.bh__table_cell { padding: 5px; background-color: #dddddd; }

.bh__table_cell p { colour: #222222; font-family: ‘Helvetica’,Arial,sans-serif !necessary; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#dddddd; }

.bh__table_header p { colour: #222222; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !necessary; overflow-wrap: break-word; }

Introduced by

The commercial actual property market within the US is experiencing a interval of exceptional progress. Clarion Companions’ newest analysis report examines the sturdy efficiency of the sector, which is pushed by e-commerce corporations, strategic stock stockpiling and the event of specialised subtypes comparable to industrial out of doors storage (IOS). Uncover prime insights on why US industrial actual property continues to outperform.

At the moment's Animal Spirits is dropped at you by Innovator ETFs and the CME Group:

See right here for extra info on Innovator ETFs suite of risk-managed ETFs and right here for extra info on CME Group's precious academic supplies and buying and selling instruments

The Compound Podcasts:

On right this moment’s present, we focus on:

-

Yardeni Says Fed Lower Raises Odds of 'Outright Soften-Up' in Shares

-

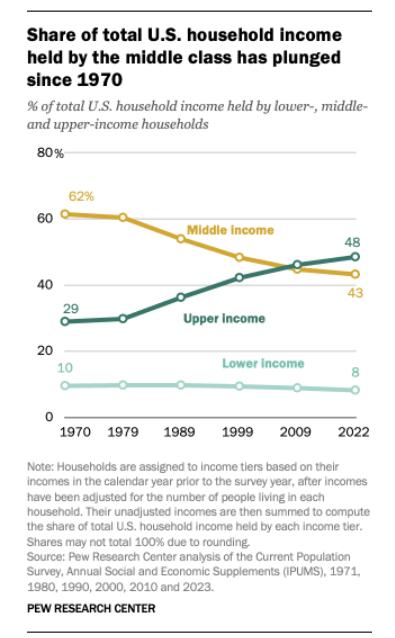

Are you within the American center class? Discover out with our revenue calculator

-

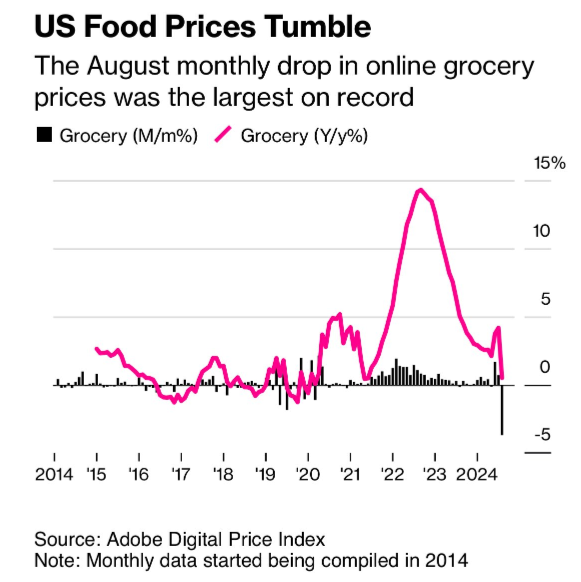

US On-line Grocery Costs Plunge the Most on Report in August

-

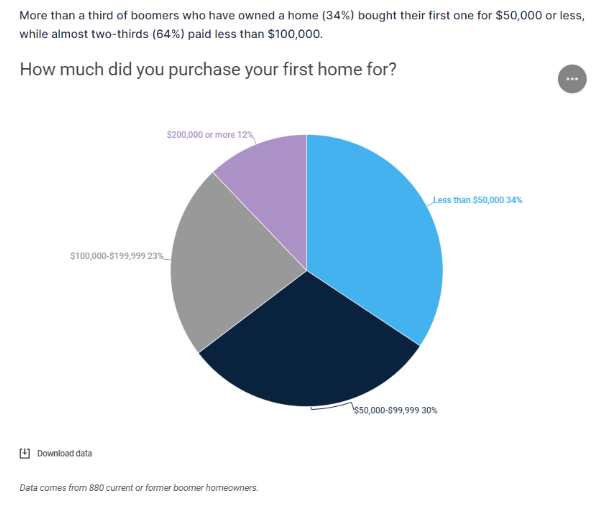

Child Boomer Housing Market 2024: Extra Than Half of Older House owners By no means Plan to Promote

-

Reversing the Actual-Property Doom Loop Is Doable. Simply Have a look at Detroit.

