance for greater charges of return in your cash. It is necessary to notice that these aren’t actually “financial savings accounts”. These are funding and lending accounts that will let you earn a excessive yield in your crypto “simply”. However they don’t seem to be with out danger!

Some common choices are Uphold and Nexo (solely accessible outdoors america). You may earn upwards of 25% APY in your crypto at these corporations, however there are dangers. Try our full information to Crypto Financial savings Accounts right here.

You can too have a look at staking your crypto, lending your crypto, and even shopping for NFTs. There are plenty of alternatives to earn passive earnings with crypto – we put collectively a full information right here: How To Make Passive Revenue With Crypto.

Standard Cryptocurrencies for Staking

7. CD Ladders

Constructing a CD Ladder requires shopping for CDs (certificates of deposits) from banks in sure increments as a way to earn the next return in your cash. CDs are supplied by banks and since they’re a low danger funding in addition they yield a low return. It is a good possibility for the chance averse to construct passive earnings streams.

For instance, what you do in order for you a five-year CD ladder is you do the next. Look how the charges rise over completely different time durations (these are estimated):

- 1 Yr CD – 4.00%

- 2 Yr CD – 4.250%

- 3 Yr CD – 4.50%

- 4 Yr CD – 5.00%

- 5 Yr CD – 5.25%

If constructing a CD Ladder sounds sophisticated, you can too persist with a conventional excessive yield financial savings account or cash market fund. Whereas the returns aren’t as wonderful as different issues on this listing, it is higher than nothing, and it is really passive earnings!

We suggest constructing a CD Ladder at CIT Financial institution as a result of they’ve the most effective CD merchandise accessible. Excessive charges and even a penalty-free CD possibility (which at the moment earns 3.50% APY). Try CIT Financial institution right here.

You can too have a look at CD alternate options like Save. Save is a hybrid product that probably permits you to earn manner above market returns, however retains your principal secure in an FDIC-insured checking account. Try Save right here >>

Try these nice offers on the perfect excessive yield CDs on our full listing of the perfect CD charges that get up to date day by day.

Advantages of CD Ladders

- Larger rates of interest in comparison with financial savings accounts (often)

- Common entry to funds

- Lowered danger of rate of interest fluctuations since you have locked in a price

8. Annuities

Annuities are an insurance coverage product that you simply pay for however can then present you passive earnings for all times within the type of month-to-month funds. The phrases with annuities range and should not all the time an excellent deal so it’s greatest to speak to a trusted monetary advisor in case you’re thinking about buying an annuity.

These investments aren’t for everybody – they will include excessive charges, and never be value it. However when you’ve got zero danger tolerance for loss, and are on the lookout for a passive earnings stream, this might be an excellent potential thought for you your portfolio.

Try Blueprint Revenue for a market for private annuities.

Kinds of Annuities

- Fastened annuities

- Variable annuities

- Listed annuities

9. Make investments Routinely In The Inventory Market

Are Robo-Advisors Price It?

If you happen to’re not thinking about choosing dividend paying shares (and I can perceive that), there are nonetheless methods to take a position passively within the inventory market. You may mechanically spend money on numerous methods by means of what’s known as a robo-advisor.

A robo-advisor is rather like what it appears like – a robotic monetary advisor. You spend about 10 minutes answering a number of questions and establishing your account, and the system will take it from there.

The most well-liked robo-advisor is Wealthfront – which you’ll setup to mechanically spend money on and they’ll deal with the remainder for you. What’s nice about Wealthfront is that they cost one of many lowest charges within the robo-advisor business, and so they make it very easy to take a position mechanically.

Plus, Wealthfront was lately named one in every of our prime picks for the Finest Robo-Advisors For 2024. They provide an excellent service plus you may get recommendation from an actual human, which is superior. Learn our full expertise with Wealthfront right here.

Join Wealthfront right here and get began investing for a passive earnings!

10. Make investments In A REIT (Actual Property Funding Belief)

If you happen to’re involved about investing straight in actual property, or possibly you are not but an accredited investor, that is okay. You may nonetheless benefit from actual property in your investments by means of REITs – Actual Property Funding Trusts.

These are funding autos that maintain property inside them – and also you because the proprietor get to profit from the features, refinances, sale, earnings (or loss) on the property.

Our favourite platform to spend money on a REIT is Fundrise¹. They solely have a $500 minimal to get began and supply quite a lot of choices we love as nicely!

The School Investor is a non-client promoter of Fundrise. The School Investor receives compensation in case you open an account at Fundrise after clicking by means of a hyperlink on this web page.The School Investor is a non-client promoter of Fundrise. The School Investor receives compensation in case you open an account at Fundrise after clicking by means of a hyperlink on this web page.

