Supply: The Faculty Investor

Utilizing an HSA (or well being financial savings account) as a retirement account is essentially the most underrated strategy to save and make investments.

One in every of my targets for this 12 months was to max out as many alternative retirement autos as potential. We have talked in regards to the methods to maxing out the standard retirement accounts, however have you ever heard of the Well being Financial savings Account or HSA? The HSA is now one in all my prime methods for saving for retirement, and it must be a excessive precedence for you too.

The HSA is a particular account that’s designed to assist folks save for healthcare bills. Nonetheless, it could actually additionally work as a “secret” IRA and lets you save much more for retirement tax-free. It is necessary to do not forget that HSAs aren’t technically retirement accounts like an IRA, however the guidelines related to the account make it an superior software for savers who qualify for it.

Let me present you why I believe the HSA is your secret retirement weapon and the way I am utilizing it as a “secret” IRA.

Remember to take a look at the perfect HSA account suppliers right here >>

How Do HSAs Work?

Well being Financial savings Accounts got here into existence in immediately’s kind within the early 2000s when President Bush expanded Medicare. An enormous premise of HSAs are that they’re tied to having a excessive deductible well being care plan, however they permit loads of advantages that Versatile Spending Accounts did not have.

So as to have the ability to contribute to an HSA, your healthcare plan should meet sure Excessive Deductible Well being Plan (HDHP) deductible limits. In 2024, these limits are:

Minimal – Most Deductibles:

Particular person: $1,600 – $8,050

Household: $3,200 – $16,100

In case your plan meets these deductible limits (which your employer will seemingly verify with you throughout open enrollment), you’ll be able to contribute pre-tax cash to your HSA.

For 2024, the HSA contribution restrict is:

Particular person: $4,150

Household: $8,300

You’ll be able to take a look at subsequent 12 months’s HSA contribution limits right here.

Supply: The Faculty Investor

It is necessary to notice that this contribution restrict contains each employer AND worker contributions. So, in case your employer goes to contribute in your behalf, you should modify your paycheck withholding appropriately.

So, now that your cash is on this account, what now? Here is the place the actual enjoyable begins. Similar to a versatile spending account, you’ll be able to withdraw the cash at any time for medical bills. The cash in your HSA carries over from 12 months to 12 months, and in case you depart your employer, you’ll be able to take your cash with you. Keep in mind, it is your HSA, identical to an IRA or 401k could be your cash too.

The superior benefit of the HSA is you could make investments the cash contained in the account. Nonetheless, it is necessary that you simply test together with your plan administrator. Every plan varies broadly (which is a bummer), however basically you’ll be able to choose funds just like a 401k inside your HSA. Some HSAs require you at all times keep a money minimal (like $2,000) earlier than you’ll be able to make investments, however when you attain that restrict, you’ll be able to put money into the funds supplied.

The Triple Tax Advantages Of HSAs (And Extra)

What makes HSAs an superior “secret” IRA is that you simply get a triple tax profit by saving in an HSA. Wait, what? Sure, HSAs provide a triple tax profit that’s unparalleled in different retirement accounts. It is these advantages that make the HSA the perfect retirement car (significantly, I simply stated that).

So, what are these wonderful advantages?

1. Contributions Are Pre-Tax

All your contributions to the HSA are pre-tax. That is completed by way of payroll deduction, however you may as well decide to do that manually in case you’re self-employed (it is simply extra tedious). That implies that you get a tax financial savings up entrance just by contributing, identical to you’d get with a standard 401k.

For instance, in case you’re within the 25% tax bracket, and also you contribute the utmost of $8,300 for a household, you can doubtlessly see a tax financial savings of round $2,075 greenback in 12 months one. If you’ll be able to have the contributions completed by way of payroll deduction, you may as well save on FICA taxes (Social Safety and Medicare). That may prevent one other $634 per 12 months.

So, by contributing the utmost, you will understand a tax financial savings instantly of $2,709.

2. Progress Is Tax-Free

Similar to an IRA, all the cash inside your HSA grows tax free. So, in case you make investments and see large good points – these are tax free. When you’ve got a bunch of dividend paying funds, the dividends are tax free. Merely sit again and watch your cash develop over time.

3. Withdraw Is Tax Free For Certified Medical Bills

With an HSA, certified medical bills are in a position to be taken out tax free at any time. We’ll discuss this extra in a second, however I need you to do not forget that phrase: withdrawn at any time. In contrast to a versatile spending account the place there are timelines for reimbursement, that does not apply to your HSA account. For reference, the IRS has a fairly complete record of certified medical bills.

