HCL Applied sciences Ltd

HCL Applied sciences Ltd. is a worldwide know-how firm delivering industry-leading capabilities centered round digital, engineering, cloud and AI, powered by a broad portfolio of know-how companies and merchandise. The corporate caters to shoppers throughout main verticals, offering {industry} options for Monetary Providers, Manufacturing, Life Sciences and Healthcare, Expertise and Providers, Telecom and Media, Retails and Client Packaged Items (CPG) and Public Providers. The corporate generated income and internet revenue CAGR of 13% and 12% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 23% and 28% for FY 21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.08.

The corporate has secured quite a few offers throughout the US, Europe, Asia, and Africa in AI and GenAI platforms. The Complete Contract Worth (TCV) for Q2FY25 stands at $2.2 billion, with a robust mixture of shoppers from numerous sectors together with monetary companies, medical know-how, biopharma, telecom, semiconductor, and energy & power distribution. Lately, the corporate acquired Zeenea, a Paris-based software program agency specializing in knowledge catalog and governance options, additional enhancing its knowledge and analytics enterprise. Administration is optimistic that GenAI will considerably increase income streams. The strategic acquisitions and enlargement initiatives are anticipated to strengthen the corporate’s world market presence. We anticipate that HCL Applied sciences Ltd. will preserve its development trajectory, supported by its various order wins and execution capabilities.

Dangers:

- Foreign exchange Threat – The corporate has important operations in international markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

Rainbow Childrens Medicare Ltd

Integrated in 1998 and headquartered in Hyderabad, Rainbow Youngsters’s Medicare Ltd. is a number one pediatric multi-speciality and perinatal care hospital chain within the nation. The corporate is a complete supplier of pediatric and perinatal care companies providing holistic healthcare options that cowl the complete spectrum from fertility until conception, maternal care throughout being pregnant to foetal well being, new child by means of childhood care and gynecology companies. The income and internet revenue CAGR of the corporate for the previous 3 years is round 26% and 75% between FY21-FY24. The three-year common ROE and ROCE for the corporate is round 22% every for the previous 3 years. The corporate has a wholesome capital construction with a debt-to-equity ratio of 0.57.

The corporate is increasing its capability by including new beds in current amenities in addition to establishing new amenities throughout a number of areas. With an purpose to boost retail expertise inside hospital amenities, the corporate is planning to launch “Butterfly Necessities,” a specialised retail retailer for ladies and youngsters. Its operational technique and enlargement plan are aimed toward capitalizing on important alternatives within the maternity and pediatric sectors. The expansion of its hospital community has pushed income development, and we count on the corporate to take care of this momentum. With its robust market place and futuristic enterprise methods, we’re assured that the corporate will proceed to develop alongside the huge potential in pediatric and maternity care.

Dangers:

- Regulatory threat – Healthcare is a extremely regulated {industry}, and adjustments in healthcare and related insurance policies can impression money flows.

JSW Infrastructure Ltd

JSW Infrastructure Ltd. stands because the second-largest non-public port operator in India with a cargo dealing with capability of 170 MTPA and a objective to boost the capability to 400 MTPA by 2030. The corporate has 10 port and terminals amenities strategically positioned at key areas alongside the East and West coasts of India together with multi-modal evacuation channels. The corporate’s monetary efficiency is strong with a 3-year (FY21-24) income and internet revenue CAGR of 33% and internet revenue CAGR of 59% respectively, common 3-year ROE of 17% and ROCE of 15% backed by a wholesome capital construction with debt-to-equity ratio of 0.56.

The corporate has secured a number of orders from each authorities and non-government entities, each domestically and internationally, together with for railways and port operations, positioning it to fulfill its FY25 quantity development goal of 10-12%. It has additionally acquired a 70.37% stake in Navkar Company Ltd., a cargo transit service supplier. With important progress towards its long-term goal of enhancing logistics and last-mile connectivity throughout India, the corporate has set a capex steerage of Rs. 13,000-14,000 crore for the following three years. We consider the corporate is strategically positioned to profit from the rising Indian financial system, substantial infrastructure improvement, and robust cargo development potential.

Dangers:

- Business threat – A discount in financial exercise or slowdown in vital sectors could result in decreased cargo motion, probably impacting port utilization and income predictability.

