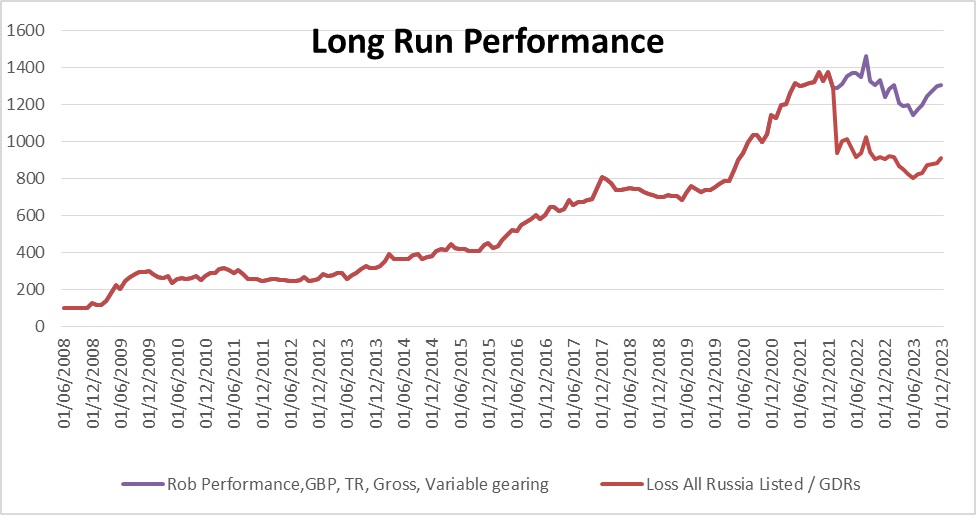

Normal finish of yr overview right here. It hasn’t gone nicely, general +0.8 (excluding Russian frozen shares) or +5.4% together with Russian frozen shares. If Russia goes again to regular can be up much more as there are a whole lot of dividends ready to be collected, not included within the under.

Linking again to final yr I used to be just about mistaken about every thing. I used to be closely into pure useful resource shares (c57% weight vs 41% now), not one of the best sector in 2023. A number of the fall in weight is because of me mildly chopping weights as shares didn’t go my approach / although fairly a bit is because of worth falls. I had moments of fine judgement – noticed the likelihood for political change in Russia – which very almost took place with the Prigozhin mutiny, bought into financials late within the yr. Broadly issues haven’t labored. There’s a gentle constructive factor to this – if I will be fairly mistaken on nearly every thing and nonetheless not lose *a lot* cash it’s not too unhealthy – nevertheless it’s removed from excellent given time I put in / potential returns. It’s additionally constructive I havent gone off the rails after the big Russian loss final yr – its straightforward to chase / elevate publicity, which is one thing I don’t assume I’ve achieved. There may be an argument round stops – which I don’t use – going to be a bit extra cautious with shares purchased at highs – significantly Hoegh Autos.

Weights are under:

Figures are as at twenty third Dec – so a bit approximate – however a typically correct flavour of the place I’m. (some very illiquid shares like ALF costs are incorrect…

Not inclined to vary sector weights an excessive amount of, much less valuable about shares. I’ve additionally been fairly badly hit by manufacturing issues, AAZ had tailing dam points, PTAL – points with the natives, JSE – manufacturing issues. Unsure if that is simply dumb luck or a few of these issues have been within the worth – I definitely knew PTAL had issues with ‘group relations’. JSE’s issues with their FPSO (floating manufacturing ship) might have been forseen if I had researched higher – vital to look into age of vessels, didn’t know/assume to do it on the time nevertheless. These few hundred million market cap shares are far more weak than I assumed- money piles can evaporate in a short time in the event that they hit points.

Strikes in a few of my bigger weight useful resource co’s that I proceed to carry have been unlucky – CAML -27%, KIST -61%, TGA -53% and THS -32%. While gasoline and coal are down considerably copper is about buying and selling on the worth it was in the beginning of 2023, Tharisa’s basket isnt down that a lot. CAML is buying and selling at a PE of 8, 9% yield, THS PE of three.5, 1/4 guide, although marred by a administration who insist on progress capex while buying and selling sub guide. They could get fortunate if costs rise nevertheless it’s luck, not judgement. TGA, additionally very, very low-cost 7% yield, low single digit PE, once more, irritatingly, investing reasonably than returning capital. These giant falls usually are not sensible from a capital preservation perspective, one wants a 100% rise to counter a 50% fall. But when we do get a choose up within the financial system / useful resource costs these might simply get again the place they have been. There may additionally be an argument these can simply rerate with the market, although at current they simply appear to be disliked. PTAL appears to be doing nicely with first rate prospects and a ten%+ yield, with buybacks – all relies on the oil worth. Draw back to all that is being commodity producers they solely have a lot management over their destiny – why many buyers dislike them.

