A lot of the media protection surrounding markets pertains to feelings. When the market rises, we learn concerning the pleasure. When the market declines, we hear how buyers are frightened. This commentary could be very evocative, however it’s not very helpful. What does it even imply when the market is “scared”?

Enter the worry index, a time period usually utilized by the media to point that the markets might be coming into a interval of turbulence and carry out poorly. What the headlines are literally speaking about is the CBOE Volatility Index (VIX). Many view this index as a predictor of uncertainty available in the market and, thus, as a measure of broader financial uncertainty. So, when the headlines say worry, they imply uncertainty. In market communicate, these phrases usually imply the identical factor.

What Is the VIX?

Merely put, the VIX is a measure of uncertainty. It’s primarily based on the bets merchants place on how a lot they collectively count on the market will fluctuate over the following 30 days. The index can hint its origins again to 1987. The fashionable-day model was launched in 1993; after some tinkering, the present model was launched in 2003.

Like every index, the VIX is a quantity. It has traditionally ranged from 9 to 80, with a median of 19 over time. Low numbers, that are values under 11, point out merchants count on an unusually calm surroundings. Values above 27, then again, imply they count on bother forward.

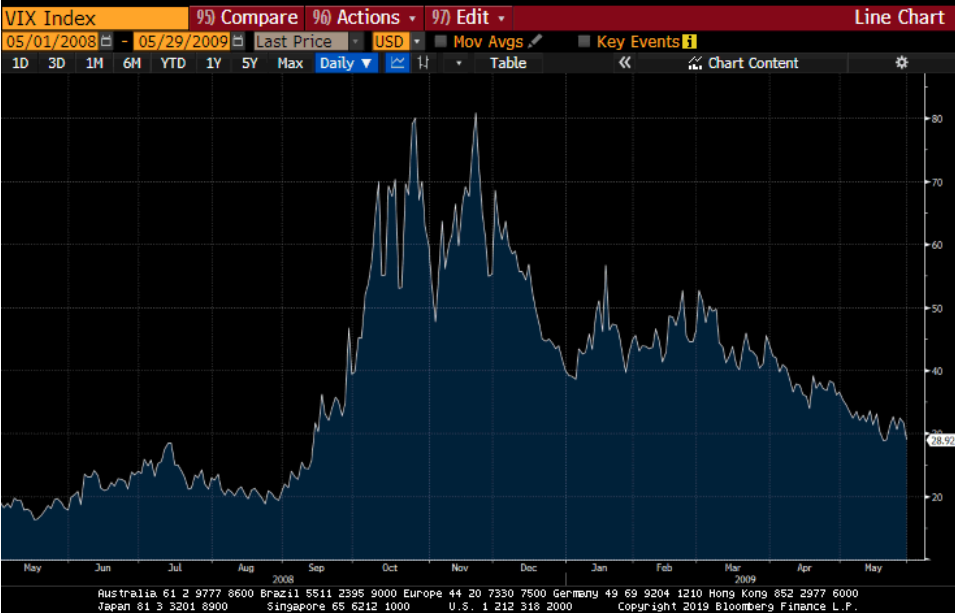

The VIX can change rapidly. In September 2008, the VIX was buying and selling at slightly below 19—that means individuals, through choices, thought issues would stay comparatively calm. However solely a few months later, the VIX was buying and selling at over 80 because the monetary disaster worsened. So, the VIX was an excellent indicator that bother was on the way in which, nevertheless it was not so good at predicting the market’s efficiency. The VIX did spike in November 2008, however the market did not hit backside till March, practically 4 months later.

As with something in monetary markets, the VIX is affected by individuals’s biases and may overshoot and undershoot. Though the 2008 spike did certainly predict a disaster, that has not all the time been the case. The subsequent comparable spike, on February 5, 2018, noticed the VIX index climb greater than 100%, primarily based not on precise financial and market dangers however on technical components throughout the markets themselves. So, whereas the VIX measure skilled a file one-day rise, it was not an excellent predictor of future bother.

If Not the VIX, Then What?

Given the downsides of the VIX, it’s useful to look past the attention-seeking headlines and determine broader measures of market and financial stress. The most effective of those comes from the Fed of Kansas Metropolis. It publishes an index that provides a broader view of stress throughout the fairness and stuck earnings markets and offers insights into the general financial system.

