On October 1, 2024, CrossingBridge Advisors launched CrossingBridge Nordic Excessive Revenue Bond Fund (NRDCX). The fund will put money into high-income bonds issued, originated, or underwritten out of Denmark, Finland, Norway, and Sweden. These is likely to be fastened or floating fee bonds, zero-coupon bonds and convertible bonds, and bonds issued by firms and governments. It is going to be solely managed by CrossingBridge Advisors.

The managers will search excessive present revenue, and the prospect of some capital development, throughout the Nordic bond universe. Inside that house, they function with few externally imposed constraints past a dedication to keep away from actual property and financials. The agency’s internally imposed constraint is an intense dislike of shedding their traders’ cash. The fund will hedge its foreign money publicity with one- to three-month ahead foreign money swaps.

David Sherman in his capability as CIO and Spencer Rolfe as portfolio supervisor of the fund with assistant portfolio supervisor Chen Ling. Mr. Sherman based CrossingBridge, its predecessor Cohanzick (1996), and is the agency’s Chief Funding Officer. Mr. Rolfe joined in 2017 as a distressed credit score and particular alternatives analyst, spent a stretch as Managing Director at Corvid Peak Credit score Administration, and returned to CrossingBridge in 2023. They’re assisted by Chen Ling, who has been with the agency since 2021. As of 8/31/2024, the agency manages over $3.2 billion in belongings.

Two-plus the explanation why the fund is value your consideration

Nordic Bonds as an asset class are intriguing.

The Nordic bond market is giant and mature. Terje Monsen of DNB Asset Administration, a Nordic funding supervisor with about 100 funds and $90 billion in AUM, describes the market this fashion:

The Nordic bond market has a long time of historical past with the primary credit score funds established in Norway within the Eighties. Over time the market has grown and developed right into a well-diversified and fairly liquid market, complete dimension estimated at round EUR 1500 bn.

The prime driver for the market’s development is a change within the willingness or capability of economic lending by banks. As soon as upon a time, firms trying to borrow giant sums of cash for comparatively quick intervals might organize a leveraged or floating fee mortgage from market markets resembling Donaldson, Lufkin, Jenrette (DLJ), or Credit score Suisse which now not exist. European UCITS aren’t permitted to personal floating-rate loans, which locked away one other supply of capital. A workaround was repackaging the mortgage as a form of floating fee bond issued, primarily, in Norway. David Sherman experiences that the market is rising by 30% per yr. That’s per experiences from Nordic Trustee, a supplier of European bond market knowledge and companies.

“Nordic bonds” can discuss with each bonds issued by Nordic entities and bonds issued in Nordic markets by non-Nordic entities. As a result of the Nordic markets are extra amenable to smaller-sized points – these within the $50 – 450 million vary – than the US market which higher accommodates large points, many smaller US and European debtors work via the Nordics. About one-quarter of the €60 billion Nordic high-yield market, specifically, are non-Nordic issuers.

CrossingBridge, understandably, did appreciable analysis earlier than committing to a fund devoted to this market. Key traits of the Nordic market uncovered of their analysis:

- Nordic bonds presently earn 200-400bps extra than comparable US HY bonds / leveraged loans with higher credit score high quality and fewer leverage.

- Whole returns on Nordic HY bonds are greater than on US bonds, 6.1% versus 5.5% when measured over rolling 12-month intervals

- Nordic HY bonds are modestly extra risky than their US friends however a lot much less risky than world floating fee excessive yield bonds; that latter comparability is significant as a result of Nordic bonds operate for some issuers as an alternative to a floating fee leveraged mortgage. A lot of the argument for an actively managed fixed-income fund is that managers are cognizant of and able to mitigating such volatility.

- Greater than 80% of Nordic bonds have robust covenants protecting monetary upkeep, debt issuances, and different creditor protections. Within the US, solely about 10% of loans have such covenants. That’s related as a result of many of those bonds are stand-ins for leveraged loans.

