The Nationwide Financial savings Schemes (NSSs) are one of many extremely popular saving schemes in India. These are regulated by the Ministry of Finance. They’re thought of to be very protected and include engaging returns.

These schemes additionally act as devices of economic inclusion particularly within the geographically inaccessible areas resulting from their implementation primarily by the Publish Workplaces, which have attain far and broad.

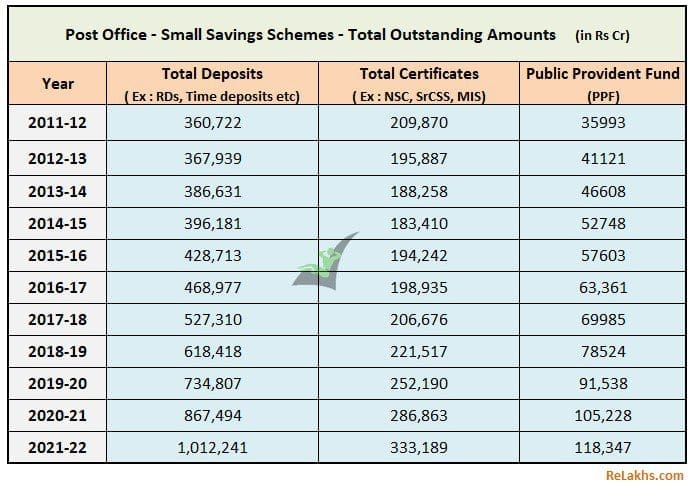

Indian households’ financial savings in Publish workplace time deposits and PPF (Public Provident Fund) have been rising steadily since 2011. Under desk give us an concept on the full excellent quantities which might be with varied small financial savings schemes.

A few of the extremely popular schemes which fall beneath Small Financial savings Schemes are as beneath;

- PPF (Public Provident Fund)

- Sukanya Samriddhi Scheme

- Month-to-month Revenue Scheme (Month-to-month Revenue Account)

- Senior Citizen Financial savings Scheme

- KVP (Kisan Vikas Patra)

- NSC (Nationwide Financial savings Certificates)

- Time Deposits &

- Recurring Deposits

Newest Publish Workplace Small Saving Schemes Rates of interest Apr – Jun 2024 | Q1 of FY 2024-25

The federal government has saved rates of interest on all small financial savings schemes unchanged April to June quarter of FY 2024-25. The most recent charges of curiosity relevant on varied small financial savings schemes for the third quarter from Apr to Jun 2024 efficient from 1.04.2024 can be as beneath;

| Saving Scheme | Charges of Curiosity from 1st Jan 2024 to thirty first Mar 2024 |

New Charges of Curiosity from 1st Apr 2024 to thirtieth Jun 2024 |

Frequency of Compouding |

Most Deposit (in Rs) |

Tenure (Years) |

| Sukanya Samriddhi Account – Woman Baby Scheme |

8.2% | 8.2% | Yearly | 1.5 Lakh | 21 |

| 5 Yr Sr.CSS | 8.2% | 8.2% | Quarterly & Paid | 30 Lakh (w.e.f. FY 2023-24) |

5 |

| PPF | 7.1% | 7.1% | Yearly | 1.5 Lakh | 15 |

| Financial savings Deposit | 4.0% | 4.0% | Yearly | No Restrict | NA |

| 1 Yr Time period Deposit | 6.9% | 6.9% | Quarterly | No Restrict | 1 |

| 2 Yr Time period Deposit | 7% | 7% | Quarterly | No Restrict | 2 |

| 3 Yr Time period Deposit | 7.1% | 7.1% | Quarterly | No Restrict | 3 |

| 5 Yr Time period Deposit | 7.5% | 7.5% | Quarterly | No Restrict | 5 |

| 5 Yr Recurring Deposit | 6.7% | 6.7% | Quarterly | No Restrict | 5 |

| 5 Yr MIS | 7.4% | 7.4% | Month-to-month & Paid | 9.5 Lakh Single A/c 15 Lakh Joint A/c |

5 |

| 5 Yr NSC | 7.7% | 7.7% | Yearly | No Restrict | 5 |

| Kisan Vikas Patra (KVP) | 7.5% | 7.5% | Yearly | No Restrict | 115 months |

- With efficient from the Monetary Yr 2023-24, the utmost deposit restrict for the month-to-month financial savings scheme is enhanced from Rs.4.5 lakh to Rs.9 lakh for a single account and from Rs.9 lakh to Rs.15 lakh for a joint account.

- The utmost deposit for senior citizen saving scheme has been enhanced from Rs 15 lakhs to Rs 30 lakhs.

- Kindly observe that rates of interest of Small Financial savings Schemes are actually reviewed and reset (if any) on a quarterly foundation.

- The revised charges (if any) are relevant for all the brand new investments MADE in the course of the respective interval. For the prevailing investments beneath all of the schemes (EXCEPT PPF & SUKANYA SAMRIDDHI SCHEME), the contracted rate of interest stays unchanged till maturity. The revised charges (if any) are relevant for all the brand new investments MADE in the course of the respective interval.

Continue studying associated articles :

(Publish first revealed on : 06-Apr-2024)