Should you’re desirous to embark on a cruise and have accrued factors, you may not should pay in your subsequent journey.

On this information, we are going to discover methods that can assist you optimize your factors and miles to scale back the price of your cruise trip. We’ll talk about leveraging loyalty packages and the perfect methods to unlock financial savings in your cruise fare.

Listed here are the highest methods to make use of your factors and miles for a cruise.

Associated: A newcomers information to choosing a cruise line

Do you have to guide a cruise with factors and miles?

Whereas numerous choices can be found for redeeming your factors and miles towards a cruise, you will need to observe that the worth you obtain may not at all times be optimum (i.e., lower than TPG’s month-to-month valuations). Within the realm of journey rewards, there are sometimes extra profitable alternatives to leverage your factors and miles for flights or lodge stays, the place the worth and adaptability are usually larger.

If in case you have American Categorical Membership Rewards factors, Capital One miles or Chase Final Rewards factors, you would possibly be capable to get a redemption worth of 1 to 1.5 cents per level for cruises. On this case, you’d get $100 or $150 off your cruise fare by redeeming 10,000 factors. Whereas this may appear excessive, it falls quick in comparison with the worth some vacationers get when redeeming factors for luxurious inns or business-class flights.

Some cruise traces have their very own bank cards, however a number of have shaped partnerships with different manufacturers. For instance, Marriott Bonvoy members can redeem factors on Ritz-Carlton Yacht Assortment cruises at a charge of 180,000 factors for a $1,000 financial savings. Nevertheless, these associate choices are sometimes restricted and would possibly require loyalty to a selected journey model.

You possibly can at all times use factors to scale back journey bills for any cruise trip. For instance, you should use Amex Membership Rewards factors, Bilt Rewards Factors, Capital One miles, Chase Final Rewards factors, Wells Fargo Rewards factors and Citi ThankYou Rewards factors to cowl prices related to airfare, inns or rental automobiles in your cruise. This typically proves to be a greater use of your rewards.

Nevertheless, if you wish to use your accrued factors to scale back your cruise prices, listed here are numerous choices for reserving a cruise with factors and miles.

Each day Publication

Reward your inbox with the TPG Each day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

E book a cruise with bank card factors

You need to use sure bank card factors to guide a cruise. Usually, you may be required to make the reservation by means of the portal supplied by your bank card issuer, however some require calling a reserving heart. You may additionally be capable to cost the cruise to your card after which redeem your rewards for a press release credit score in opposition to some (or all) of that buy.

This is methods to guide a cruise on factors with a number of main bank card firms.

American Categorical Membership Rewards

If in case you have an eligible American Categorical card that earns Membership Rewards factors, you should use these factors to cowl the price of your cruise by means of the Pay with Factors program. With this program, you may redeem Membership Rewards factors at a worth of 0.5 to 0.7 cents per level for many journey purchases. Nevertheless, TPG values Membership Rewards factors at 2 cents every (per our January 2025 valuations) whenever you maximize this system’s switch companions, so you’ll use them at a decrease worth in the event you use Pay with Factors.

The Amex Journey portal has a user-friendly search characteristic that permits you to discover totally different cruises primarily based on particular filters reminiscent of date, vacation spot, cruise line and journey period even earlier than you log in.

To guide a cruise utilizing Pay with Factors, log in to the journey portal and do the next:

- Choose your most well-liked cruise itinerary and cabin.

- Enter your passenger info.

- When it is time to take a look at, enter your Membership Rewards-enrolled American Categorical card info and choose “Sure” to find out what number of Membership Rewards factors your account has.

- You possibly can pay for the whole cruise utilizing Pay with Factors or erase a portion of the price and pay the remainder with money.

Alternatively, you may search for the cruise you need and name 800-297-5627 to guide immediately with the Amex Journey crew over the telephone.

Associated: The perfect bank cards for reserving cruises

Chase Final Rewards

The Chase Journey℠ portal is just like Amex Journey, however the redemption worth is larger.

When reserving by means of Chase, Chase Sapphire Most popular® Card factors might be redeemed for 1.25 cents every towards journey, whereas Chase Sapphire Reserve® factors might be redeemed for 1.5 cents every.

Sadly, Chase’s reserving system would not allow you to guide cruises by means of Chase’s on-line journey portal. You may should name the reserving hotline and discuss to somebody within the cruise reservations division as a substitute.

To guide a cruise and pay with Chase Final Rewards factors:

- Discover the cruise itinerary and availability you need by means of the cruise line’s web site. If in case you have a selected cabin in thoughts, have that info helpful. Sadly, stories point out that you just can’t guide Disney Cruise Line sailings with Chase Final Rewards.

- Name a Chase journey specialist immediately at 855-234-2542, and be ready to stroll the adviser by means of the cruise line reserving web page on their finish to allow them to discover and guide the cabin and choices you need. Cruise advisers can be found Monday by means of Friday from 9 a.m. to 9 p.m. Jap time and on Saturday from 9 a.m. to five p.m. Jap time.