Past these three, there are two extra superior advantages to contemplate:

4. After Age 65, Withdraws Are Taxed Simply Like An IRA (No Penalty)

If you happen to nonetheless have cash in your HSA at age 65 that you have not been in a position to get reimbursed with certified medical bills (as a result of perhaps you are a rockstar and have hundreds of thousands saved in your HSA), do not fret! After age 65, your HSA now works identical to a standard IRA. There aren’t any penalties for withdrawing the cash in your account – you’ll simply pay atypical revenue tax on the cash. As such, you’ll be able to leverage your HSA, together with different retirement accounts, to realize tax diversification in retirement.

5. You Can Use HSA Cash For Your Medicare Premiums

Lastly, one other unstated advantage of the HSA is that you need to use your HSA cash after age 65 on your Medicare Premiums – tax free. No different medical financial savings account has ever allowed for the usage of tax free cash for use for Medicare or insurance coverage premiums, so that is large. You might not understand it, however you can be spending $400 per 30 days on Medicare premiums. When you’ve got an HSA, you can use pre-tax cash for that, as a substitute of different accounts or Social Safety.

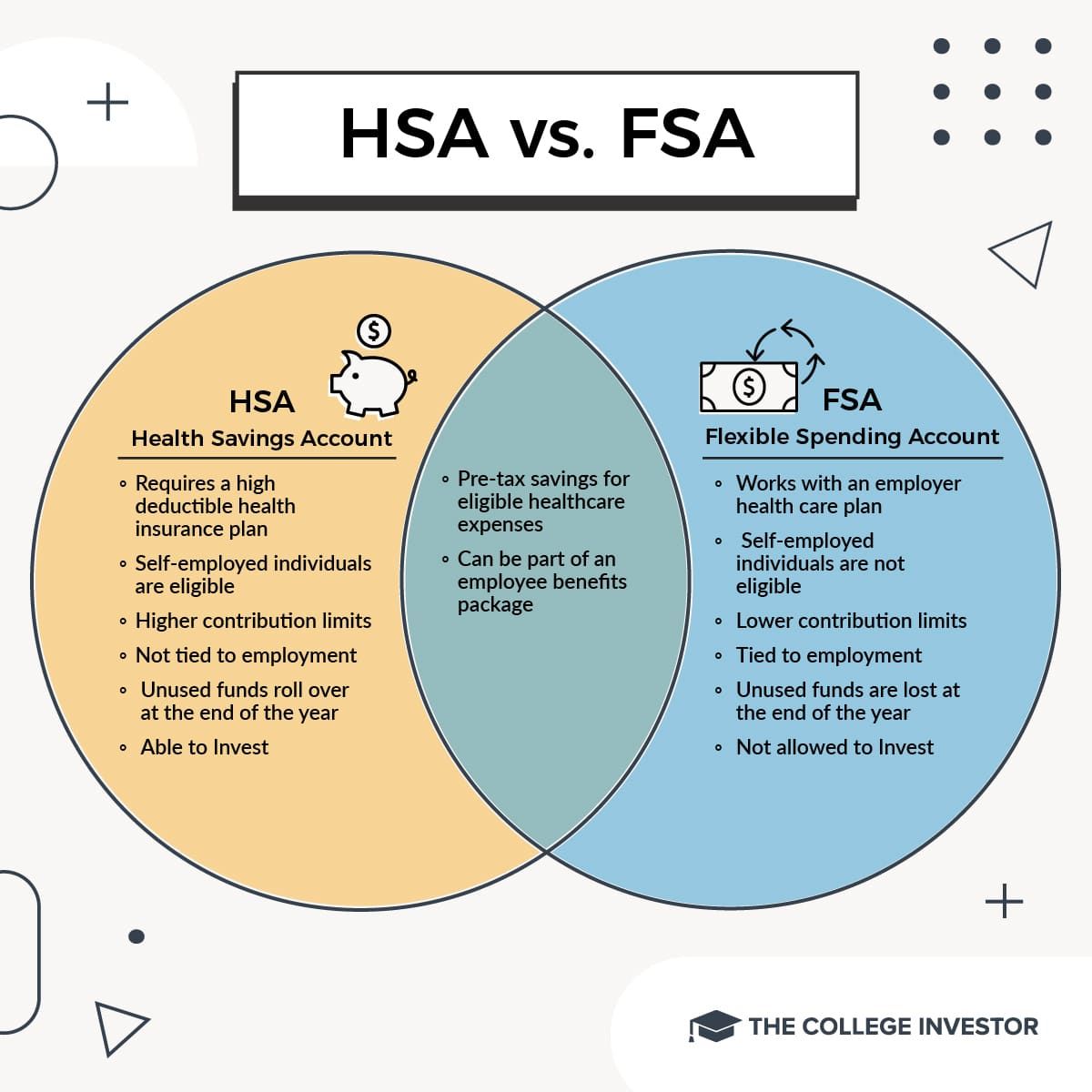

Do not Confuse An HSA With An FSA

When speaking about utilizing an HSA as an IRA, it is important that you do not confuse the HSA with the extra frequent FSA, or Versatile Spending Account. These accounts additionally allow you to save pre-tax cash for medical bills, however the limits are decrease, and you can not make investments the cash. Even worse, FSAs solely permit a tiny rollover yearly.

