Politicians don’t management the inventory market.

When shares go up presidents get an excessive amount of credit score and once they go down they get an excessive amount of blame. It’s principally circumstantial relying on the timing of cycles and such.

However the markets transfer quicker than ever nowadays. Buyers are continuously pricing sooner or later, generally proper, generally unsuitable, but by no means doubtful.

The inventory market was already up large heading into the election however issues took off within the days following the result.1

Many traders are positioning for a increase beneath a Trump presidency. The largest pushback I’ve seen is that valuations have been stretched after the large run-up for the reason that 2022 bear market.

We’ve been in a bull marketplace for a while now. The inventory market must be costly! Let’s take a look at the numbers to see the place issues stand.

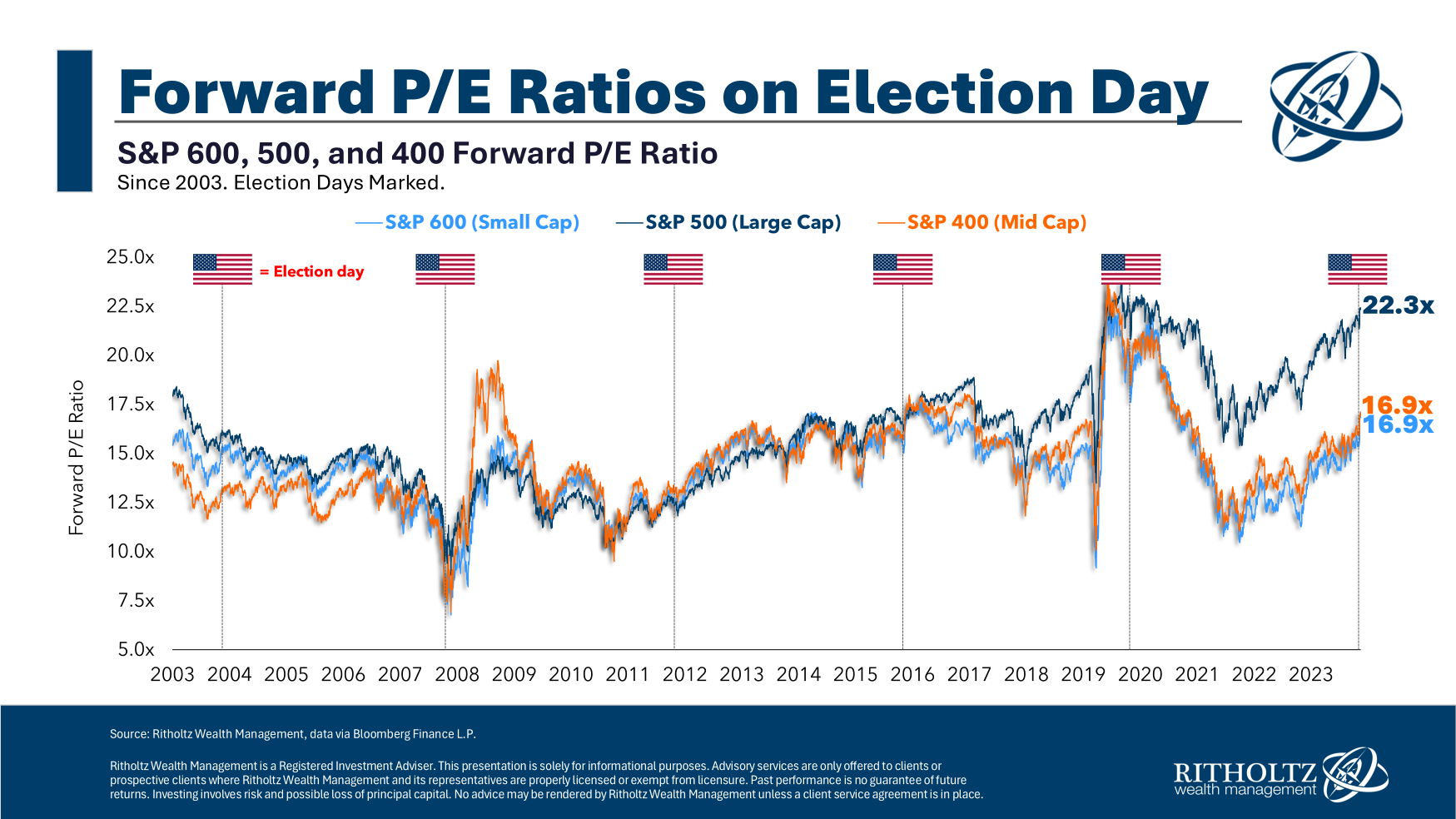

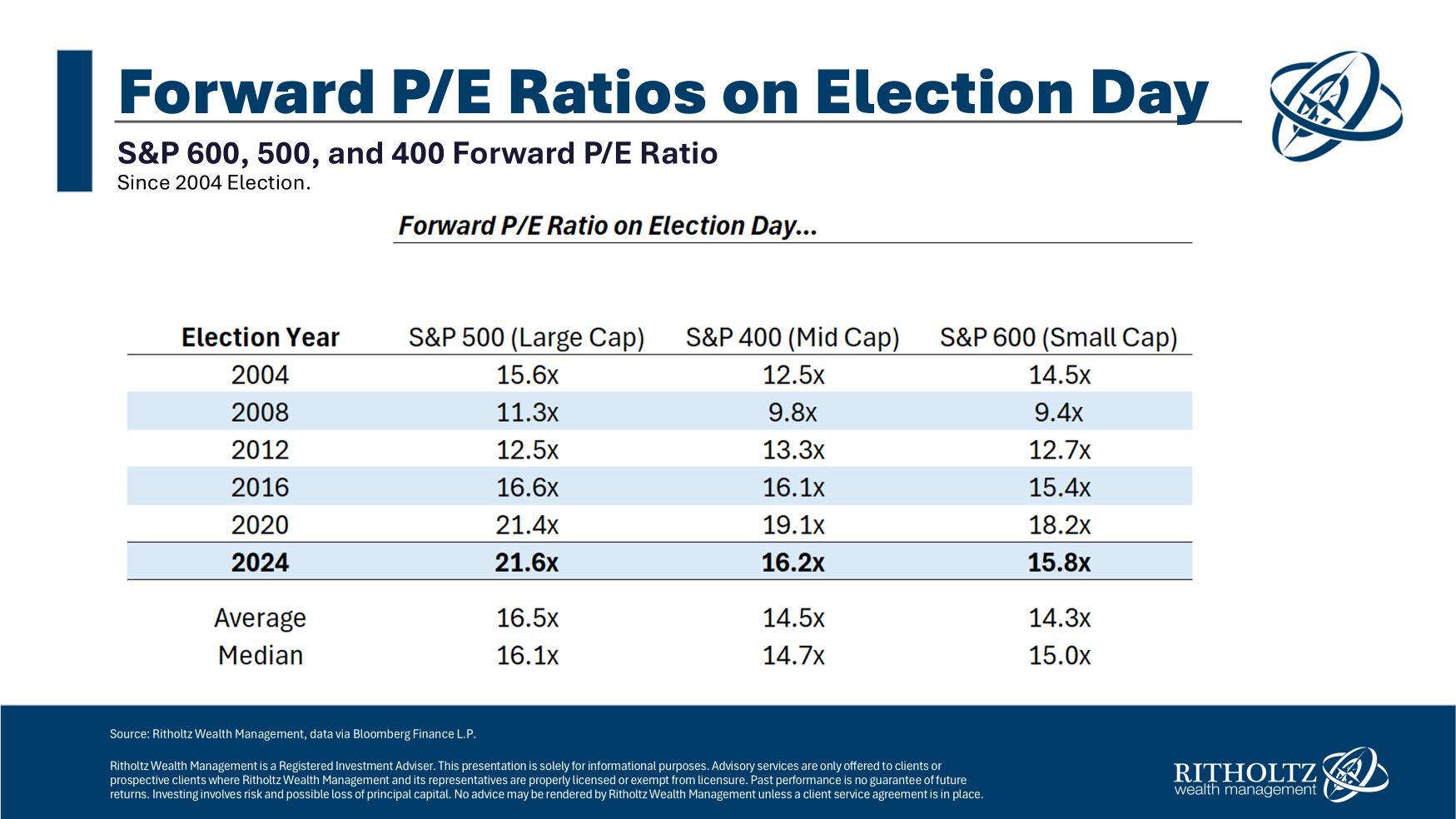

Our crack analysis staff appeared again at ahead price-to-earnings ratios on election day for every of the previous six presidential elections:

Listed here are the precise values:

Shares had been clearly less expensive in 2004, 2008 and 2012 as a result of the market was in or popping out of a crash in every of these cases.