Minda Company Ltd

Minda Company Ltd. is a number one auto-ancillary main catering to passenger and business autos, bikes, off-road autos and Tier 1 vehicle producers. With product portfolio spanning throughout Mechatronics, Electrical Distribution System, Inside Plastic Division, Drivers Data System and many others., the corporate has presence in India in addition to worldwide markets corresponding to Indonesia, Vietnam, Europe, Japan and Uzbekistan. The corporate has generated income and internet revenue CAGR of 25% and 35% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 15% every for FY21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.25.

The corporate is making important investments to increase its manufacturing capability. Within the first half of FY25, the full lifetime order e book surpassed Rs.4,750 crore, and the variety of patents exceeded 285, with 14 new patents filed throughout the interval. Moreover, the corporate has entered right into a know-how license settlement with SANCO (China) to enhance its wiring harness product for the electrical automobile (EV) market. To fulfill the rising demand, the corporate is establishing 4 new amenities – two in diecasting, one within the instrument cluster division, and one within the wiring harness part division. By aligning with future developments and rising manufacturing capabilities, we consider the corporate is positioning itself for long-term development.

Threat:

- Socio-economic threat – Any socio-economic instability that might lead to a rise in enter prices corresponding to uncooked materials, freight prices, and many others. would possibly negatively impression the margins and profitability.

Oberoi Realty Ltd

Integrated in 1998 and headquartered in Goregaon, Oberoi Realty Ltd. is concentrated on premium developments in residential, workplace house, retail, hospitality and social infrastructure tasks. The corporate is without doubt one of the strongest manufacturers in Mumbai Metropolitan Area (MMR). The corporate generated income and PAT CAGR of 30% and 34% over the interval of three years (FY21-24). The typical 3-year ROE & ROCE is at 14% every for FY21-24. The corporate has a robust steadiness sheet with a sturdy debt-to-equity ratio of 0.14.

The corporate has a sturdy pipeline of upcoming launches in key areas, together with two towers in Goregaon, one in Borivali, and two in Thane (Kolshet and Pokhran). Development is already underway, with work progressing on flooring 10 to fifteen. As well as, the corporate is in search of alternatives to increase past the MMR area, significantly focusing on Delhi NCR. It’s anticipated to lift Rs.6,000 crore, which is anticipated to generate a Gross Improvement Worth (GDV) of Rs.70,000-80,000 crore over the following few years. We consider the corporate will preserve its development trajectory attributable to its robust market place, environment friendly execution, wholesome cashflows, and a stable pipeline of upcoming tasks, guaranteeing clear income visibility for the longer term.

Threat:

- Macro-economic situations – Adjustments in macro-economic situations corresponding to excessive inflation, financial slowdown, excessive rates of interest and many others. may have an effect on the corporate turnover.

Doms Industries Ltd

Integrated in 2006, DOMS Industries Ltd. is a stationery and artwork product firm primarily engaged in designing, creating, manufacturing, and promoting a variety of those merchandise beneath the flagship model, DOMS. The merchandise supplied by the corporate embrace pencil and equipment, drawing, colouring and paper stationery, mathematical drawing devices, marker pens and many others. The corporate has generated a income and internet revenue CAGR of 56% and 190% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 24% and 25% for FY21-23 interval. The corporate has a robust steadiness sheet with a sturdy debt-to-equity ratio of 0.23.

With 16 manufacturing amenities throughout 4 areas supported by a community of 11,500+ staff and 4,750+ distributors, the corporate sells its merchandise throughout 50+ international locations. The corporate has accomplished the acquisition of almost 52% stake in Uniclan Healthcare, a producer of child hygiene merchandise. The corporate can be enterprise a 20% capability enlargement in mathematical instrument bins, initiatives to enhance the utilization of its third pen plant to most capability of 1 million pens per day and a 20% enhance in e book manufacturing capability. The corporate’s continued give attention to launching new merchandise and enlargement into new product classes backed by sturdy distribution community are anticipated to be key development drivers.

Threat:

- Uncooked materials value volatility – Volatility in uncooked supplies costs could have an effect on the earnings and revenue margins.