11. Make investments In A Enterprise

Are Enterprise Loans Price It?

One other option to generate passive earnings is to take a position and be a silent accomplice in a enterprise. That is very dangerous, however with danger comes the potential for top returns. For instance, a number of years in the past each Lyft and Uber had been on the lookout for non-public buyers to spend money on their corporations. As we speak, they’re value billions – however you as an investor would solely reap that profit in the event that they go public through an IPO, or get acquired. So, it is dangerous.

However there are methods to cut back your danger. For instance, you may make investments small quantities in lots of corporations by means of lending them cash in small bonds.

There are actually instruments accessible the place you may mortgage cash to a enterprise and receives a commission a stable return for doing it!

Small Enterprise Loans

% is an organization that will let you lend cash to companies in numerous methods. They’re a market for lending, and so they supply industrial loans, receivable loans, and extra. You should be an accredited investor, however in case you’re on the lookout for extra danger and reward, it might be an possibility. Learn our full expertise and % overview right here.

12. Make investments In Scholar Revenue-Share Agreements

An Revenue-Share Settlement (ISA) is an various to scholar loans. Through the use of an ISA, a scholar’s tuition is paid for in change for a proportion of their future earnings.

Who’s funding these ISAs? Non-public buyers and universities fund them. Traders mainly take a wager on a scholar’s future.

You see these mostly at coding academies and commerce colleges, however they’re rising in recognition.

Edly is an organization that permits you to spend money on ISAs. They’ve two choices – one you may make investments straight in a notice, and the opposite in a fund that they use for future notes. Relying on timing, there may not be any open notes accessible in to take a position.

You should be an accredited investor to take a position, and there’s a $10,000 minimal. Nevertheless, they’re focusing on 8-14% returns, which is superior. Learn our full Edly expertise and overview right here.

13. Peer to Peer Lending

Is Peer-To Peer Lending

Price It?

P2P lending is the follow of loaning cash to debtors who usually don’t qualify for conventional loans. Because the lender you will have the power to decide on the debtors and are capable of unfold your funding quantity out to mitigate your danger.

Proper now, Lenme is without doubt one of the final peer to look lending platforms on the market. However these loans are going for use for private causes, so maintain that in thoughts. Try our full Lenme overview right here.

What’s nice about that is that you just lend your cash, and also you receives a commission again principal and curiosity on that mortgage.

The median return on money movement is 3% – which is healthier than some financial savings accounts you are going to discover at the moment. Try different CD alternate options.

14. Onerous Cash Loans

Is Onerous Cash Lending

Price It?

Much like different forms of peer to look lending, laborious cash loans give attention to a particular area of interest – actual property loans. These loans are usually used for repair and flip tasks, or quick time period bridge loans.

Proper now, Groundfloor is without doubt one of the oldest platforms within the house that has been making a market for laborious cash loans.

Nevertheless, understand it isn’t with out danger. Based on Groundfloor, there was been a 1% loss ratio since they began with their market.

If you happen to’re , you may get began on Groundfloor for as little as $10. See our full Groundfloor overview right here.

15. Turn out to be An Angel Investor

Is Angel Investing

Price It?

Have you ever ever watched the present Shark Tank, the place the 5 buyers take heed to pitches from small corporations after which make gives to take a position? That is known as angel investing – and for a lot of buyers, it does not appear to be the present Shark Tank in any respect!

As a substitute, most corporations pitch their concepts on-line through e-mail introductions, zoom conferences, and small shows. And there are even some web sites that “syndicate” offers collectively – the place a bunch of individuals get to collectively to spend money on a startup. And you may be part of that too!

You must keep in mind that that is extraordinarily excessive danger, excessive reward – nevertheless it’s completely passive investing. Most startups do fail, and if the corporate you spend money on fails, you would lose all of your funding.

If you happen to’re trying to turn out to be an angel investor, try AngelList or Propel(x). AngelList in all probability has the very best quantity of deal movement accessible, whereas Propel(x) focuses on area of interest offers.

Ideas for Investing in a Enterprise

- Select a enterprise with progress potential

- Assess the administration crew’s competence

- Perceive the exit potential and technique

16. Lend In opposition to NFTs

If you happen to’re into the NFT-space, there’s a actually attention-grabbing manner you could make passive earnings by merely lending to others with NFTs as collateral. What this implies in follow is that you simply create a wise contract with somebody who owns an NFT, you agree on an quantity to lend to them, a reimbursement interval, and also you each digitally signal this contract.