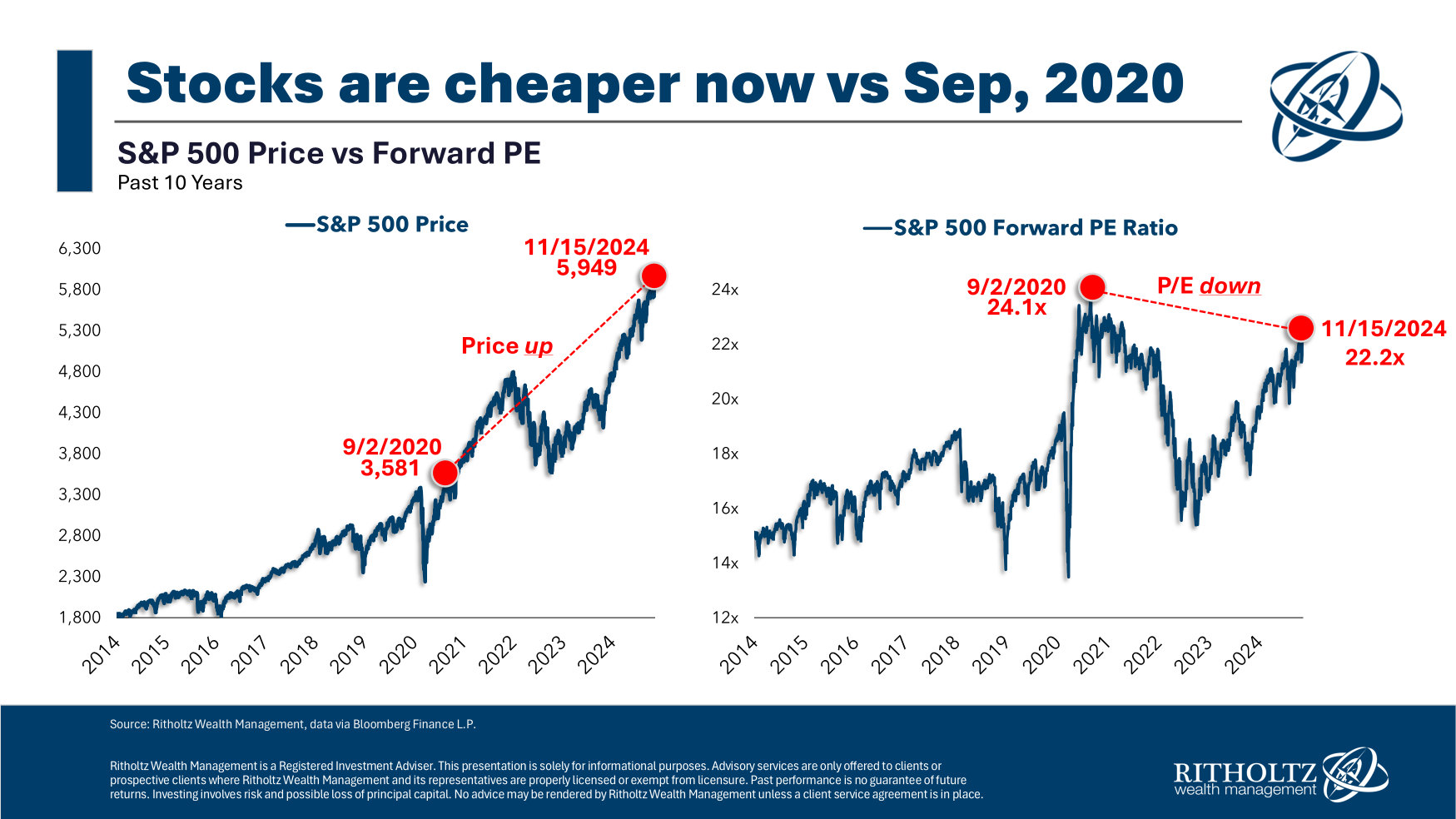

Now take a look at the 2020 and 2024 valuations. The S&P 500 is up almost 90% since election day 2020 but valuations are basically equivalent.

