There’s numerous enthusiasm for Roth IRA conversions and Mega Backdoor Roth IRAs—and for good motive. Paying taxes upfront in your retirement accounts generally is a savvy transfer, particularly for those who’re in a mid-to-lower federal revenue tax bracket, because it permits for tax-free withdrawals sooner or later.

That stated, due to the most recent commonplace deduction quantities and revenue thresholds for paying no long-term capital good points tax, extra People now have the chance to make bigger tax-free withdrawals from their taxable brokerage accounts. For 2025, that tax-free revenue quantity is as much as $68,860 for a single individual and $126,700 for a married couple.

The overwhelming majority of People ought to have the ability to reside comfortably in retirement on $68,860 or $126,700. In any case, the median particular person revenue in our nation is about $43,000 earlier than taxes. Subsequently, do not neglect constructing your taxable investments!

This text will present you how one can earn and withdraw six figures whereas paying no taxes. I’ll additionally present a information on how a lot you need to save for retirement if these revenue ranges are ample on your wants. As I am not a tax skilled, simply an fanatic, be at liberty to problem me and share some additional insights if you’re one.

Associated: 2025 Federal Revenue Tax Charges And The New Ultimate Revenue

A Taxable Brokerage Account Will increase In Significance

For these pursuing FIRE, rising your taxable brokerage account is essential, because it generates the passive revenue you may depend on in retirement. In contrast to tax-advantaged retirement accounts, there aren’t any contribution limits, and no required minimal distributions. Moreover, you possibly can take tax-free withdrawals, as you may see under.

In the event you’re planning to retire early, I like to recommend maxing out your tax-advantaged retirement accounts every year whereas working to develop your taxable brokerage account to thrice the scale of your tax-advantaged accounts. Attaining this stability can set you up for monetary freedom. Since beginning Monetary Samurai in 2009, I’ve encountered many individuals who uncared for their taxable brokerage accounts, which in the end left them constrained.

Under is a case research displaying how a lot you would possibly intention to build up in taxable investments alongside your tax-advantaged accounts. Whereas this may occasionally seem to be a stretch purpose for some, it is my really useful framework for constructing long-term wealth. At age 50, you probably will not should pay any revenue taxes upon withdrawal with a $2.4 million web price.

Normal Deduction Limits And Revenue Thresholds For 0% Tax

To grasp how one can obtain tax-free withdrawals from taxable brokerage accounts we should first know two key components:

- The newest commonplace deduction quantities: $15,000 for singles and $30,000 for married {couples} for 2025.

