I typically marvel with so little fairness extracted this cycle if it’s nonetheless early innings for the housing market. A minimum of by way of the subsequent collapse.

Positive, house gross sales quantity has plummeted due to unaffordable circumstances, pushed by excessive house costs and considerably increased mortgage charges.

However can we nonetheless want a flood of HELOCs and money out refis earlier than the market inevitably overheats once more?

In any other case it’s simply an unaffordable market that’s seemingly simply going to get extra reasonably priced as mortgage charges ease, house costs stall, and wages improve.

The place’s the enjoyable in that?

Owners Had been Maxed Out within the Early 2000s

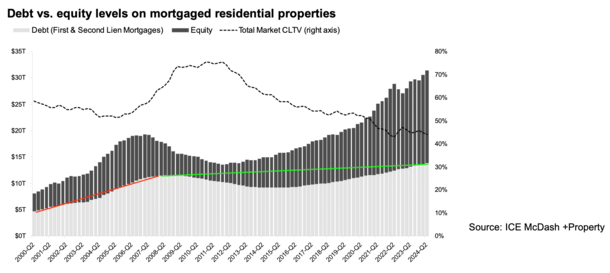

In case you have a look at excellent mortgage debt in the present day, it actually hasn’t risen a lot over the previous 16 or so years when the housing bubble popped.

It skyrocketed within the early 2000s, due to quickly rising house costs and nil down financing.

And a flood of money out refinances that went all the way in which to 100% LTV and past (125% financing anybody?).

Mainly householders and residential consumers again then borrowed each penny attainable, after which some.

Both they cashed out each six months on increased valuations, fueled by shoddy house value determinations, or they took out a HELOC or house fairness mortgage behind their first mortgage.

Many additionally purchases funding properties with no cash down, and even with none documentation.

No matter it was, house consumers again then at all times maxed out their borrowing capability.

It was type of the transfer again then. Your mortgage officer or mortgage dealer would inform you how a lot you might afford and you’ll max that out. There was no purpose to carry again.

If it wasn’t reasonably priced, said earnings would simply be said increased to make it pencil.

Exacerbating that was defective house value determinations that allowed property values to go up and up and up.

After all, it wasn’t lengthy earlier than the bubble burst, and we noticed an unprecedented flood of quick gross sales and foreclosures.

A lot of these mortgages had been written off. And numerous that cash was used to purchase discretionary toys, whether or not it was a brand new speedboat or a hummer or satirically, a second house or rental property.

Most of it was misplaced as a result of it merely wasn’t reasonably priced.

And it didn’t have to be as a result of nearly all of the loans again then had been underwritten with said earnings loans or no doc loans.

Excellent Mortgage Debt Is Low Relative to the Early 2000s

At present, issues are loads completely different within the housing market. Your typical home-owner has a 30-year mounted mortgage. Possibly they also have a 15-year mounted.

And there’s an excellent likelihood they’ve a mortgage rate of interest someplace between two and 4 p.c. Possibly even decrease. Sure, some householders have charges that begin with a “1.”

A lot of them additionally bought their properties previous to the large run up in costs previous to the pandemic.

So the nationwide LTV is one thing ridiculously low under 30%. In different phrases, for each $1 million in home worth, a borrower solely owes $300,000!

Simply have a look at the chart from ICE that reveals the huge hole between debt and fairness.

Contemplate your common home-owner having a ton of house fairness that’s largely untapped, with the power to take out a second mortgage and nonetheless keep a big cushion.

Lengthy story quick, many present householders took on little or no mortgage debt relative to their property values.

Regardless of this, we proceed to undergo from an affordability disaster. Those that haven’t but purchased in typically can’t afford it.

Each house costs and mortgage charges are too excessive to qualify new house consumers.

The issue is, there isn’t a lot purpose for house costs to ease as a result of present homeowners are in such an excellent place. And there are too few accessible, for-sale properties.

Given how excessive costs are, and the way poor affordability is, there are some that assume we’re on one other bubble. However it’s troublesome to get there with out financing.

And as famous, the financing has been fairly pristine. It’s additionally been very conservative.

In different phrases, it’s laborious to get a widespread crash the place thousands and thousands of house owners fall behind on their mortgages.

On the similar time, present householders worth their mortgages greater than ever as a result of they’re so low-cost.

Merely put, their present housing fee is the best choice they’ve bought.

In lots of instances, it will be far more costly to go hire or to purchase a alternative property. So that they’re staying put.

Do We Want a Second Mortgage Surge to Deliver Down the Housing Market?

So how can we get one other housing market crash? Properly, I’ve thought of this fairly a bit these days.

Whereas housing isn’t the “downside” this time round, because it was within the early 2000s, shoppers are getting stretched.

There’ll come a time the place many might want to borrow from their properties to afford on a regular basis bills.

This might imply taking out a second mortgage, similar to a HELOC or house fairness mortgage.

Assuming this occurs en masse, you might see a scenario the place mortgage debt explodes increased.

On the similar time, house costs may stagnate and even fall in sure markets on account of ongoing unaffordability and weakening financial circumstances.

If that occurs, we may have a scenario the place householders are overextended as soon as once more, with much less fairness serving as a cushion in the event that they fall behind on funds.

Then you might have a housing market stuffed with properties which are loads nearer to being maxed out, just like what we noticed within the early 2000s.

After all, the large distinction would nonetheless be the standard of the underlying house loans.

And the primary mortgages, which if stored intact would nonetheless be tremendous low-cost, fixed-rate mortgages.

So even then, a serious housing crash appears unlikely.

Positive, I may see the more moderen house consumers who didn’t get an ultra-low mortgage charge, or a low buy worth, stroll away from their properties.

However the bulk of the market will not be that home-owner this time round. Gross sales quantity has been low since each excessive mortgage charges and excessive costs took maintain.

The purpose right here is that we may nonetheless be within the early innings of the housing cycle, as unusual as that sounds.

That’s, if you wish to base it on new mortgage debt (borrowing) this cycle.

As a result of if you happen to have a look at the chart posted above, it’s clear in the present day’s householders simply haven’t borrowed a lot in any respect.