- Your cruise adviser will arrange the itinerary for you and, upon checkout, will ask you what number of factors you need to apply in opposition to your closing stability.

Citi ThankYou Rewards

The Citi ThankYou portal doesn’t at the moment enable cardholders to make use of their ThankYou factors as credit score for a cruise.

Capital One miles

Capital One provides extra flexibility and a extra easy redemption course of than Amex and Chase. Until you switch your miles to an airline or lodge associate, every mile is price a flat 1 cent towards journey.

Redeeming factors would not require reserving by means of a portal, releasing you as much as guide your cruise immediately with the corporate or through a journey agent to get further perks. This selection additionally helps you to pursue promotional bundle charges or reductions that may not be obtainable by means of the Amex or Chase portals.

The award redemption course of is easy: Use the cardboard when paying in your cruise bundle, then log in to your account and use the “Cowl your journey purchases” possibility to use your mileage stability as a credit score towards the full quantity you owe in your bank card assertion.

You possibly can earn Capital One miles with the Capital One Enterprise Rewards Credit score Card and the Capital One Enterprise X Rewards Credit score Card. Every has various options, so perform some research to resolve which card is finest for you.

Associated: Capital One Enterprise Rewards vs. Capital One Enterprise X: Price the additional $300 in annual charges?

E book a cruise with airline miles

You may as well guide cruises utilizing airline miles. Nevertheless, like different choices, the worth of your journey rewards is usually underwhelming. The next journey suppliers provide cruise portals that let you redeem rewards:

For instance, within the United Cruises portal, this seven-night Disney cruise out of San Juan, Puerto Rico, prices 239,143 United Airways MileagePlus miles per particular person for an inside cabin — price $3,228 by TPG’s January 2025 valuation of United miles.

In distinction, the identical room and crusing dates value simply $1,674 per particular person when paid for with money — a greater worth than with United miles.

Use factors from cruise line cobranded bank cards to guide

With cruise line cobranded bank cards, you may earn factors for purchases which you can then use to offset the price of your cruise reserving. Nevertheless, this may not be your only option for incomes and redeeming factors.