Keep in mind that most NFT lending is completed through Ethereum, so that you present the funds in ETH, and so they repay you in ETH. If the borrower does not repay you in time (or in any respect), the sensible contract will switch you possession of the collateral NFT.

Try this listing of platforms the place you are able to do NFT lending.

17. Do not Neglect Your Matching Contributions

Is 401k Matching

Price It?

That is one in every of my favourite passive earnings concepts, as a result of it is really easy, but so many individuals fail at it. It is easy – benefit from matching contributions on your 401k or HSA.

That is actually free cash for merely contributing to your personal retirement accounts. By not profiting from the match, you are leaving free cash on the desk.

All you need to do is be sure that you are contributing sufficient to your 401k or HSA so that you simply get the total matching contribution. To your HSA, your employer additionally may require you to take motion – like taking a well being evaluation or getting a bodily. However all that free cash can add up!

Word: When you’ve got previous 401k from previous jobs laying round, it is best to roll them over and ensure they’re invested accurately. Providers like Beagle and Capitalize can assist.

Passive Revenue Concepts Requiring an Upfront Time Funding

The following part of passive earnings concepts require a time funding. As a substitute of utilizing cash, it’s essential to put in sweat fairness to make these occur. That is associated to a aspect hustle. Our information to the greatest aspect hustles can assist you discover concepts that require a time funding – which might then springboard you right into a passive earnings stream.

Nearly all of those concepts require beginning a private weblog or web site. However the wonderful thing about that’s that it is extremely low cost to do. We suggest utilizing Bluehost to get began. You get a free area identify and internet hosting begins at simply $2.95 per thirty days – a deal that you simply will not discover many different locations on-line! You may afford that to begin constructing a passive earnings stream.

18. Promote an eBook On-line

Self Publishing is mainstream at the moment. Once you buy an eBook off of Amazon there’s a fairly good probability you’re shopping for a self-published guide. Self-publishing can also be ridiculously simple. I attempted this a number of years in the past and couldn’t imagine how easy the method was.

To self-publish a guide you’ll first want to jot down and edit it, create a canopy, after which add to a program corresponding to Amazon’s Kindle Direct Publishing. Don’t count on immediate success although. There’ll have to be plenty of upfront advertising and marketing earlier than you may flip this right into a passive earnings stream.

The same possibility is to create printables you could promote on-line. Printables aren’t as in-depth as a full eBook, so they’re simpler to create and you may nonetheless earn a passive earnings in your gross sales! Discover ways to create on-line objects to promote on Fiverr and Etsy in your first day of this on-line course that teaches you what to do: The E-Printables Promoting Course.

Ideas for Profitable eBook Publishing

- Determine a worthwhile area of interest or subject

- Create partaking, well-written content material

- Promote your guide by means of numerous channels

19. Create an On-line Course To Promote

Are On-line Programs Price It?

Udemy is an internet platform that lets its person take video programs on a big selection of topics. As a substitute of being a shopper on Udemy you may as an alternative be a producer, create your personal video course, and permit customers to buy it. It is a unbelievable possibility if you’re extremely educated in a particular subject material. This may also be a good way to show conventional tutoring right into a passive earnings stream!

Much like Udemy, you can begin a YouTube channel the place you educate excessive demand topics, and you may monetize through advertisements. You do the work up-front to create the movies, and then you definately benefit from the passive earnings steams from the advertisements for years to return!

Try Udemy right here to get began >>

Ideas for Making a Profitable On-line Course

- Determine a high-demand topic

- Create partaking and informative content material

- Market your course successfully

20. Promoting Inventory Images

Is Promoting Inventory Images

Price It?

Do you ever surprise the place your favourite web sites, blogs, and typically even magazines get their pictures? These are usually purchased from inventory photograph web sites. If you happen to get pleasure from pictures you may submit your pictures to inventory photograph websites and obtain a fee each time somebody purchases one in every of them.

One of many largest marketplaces to promote inventory pictures is DepositPhotos. You may add your pictures are earn cash at any time when somebody makes use of them.

Actually, try this superior story of one in every of our scholarship contestants who turned pictures right into a inventory photograph enterprise.

21. Licensing Music

Is Licensing Music

Price It?

Similar to inventory pictures you may license and earn a royalty off of your music when somebody chooses to make use of it. Music is commonly licensed for YouTube Movies, commercials, and extra.

With the quantity of YouTube movies and podcasts which can be being created, there’s extra demand than ever for music – and persons are keen to pay for it.