See the full distinction between an HSA and FSA right here, or this fast comparability chart:

Supply: The Faculty Investor

How To Leverage Your HSA Like A Secret IRA

So, all of these tax advantages are charming and all, however significantly, how will you actually leverage the HSA like a “secret” IRA? Nicely, let me let you know the secret HSA hack that basically units the HSA excessive.

Do not forget that phrase earlier: you’ll be able to withdraw cash from the HSA anytime? That’s what makes the HSA so highly effective and why I like to recommend that you simply use the HSA as a major retirement financial savings car.

Principally, in case you can afford to pay on your medical payments immediately, try to be maximizing your contribution to your HSA between your cash and your employer. Most employers who provide HSAs usually contribute anyplace from $600 to $1,250 to your account. That is a free match, identical to a 401k, and also you by no means need to depart cash on the desk. So, it is then on you to make up the completely different to contribute to the utmost.

If you get billed out of your well being suppliers, merely pay the invoice out of pocket, AND SAVE THE RECEIPT. I merely created a file that is known as “Medical Payments – To Be Reimbursed”. Here is what it appears to be like like:

Instance HSA Receipt File. Supply: The Faculty Investor

Subsequent, depart the cash in your HSA to develop for so long as potential. Contribute the utmost to your HSA yearly. Rinse and repeat. Over time, the added contributions and compounding of cash will permit your HSA to develop and develop and develop! As you get new medical receipts, merely add them to your file.

My private aim is to let this cash develop for years. Perhaps 65, however perhaps sooner. I haven’t got a set deadline, however I do know that I need the ability of compounding to take over and actually maximize the tax free good points.

Lastly, whenever you’re able to withdraw, merely submit your large file of “Medical Payments To Be Reimbursed” and you will get an enormous stack of tax free cash. You possibly can even do some bit at a time. It is not like it’s important to take all of it out directly.

That is the way you leverage your HSA as a “secret” IRA.

Issues About Having A Excessive Deductible Well being Plan (HDHP)

One of many largest considerations with an HSA is having a excessive deductible well being plan (HDHP). It may be a scary change from conventional HMO well being plans, and truthfully, loads of the language in most employer open enrollment packages makes it tremendous exhausting to grasp what you’ll actually pay.

After having a HDHP for some time, and having a number of medical payments to associate with it, I wished to alleviate some considerations about having a HDHP, as a result of I’ve discovered it to not be scary in any respect, and in lots of instances, it has been cheaper than my outdated insurance coverage protection AT MY SAME EMPLOYER.

It is necessary to do not forget that a HDHP remains to be insurance coverage. And with insurance coverage, you get loads of protection already. For instance, most HDHPs embody 100% protection for wellness visits, vaccinations, and extra. And plenty of providers are coated at 80% – sick visits, x-rays, surgical procedure, and many others. And plenty of plans nonetheless provide first rate prescription drug protection, with $4 generics, and many others.

If you wish to evaluate your choices that embody an HSA, take a look at Coverage Genius for a fast and straightforward quote.

My Story

You might assume that 80% protection quantity is horrifying, however you even have to comprehend that you will pay 80% of the insurance coverage negotiated value with the hospital – which is normally fairly low-cost. For instance, I just lately needed to get a CT scan. The hospital billed my insurance coverage $2,100. However I solely needed to pay $370.16 – or 17%. And when the time comes, I can at all times submit that $370 invoice to get reimbursed from my HSA.

Beneath my outdated PPO plan, I used to be stunned that vaccinations and wellness visits weren’t coated. With a child, that added as much as loads of medical bills. Now, below the HSA with HDHP, wellness visits and vaccinations are 100% coated – so I am seeing a financial savings in medical bills instantly.

In fact, each plan is completely different, and you need to learn the tremendous print on any potential medical insurance plan. However keep in mind:

- HDHPs are nonetheless insurance coverage, so that you get loads of protection routinely

- You’ll solely pay a portion of any payments, and that is on the negotiated quantity by the insurance coverage firm

- The utmost you will ever pay annually is your Out of Pocket Most

Conclusion

If you happen to qualify for a Well being Financial savings Account or HSA, you should be maxing it out annually and leveraging it like an Particular person Retirement Account. The HSA performs a crucial position in the order of operations for saving for retirement.

Keep in mind, the important thing advantages with HSAs and the explanation to make use of the HSA as an IRA are:

- Triple Tax Financial savings

- Carry over yearly and rollover from employers

- Potential to reimburse bills anytime

- Acts like a standard IRA after age 65

If that does not excite you, and make you assume that the HSA is the perfect retirement account ever, I do not know what to let you know. I am placing it on the market that the HSA is the perfect retirement account, though it technically is not a retirement account. Now go get this setup.