How can that be?

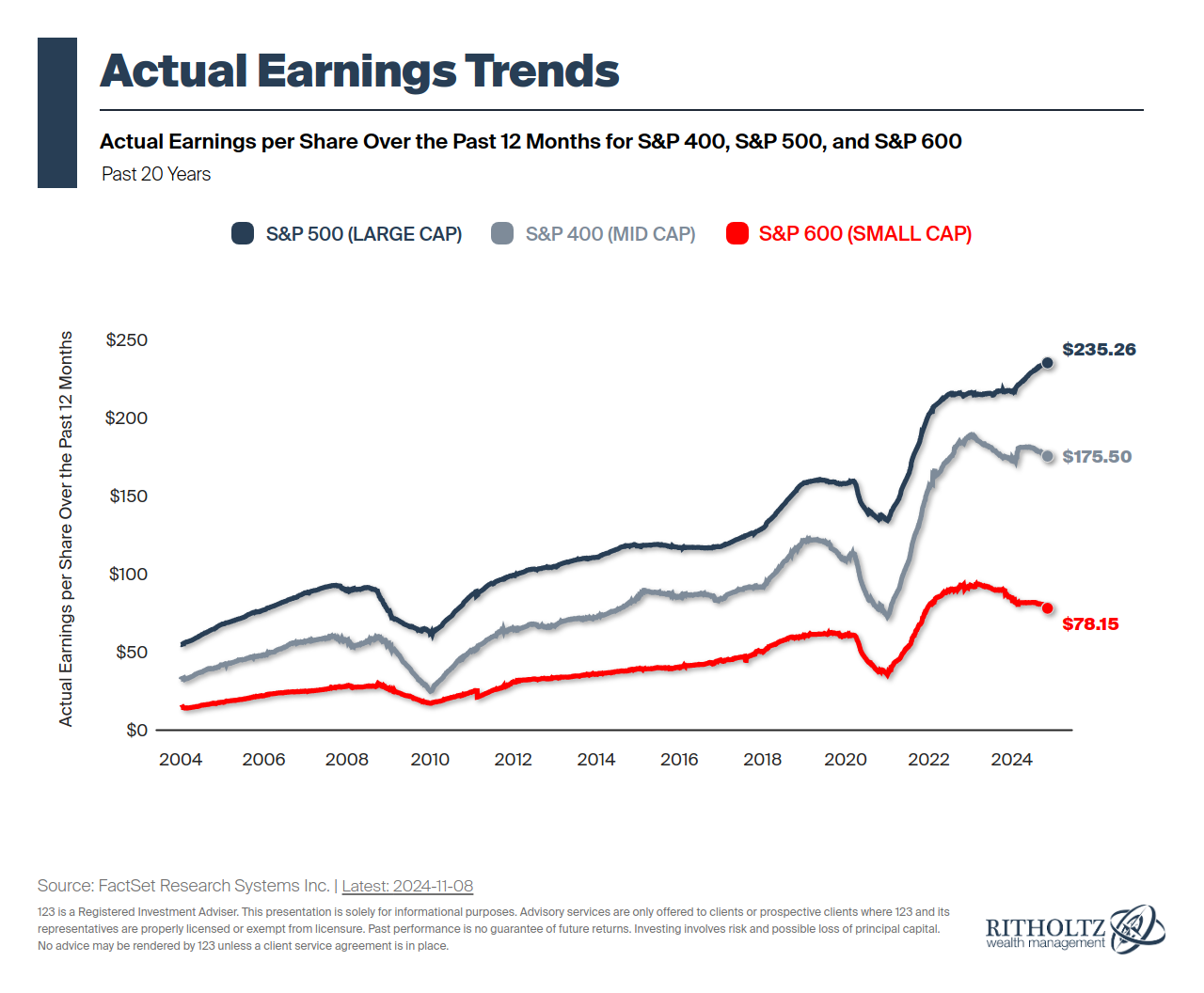

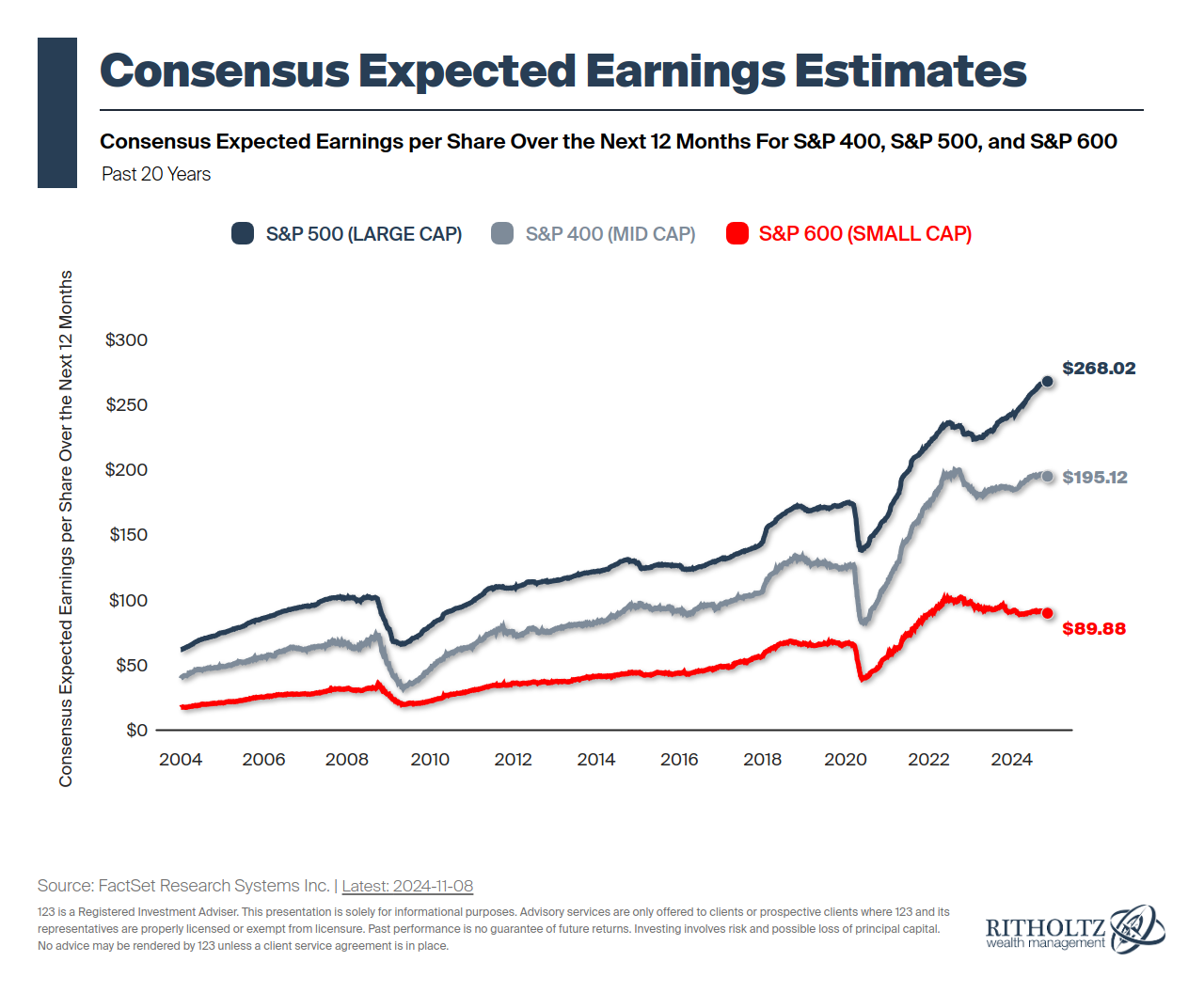

Check out earnings:

Inventory costs are up loads however fundamentals2 have saved tempo. In actual fact, the inventory market has really gotten inexpensive over the previous couple of years due to earnings development:

Earnings are anticipated to continue to grow too:

In fact, analysts can’t predict the long run. They might be unsuitable but it surely’s not as unhealthy as some individuals would have you ever imagine.