-

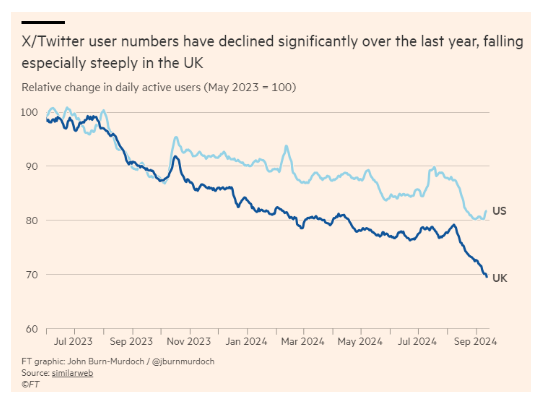

With Bluesky, the social media echo chamber is again in vogue

Charts:

Tweets:

At the moment is about to be the most important hole larger for the S&P 500 ETF $SPY (+1.6%) after a scheduled Fed Day since 10/30/08 (+2.9%) after Bernanke reduce by 50 bps within the midst of the Monetary Disaster.

— Bespoke (@bespokeinvest)

12:45 PM • Sep 19, 2024

Youngsters born on this date are actually sufficiently old to drive.

@MikeZaccardi $LEH $MER $AIG

— Carl Quintanilla (@carlquintanilla)

12:59 PM • Sep 15, 2024

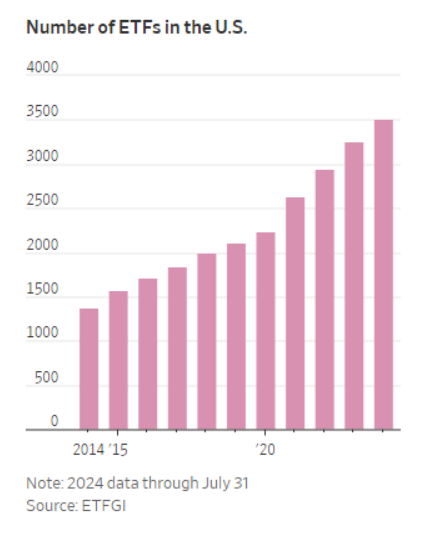

IMHO traders would quite entry illiquid belongings like non-public eq/credit score in ETFs and take care of reductions and premiums (even steep ones) than in an interval/closed finish/mutual fund.. one eg $HYD which traded at 29% low cost in 2020, since then it is remained highly regarded, even… x.com/i/internet/standing/1…

— Eric Balchunas (@EricBalchunas)

1:55 PM • Sep 18, 2024

1/ Some issues are completely different, some issues are completely different.

The job marketplace for folks of their early 20s is behaving like a reasonably commonplace recessionary cycle (albeit early in that cycle).

Employment is falling. Unemployment is rising.

— Man Berger (@EconBerger)

3:05 PM • Sep 12, 2024

Gen Z simply overtook Child Boomers

U.S. full-time workforce, by era

Millennials: 49.5m

Gen X: 42.8mChild boomers: 17.3m

Gen Z: 17.1m— Lance Lambert (@NewsLambert)

12:46 AM • Sep 23, 2024

Powell says decrease charges will deliver sellers and consumers again to the housing market.

In actual fact, extra locked-in owners and renters are itching to maneuver quickly.

If we get 100+ bps of cuts by subsequent March, spring 2025 may see a giant spike in each listings and gross sales.

— Eric Finnigan (@EricFinnigan)

7:35 PM • Sep 18, 2024

from JPM: “Median balances in June 2024 had been 15% larger than that they had been in June 2019 for low-income households, and 5% larger for high-income households

{{Word that is % change (relative to 2019) in median month-to-month ***actual*** money balances, by revenue quartile}}

— talmon joseph smith (@talmonsmith)

8:49 PM • Sep 19, 2024

BREAKING: X is about to take away the present block button, that means that if an account is public, their posts can be seen to the blocked customers as nicely!

— Nima Owji (@nima_owji)

6:03 PM • Sep 23, 2024

Suggestions:

Contact us at [email protected] with any suggestions, suggestions, or questions.

Comply with us on Fb, Instagram, and YouTube.

Try our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Previous efficiency is not any assure of future outcomes. There might be no assurance that any Schafer Cullen technique or funding will obtain its targets or keep away from substantial losses.

Nothing on this weblog constitutes funding recommendation, efficiency knowledge or any advice that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a selected safety and associated efficiency knowledge shouldn’t be a advice to purchase or promote that safety. Any opinions expressed herein don’t represent or suggest endorsement, sponsorship, or advice by Ritholtz Wealth Administration or its workers.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the chance of loss. Nothing on this web site needs to be construed as, and is probably not utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.