A reader asks:

I not too long ago bought my condominium for $400k and need to make investments the cash within the inventory market. Nevertheless, it seems the market is at an all time excessive. Ought to I make investments elsewhere or anticipate a market correction?

It’s comprehensible when traders get nervous about placing cash to work at all-time highs.

A type of all-time highs would be the final one earlier than a prolonged bear market! Nobody desires to place an enormous slug of money to work proper at THE peak.

It’s scary however if you happen to’re an investor in shares it’s a must to get used to them new highs. They occur extra usually than you assume.

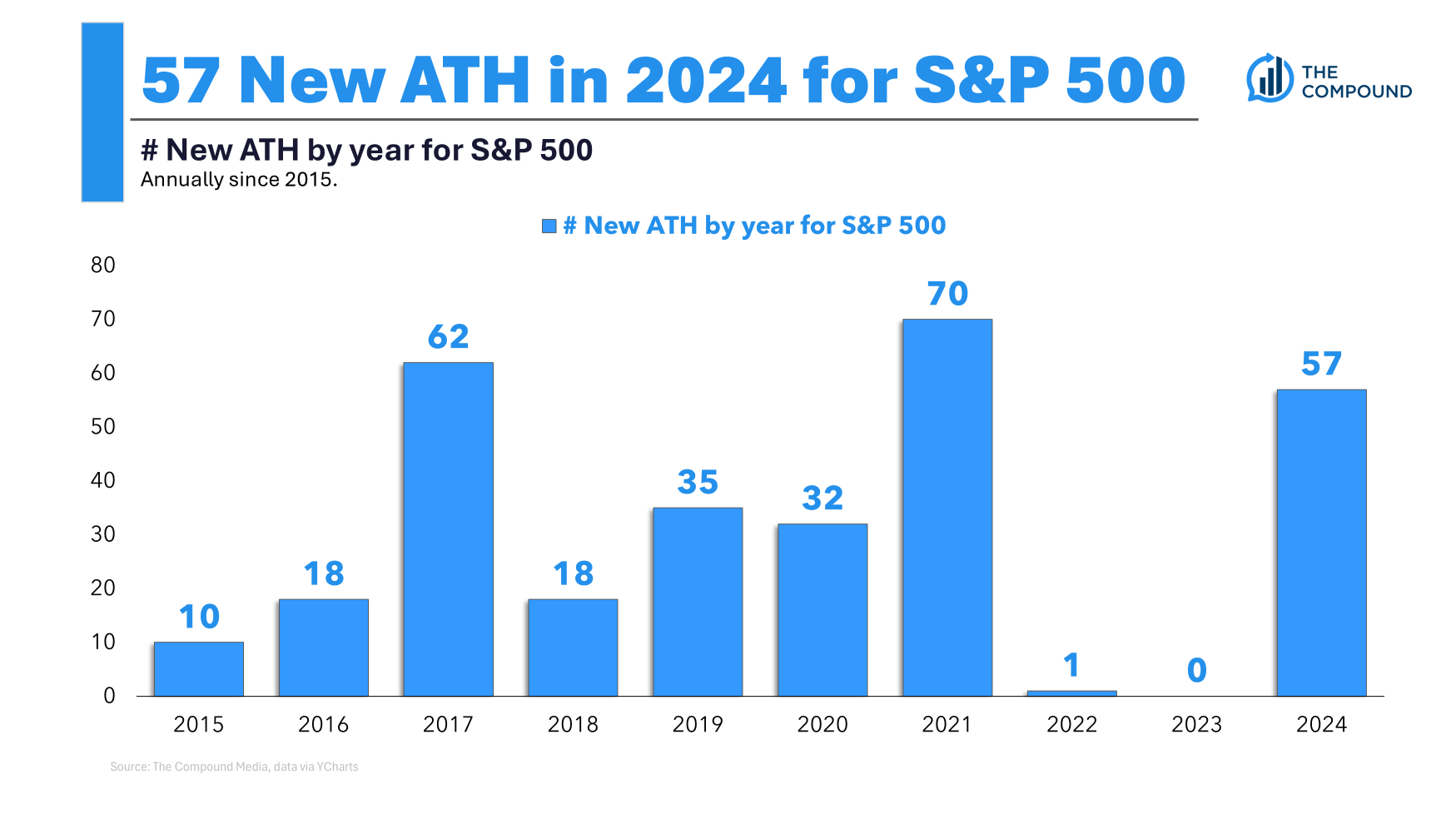

We’ve had numerous new all-time highs this yr:

We’re closing in on 60 this yr alone. Which means considered one of each 4 buying and selling days has been a brand new excessive this yr.

Over the previous 10 years we’ve skilled simply over 300 new all-time highs. That’s so much.

I regarded again on the variety of new all-time highs over rolling 10 yr home windows for the S&P 500 going again to 1950. The typical in that time-frame was 170 all-time highs. Over 20 years the typical was 319 new highs.1

So it’s a must to get used to coping with all-time highs. They occur recurrently, round 7% of all buying and selling days since 1950. On common, that’s one new excessive each 14 buying and selling days or so.

To be honest, we’ve been on a heck of a run each this decade and because the finish of the GFC. Market historical past is useful but it surely must be put within the context of the current.

The laborious half about investing is feelings are inclined to trump math in the case of decision-making. New all-time highs add to the feelings, particularly if you’re coping with an enormous pile of money after the market has skilled outsized good points.

When you’re nervous about investing at all-time highs, perhaps you shouldn’t put your whole dry powder to work within the inventory market.

My normal rule of thumb is you must solely spend money on the inventory market an quantity you’d be keen to carry by means of each bull and bear markets. Nobody can predict when shares will take off or get crushed so your asset allocation ought to take that into consideration.

A extra diversified portfolio of shares, bonds, money and different investments might need a decrease anticipated return than an all-stock portfolio, but it surely additionally spreads your dangers.

Because of this it’s so necessary to have a pre-established asset allocation in place. That method you don’t have to consider it when you could have money to take a position.

The proper choice will solely be identified with the advantage of hindsight as a result of each investor is compelled to make selections with imperfect details about the long run. So It goes.

With that caveat out of the way in which, listed here are some affordable choices to take a position your money proceeds with shares at all-time highs:

- Put your whole cash to work in a lump sum and play the likelihood that more often than not the inventory market goes up.

- Greenback price common your money into the market on a periodic foundation to diversify your entry factors and add a remorse minimization hedge.

- Allocate your property to a extra broadly diversified portfolio of shares, bonds, money and probably different investments.

No matter you resolve to do, an important factor is you want a plan in place forward of time so that you’re not guessing about what to do subsequent.

Josh Brown joined me on Ask the Compound this week to cut it up on this query:

We additionally lined questions on how AI will impression the monetary recommendation panorama, timing the following market correction, factoring an inheritance into the house-buying course of and utilizing long-dated choices in a portfolio.

Additional Studying:

All-Time Highs within the Inventory Market are Normally Adopted by All-Time Highs

1Probably the most over any 10 yr time-frame was 344. The least was simply 9 (whats up misplaced decade).

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.