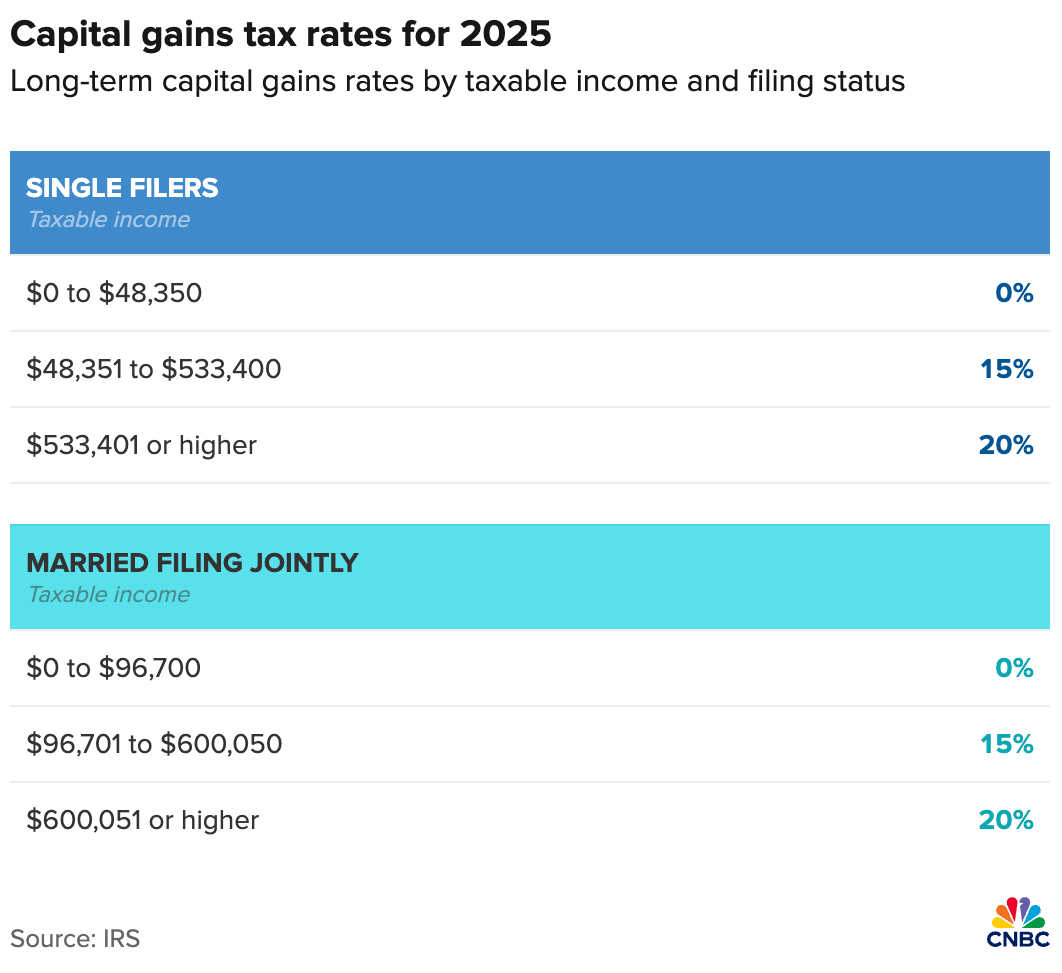

- The revenue threshold for the 0% tax bracket on certified dividends and long-term capital good points: $53,850 for singles and $96,700 for married {couples}.

By including the usual deduction to the revenue threshold based mostly in your marital standing, we are able to calculate the tax-free revenue and withdrawal limits. For 2025, these limits are:

- $68,850 for singles

- $126,700 for married {couples} submitting collectively

Nonetheless, to keep away from paying taxes on $68,850 or $126,700, the composition of your revenue is essential. Let’s illustrate this with an instance for a married couple submitting collectively. At all times verify the most recent commonplace deduction and revenue threshold quantities, as they alter yearly.

Meet Chris and Taylor – Semi-Retired And Consulting Half-time

Chris and Taylor are of their early 60s, semi-retired, and residing off a mixture of passive revenue from investments and part-time consulting work. They’ve constructed a $2 million taxable retirement portfolio throughout their working years and now concentrate on optimizing their tax scenario to reside comfortably.

How They Earn Tax-Free Revenue in 2025

- Normal Deduction

The usual deduction for married {couples} submitting collectively is $30,000 in 2025. This deduction shields the primary $30,000 of their revenue from federal revenue taxes. - 0% Lengthy-Time period Capital Features Tax Charge

The 0% tax fee on long-term capital good points and certified dividends applies so long as their taxable revenue (after deductions) stays under $96,700. - Combining the Two

By combining their commonplace deduction with the 0% capital good points tax threshold, Chris and Taylor can earn:- $30,000 in odd revenue (e.g., consulting revenue or IRA withdrawals)$96,700 in long-term capital good points or certified dividendsThis offers them a complete tax-free revenue of $126,700 in 2025.

Chris and Taylor’s Half-Time Consulting

Chris and Taylor earn $30,000 from part-time consulting—a pursuit I extremely encourage for semi-retirees or retirees to remain mentally energetic and engaged with society. This odd revenue is absolutely offset by their $30,000 commonplace deduction, that means they pay 0% federal tax on their consulting revenue.

After listening to my podcast interview with Invoice Bengen, the creator of the 4% Rule, they really feel snug withdrawing between 4% to five% yearly from their $2 million taxable portfolio. This 12 months, they promote investments, realizing $96,700 in long-term capital good points. As a result of their taxable revenue (after accounting for the usual deduction) matches the $96,700 threshold for the 0% federal long-term capital good points tax fee, they owe 0% federal tax on these good points as effectively.

Nonetheless, Chris and Taylor reside in California, the place all capital good points and dividends are taxed as odd revenue. At their marginal California state revenue tax fee, they owe $5,365 in state taxes on their mixed revenue of $126,700, leading to an efficient state tax fee of 4.23%. Not unhealthy, however one thing to contemplate.

$126,700 Tax-Free Revenue Is Equal To ~$170,000 In Wages

To stroll away with $126,700 after taxes, you would want to earn roughly $170,000 in gross revenue at a 25% efficient tax fee (together with FICA taxes), assuming no state revenue taxes. In the event you reside in states like California, New Jersey, or New York, the place state taxes considerably impression your take-home pay, you’d probably have to earn nearer to $180,000 in gross revenue to attain the identical after-tax quantity.

For Chris and Taylor to keep away from paying state revenue taxes fully on their $126,700 revenue, relocating to one of many 9 no-income-tax states—akin to Texas, Florida, or Tennessee—is one answer. Alternatively, states like Illinois, Pennsylvania, or South Carolina, which tax revenue extra favorably or exclude sure revenue sorts, may additionally present significant tax financial savings relying on how their revenue is structured.

