For those who recall, Chase took over troubled First Republic Financial institution again in Could 2023.

Previous to First Republic going beneath, they have been the main jumbo dwelling mortgage lender within the United States.

They catered to very rich owners and businesspeople. And it was mockingly their ultra-low price mortgages that finally took them down.

At this time, Chase is the highest jumbo mortgage lender within the nation, with manufacturing of greater than $8 billion within the first half of 2024, per Inside Mortgage Finance.

Like First Republic, they too are wooing high-net price people with particular mortgage price reductions.

As much as 1% Off Mortgage Charges If You Carry Cash to the Financial institution

In 2023, Chase was the third largest mortgage originator within the nation, per HMDA information. And the biggest depository issuer of dwelling loans.

They have been solely overwhelmed out by two nonbanks, United Wholesale Mortgage and Rocket Mortgage.

Their acquisition of troubled First Republic has solely made them greater, and put an excellent stronger emphasis on jumbo mortgage lending on the financial institution.

In essence, they’re carrying on a number of the similar rules, although possible with added guardrails to keep away from the identical destiny.

A kind of practices is providing mortgage price reductions to their wealthiest prospects, specifically these prepared to park numerous cash on the financial institution.

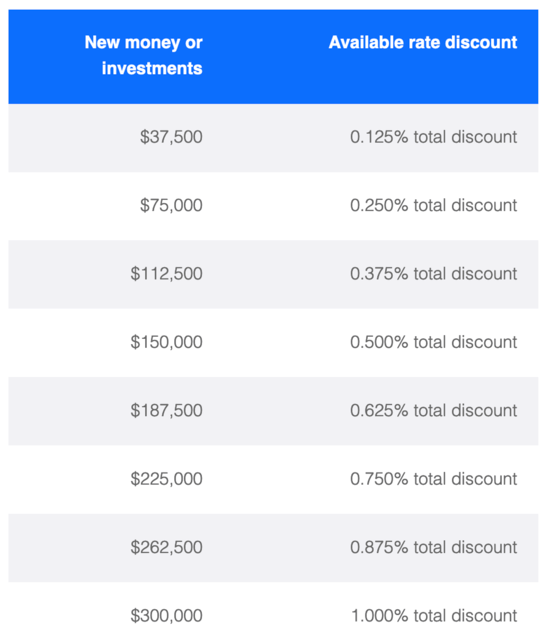

The NYC-based financial institution’s so-called “Relationship Pricing Program” provides mortgage price reductions starting from 0.125% and 1% based mostly on new and present balances on the financial institution.

These apply whether or not you’re shopping for a house or refinancing an present mortgage.

As seen within the chart, those that can muster $37,500 in new cash or investments can obtain a 0.125% price low cost.

Whereas that’s nothing huge, prospects who’re in a position to usher in $300,000 in new cash or investments can get a full 1.00% low cost on their rate of interest.

For instance, if the supplied mortgage price have been 6.5%, they might offer you a price of 5.5%. And that could possibly be laborious to beat by outdoors lenders.

On a big mortgage quantity, we’re speaking about some vital financial savings.

Utilizing a $1,500,000 mortgage quantity, the distinction can be roughly $965 monthly. Or $11,580 yearly.

In addition they provide a price low cost of as much as 0.25% for present balances on the financial institution (0.125% for $500k-$999k, 0.25% for $1M+).

How the Relationship Pricing Program Works

To obtain the rate of interest low cost, new cash should be deposited within the buyer’s Chase account a minimum of 10 calendar days previous to the scheduled mortgage deadline.

Notice that sure accounts don’t qualify, together with enterprise, deferred compensation, scholar, custodial, 529b faculty financial savings, donor-advised funds, choose retirement accounts, and non-vested RSUs.

So be certain the brand new funds will truly depend towards the low cost.

Clients shall be underwritten through the precise be aware price earlier than the low cost, per Inside Mortgage Finance.

In different phrases, it doesn’t seem you can qualify on the decrease price, assuming you wanted to.

And be aware that funds that settle in a buyer’s deposit and/or funding accounts 14 calendar days or extra previous to the completion of a mortgage utility aren’t eligible for the brand new cash low cost.

It’s additionally attainable to obtain a post-close price low cost if funds are obtained and settled inside 30 days of mortgage closing.

However it could be decrease than reductions out there previous to closing, and the shopper should signal a price change modification.

These prospects can even not obtain a refund of any curiosity already paid previous to the speed change taking impact.

And whereas new and present stability reductions will be mixed, the full price low cost can’t exceed 1%.

Lastly, for adjustable-rate mortgages, the speed low cost will apply in the course of the preliminary price interval solely.

For instance, the primary 5 years on a 5/6 ARM, or first seven years on a 7/6 ARM.

Good Deal or Not?

As with every of these kind of offers, it’s essential to evaluate what you can obtain elsewhere.

I at all times have a look at the all-in price of the mortgage. That features each closing prices and the rate of interest obtained.

A reduction means nothing if one other financial institution or lender can provide a decrease mortgage price with fewer closing prices.

For instance, 1% off a price of seven% is 6%. If one other lender can provide me 5.875%, who cares if it’s 1% off?

And the way a lot do I have to pay to get that rate of interest? Factors, origination charges, and many others.?

So take the time to check provides, and in addition contemplate how a lot your cash is anticipated to earn whereas parked in a Chase account.

There’s alternative price to contemplate right here as effectively, which might cloud the comparability when anticipated returns aren’t assured.

But when Chase is blowing the competitors out of the water, then it could be a no brainer and additional cause to make use of them versus one other mortgage firm.