The important thing option to do it’s to get your music in a library that folks can search. Try this information on how one can license your music.

If you have already got a license and need to promote it for money, or in case you’re trying to purchase music licenses to earn earnings, try Royalty Alternate. This platform connects artists with these trying to construct a royalty income steam.

Standard Inventory Audio Platforms

- AudioJungle

- Pond5

- PremiumBeat

22. Affiliate Advertising and marketing

Is Affiliate Advertising and marketing

Price It?

Internet affiliate marketing is the follow of partnering with an organization (changing into their affiliate) to obtain a fee on a product. This methodology of producing earnings works the perfect for these with blogs and web sites. Even then, it takes a very long time to construct up earlier than it turns into passive.

Larry Ludwig is a 25 12 months knowledgeable on advertising and marketing and he constructed (and retired early) by creating web sites that earned passive earnings with affiliate marketing online. We’re recognized Larry for a very long time and undoubtedly is aware of what he is speaking about.

If you wish to get began with affiliate marketing online try this course on affiliate marketing online and how one can turn out to be a full time blogger.

How one can Reach Affiliate Advertising and marketing

- Select a distinct segment with a robust viewers

- Promote merchandise related to your viewers

- Construct belief and credibility by means of high quality content material

23. Design T-Shirts

Is Promoting T-Shirts

Price It?

Websites like Cafe Press enable customers to customized design objects like T-shirts. In case your design turns into common and makes gross sales you’ll be capable to earn royalties. Plus, the passive earnings stream of that is you could setup print on demand companies in order that you do not have to have any stock and orders merely get fulfilled when clients organize them.

Even Amazon has gotten into this enterprise of print on demand. Amazon has a brand new service known as Amazon Merch, the place you merely add your designs and Amazon takes care of the remainder (making it, packing it, and delivery it).

Standard Merchandise Platforms

24. Promote Digital Information

Is Promoting Digital Information

Price It?

I’ve been into residence décor currently and I needed to flip to Etsy to seek out precisely what I wished. I ended up buying digital information of the paintings I wished printed out! The vendor had made a bunch of wall artwork, digitized, and listed it on Etsy for fast obtain. There are different common digital information on Etsy as nicely corresponding to month-to-month planners. If you happen to’re into graphic design this might be a tremendous passive earnings thought for you.

Adrian Brambilia is an internet marketer that has developed an enormous quantity of passive earnings streams over the previous couple of years. If that is one thing you are inquisitive about, try this course by Adrian Brambila that may allow you to get began.

Actually, we promote digital information too. I re-used my first resumes and canopy letters as a digital product in order that different faculty graduates may get a head begin. Try my skilled resume templates right here.

Standard Locations To Promote Digital Information

- Etsy

- Academics Serving to Academics

- Gumroad

Semi-Passive Small Enterprise Concepts

I name these semi-passive earnings as a result of they’re extra like a enterprise, much less just like the concepts above. All of them additionally require a small mixture of money and time funding. However when you make investments, you may earn extra earnings and usually accomplish that passively.

Nevertheless, these all do require some ongoing time funding, so they are not 100% passive like having a financial savings account.

25. Checklist Your Place On Airbnb

Is Itemizing On Airbnb

Price It?

When you’ve got a home, house, spare room, and even yard, think about itemizing your property on AirBNB and begin incomes cash whenever you get your home booked. Enroll your home at the moment.

AirBNB is nice as a result of you may earn cash on an area you already personal. It does require a bit of work up entrance to prep your home, listing it, and clear up after visitors, nevertheless it’s fairly passive in any other case.

Supply: The School Investor

26. Hire Out Your Area

Is Renting Your Property

Price It?

Possibly you do not have a room to spare, or a complete different home (who can afford it)? However possibly you will have house you could hire for individuals needing storage. That is the place Neighbor is available in.

With Neighbor, you may hire house you are not utilizing to others to retailer their stuff. Some frequent issues that folks hire are driveway house or parking house for automobile or RV storage, storage space for storing, and enterprise space for storing.

Try the Neighbor app right here and begin incomes passive earnings from renting out random house you will have. You can too try our overview and expertise with Neighbor.

Ideas for Renting Out Storage Area

- Guarantee a safe and clear storage surroundings

- Set a aggressive rental price

- Promote your house on native platforms

27. Hire Out Your Automobile

Is Renting Your Automobile

Price It?

Much like itemizing your home for hire, you can too listing your automobile for hire. This may be really passive as a result of when you listing your automobile, it could possibly earn you earnings whenever you’re not utilizing it!