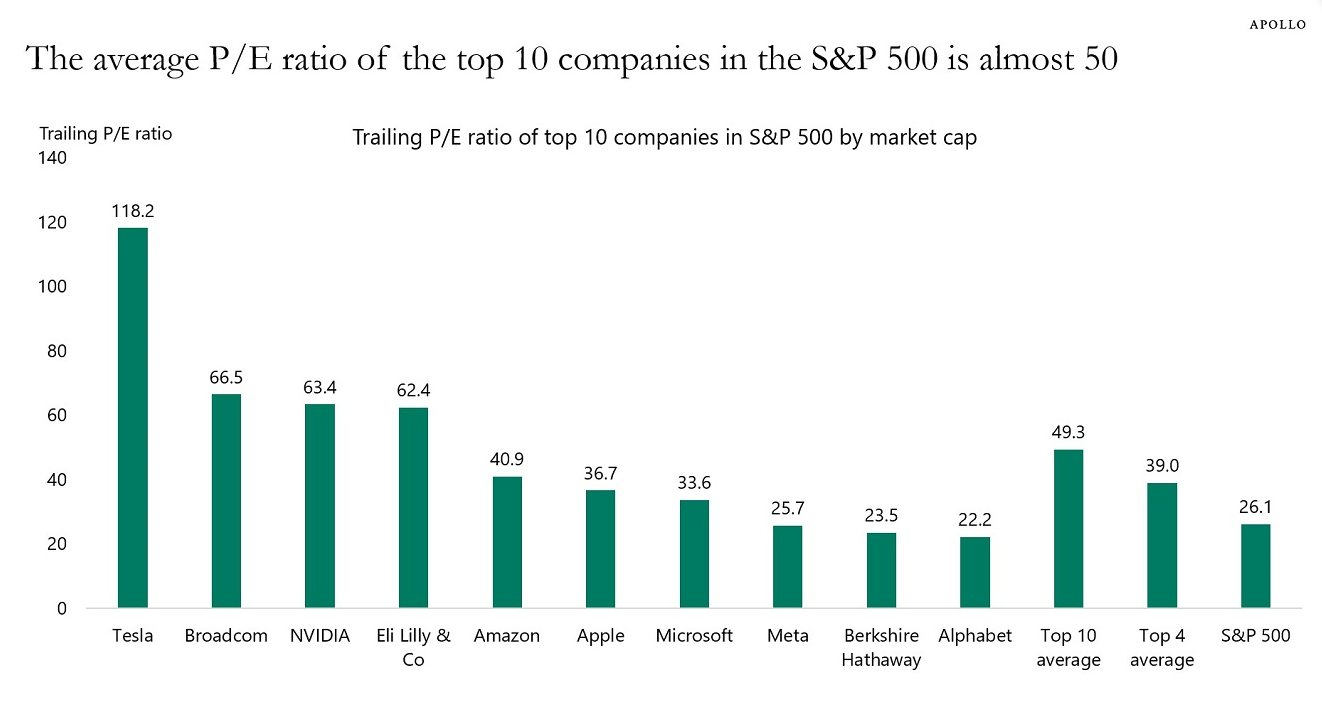

It’s additionally necessary to level out that a lot of the valuation premium on the S&P 500 comes from the biggest shares (by way of Torsten Slok):

These shares have excessive valuations for good cause — they’re among the best-run firms on this planet.

After I converse to traders nowadays there are two extremes in the case of enthusiastic about giant cap U.S. shares:

- The S&P 500 is overvalued. I’m nervous.

- The S&P 500 is the one recreation on the town. Why would I put money into anything?

The excellent news for valuation-conscious traders is there may be loads of worth outdoors of the mega-cap shares. Valuations for small and mid cap shares are nonetheless fairly low cost. They’re far inexpensive now than they had been earlier than the pandemic. Perhaps there’s a cause for that however shares don’t get low cost for no cause.

Valuations haven’t mattered that a lot throughout this prolonged bull market as a result of the most important, fastest-growing firms have been so dominant. It’s potential that might proceed. So long as earnings proceed to develop it appears silly to wager towards the perfect firms on this planet.

Nonetheless, there are cheaper areas of the market when you’re involved about valuations.

Diversification goes to show its price once more sooner or later. I simply don’t know when.

Michael and I talked about inventory market valuations and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Timing the Inventory Market Utilizing Valuations

Now right here’s what I’ve been studying recently:

Books:

1Many traders assume the rationale shares took off as a result of the election end result got here so shortly. I can see that.

2A few of the numbers in these charts are trailing 12 month PE ratios and a few are ahead PE ratios. That’s why the numbers don’t at all times match up completely. Shut sufficient is sweet sufficient for valuations.

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.