A inventory which has had manufacturing points is GKP – Gulf Keystone Petroleum it’s points concern the legitimacy of it’s manufacturing contract / pipeline entry. It’s the one one I’ve added to reasonably than diminished over the yr – averaging down. The entire Kurdish oil trade has a query mark (relying on who you hearken to) relating to the legitimacy of it’s contracts. However, I can’t consider an instance the place a complete trade was seized / nationalised / expropriated. Everybody – Kurdish govt / Iraqi govt and oil firms have mentioned that contracts can be revered / discussions are ongoing. It’s removed from threat free – I think largest threat is that one firm is punished / seized to encourage a deal to be made by the others. Enormous upside on this – it’s a really giant discipline with very low extraction value – regardless that the oil isnt the very best quality, if made respectable relying on the precise deal. They’re greater than overlaying their prices so in my opinion price a glance in case you have threat tolerance for a considerable loss. If this works it’s a 3x-5x or extra, however it’s one the place the end result is basically exterior administration’s management – for causes aside from commodity costs.

One in all my greatest performing investments is JEMA – previously JP Morgan Russia. It’s an odd one – buying and selling at 48p ‘official’ NAV with a share worth of c £1.30 and a MOEX NAV at about £5-£6. JPM have marked all of the Russian holdings to about 0. I’m up about 55% and have trimmed the place – promoting a couple of third already. There may be rising discuss of seizing Russian property to pay for the subsequent spherical of Ukraine funding. Not solely positive what to do on it – upside remains to be large however I have already got 30% of the portfolio worth in Russian, sanctioned shares. I dont really want an additional weighting to turbo charged Russian publicity with the identical dangers – going to have to chop this to handle threat however considerably reluctant to, given the upside… I consider a whole lot of the frozen Russian property are held by Clearstream in Belgium , however not sure to what diploma Belgium actually makes the decisons on that one. Russia seems to have ‘received’ at the very least to a point militarily – they’re making gradual progress, nevertheless they’re eager to have ‘peace’ / stop fireplace talks. I think it’s because their wins usually are not sustainable, human losses/ monetary value is just too heavy to be sustained. Ukraine lacks the manpower and doubtlessly arms for an ongoing attritional combat however Russia lacks the motivation. My view is Russia cracks first and we see extra mutinies in 2024.

Uranium commerce has gone nicely – KAP/URNM up 43/53%. Have switched a bit bit of cash out of URNM into YCA – possibly the metallic will proceed to outperform the miners for fairly some time. I’m considerably skeptical of YCA / SPUT shopping for Uranium to tighten the market – as an industrial commodity – it solely actually has worth if it’s used – so implied worth of spot / spot -% means sooner or later it will likely be used, and if it will likely be used then tightening of the market in all probability shouldn’t occur. Not how persons are taking a look at it for the time being although.

Financials have achieved nicely – regardless of me including Nov/Oct so that they haven’t had an excessive amount of time to contribute. October costs for plenty of funding trusts / asset managers and so forth. (largely UK based mostly) regarded very depressed, 10% yields 40% and so forth low cost to guide values. Startling how rapidly issues have bounced. Not solely positive greatest solution to deal with these long term, they might be a pleasant strong earnings play, purchased at excessive yields or if I discover one thing higher then time to promote . I wrote about these not too long ago in this submit. I’m a bit involved about them as a long term maintain – the upside could be very a lot restricted, although excessive likelihood. I want to be within the ‘actual’ inflation linked financial system, laborious property reasonably than the monetary financial system.

A monetary I purchased after that submit is PHNX – Phoenix Group – this can be a giant closed life insurance coverage supervisor it’s buying and selling at an honest 9% yield. The dividend is £500m for an organization which is producing £1.3-1.4bn pa in money and which has £3.9bn solvency 2 surpulus – it must be sustainable. As ever with hyper large-cap insurers as an novice you’re by no means fairly positive what the regulator will give you which is able to wreck your day. You might be additionally betting towards the brand new weight reduction medication growing lifespan – although of late expectancy has been falling unexpectedly. Not one I’ll maintain for too lengthy – I’m fascinated about a yr or two, however I feel it’s under-priced. Searching for alpha write up right here (not by me).