Our favourite accomplice to hire your automobile is Turo. Turo permits you to put your automobile out for hire, and when individuals hire it, Turo handles the remainder!

The cool factor with Turo is that, relying in your location and how much automobile you will have, you can also make a good passive earnings!

Try Turo right here and get began incomes passive earnings together with your automobile! Try our listing of different methods to earn a living together with your automobile as nicely (a lot of the others aren’t passive although).

Standard Automobile-Sharing Platforms

Simple Passive Revenue Concepts

Final on the listing I wished to level out a few simple passive earnings concepts. These require no cash and no upfront work. Whereas the earnings are menial you continue to can’t beat simple passive earnings!

28. Cashback Websites

Are Cashback Websites

Price It?

Similar to cashback rewards playing cards it is best to choose to make use of a cashback web site when procuring on-line. If you happen to don’t you’re giving up free cash that requires little to no work! We simply in contrast the 2 hottest websites – Rakuten versus TopCashBack.

All you need to do is login to those websites earlier than you make a purchase order, click on the hyperlink, and you will earn the proportion cash-back the positioning gives.

If you wish to know which websites are providing the very best cashback, try Cashback Monitor – a free comparability web site that finds you the perfect cashback offers on the market.

29. Get Paid To Have An App On Your Telephone

What in case you may set up an app in your cellphone, and receives a commission for it? Sure, this app tracks what you are doing and it sells your information – however what’s extra passive than that?

If you happen to do not need to do something out of the norm, try Neilson Digital. You merely obtain the app and do what you usually do. The app runs within the background and you’re entered to win rewards. Easy, simple option to get cash for nothing! Obtain the app right here.

Cellular Expression is an identical app for iPad. You may earn rewards for putting in it and leaving it in your gadget for at the least 90 days. And increase! You receives a commission!

Standard Market Analysis Platforms

30. Use Cashback Apps

Are Receipt Apps

Price It?

Past bank cards and web sites, there are additionally cashback apps that may allow you to get passive earnings from the procuring you are already doing.

Dosh, for instance, works with 10,000 retailers and all you need to do is obtain the app and store. Learn our Dosh overview right here to study extra.

Honey is a browser extension that can discover coupon codes and different reductions for any merchandise you are shopping for. Learn our full Honey overview right here.

How one can Get Began

Whereas it may be tempting to need to choose 5 passive earnings concepts to get began with I’d actually encourage you to choose one at first. You want time and the power to focus to essentially a develop a passive earnings stream. Grasp one factor earlier than shifting on to the opposite.

It’s going to take a considerable period of time or cash at first however I promise incomes passive earnings is the whole lot it’s cracked as much as be! Decide an thought, make a plan, and dedicate your self till that earnings stream involves fruition.

Who Is This For?

Passive earnings is greater than an attractive phrase you hear social media personalities speaking about. Passive earnings is the important thing to constructing wealth over the long run. And there are a number of the way to go about constructing passive earnings streams, relying on what your monetary and “life” scenario is.

Though passive earnings can take time to construct, over time, the earnings streams you develop can find yourself sustaining all of your earnings – permitting you to retire comfortably. And the sooner you begin, the better it’s. But it surely takes momentum and consistency over time.

The entire passive earnings concepts we’re speaking about require both an up-front funding of time, or an up-front funding of cash. And relying on the place you are at in life, it would take extra of 1 or different – or a mixture. These concepts are designed to spark your need to begin constructing wealth!

What are a few of your favourite passive earnings concepts?

¹ The knowledge contained herein neither constitutes a suggestion for nor a solicitation of curiosity in any securities providing; nonetheless, if a sign of curiosity is supplied, it might be withdrawn or revoked, with out obligation or dedication of any sort previous to being accepted following the qualification or effectiveness of the relevant providing doc, and any supply, solicitation or sale of any securities shall be made solely via an providing round, non-public placement memorandum, or prospectus. No cash or different consideration is hereby being solicited, and won’t be accepted with out such potential investor having been supplied the relevant providing doc. Becoming a member of the Fundrise Platform neither constitutes a sign of curiosity in any providing nor entails any obligation or dedication of any sort.

The publicly filed providing circulars of the issuers sponsored by Rise Corporations Corp., not all of which can be at the moment certified by the Securities and Alternate Fee, could also be discovered at www.fundrise.com/oc.

The School Investor receives money compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for every new shopper that applies for a Wealthfront Automated Investing Account by means of our hyperlinks. This may increasingly create an incentive that leads to a cloth battle of curiosity. The School Investor is just not a Wealthfront Advisers shopper. Extra data is accessible through our hyperlinks to Wealthfront Advisers.