Id theft is fraud. It’s when somebody illegally finds and makes use of your private info to entry your cash. The criminals could attempt to hack into your checking account, apply for credit score in your identify (comparable to a house mortgage or retailer card) or use your bank card to purchase issues on-line.

Which playing cards include id theft and fraud safety?

Most bank cards include fraud safety, however the particulars and processes will differ between lenders. Look in your bank card’s web site to see particulars of its fraud safety assure.

That will help you out, listed here are a number of of the highest id theft protections.

There are T&Cs to fraud safety, so verify the cardboard’s PDS for particular particulars.

| Model | Fraud safety | Fraud money-back assure | On-line safety | Immediate card lock |

|---|---|---|---|---|

| American Categorical | Fraud Management: a complicated bot that detects fraudulent transactions and notifies you by textual content or electronic mail instantly. You’ll be able to reply Y to verify the transaction, or name Amex to report the exercise as fraudulent. | Amex will refund any misplaced cash from fraudulent transactions so long as you didn’t contribute to or delay reporting the fraudulent transactions, and also you’ve complied with the Card Situations comparable to taking affordable care to maintain your card and account particulars protected. | American Categorical Safekey: confirms your id by asking for extra info when purchasing with sure retailers on-line, comparable to asking for a dynamic One-time Code despatched through electronic mail or textual content. | ✔ Log in via the American Categorical on-line account portal. |

| ANZ | ANZ Falcon: 24/7 anti-fraud safety that identifies suspect transactions. ANZ will contact you to verify the transaction and will freeze your card briefly. | So long as you promptly notify ANZ of the fraudulent exercise and didn’t contribute to any funds misplaced, ANZ will credit score your account with the quantity stolen. | Visa Safe: free companies that provide you with additional safety whilst you’re purchasing on-line at taking part retailers. | ✔ By way of the ANZ App below Card > Handle > Handle Card > Briefly Block Card |

| NAB | NAB Defence: The place you see the NAB Defence brand, you’ll be protected in opposition to fraud (utilizing your bodily card or digital pockets), so long as you’re upholding your duties as a cardholder. | NAB says you’ll be reimbursed the quantity taken out of your account if, in opposition to all its greatest defences, you’re a sufferer of fraud. | SMS Safety: Offers distinctive authentication codes if you’re utilizing on-line banking or the NAB app. It protects your accounts even when your NAB ID and password fall into the improper fingers. | ✔ By way of the NAB app below My Playing cards > Block card |

| Westpac | Westpac’s Fraud Detection Workforce will subject an SMS if any uncommon exercise is detected. | So long as you haven’t disclosed safety info together with your PIN and have met card situations round safety. | Digital Card Safety: the 3-digit safety quantity in your digital pockets (and on-line funds) refreshes each 24 hours to maintain your particulars safer. | ✔ By way of the net banking portal or Westpac app below Playing cards > Lock card briefly |

| Citi | Fraud Early Warning: Citi screens your spending to identify uncommon or high-risk transactions. You’ll be issued a Two-Approach Alert SMS to verify the transaction. | So long as you haven’t disclosed safety info together with your PIN and have met card situations round safety. | Use biometrics comparable to facial recognition and fingerprint know-how to maintain your on-line info safe. | ✔ By way of the Citi Cellular App below Card Settings > Lock card |

How does id theft have an effect on you?

In addition to providing you with a punched-in-the-gut feeling, id theft can have real-world ramifications. If fraudsters apply for loans in your identify, together with house loans, private loans, cell phone plans or bank cards, after which default on these loans (which they are going to), the black marks can be recorded in your credit score report.

Defaulted funds are stored on file for 2 to 5 years, and each lender who checks your credit score profile will see them. That may have an effect on approval in your personal mortgage down the monitor.

Id theft additionally means you’ll have to do a full audit of all of your accounts, change passwords and use higher password safety, comparable to two-step authentication.

How one can shield in opposition to bank card fraud?

Fraudsters can use info out of your driver’s licence, delivery certificates, or passport to entry cash or credit score, or they will pay money for your debit or bank card particulars.

As handy as on-line spending and tap-and-go funds are, it’s additionally opened up a world of alternative to fraudsters. Now, thieves can purchase something below $100 with a easy faucet or swipe, with no PIN or card verification obligatory.

For instance, lately I helped somebody who had their bank card stolen and watched in real-time because the thief made six transactions (all below $100, typically two transactions in a single retailer) at pet shops, supermarkets and petrol stations. Clearly, the legal life is tough work as a result of the bandit additionally indulged in $65 price of pizza.

Fortunately, the sufferer was in a position to contact his financial institution, which put a freeze on his card (some apps help you do that immediately, such because the Citi Cellular App). His cash was reimbursed below the fraud safety assure on his bank card, and the legal was ultimately tracked down due to retailer safety cameras.

The pizza was by no means recovered.

You’ll be able to cut back your probabilities of having your id stolen by following some fundamental safety guidelines:

- Shred any letters or paperwork together with your identify and private data on them earlier than throwing them away

- Put a lock in your mailbox

- Keep watch over your financial institution and bank card accounts for purchases you didn’t make.

- Keep away from public WiFi in the event you’re checking your financial institution accounts or shopping for one thing on-line.

- Use extremely rated safety software program in your pc, significantly one with additional safety features for on-line banking and adware safety.

- Replace banking passwords to a stronger, longer password with a mixture of letters, numbers, capitals and particular characters.

- By no means share private info on social media or through electronic mail, textual content or messenger.

- Be careful for messages on WhatsApp, Fb Messenger and Instagram pretending to be a member of the family or asking for cash.

- Select credit score and debit playing cards with a microchip (a Chip Card) if potential, as they’re much more safe than magnetic stripe playing cards.

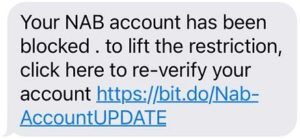

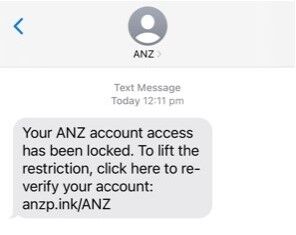

- Don’t click on hyperlinks on SMS or emails asking so that you can login or share any private info (known as phishing).

Searching for phishing scams

All of us learnt a lesson from the Optus information breach in September 2022 about being cautious with our private information. However fraudsters took it a step additional, utilizing textual content messages to phish weak folks caught up within the breach and pretending to be from Optus or their financial institution.

E-mail phishing or SMS scamming (known as SMishing) is a well-liked means for criminals to entry your information by pretending to be a reputable message, getting you to click on a hyperlink and enter your particulars. Listed here are some examples:

Phishing is getting much more sneaky as a result of fraudsters can mimic the financial institution’s cellphone quantity and identify, so their message reveals up in the identical dialog as reputable messages out of your financial institution.

It’s essential to know that banks won’t ever:

- Ask you to click on a hyperlink in an electronic mail, textual content message or Whatsapp so you possibly can affirm or replace private info or transactions.

- Ask you to switch cash to a different account.

Most banks have a web page on their web site with the most recent safety alerts and scams, so you possibly can verify any messages you obtain with the financial institution’s identify on it first.

If in any doubt, don’t click on. Name your financial institution first. Should you’re undecided a few cellphone name purporting to be out of your financial institution, cling up and name the financial institution to verify. They gained’t be offended.

Utilizing fraud safety in your bank card

Fraud safety is a part of the phrases of your bank card (bear in mind, it’s within the financial institution’s greatest curiosity to maintain fraud to a minimal, too!). You’ll have the choice to register for additional safety features comparable to NAB’s SMS Safety.

Should you suppose your account has been used fraudulently, contact your card issuer instantly. Most occasions, you possibly can put an immediate lock in your card to cease any additional transactions via your card’s app or on-line portal.

From there, the method can differ between bank card firms however sometimes includes an investigation into the fraudulent exercise, after which a reimbursement if it’s agreed you’re not liable.

⭐A word about microchips: many bank card firms are updating to CHIP know-how, which shops your information on a microchip embedded within the card moderately than on the magnetic stripe. If chip playing cards can be found together with your bank card supplier, you’ll be issued one when your card is up for renewal.

What to do in the event you’ve been scammed or had your id stolen

- Contact your bank card issuer (this consists of the lack of your card, too)

- Work together with your card issuer and the police to open a case for fraudulent exercise in opposition to your identify.

- Get a credit score verify performed to see if any harm was brought on to your credit score rating. Contact any establishments which have recorded a default from a missed cost that was associated to the fraud.