Offered out of AA4 and DNA2 – first rate earnings on each (+100% on some tranches, held since 2020) however I feel there are higher locations for funds now. I could also be lacking out on a little bit of upside if the A380 finds extra of a market – maybe if one other airline begins utilizing it, although I doubt it’s logistically easy. There are actually higher alternatives on the market, although AA4 might have extra upside however at increased threat.

Fondul Proprietea is now a tiny weight – after tender affords / returns of capital. Its a bit unhappy to be saying goodbye. I got here up with this concept again in 2012 and have benefited from a closing of a 50% low cost and progress in underlying investments – it’s actually the best funding. It has had a 962% rise since inception (2011) and I’ve owned it since 2012 – although once in a while have needed to drop it because of dealer points. Time to promote this – as there isn’t an excessive amount of upside left now. Actually struggling to seek out issues with this degree of high quality / cheapness / ongoing compounding alternative.

Having mentioned this, one which can match the invoice is Beximco (BXP) this can be a Bangladeshi Pharma, buying and selling at a PE of 5, doubled income since 2018 (in BDT, however even in USD it has grown impressively) and it has considerably elevated earnings (my 2019 write up right here). It’s presently buying and selling at half the place it’s in Bangladesh however there isn’t any arbitrage alternative. Frustratingly, I needed to reduce my weight as my dealer wouldn’t permit it in a tax environment friendly ISA account, this didn’t harm me as the worth fell. My dealer has modified their thoughts so now I can put it again and lift the load. Brokers right here appear to depend on giant screening companies and drop / add companies to the checklist of what’s eligible – not relying on the foundations however how they really feel on the time.

Walker Cripps could be very a lot the worst sort of worth funding – the one the place nothing occurs. Walker Cripps is reasonable on an AUM foundation however hasn’t moved since I purchased it in 2015. Probably I’ve given this too lengthy, then once more there may be consolidation within the sector and this is able to be good for it… The FOMO of figuring out the day I promote it a suggestion can be made at 3x the present worth retains me holding, my not insubstantial endurance is operating out.

I nonetheless have some leverage – however that’s low-cost mortgage / unsecured debt at 3/4% charges. Its a comparatively small quantity vs portfolio / portfolio + property property – about 20%/11%. In impact, as in prior years leverage is getting used to purchase gold / held on deposit at the next charge…

When it comes to life – no change, nonetheless dwelling within the UK, reasonably unhappily employed (low/mid degree information analyst) three days per week, doing investments / little little bit of property the remainder of the time. Actually wanting ahead to life beginning correctly when I’m now not employed / ideally leaving the nation. Was considerably distracted by a pointless court docket case in the course of the first half of the yr and didn’t see a lot alternative so didn’t do a lot. Second half has been higher, significantly after October. I nonetheless assume an enormous transfer in most of the useful resource co’s I maintain is probably going, so actually dont wish to transfer earlier than that occurs – as a rustic transfer will entail pulling fairly a bit out of shares. PE’s of below 5 usually are not doubtless in my opinion to be sustained, although there’s a threat a sustained recession / melancholy shrinks earnings and share costs additional… I’d prefer to get extra copper / tin / silver publicity however haven’t but discovered any shares I like, and ETF’s usually are not with out their issues…

Suppose this yr has suffered from me largely being in first rate shares by way of yield / valuation however not shares the market cares about / likes which is why they’re low-cost. I might go extra mainstream however I’d reasonably keep the place I’m and watch for the market come to me reasonably than chase… Not wedded to explicit shares however the weighting to the useful resource sector wants to stay – they’ve been below invested in they’re low-cost and retro – very a lot assume they may have their day within the solar. Plan to change again from among the funds to sources as soon as the financials get again to nearer to what I anticipate is their honest worth.

Shares I plan to take a look at subsequent are tobacco – BATS/IMB in all probability – if I can get comfy with authorized dangers / debt ranges, they’re yielding nicely and usually are not extremely valued. Once I can purchase mainstream shares at single digit PE/ EV/EBITDA there isn’t any have to go too far into unique territory. Not the preferred – they do kill their prospects in any case, however vapes, hashish and so forth might present a chance to truly purchase progress at a low worth – significantly if regulation cuts out dodgy Chinese language imports. Nonetheless wish to rebuy Royal Mail on the proper worth. Long run I would like extra Latin American / Asian listed shares. China seems to be low-cost however I’m very cautious of avoiding a repeat of the Russian state of affairs.

Better of luck for 2024 – as ever feedback/views appreciated.