This gross revenue comparability underscores the worth of saving and investing for retirement. Diversifying retirement funds via a Roth IRA or Mega Backdoor Roth IRA is one other efficient technique, relying how wealthy you suppose you may be.

Nonetheless, for those who anticipate staying under sure web price thresholds in retirement, the Roth IRA’s advantages could diminish, as you might obtain tax-free withdrawals from taxable brokerage accounts regardless.

$3 Million Retirement Portfolio Threshold To Begin Worrying About RMDs And Paying Taxes

One problem that some rich or frugal retirees face is the requirement to take Required Minimal Distributions (RMDs) beginning at age 73, as mandated by the SECURE 2.0 Act. These RMDs, that are handled as odd revenue, can doubtlessly push retirees into the next tax bracket.

Nonetheless, for those who do not anticipate retiring with greater than $3 million in your 401(okay) or IRA as a married couple, you’re probably secure from paying important taxes in retirement. This security comes from the commonplace deduction and the growing revenue thresholds for 0% tax on long-term capital good points. Even when factoring within the common Social Safety revenue for a few $40,000 in at the moment’s {dollars}, many retirees can nonetheless handle a comparatively low tax burden.

For singles, shoot for a retirement portfolio of $1.5 million and really feel secure from paying taxes on account of RMDs. $1.5 million is $200,000 extra from how a lot employees of their 50s stated they wanted to retire comfortably in a 2023 Northwestern Mutual survey. The retirement portfolio threshold quantities might be listed to inflation over time. However these are two simple to recollect figures if folks wish to shoot for web price targets.

RMD Instance With Little-To-No Taxes To Pay

Under is a graphical instance of a retiree pressured to take RMDs at age 73 with a $3 million 401(okay). The calculation assumes:

- A withdrawal fee of three.8%, as decided by the Uniform Lifetime Desk calculation.

- No extra contributions are made after retirement.

- An annual funding progress fee of 5%.

By the point you flip 73, the married revenue threshold for the 0% tax fee will probably be increased than the RMD quantities mentioned above. Moreover, the commonplace deduction may doubtlessly eradicate most, if not all, of your Social Safety revenue from being taxed. To decrease your RMD quantities, you too can begin withdrawing ahead of age 73 to unfold issues out.

Alternatively, for those who anticipate having retirement portfolios effectively over $1.5 million / $3 million, you’ll have a larger incentive to reap the benefits of Roth IRA conversions and Mega Backdoor Roth IRAs earlier in your profession. The perfect time to implement these methods is when your revenue is at its lowest, akin to after a layoff or throughout an early retirement part.

Abstract Of Tax-Free Withdrawals From Retirement Accounts

To realize tax-free withdrawals and revenue in retirement, retirees ought to keep inside the usual deduction and 0% tax bracket for long-term capital good points and certified dividends. In 2025, this implies conserving taxable revenue below $68,850 (single) or $126,700 (married), which incorporates the usual deduction ($15,000 single, $30,000 married) and the tax-free threshold for capital good points/dividends.

Required Minimal Distributions (RMDs) from 401(okay)s and IRAs begin at age 73 and are taxed as odd revenue. To keep away from increased taxes, restrict pre-tax account balances to $1.5 million (single) or $3 million (married), and think about Roth conversions earlier in retirement.

Social Safety also needs to be managed to keep away from taxes. As much as 85% of advantages might be taxed if mixed revenue exceeds $34,000 (single) or $44,000 (married). By balancing RMDs, dividends, and capital good points, retirees can get pleasure from tax-free revenue.

Worst case, for those who accumulate extra money than anticipated, you’ll simply pay extra taxes—not a nasty drawback to have!

Readers, do you know that People can now earn and withdraw a lot with out paying any taxes? If that’s the case, why are some folks nonetheless attempting to build up far more than $1.5 million per individual for retirement?

Suggestions To Assist You Retire Earlier

Retire early with a severance bundle: In the event you’re planning to retire early, think about negotiating a severance bundle as an alternative of merely quitting. You don’t have anything to lose. A severance bundle offers an important monetary cushion that can assist you in your subsequent journey. My spouse and I each negotiated severance offers in 2012 and 2015, which gave us the braveness to go away work behind. I’ve detailed all my methods in my e-book, Learn how to Engineer Your Layoff. The e-book is now in its sixth version.

Keep on prime of your funds: Realizing when you possibly can retire requires cautious monitoring of your investments and web price. I’ve been utilizing Empower to observe my funds at no cost since 2012, and it’s been a game-changer. Their Retirement Planner helps you calculate your money circulation and bills in retirement—an indispensable instrument for planning your future.

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about among the most attention-grabbing matters on this web site. Your shares, rankings, and opinions are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. All the pieces is written based mostly on firsthand expertise and experience as a result of cash is simply too essential to be left as much as the inexperienced.