The Kansas Metropolis Monetary Stress Index

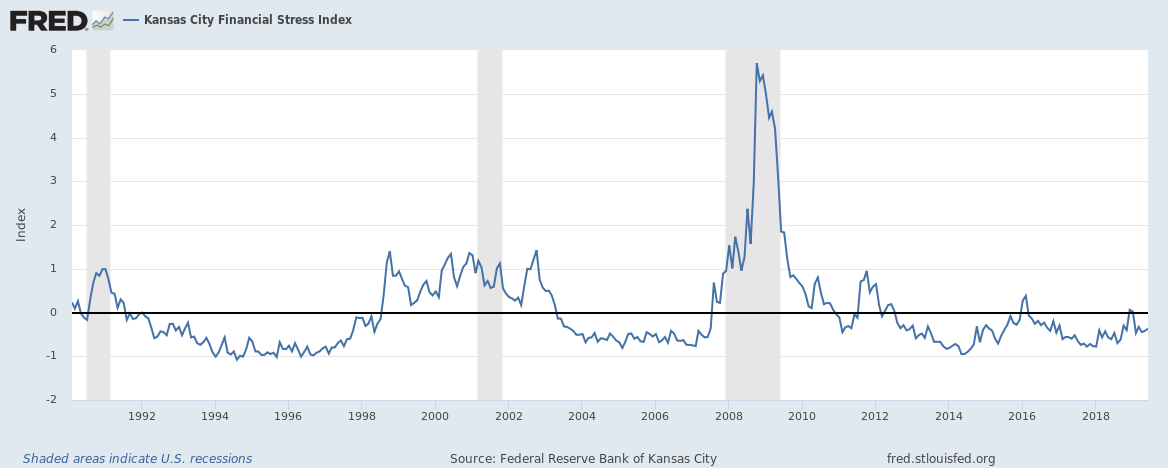

The Kansas Metropolis Monetary Stress Index makes use of 11 various factors to determine if present monetary stress is above or under long-term averages. This end result may give buyers perception into how the market and the financial system are directionally doing. Forward of the monetary disaster, the stress index began shifting greater in 2007 and moved above zero in August 2007, as cracks beneath the floor began to seem for the market and the financial system. Extra lately, in 2015, the index moved incrementally greater with uncertainty showing throughout the mounted earnings markets, particularly the high-yield market. In each circumstances, the incremental will increase within the index make clear cracks percolating outdoors of the headlines. Each instances, this index was a well timed and proper indicator.

Mainly, the Kansas Metropolis index appears at a variety of financial and monetary components, relatively than simply slender buying and selling motion. Stepping into the small print of the precise components (as mentioned under) generally is a bit daunting. However the components could be narrowed down to 2 groupings—yield ratios and asset habits—that describe what buyers and markets are pondering.

Yield ratios. These ratios give a sign of how a lot additional buyers need to be paid for taking over larger threat and fewer liquidity. In unhealthy instances, buyers look to put money into higher-quality, extra liquid securities as a result of they’re unsure concerning the future. Thus, the Kansas Metropolis index compares quite a lot of bond markets relative to higher-quality equivalents. It makes use of ratios (dividing the yield of two securities) versus spreads (subtracting the yield from two securities), which permits for much less distortion in low-rate environments. Additionally, utilizing financing ratios of companies and customers provides insights into the broader financial system.

Asset habits. These indicators could be cut up into broad market and banking-related indicators. Banks are economically delicate. In periods of stress, buyers shun these banks which are deemed decrease high quality and like banks which are good high quality. This desire creates a variety of efficiency among the many financial institution shares when instances are unhealthy and a slender vary when buyers are keen to tackle extra threat, which influences the stress index. The Kansas Metropolis index additionally makes use of two volatility measures, one among which is the VIX. The opposite focuses on the volatility of banks to assist present if issues are getting extra unstable or much less.

What In regards to the St. Louis Monetary Stress Index?

The St. Louis Monetary Stress Index is one other extensively cited stress index. Certainly, at its core, it has many similarities to the Kansas Metropolis index. However the St. Louis index places a larger weight on absolute yield ranges which were trending decrease for a interval. Additionally, relatively than going “beneath the hood with financial institution shares,” the St. Louis index merely appears on the value stage of financial institution shares. Right here at Commonwealth, we take a look at all these components. However for my cash, the Kansas Metropolis index is the higher measure.

Look Beneath the Headlines

Though the VIX is the media’s most well-liked indicator of stress throughout the market, the Kansas Metropolis Monetary Stress Index does a greater job of measuring broad stress throughout the market. Extra essential, its directional motion can present stress is ebbing or flowing beneath the floor of the financial system. The impact of the motion can be utilized as an indicator for buyers about whether or not they need to be cautious of underlying market and financial components relatively than being blinded by flashy headlines from the media. In fact, it is very important watch the headlines. However paying extra consideration to the small print beneath is critical to correctly handle your investments.

Editor’s Word: The authentic model of this text appeared on the Impartial Market Observer.