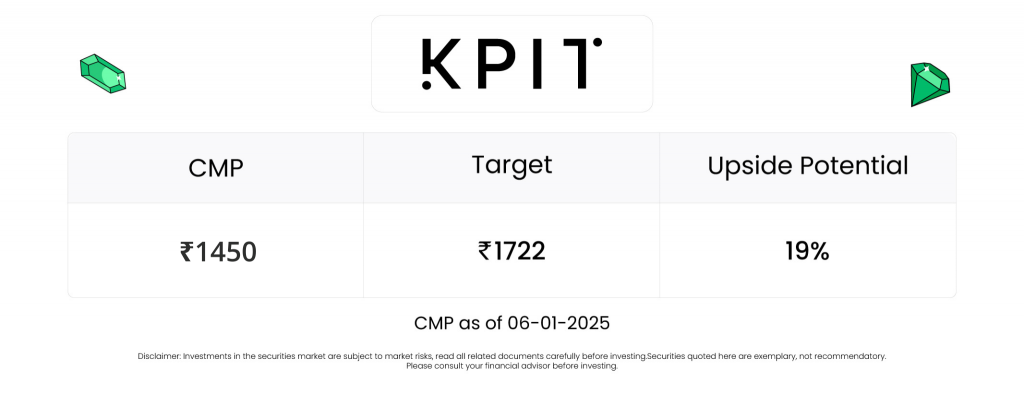

KPIT Applied sciences Ltd

Based in 2018 and based mostly in Pune, KPIT Applied sciences Ltd. is a number one software program and system integration companion for the worldwide mobility ecosystem. The corporate is a trusted collaborator for main automotive {industry} leaders, having established over 25 strategic partnerships with Unique Gear Producers (OEMs) and Tier 1 suppliers to drive mobility transformation. The corporate has generated income and PAT CAGR of 34% and 61% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 27% and 31% for FY 21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.14.

The corporate plans to spice up profitability by securing extra fixed-price tasks. Administration can be specializing in strategic partnerships and potential acquisitions to strengthen its market place. Leveraging its experience in rising applied sciences, together with deep consumer relationships and trusted partnerships, has led to important deal wins. Along with buying new offers from the prevailing shoppers, the corporate is in discussions with new shoppers from Europe and America to construct long-term massive engagements.

Threat

- Foreign exchange threat – The corporate has important operations in international markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

Aurobindo Pharma Ltd

Integrated in 1986 and headquartered in Hyderabad, Aurobindo Pharma Ltd. is an built-in world pharmaceutical firm engaged within the improvement, manufacturing, and commercialization of a variety of generic prescription drugs, branded specialty prescription drugs, and energetic pharmaceutical elements (APIs) worldwide. The corporate has generated income and PAT development of 12% and 54% over the past twelve months (TTM). The typical 3-year ROE & ROCE is round 10% and 12% FY21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.27.

The corporate launched 14 merchandise and acquired approval for 8 ANDAs throughout Q2FY25. It’s actively increasing its capacities in China and throughout product segments like Penicillin G, 6-APA, and Granulation, which is able to increase operational efficiencies and assist obtain development aims within the upcoming quarter. Penicillin G product facility is anticipated to break-even by Q4FY25 and begin contributing positively from FY26 onwards. The corporate is focusing on EBITDA margin of 21-22% in FY25. The administration is assured in sustaining development momentum, supported by elevated volumes, new product launches and steady pricing dynamics.

Threat:

- Regulatory threat – Vulnerability to regulatory adjustments, particularly scrutiny by businesses like USFDA would possibly impression operations.

Nippon Life India Asset Administration Ltd

Established in 1995, Nippon Life India Asset Administration Ltd. is engaged in managing mutual funds together with alternate traded funds (ETFs), managed accounts, together with portfolio administration companies, different funding funds and pension funds; and offshore funds and advisory mandates. It’s the 4th largest AMC based mostly on Quarterly Common Belongings Beneath Administration (QAAUM). It is usually ranked number one non-bank sponsored MF in India.

Throughout Q2FY25 (YoY comparability), the corporate’s SIP folio elevated from 71 million to 99 million, a 39% development. SIP AUM elevated by 59% YoY to Rs.13,817 crore from Rs.8,704 crore of corresponding quarter within the earlier yr. The corporate’s income elevated by 44% to Rs.5,713 million, core working revenue elevated by 57% to Rs.3,653 million and internet revenue elevated by 47% to Rs.3,601 million.

Threat:

- Regulatory Threat – Any hostile change of laws would possibly adversely impression the enterprise.

Be aware: Please observe that this isn’t a advice and is meant just for instructional functions. So, kindly seek the advice of your monetary advisor earlier than investing.

Different articles chances are you’ll like

Publish Views:

185