With regards to evaluating methods to train your Non-Certified Inventory Choices (NQSOs), what’s your greatest plan of assault? Do you …

With regards to evaluating methods to train your Non-Certified Inventory Choices (NQSOs), what’s your greatest plan of assault? Do you …

- Train and promote all of your NQSOs instantly, cashing out the total proceeds?

- Train your NQSOs and maintain shares of inventory, hoping the inventory worth will go up?

- Or, depart your NQSOs unexercised and hope the inventory worth will go up?

In case you anticipate a better inventory worth sooner or later, you would possibly assume it makes probably the most sense to train and maintain your NQSOs before later; this begins up the holding interval in your inventory, so you possibly can hope to pay preferential long-term capital acquire (LTCG) taxes on any post-exercise acquire if you do promote.

Sadly, this LTCG-focused technique might not show to be the very best for NQSOs. The truth is (and all else being equal), you is likely to be higher off ready to train your NQSOs till you’re additionally able to promote the inventory, even understanding that you just’ll incur greater bizarre earnings tax charges on the total proceeds.

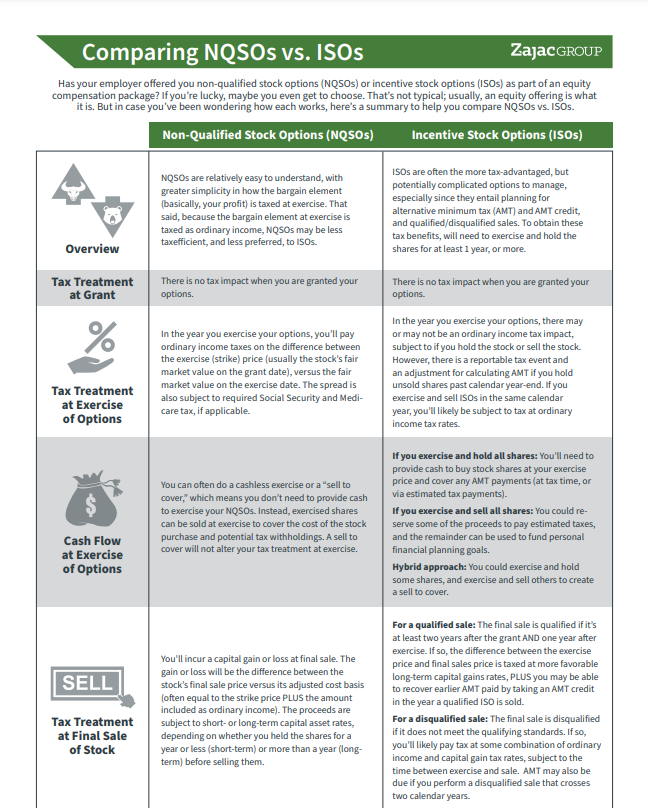

To know why requires a better take a look at how NQSOs are taxed and the way they settle at train, particularly in comparison with Incentive Inventory Choices (ISOs). The variations will assist inform why several types of worker inventory choices might warrant totally different methods. Whereas an train and maintain of ISOs would possibly make plenty of sense, the identical logic won’t be so helpful when you have NQSOs.

Incentive Inventory Choices vs. Non-Certified Inventory Choices

First, let’s check out some essential distinctions between ISO and NQSO tax therapies at train and at last sale. It will assist us perceive why an train and maintain of ISOs is doubtlessly financially superior to an train and maintain of NQSOs.

For ISOs: There is NO bizarre earnings tax influence or tax withholding at train. (There’s, nevertheless, an AMT adjustment if you happen to maintain the inventory previous the year-end.) Whenever you train your ISOs, you usually take possession of the gross variety of choices exercised. As well as, if you promote shares later, you possibly can seize long-term capital good points on the total unfold between the ISO’s strike worth and the ultimate sale worth of the inventory, so long as you do a qualifying disposition (promoting your inventory a minimum of 2 years after the supply date and 1 yr after the acquisition date). These logistics could make it significantly enticing to carry out an train and maintain of ISOs, and obtain LTCG tax remedy.

NQSOs vs. ISOs

This abstract will break down the variations in how they work and what you must take into account.

For NQSOs: There IS a reportable bizarre earnings tax occasion at train. There’s additionally a required tax withholding at train, after which a second reportable tax occasion if you promote your shares. Nonetheless, solely the distinction between the honest market worth (FMV) at train and the ultimate gross sales worth is eligible for LTCG tax remedy.

Notably essential in regards to the train of NQSOs, and materially totally different than ISOs, is that you just often find yourself proudly owning much less shares of inventory submit train than gross choices exercised. (Extra on this later.)

Though holding fewer post-exercise shares gives some draw back safety ought to the share worth fall earlier than you promote (as in comparison with holding unexercised non-qualified inventory choices), it additionally reduces the upside potential ought to the share worth rise. And this upside potential of retaining unexercised NQSOs can yield effectively greater than ready for the LTCG fee on a fewer variety of exercised and held shares.