- 49% of Nordic HY bonds function floating charges, 64% have maturities throughout the subsequent three years

The market is very clear and well-regulated. As a result of the market is dominated by smaller offers and newer issuers, yields are usually greater than for comparable US points. David Sherman, in dialog, believes that default charges (excluding vitality, actual property, and financials) are usually comparable with these within the US however restoration charges are greater within the Nordic market. That’s, if an issuer defaults, bondholders get extra of their funding again there versus right here.

Lastly, the fund is more likely to be frivolously correlated with US fixed-income markets. Credit score-oriented funds typically transfer unbiased of funding grade ones anyway, and the distinctive traits of a Nordic high-yield focus, together with the distinctive nature of the issuers, is more likely to heighten that independence.

David Sherman and CrossingBridge are distinctive stewards of your cash.

CrossingBridge advises, or sub-advises, 5 open-ended mutual funds, and one exchange-traded fund. All are income-oriented, energetic, and capacity-constrained. As well as, all have top-tier risk-adjusted returns since inception.

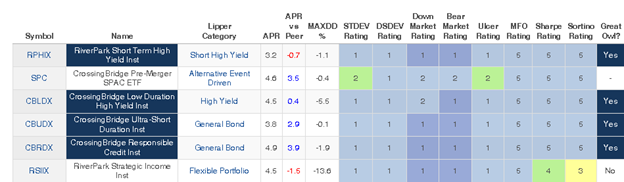

MFO Premium permits us to trace funds, together with ETFs, on an uncommon array of measures of danger consciousness, consistency, and risk-adjusted efficiency. For the sake of these not prepared to obsess over whether or not an Ulcer Index of 1.3 is good, we virtually current color-coded rankings. Blue, in numerous shades, is all the time the highest tier, adopted by inexperienced, yellow, orange, and purple. Under are all the danger and risk-return rankings for all the funds suggested or sub-advised by Cohanzick/CrossingBridge since inception.

Whole and risk-adjusted efficiency since inception, all CrossingBridge funds (via 8/30/2024)

Supply: MFO Premium fund screener and Lipper world dataset. The class assignments are Lipper’s; their validity is, after all, open to dialogue.

Right here’s the quick model: each fund, by nearly each measure, has been a top-tier performer since launch. That displays, in our judgment, the virtues of each an intense dislike of shedding traders’ cash and a willingness to go the place bigger companies can’t.

In accordance with Mr. Sherman’s testimony, he has been investing in Nordic bonds because the early years of the century, and CrossingBridge funds presently maintain $300 million in Nordic paper already, “some money alternate options, some credit score alternatives however about 80% within the Core Worth or buy-and-hold class.” That Core Worth portfolio has considerably much less leverage than its US friends, an estimated yield-to-worst of 10.28% (once more, a lot greater than within the US HY market), and an option-adjusted unfold of 707 bps, which was calculated by making use of August 31, 2024 costs to the agency’s publicly disclosed holdings of June 30, 2024. on the June 30th holdings publicly accessible making use of August 31st pricing. In addition they have restricted oil-and-gas publicity together with service firms.

NCI Advisory is an fascinating useful resource.

(That qualifies as level 5 of a cause.)

CrossingBridge has a enterprise relationship with NCI and is a minority proprietor of the agency, however NCI has no function in managing the fund. As we famous above, Mr. Sherman has each an intensive historical past in, and intensive holdings of, Nordic bonds – some ultra-short money alternate options and a few credit score alternatives, however the overwhelming majority are core worth or buy-and-hold points – in its different portfolios.

Whereas English is the lingua franca of European investing, and buying and selling might be accomplished from New York, CrossingBridge concluded that there was a compelling case for having “ears on the bottom.” There’s a six-hour time distinction between New York and Copenhagen so necessary developments may happen when markets first open in Europe however managers are nonetheless sleeping in New York. There are nuances in company communications that is likely to be caught by native audio system however missed in translation. And there’s the potential for native developments and cultural variations that merely is probably not obvious or understood by foreigners. In these and different situations, NCI’s insights are invaluable. CrossingBridge felt a strategic relationship would create an alignment of curiosity and supply to channel insights it would in any other case not obtain.

Administrative element

The fund’s minimal preliminary funding is $5,000. The web expense ratio is 0.95%.