Firm overview

NTPC Inexperienced Vitality Restricted (NGEL) is the biggest renewable vitality public sector enterprise (excluding hydro) by way of working capability as of 30 September 2024. It’s the wholly owned subsidiary of NTPC Restricted, a ‘Maharatna’ central public sector enterprise. The corporate’s renewable vitality portfolio contains of each photo voltaic and wind energy belongings with presence throughout a number of places in additional than 6 states. The corporate has an operational capability of three,220 MW of photo voltaic initiatives and 100 MW of wind initiatives throughout six (6) states as of 30 September 2024. The corporate’s mission portfolio consisted of 16,896MWs together with 3,320 MWs of working initiatives and 13,576 MWs of contracted and awarded initiatives.

Objects of the provide

- To spend money on the corporate’s wholly owned subsidiary NTPC Renewable Vitality Restricted (NREL) for compensation/ prepayment, in full or in a part of sure excellent borrowings availed by NREL; and

- Common company functions.

Funding Rationale

- Sturdy parentage – The corporate advantages from the strong backing of NTPC Restricted, a serious built-in vitality participant with an electrical energy technology capability of 76 GW (as of 30 September 2024), spanning coal, hydro, fuel, and renewable vitality operations throughout India. NTPC Ltd brings intensive experience in executing large-scale initiatives, robust long-term relationships with offtakers and suppliers, and important monetary energy. NGEL is poised to play a vital function in NTPC’s technique to broaden its non-fossil-based capability to 45-50% of its portfolio, with a goal of 60 GW in renewable vitality capability by 2032. Moreover, NGEL additional derives advantages from NTPC by way of its expertise in environment friendly operations of energy stations, superior execution capabilities, land banks throughout India for energy initiatives, expertise of coping with State DISCOMs and many others. NGEL additionally holds the best credit standing from CRISIL, reflecting the robust credit score profile of its mother or father, NTPC Restricted.

- Established place – The corporate ranks among the many prime 10 renewable vitality gamers in India by operational capability. It boasts a considerable portfolio of utility-scale photo voltaic and wind vitality initiatives, serving each public sector undertakings (PSUs) and Indian corporates. As of 30 September 2024, the portfolio totaled 16,896 MW, together with 3,320 MW from working initiatives and 13,576 MW from contracted and awarded initiatives. The pipeline capability stood at 9,175 MW, bringing the mixed whole of the portfolio and pipeline to 26,071 MW. The corporate has 17 offtakers throughout 41 photo voltaic initiatives and 11 wind initiatives, all of that are authorities businesses and public utilities, with long-term Energy Buy Agreements (PPAs) which have a mean time period of 25 years.

- Monetary efficiency – The corporate reported income of Rs.1,963 crore in FY24 towards Rs.170 crore in FY23, a development of 1057%. The EBITDA of the corporate in FY24 is at Rs.1,747 crore, a 1054% YoY development in comparison with the Rs.151 crore of FY23. The online revenue elevated by 101% in comparison with Rs.345 crore in comparison with Rs.171 crore of FY22.

Key dangers

- Uncooked materials worth volatility – Any disruption to the well timed and enough provide, or volatility within the costs of required supplies, elements and gear could adversely affect on the enterprise, outcomes of operations and monetary situation.

- Regional focus – A significant portion of the corporate’s renewable vitality initiatives are concentrated in Rajasthan (62% as of 30 September 2024). Any important social, political, financial or seasonal disruption, pure calamities or civil disruptions in Rajasthan might have an adversarial impact on the enterprise.

Outlook

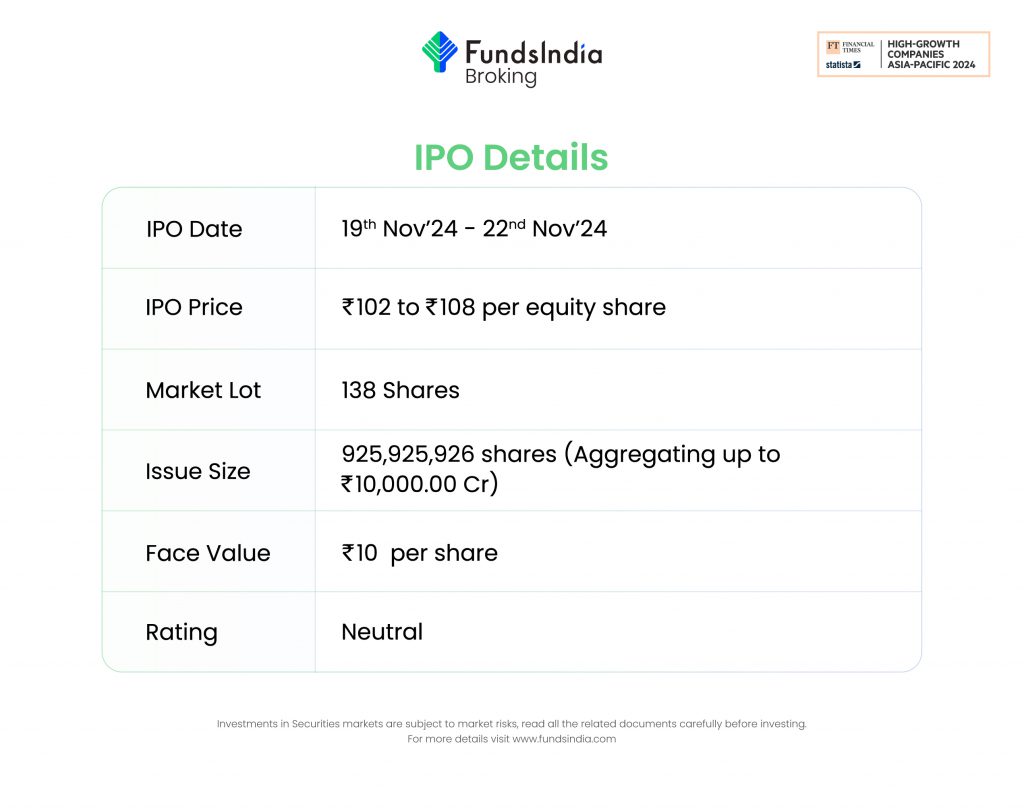

We imagine that the backing of the NTPC Group will allow NGEL to broaden its renewable vitality portfolio and set up itself as a number one inexperienced energy firm in India. The corporate’s technique to develop its mission pipeline by cautious bidding and strategic partnerships with PSUs and personal corporates, together with its give attention to rising vitality options equivalent to inexperienced hydrogen, inexperienced chemical substances, and vitality storage, positions it for important development. Moreover, the chance to contribute to the nation’s sustainability objectives additional enhances the corporate’s development potential. Based on RHP, Adani Inexperienced Vitality Restricted and ReNew Vitality International PLC are the listed opponents for NGEL. The friends are buying and selling at a mean P/E of 153.44x with the best P/E of 259.83x and the bottom being 47.05x. On the increased worth band, the itemizing market cap of NGEL can be round ~Rs.91,000 crore and the corporate is demanding a P/E a number of of 263.98x primarily based on submit situation diluted FY24 EPS of Rs.0.41. Primarily based on the above views, we imagine the difficulty is aggressively priced (learn as overvalued) and we offer a ‘Impartial’ ranking for this IPO for a medium to long-term Holding.

Be aware: Please word that this isn’t a suggestion and is meant just for instructional functions. So, kindly seek the advice of your monetary advisor earlier than investing.

Different articles it’s possible you’ll like

Put up Views:

110