On October 15, 2024, Bridgeway Capital launched Bridgeway World Alternatives Fund (BRGOX), an extended/brief fairness fund that may pursue long-term constructive absolute returns whereas limiting publicity to basic inventory market threat. Utilizing superior quantitative modeling, the fund will maintain 250-300 lengthy positions and 250-300 brief positions. The portfolio is designed with a bias towards high quality, worth, and sentiment. It can in any other case be impartial as to nation, dimension, sector, and beta. That’s, it’ll shoot for a beta of zero, a internet China publicity of zero, and so forth.

The fund can be managed by a Bridgeway workforce led by Co-Chief Funding Officer Jacob Pozharny, PhD. He joined Bridgeway in 2018 and leads the agency’s worldwide and various fairness investing efforts. Jacob was previously head of worldwide fairness analysis and portfolio administration at QMA, a Prudential World Funding Administration (PGIM) firm the place he efficiently managed $15 billion, and head of worldwide quantitative fairness at TIAA-CREF the place he was accountable for about $10 billion. Reportedly his QMA workforce constantly outperformed world, EAFE, EM, EAFE small-cap, and EM small-cap benchmarks. The truth that he grew QMA property from $2.5 billion to $15 billion in seven years implies some appreciable satisfaction along with his efficiency.

The important thing can be intangible capital depth

The world, and the world economic system, have modified dramatically previously quarter century. Accounting requirements and valuation metrics haven’t; they continue to be largely rooted within the Twentieth-century financial mannequin. A half-century in the past, an organization’s most respected property – those who weighed most closely on steadiness sheets and in inventory valuation metrics – had been bodily objects: factories, machines, uncooked materials reserves, and so forth. Within the 21st century, the dominant property are principally intangible: patents, analysis packages, mental property, community results, and so on. Based mostly on outdated guidelines, intangible property weren’t measurable items whereas expenditures on creating intangibles had been marked as damaging. That’s, a analysis and growth program was seen as a drag on the steadiness sheet which contributed nothing.

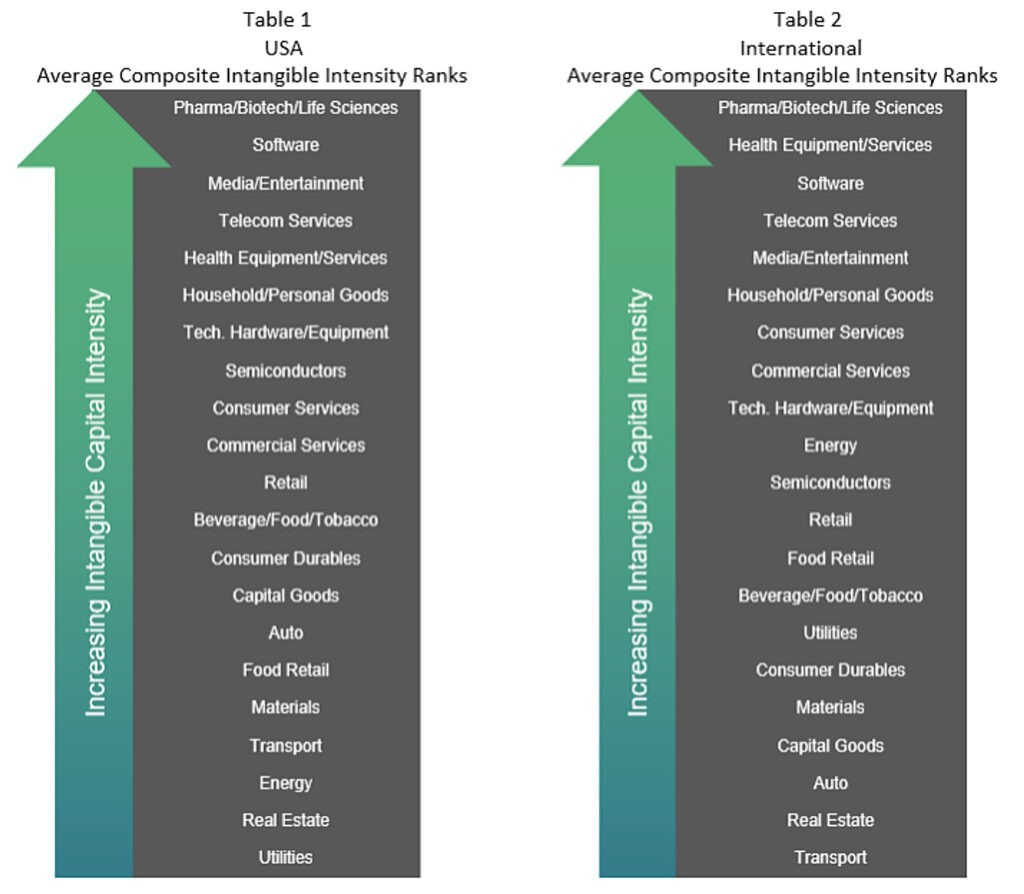

Dr. Pozharny has printed plenty of analysis on the character and significance of intangible capital on a agency’s prospects and has recognized the industries wherein intangible capital is a very powerful driver of success. That led to the formulation of Bridgeway’s Intangible Capital Depth metric. The notion is that by factoring in intangible capital, Bridgeway can higher determine enticing development alternatives and higher assess the agency’s precise inventory valuation.

Bridgeway just isn’t the primary investor to pursue intangible capital with focus and self-discipline. Guinness Atkinson World Innovators has used it to create a high-performance (prime 5% of worldwide development funds over the previous 15 years), low turnover (8%) portfolio that has drawn much less consideration than its deserves warrant.

Bridgeway, not like World Innovators, will actively brief shares. Founder John Montgomery’s evaluation is {that a} well-devised brief e-book may add much more worth than the lengthy e-book alone.

Why not run this as an ETF? Two causes. Shorting in an ETF is tough. And ETFs can’t near new traders. Bridgeway intends to shut this fund to new traders at between $100-150 million. As soon as the fund closes the technique will solely be obtainable via bigger individually managed accounts and a Bridgeway hedge fund. Each will cost greater than the 1.5% e.r. on the mutual fund.

Web site: Bridgeway World Alternatives Fund. The fund is offered at Schwab for a $2500 minimal and at Constancy.