Andrew Walker lately had Matt Turk on his podcast the place they mentioned this concept. I usually agree, however for my very own course of, I wished to write down out my ideas as properly.

Goal Hospitality (TH) ($1.2B market cap) is a supplier of cell momentary housing (beforehand colloquially known as “man camps”) that traditionally targeted on the vitality exploration sector (about 1/4 of their enterprise at present) however during the last decade, and principally in the previous few years, TH has moved into the enterprise of housing migrants crossing the U.S. southern border. Their largest contract is an inflow care facility (“ICF”) known as Pecos Youngsters’s Heart in Texas that homes unaccompanied minors, by legislation unaccompanied minors can’t be deported instantly and efforts must be made to reunite them with relations. Throughout this time interval, which might final a number of years, the minors want affordable and secure housing quarters. There’s political danger on this enterprise, for some time there all these camps have been known as “youngsters in cages” and different politically charged phrases. However with a lot of migrants coming from destabilized locations like Venezuela, Ecuador and Haiti, the necessity for secure momentary housing would not seem like going away anytime quickly.

The oil & gasoline housing enterprise isn’t notably nice, Civeo (CVEO) is an effective comparable, many oil & gasoline initiatives require considerably extra workers (momentary residents) throughout the starting of initiatives and comparatively few are wanted throughout the upkeep intervals, placing the enterprise on the whims of commodity cycles. However with authorities contracts, contracts are usually longer in period, my psychological mannequin for the unaccompanied minors camps is extra inline with authorities contractors that present companies to international U.S. army bases in battle zones. One thing like V2X (VVX, fka Vectrus, a spin from XLS) involves thoughts, there is a steady want for occupancy so long as the necessity is there and that want sometimes lasts longer than the general public expects on the outset.

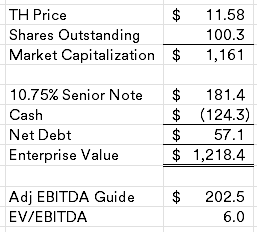

Goal Hospitality is at present pretty low cost at solely 6x EBITDA with minimal debt (administration initiatives to be in a internet money place by 12 months finish).

CVEO and VVX clearly aren’t good comps, however I’ve owned each companies within the distant previous and comply with them loosely, CVEO trades for 5x EBTDA and VVX trades for 8.5x EBITDA. Mixing the 2 primarily based on Goal Hospitality’s enterprise combine will get me one thing nearer to a 7.5x a number of or a $14.50 share worth.

TH is a former 2019 classic SPAC (earlier than all of the craziness) and remains to be 65% owned by Arrow Holdings (now TDR Capital), TDR Capital submitted a bid on 3/25/24 to buyout the minority shareholders for $10.80/share. The next day, Conversant Capital (identical agency that was concerned with Indus Realty (INDT) and at present the controlling shareholder of Sonida Senior Residing (SNDA)) popped up with a 5% possession submitting with the under disclosure:

As beforehand disclosed in its filings on Type 13F, Conversant Capital LLC has owned a considerable place within the Firm Frequent Inventory for roughly two years, within the type of shares of Frequent Inventory and choices to buy shares of Frequent Inventory. As long-term buyers within the Firm, the Reporting Individuals intently monitor developments concerning the shares of Frequent Inventory. The reporting individuals are conscious that TDR Capital LLP (“TDR”) has made an unsolicited non-binding proposal to the Board of Administrators of the Firm pursuant to which Arrow proposes to take the Firm personal by buying all the excellent shares of Frequent Inventory, apart from these already owned by any of Arrow, any funding fund managed by TDR or their respective associates. The Reporting Individuals intend to overview that proposal and another proposals made in reference to their analysis of their funding within the Firm to guage whether or not any such proposal is within the Reporting Individuals’ greatest pursuits.

In TDR’s provide letter, they’re requiring their provide obtain a majority of the minority shareholders vote for the deal, with Conversant a big and now public shareholder, they supply credible safety in opposition to a take below. A particular committee was shaped on 4/29/24 to think about the provide, the press launch additionally talked about the next:

The mandate of the Particular Committee is to think about and consider the Proposal and any various proposals or different strategic alternate options that could be obtainable to the Firm. The Particular Committee has retained Centerview Companions LLC and Ardea Companions LP as its monetary advisors and Cravath, Swaine & Moore LLP as its authorized advisor.

Appears like a full course of may very well be underway and never simply an unique negotiation with TDR Capital. If nothing comes of the method, I nonetheless assume the shares are low cost as the corporate has vaguely mentioned being within the procurement stage on a number of massive contracts together with one other ICF/unaccompanied minor location, uncommon earth mines, massive expertise initiatives, and so on. A number of of which have been described as “impactful” on earnings calls. In whole, they count on to generate $500MM in free money over the subsequent a number of years that can be used to deploy into new development alternatives which might additional diversify the enterprise mannequin, doubtlessly additional elevating the a number of.

Disclosure: I personal shares of TH