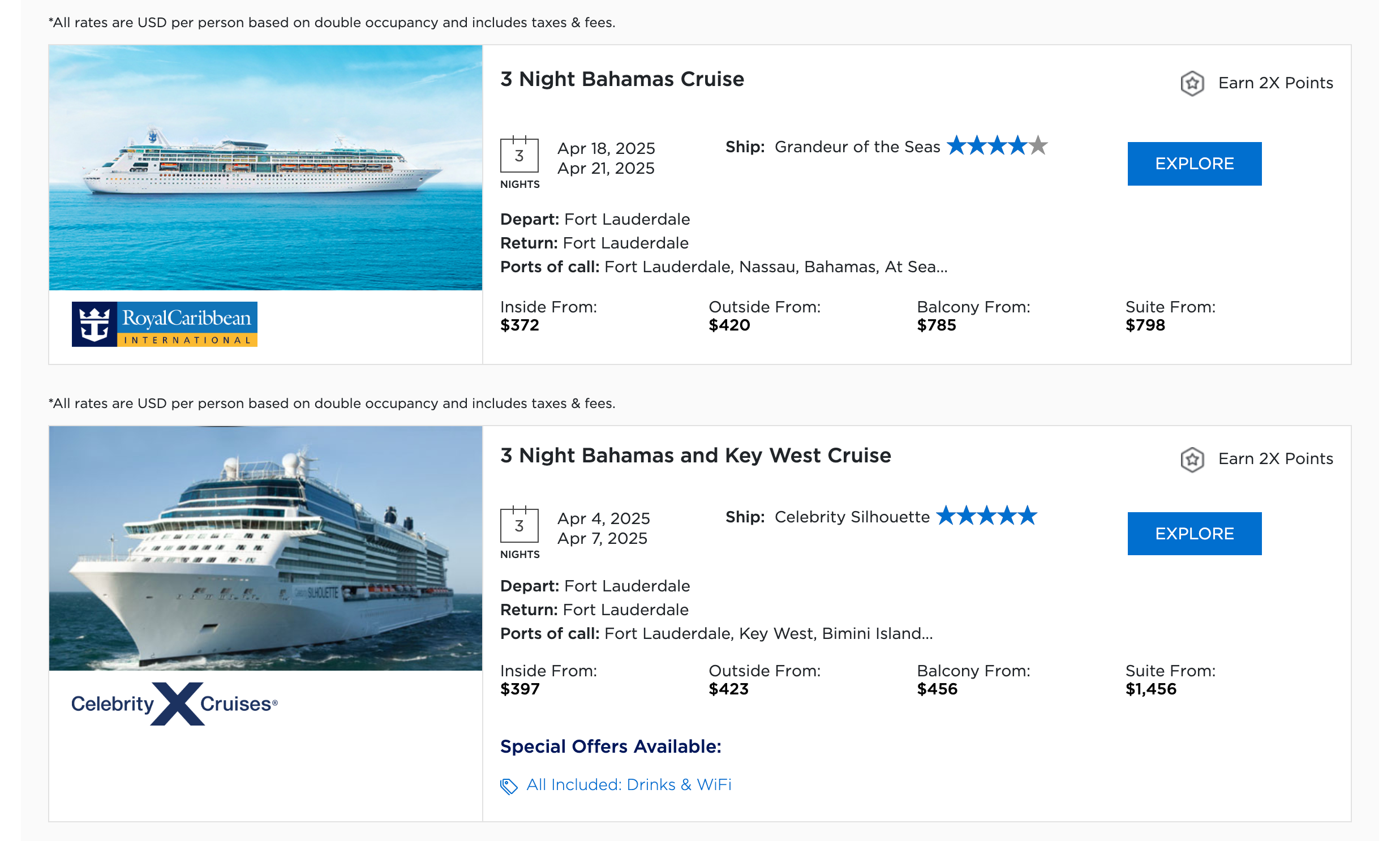

Right here, you may need to make sure you should use your factors towards the cruise fare as a substitute of solely onboard purchases. For instance, the Royal Caribbean Visa Signature® Credit score Card provides a welcome bonus of 30,000 factors after you spend $1,000 or extra on purchases inside 90 days of opening your account. Your redemption selections range.

For example, you may redeem 25,000 factors towards your companion’s cruise fare on a three- or four-night Royal Caribbean cruise (sure situations apply, e.g., might not exceed $500 in worth). Or, you may redeem 30,000 factors for a $300 low cost on a Superstar Cruises voyage. To study extra about methods to redeem MyCruise Rewards factors, try this PDF.

The data for the Royal Caribbean Visa Signature card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Redeem Marriott Bonvoy factors

In 2021, Marriott introduced that the Ritz-Carlton Yacht Assortment would take part within the Marriott Bonvoy loyalty program. Members can redeem factors on Ritz-Carlton cruises and revel in elite standing perks on voyages. Nevertheless, the redemption charges aren’t nice.

You possibly can redeem at the least 180,000 factors towards a flat $1,000 financial savings on the cruise fare. After that, you may redeem increments of 90,000 factors towards $500 in financial savings, as much as the whole cruise fare. This redemption charge is about 0.56 cents per Marriott level, effectively under TPG’s January 2025 valuation of 0.85 cents per level.

Moreover, Marriott Bonvoy’s Cruise with Factors program permits you to money in Marriott factors for credit score towards any cruise that is bookable on the Cruise with Factors web site.

You possibly can redeem factors within the following denominations, all valued at 0.4 cents per level:

- 63,000 factors for $250 off your cruise fare

- 125,000 factors for $500 off

- 250,000 factors for $1,000 off

- 625,000 factors for $2,500 off

- 1,250,000 factors for $5,000 off

To redeem Marriott factors for a cruise, name 800-596-0452.

Use factors and miles for precruise inns and flights

You would possibly maximize your factors and miles by redeeming them for flights to your departure port and precruise and postcruise lodge stays as a substitute of the cruise fare itself. You possibly can typically get greater than 1 or 1.5 cents per level with flights and lodge stays.

For instance, you can switch your Chase Final Rewards factors to United MileagePlus and get a fantastic redemption worth by reserving a flight to Miami Worldwide Airport (MIA). Should you’re an elite member or have a United bank card, you would possibly even have entry to particular member award pricing.

Or you can use 12,000 to 18,000 World of Hyatt factors or an annual Class 1-4 award from the World of Hyatt Credit score Card to pay for a room on the Hyatt Regency Orlando Worldwide Airport (a Class 4 lodge) in Florida earlier than heading to Port Canaveral the following day.

Associated: How (and why) you need to earn transferable bank card factors in 2025

Backside line

It is not at all times simple to get nice worth in your factors and miles whenever you use them towards cruise redemptions — at the least, not the best way you may with business-class flights. Nevertheless, redeeming your factors without spending a dime or discounted cruise journey is feasible.

That stated, to redeem your rewards for max worth, you need to keep away from utilizing airline miles or lodge factors for cruises. These are higher used on flights and in a single day stays.

It is a related story for bank card currencies. Capital One provides probably the most flexibility of all the foremost issuers as a result of you may guide your cruise immediately or by means of a journey agent. With a number of reserving choices, you may benefit from further perks and entry promotional charges from journey brokers and on-line retailers that are not obtainable by means of bank card portals. You might even stack these offers for added financial savings by reserving through an airline portal to earn miles.

As soon as booked, the Capital One award redemption course of is easy: Apply your mileage stability as a credit score towards your whole bank card assertion. Every mile is price a flat 1 cent towards journey, so that you at all times know the worth for comparability functions.

That is how we would guide a cruise with factors and miles to get the perfect worth.

Planning a cruise? Begin with these tales: