In yesterday’s submit, we concluded that rates of interest have been influenced—however not set—by the Fed. We additionally noticed that charges have been influenced—however not set—by the availability and demand of capital. We famous in each circumstances, nevertheless, that there was appreciable variance over what these two fashions indicated, which suggests there’s something else happening.

To determine what that “one thing else” is, I need to dig a bit deeper into the charges themselves. In concept, charges encompass three elements: a foundational risk-free price, which is what buyers must delay present consumption; plus compensation for credit score threat; plus compensation for inflation threat. If we use U.S. Treasury charges as the idea for our evaluation, we will exclude credit score threat (sure, I do know, however work with me right here) and are left with the risk-free price plus inflation.

U.S. Treasury Fee

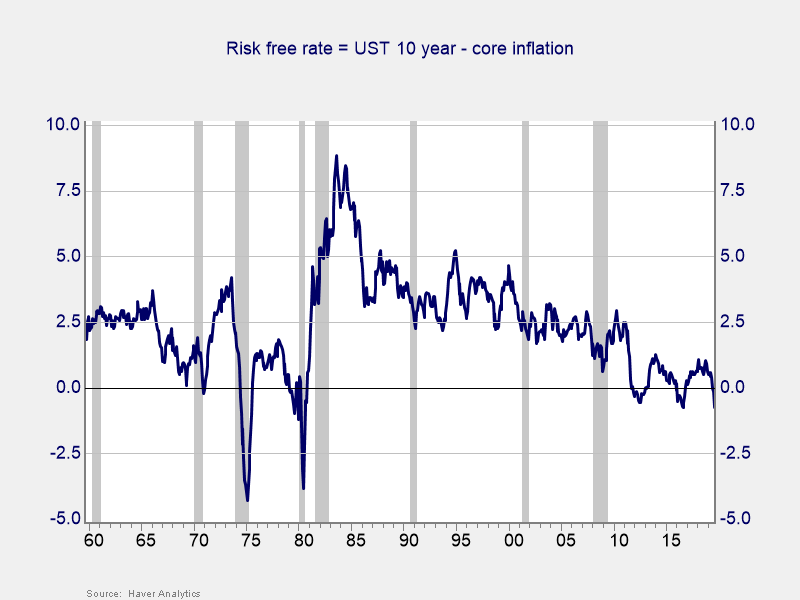

The chart beneath reveals that relationship, with charges extremely correlated with inflation. However it additionally reveals one thing completely different: past the drop in inflation, there was one thing else occurring to deliver rates of interest as little as they’re. The danger-free price, which is the hole between the 10-year Treasury price and the inflation price, has declined as properly.

Threat-Free Fee

We are able to see that decline clearly within the chart beneath, which reveals the risk-free price, calculated because the 10-year Treasury price much less core inflation. From the early Nineteen Eighties to the early 2010s, that price declined steadily. Whereas inflation went up and down and geopolitical occasions got here and went, there was a gentle lower in what buyers thought of to be a base degree of return. Lately, that risk-free price has held pretty regular at round zero.

Any rationalization for this conduct has to account for each the multidecade decline and the current stabilization round zero. It additionally has to account for the truth that we have now been right here earlier than. By analyzing charges on this manner, we will see that present circumstances will not be distinctive. We noticed one thing comparable within the late Nineteen Sixties by means of Nineteen Seventies.

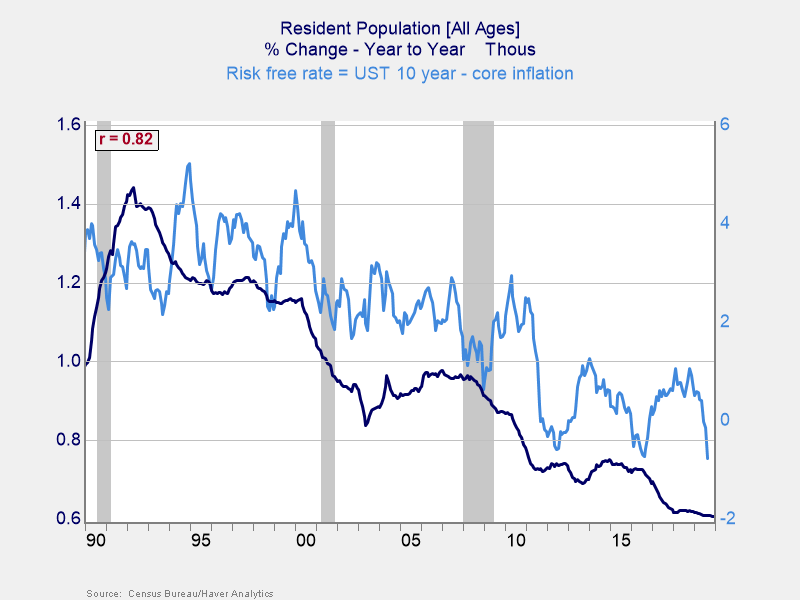

Inhabitants Development

There will not be too many components which have a constant pattern over many years, which is what is required to elucidate this type of conduct. There are additionally few components that function at a base degree to have an effect on the financial system. The one one that matches the invoice, in truth, is inhabitants development. So, let’s see how that works as a proof.

Because the chart reveals, inhabitants (particularly, development in inhabitants) works very properly. From 1990 to the current, slowing inhabitants development has gone hand in hand with decrease risk-free charges. Empirically, the info is stable, nevertheless it additionally makes theoretical sense. Youthful populations are inclined to develop extra shortly, whereas older ones develop extra slowly. A rising inhabitants wants extra capital, to construct houses, companies, and so forth. However slower development depresses the demand for capital.

This mannequin incorporates each the Fed and market fashions, nevertheless it offers them a extra stable basis. It additionally explains why charges have remained low not too long ago, regardless of each the Fed and market fashions signaling they need to rise. With inhabitants development low and prone to keep that manner, there’ll proceed to be an anchor on charges going ahead.

This mannequin additionally supplies a solution to one in every of our earlier questions, as to why charges within the U.S. are larger than in Europe and why European charges are larger than in Japan. Taking a look at relative inhabitants development, this state of affairs is strictly what we must always see—and we do. If we contemplate when charges began trending down in Europe and Japan, we additionally see that the timelines coincide with slowdowns in inhabitants development. Few issues are ever confirmed in economics, however the circumstantial proof, over many years and across the globe, is compelling. Low inhabitants development results in low risk-free rates of interest.

The Reply to Our Query

Charges are low as a result of inhabitants development is low. Charges are decrease elsewhere as a result of inhabitants development is even decrease. This example shouldn’t be going to vary over the foreseeable future, so we will anticipate decrease charges to persist as properly. This reply nonetheless leaves the query of inflation open, in fact, however that’s one thing we will look ahead to individually. The underlying pattern will stay of low charges. And that basically is completely different—if not from historical past, as we noticed above, a minimum of from most expectations.

As you may anticipate, this rationalization has attention-grabbing implications for each financial coverage and our investments. We’ll end up subsequent week by these matters.

Editor’s Word: The authentic model of this text appeared on the Unbiased Market Observer.