** Notice, I am somewhat late in posting my mid-year overview as I used to be unplugged a bit for the final couple weeks. Again courting the put up to its ordinary spot.**

My weblog portfolio is basically flat year-to-date with a achieve of two.99%, effectively behind the S&P 500 with a achieve of 15.29%. The damaged biotech basket carried out effectively however was usually offset by declines in a variety of my legacy holdings and simply malaise in my speculative M&A concepts (crossing my fingers that M&A picks up within the second half). Long run efficiency stays stable at a 21.75% pre-tax IRR.

Closed Positions:

- Fairly a little bit of churn occurred within the damaged biotech basket, I offered Eliem Therapeutics (ELYM), Homology Medicines (FIXX), Graphite Bio (GRPH), Kinnate Biopharma (KNTE), Reneo Prescription drugs (RPHM), Cyteir Therapeutics (CYT), AVROBIO (AVRO) and Theseus Prescription drugs (THRX) as every of those had some kind of buyout or reverse merger transaction. If there was a CVR part, I held by way of the merger and offered shortly after. A few of these rallied considerably put up reverse merger, however in try to stay to the unique thesis, I usually offered after the shareholder base turned over a bit.

- I received spooked out of each Instil Bio (TIL) and Aclaris Therapeutics (ACRS) — though I made a pleasant revenue on ACRS — as each administration groups do not seem like following the reverse merger and/or buyout with a CVR technique. Instil Bio has but to promote their new manufacturing facility and I haven’t got confidence within the property valuation, plus TIL included the road of their intention of “Exploring alternatives to in-license/purchase and develop novel therapeutic candidates in illnesses with important unmet medical want.” Aclaris introduced alongside their Q1 outcomes “we have now determined to progress ATI-2138 right into a proof-of-concept Part 2a trial in sufferers with reasonable to extreme atopic dermatitis”, nevertheless this one is perhaps price as BML Capital Administration has gathered a major stake and will push ACRS to revisit their go-forward technique.

- Sio Gene Therapies (SIOX) made their liquidating distribution and is now pushed into the non-traded bucket. Equally, Merrimack Prescription drugs (MACK) made its liquidating distribution, the remaining penny or two is now in a non-traded liquidating belief.

- Pieris Prescription drugs (PIRS) introduced they’re pursuing an analogous technique as MACK did, minimizing company bills in an effort to increase their money runway lengthy sufficient to seize any milestone funds amongst their disparate portfolio of growth partnerships. I offered to seize a tax loss, however will proceed to observe this one for a re-entry, if any of their milestones do hit, the return might be a a number of of the present market cap.

- MariaDB (MRDB) and Asensus Surgical (ASXC) had been related conditions, money burning corporations with doubtlessly beneficial IP that was topic to a non-binding tender supply, if the tender fell by way of, each might be nugatory. Fortunately for me, each offers went to a definitive settlement and I offered every because the unfold tightened to a standard vary.

- First Horizon (FHN) was added shortly after their transaction with TD Financial institution broke in center of the quick lived financial institution disaster final yr, this spring FHN handed over the long-term capital good points mark for me and I booked the revenue. I may see FHN being an acquisition goal for one of many tremendous regional banks attempting to make use of an acquisition as a springboard into the next regulatory tier class.

- I ought to most likely go away the normal merger arbitrage trades to the consultants, I exited Spirit Airways (SAVE) after the judged dominated towards the merger on anti-trust grounds, Albertsons (ACI) hasn’t gone to courtroom but, however below the present administration, doubtless faces an analogous outcome. Not like Spirit, Albertsons is affordable on a standalone foundation and their PE sponsor Cerberus is prone to search liquidity in different methods if their merger with Kroger (KR) fails.

- NexPoint Diversified Actual Property Belief (NXDT) and Transcontinental Realty Buyers (TCI) each fall into an analogous bucket for me, actual property corporations buying and selling at very huge reductions to their NAV, however with administration in no hurry to shut these gaps (or just unable to within the present rate of interest regime / actual property market). NXDT has seen some current insider shopping for that improves the story, however it has been a number of years for the reason that outdated closed finish fund transformed to a REIT and little has been executed to simplify the portfolio or inform the story.

Beforehand Undisclosed Positions:

- I’ve initiated a small place in DMC World (BOOM) which owns three separate and distinct industrial companies. The corporate has introduced a strategic overview to promote two of the three companies, forsaking a multi-family residential constructing merchandise enterprise (Arcadia). I did not purchase earlier within the story as a result of it’s unclear to me why Arcadia is chosen one to stay within the public shell, however the scenario modified when Metal Companions (savvy, NOL maximizing conglomerate) lobbed in a $16.50/share supply (shares at present commerce sub $14). BOOM has acknowledged the supply and acknowledged they’re going to think about it as a part of their higher strategic options course of.

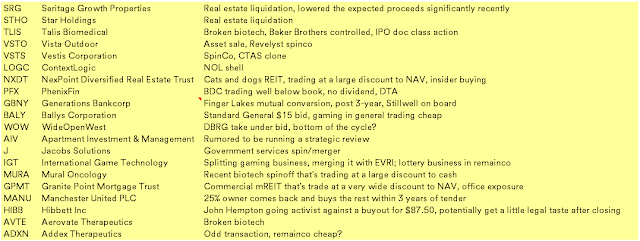

Present Portfolio:

I will probably be performing some reshuffling of my private stability sheet, doubtless withdrawing money from this account within the close to future so maintain that in thoughts after I put up the yr finish outcomes.