EPL Ltd – Main the pack sustainably

Integrated in 1992 and headquartered in Mumbai, EPL Ltd. (previously Essel Propack) is a worldwide chief in specialty packaging, serving classes like oral care, magnificence, pharma, meals, and residential care. With an annual manufacturing of 8+ billion tubes, EPL manufactures 1 in 3 oral care tubes globally. The corporate operates 21 superior amenities throughout 11 nations, together with Europe, the Americas, AMESA, and EAP areas. EPL’s main shoppers embody Colgate, P&G, Unilever, L’Oréal, Cipla, Johnson & Johnson, and so on.

Merchandise and Providers

The corporate’s product portfolio contains laminates, laminated tubes, extruded tubes, caps and closures and allotting techniques/applicators.

Subsidiaries: As of FY24, the corporate has 17 subsidiaries and 1 affiliate firm.

Development Methods

- Innovation focus: Developed tubes with as much as 50% PCR content material; sustainable tube volumes doubled to 21% in FY24; 43% of packaging is recyclable, with 85% capability prepared for sustainable tubes; 24 new patents granted in FY24.

- NeoSeam know-how: Gaining traction as a recyclable, sustainable different to conventional tubes.

- Brazil enlargement: New greenfield plant operational, serving anchor prospects and successful orders from multinationals and native shoppers, boosting presence within the Americas and export alternatives.

- European restructuring: Ongoing efforts to optimize prices and enhance margins, with advantages anticipated from the present fiscal yr.

- Key challenge wins: Important orders for 100% recyclable Platina tubes from manufacturers like Colgate, Pleasure, and Sensodyne.

- Consumer progress: Expanded enterprise with main shoppers and attracted new magnificence and cosmetics prospects, particularly in EAP and the Americas.

Monetary Efficiency

Q1FY25

- Income: Rs.1,007 crore, up 11% from Q1FY24’s Rs.910 crore.

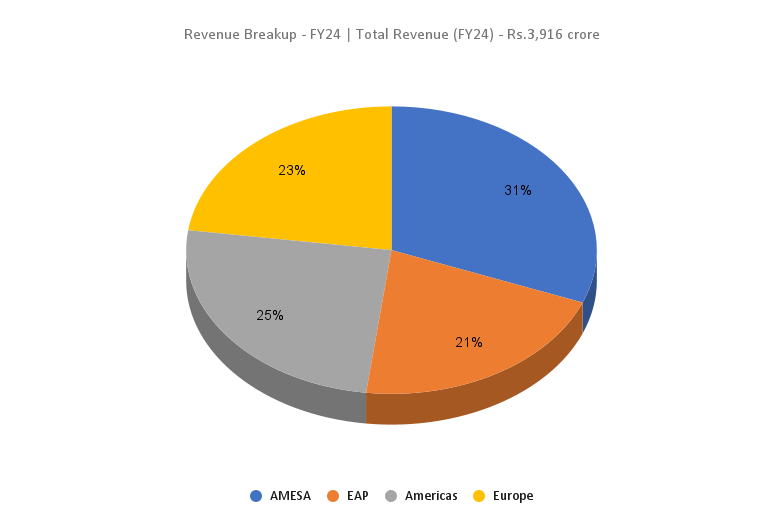

- Regional progress: AMESA +9.5%, EAP +14%, Europe +9%, Americas +19%.

- EBITDA: Rs.192 crore, 21% progress from Rs.159 crore in Q1FY24.

- EBITDA margin: Expanded to 19%, up 160 bps YoY.

- Internet revenue: Adjusted web revenue rose 35%, from Rs.47 crore to Rs.64 crore.

FY24

- Income: Rs.3,916 crore, up 6% YoY.

- Working revenue: Rs.715 crore, 24% progress YoY.

- Internet revenue: Rs.210 crore, a 9% decline YoY.

Monetary Efficiency (FY21-24)

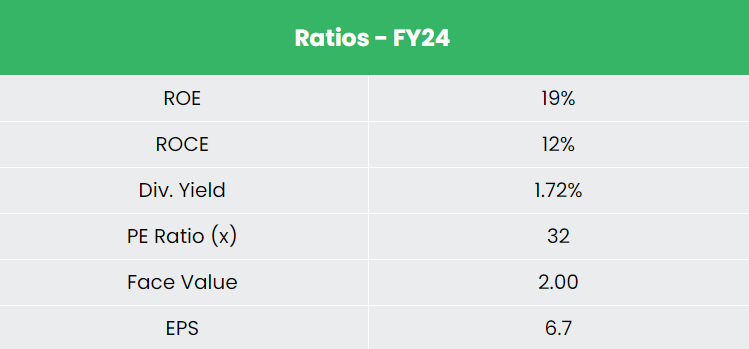

- 3-year common ROE: 12% (FY21-24)

- 3-year common ROCE: 14% (FY21-24)

- Capital construction: Wholesome with a debt-to-equity ratio of 0.44

Business outlook

- Business dimension: Packaging is the fifth largest sector within the Indian financial system.

- Development fee: Annual progress of 22-25%.

- Tech-driven: Developments in know-how and infrastructure gasoline progress.

- Sustainability shift: Business shifting in the direction of eco-friendly practices and supplies.

- Authorities help: Initiatives to scale back plastic packaging and promote sustainable manufacturing are driving change.

Development Drivers

- 100% FDI permitted by way of automated route within the packaging sector.

- Enlargement of the center class and rising disposable earnings ranges, rising client consciousness and the rise of e-commerce platforms.

- Regulatory traits favouring recyclable and eco-friendly supplies.

Aggressive Benefit

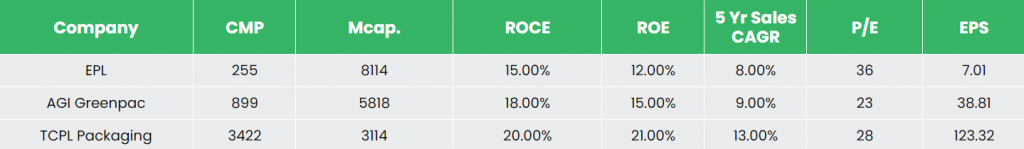

EPL is the main participant in laminates and laminated packaging options, persistently producing steady income and earnings progress. Rivals like AGI Greenpac Ltd and TCPL Packaging Ltd additionally function throughout the packaging trade, however EPL maintains its management place on this area of interest phase.

Outlook

- Sustainability focus: 100% recyclable tubes meet eco-friendly packaging demand.

- International enlargement: New manufacturing items in rising markets enhance capability.

- Business popularity: Sturdy alliances with prime world manufacturers.

- Development outlook: Administration initiatives double-digit income progress.

- Profitability: EBITDA margin anticipated to exceed 20%.

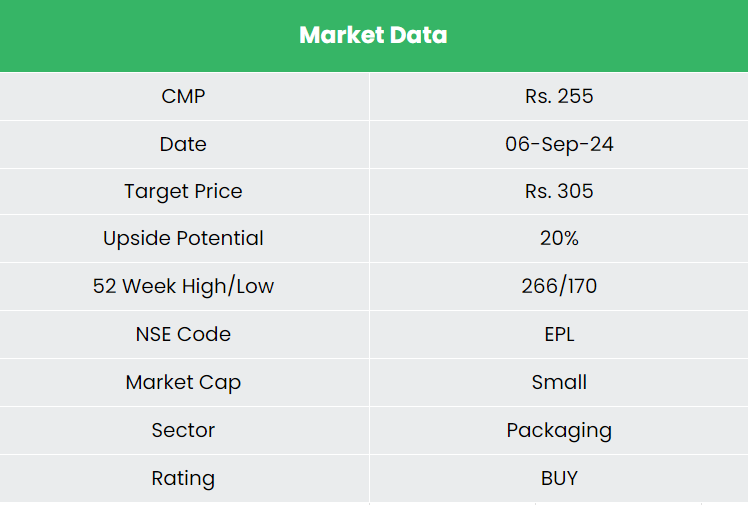

Valuation

The corporate’s numerous product portfolio, steady funding in superior applied sciences and initiatives to enhance operational effectivity is anticipated to drive future progress and additional set up the corporate’s place out there. We suggest a BUY ranking within the inventory with the goal value (TP) of Rs.305, 27x FY26E EPS.

Dangers

- Foreign exchange danger: Publicity to international markets makes the corporate susceptible to foreign money fluctuations.

- Uncooked materials value volatility: Fluctuations in uncooked materials prices might influence margins.

Notice: Please be aware that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

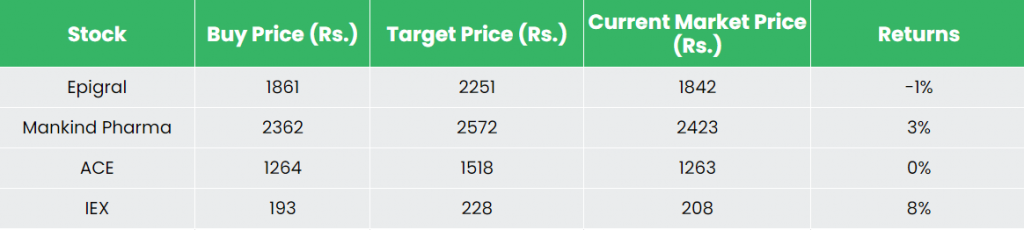

Recap of our earlier suggestions (As on 06 September 2024)

Different articles you might like

Submit Views:

1,222