This usually finally means:

In case you anticipate the inventory worth will improve, it often makes extra sense to attend to train and promote your NQSOs in a single occasion (even understanding you’ll pay bizarre earnings tax on the train and promote), as in comparison with exercising and holding a net-settled variety of shares, with the hopes of promoting later and paying at LTCG charges.

Let’s present you the way it all works.

How Are NQSOs Taxed and Settled at Train?

NQSO tax remedy is comparatively simple. Within the yr you train your choices, you’ll incur bizarre earnings taxes, plus any relevant payroll taxes reminiscent of Social Safety and Medicare. These taxes are assessed on the unfold between the strike worth of the NQSO and the Truthful Market Worth (FMV) at train, multiplied by the variety of NQSOs you train:

(FMV at Train – Strike Worth) x NQSOs Exercised = Taxable Earnings at Train

However usually talking, if you train a NQSO, you’ll really obtain a web settlement of shares … after a few of them are withheld to cowl taxes due and price of buying shares. Below present tax codes, a statutory federal withholding at train is often 22%, though it might be 37% for supplemental earnings in extra of $1 million.

Both method, you’ll personal fewer shares post-exercise than the pre-tax choices you managed pre-exercise.

For example, let’s assume the next:

- NQSOs: 10,000

- Train Worth: $20

- FMV at Train: $50

- Statutory Withholding 22%

On this situation, the variety of NQSOs managed, unexercised, is 10,000. Right here’s what a web train of those choices would appear to be, adjusting for a statutory withholding of twenty-two% and Medicare tax of 1.45% (assuming you might be previous the Social Safety wage restrict at train):

| Price to Train (NQSO Exercised * Train Worth) | ($200,000) |

| Taxable Earnings (Discount Factor) | $300,000 |

| Tax at Train | ($70,350) |

| Whole Price | ($270,350) |

| Shares to Cowl (Whole Price / FMV at Train) | 5,407 |

Submit train and maintain, you management 4,593 shares of inventory, or lower than half of the inventory you managed pre-exercise.

How Are NQSOs Taxed After Train?

After you’ve exercised your NQSOs, the fee foundation per share equals the share worth at train. Whenever you promote these shares, you’ll be taxed on the acquire/loss between their last sale worth and their price foundation:

Last Gross sales Worth – Price Foundation = Capital Acquire/Loss

This implies, if you happen to train and instantly promote all of your shares, you gained’t incur further taxes, assuming the ultimate sale worth and price foundation are the identical. In case you maintain your shares for some time earlier than promoting them, they’ll be taxed as a capital asset topic to short- or long-term capital good points remedy. Assuming a acquire:

- LTCG Fee: In case you maintain shares for greater than a yr after train, their sale is taxed at LTCG charges.

- Odd Earnings: In case you maintain them for a yr or much less, their sale is taxed as a short-term sale, topic to bizarre earnings tax charges.

Evaluating NQSO Train Methods

With an understanding of earnings tax, net-settlement, and capital good points, we are able to examine attainable outcomes of two NQSO methods, together with a timeline of occasions. In our first situation, we’ll full a web settled train and maintain. We’ll train on Day 1 on the strike worth, and when the FMV is $50 per share. We’ll maintain the inventory for simply over 1 yr, subsequently promoting the shares at $85 per share and receiving preferential LTCG tax remedy.

Within the second situation, we’ll merely wait, as we suggest, leaving the choices unexercised till we do a full train and promote at $85 per share, incurring greater bizarre earnings tax charges on the total revenue.

The comparability will illustrate, by ready to train and promote, while paying greater tax charges, the after-tax proceeds are greater than exercising and holding NQSOs and reaching preferential LTCG charges—all as a result of ready offers us management over a better variety of choices that profit from a rising inventory worth.

Hypothetical Assumptions

- NQSOs: 10,000

- Strike Worth: $20

- 32% private marginal tax fee (22% statutory withholding + 10% greater private marginal fee)

- FMV at Train: $50

- Last Sale Worth: $85

Situation 1: Train and Maintain, to “Get Lengthy-Time period Capital Positive factors”

In our train and maintain situation, we’ll train all choices upfront, promote some exercised shares straight away to cowl the train price and taxes due, pay marginal bizarre earnings tax charges on the bought shares, and maintain the remainder till they qualify for LTCG charges. In abstract, right here’s how that performs out:

- Train 10,000 choices at $20 per share, when the FMV is $50

- Promote 5,920 shares at $50 per share to cowl the price of train and the tax due

- Maintain the 4,080-share steadiness for greater than a yr; promote at $85 per share and 15% LTCG charges

- Whole after-tax proceeds: $325,380

Situation 2: Wait to Train, and Then Train and Promote (With out LTCG Tax Financial savings)

To match and distinction, another technique is to NOT train, leaving the choices untouched till the share worth is $85 per share, after which train and promote. Notably, regardless that all income are taxed as bizarre earnings, you might find yourself in a greater spot. To evaluation:

- Don’t train and maintain at $50 per share

- Train all 10,000 choices at $85 per share

- Instantly promote all 10,000 shares at $85 per share and 32% bizarre earnings tax charges

- Your complete pre-tax revenue is $650,000, with $208,000 taxes due

- Whole after-tax proceeds: $442,000 (or 36% better wealth)

Here’s a extra detailed breakdown of every situation:

| Choices Exercised | 10,000 | |

| Strike Worth | $20 | |

| FMV of Inventory at Train | $50 | |

| Future Worth | $85 | |

| Marginal Tax Fee | 32% | |

| LTCG Fee | 15% | |

| Internet Train Now Promote Later at LTCG Fee |

Maintain and Wait Train/Promote at Future |

|

| Choices Exercised | 10,000 | 10,000 |

| Exercised and Held | 4,080 | – |

| Exercised and Bought | (5,920) | 10,000 |

| Gross Worth | $500,000 | $850,000 |

| Price to Train | ($200,000) | ($200,000) |

| Taxable Earnings (Discount Factor) | $300,000 | $650,000 |

| Tax Due at Train | ($96,000) | ($208,000) |

| Whole Price | ($296,000) | ($408,000) |

| Proceeds of Shares Bought | ($296,000) | $850,000 |

| Internet Money Circulate | $442,000 | |

| $442,000 | ||

| Worth of Shares Held | $204,000 | |

| FV of Shares Held | $346,800 | |

| LTCG Tax | ($21,420) | |

| After-Tax Proceeds | $325,380 | $442,000 |

What If the Share Worth Is Down?

Nicely, certain, you might be considering. This works out effectively when the inventory worth is up. However what if it’s down? You would possibly assume it will make sense to carry out a web train and maintain before later, because you’d be shopping for the inventory “low” and capturing extra upside at LTCG charges. The bizarre earnings tax influence at train would even be decrease than it will be if the inventory worth had been greater.

Nonetheless, you’ll maintain far fewer shares of inventory after a web train when the value is low. So, leaving your choices unexercised gives way more leverage and upside as in comparison with LTCG tax charges on fewer shares.

Persevering with our instance, lets assume that the FMV at train is $25 per share. On this situation, assuming you train 10,000 NQSOs, 8,640 are required to cowl the fee and taxes due, and 1,360 shares will likely be held outright, a discount of over 85%.

If the ultimate gross sales worth continues to be $85 per share, the full web proceeds is $103,360, or lower than 25% of the Situation 2, and by far the bottom after-tax end result in our hypothetical illustration.

In case you stay unconvinced, it’s value asking your self: Is exercising my NQSOs the very best and greatest use of the capital it can take to purchase the inventory through the choice, or is there a greater various? Mentioned one other method, what if, as an alternative of exercising choices when the share worth is down, you utilize that very same cash to purchase further shares on the open market, and depart your NQSOs unexercised and untaxed? On this situation, you’d management a better variety of shares, supplying you with much more upside potential transferring ahead.

Ready to train and promote your NQSOs isn’t for everybody. For instance, when it’s accessible, early train of your NQSOs, coupled with an 83(b) election might be a good suggestion for very early-stage firms whose shares have a low strike worth with little to no hole between FMV and strike. This would possibly permit you to purchase shares at a low price, with minimal tax influence, and provoke the holding interval requirement on promoting at LTCG tax charges.

Nonetheless, there’s a sidebar to this sidebar: Consider, you might want to carry your exercised, pre-IPO shares for a protracted whereas earlier than there’s a market in which you’ll promote them; in actual fact, that market might by no means materialize, placing you at substantial threat of loss.

All Issues Thought of: When Holding NQSOs, Assume Past LTCG Tax Charges

So, we’ve now demonstrated, LTCG tax charges aren’t the one issue influencing whether or not to train and maintain your NQSOs, or train and promote concurrently in a while. The truth is, taxes might not even be crucial issue within the equation.

Bear in mind, sacrificing a major variety of shares in a net-settled train additionally means giving up their future potential worth—for higher or worse.

To keep away from any remorse over paying greater taxes on the time, consider it as being just like the tax hit you’re taking everytime you obtain further bizarre earnings, reminiscent of a bonus. Paying greater taxes on more cash in your pocket will not be such a nasty tradeoff, in any case.

This materials is meant for informational/academic functions solely and shouldn’t be construed as funding, tax, or authorized recommendation, a solicitation, or a advice to purchase or promote any safety or funding product. The knowledge contained herein is taken from sources believed to be dependable, nevertheless accuracy or completeness can’t be assured. Please contact your monetary, tax, and authorized professionals for extra data particular to your scenario. Investments are topic to threat, together with the lack of principal. As a result of funding return and principal worth fluctuate, shares could also be value kind of than their authentic worth. Some investments aren’t appropriate for all traders, and there’s no assure that any investing aim will likely be met. Previous efficiency is not any assure of future outcomes. Speak to your monetary advisor earlier than making any investing choices.

It is a hypothetical instance and is for illustrative functions solely. No particular investments had been used on this instance. Precise outcomes will differ. Previous efficiency doesn’t assure future outcomes. Investments are topic to threat, together with the lack of principal. As a result of funding return and principal worth fluctuate, shares could also be value kind of than their authentic worth. Some investments aren’t appropriate for all traders, and there’s no assure that any investing aim will likely be met. Previous efficiency is not any assure of future outcomes. Speak to your monetary advisor earlier than making any investing choices.