It’s estimated child boomers will cross down greater than $80 trillion to their millennial and Gen X heirs over the subsequent 20 years.

That is going to be the best wealth switch the world has ever seen.

The timing of those transfers shall be a hotly debated matter for a lot of households.

Child boomers had been born between 1946 and 1964, making them within the vary of 60-78 years previous. Let’s assume that places the ages of their youngsters someplace within the vary of 30-50.

The common life expectancy for somebody within the 60-78 age vary is someplace within the neighborhood of 83 to 90.1

That might imply most kids receiving an inheritance will accomplish that someday of their 60s. Clearly, not everybody shall be within the lucky place of receiving an inheritance. In case you are in that place, depend your self fortunate.

Nevertheless, some younger folks will favor to get the cash sooner slightly than later, once they have extra duties.

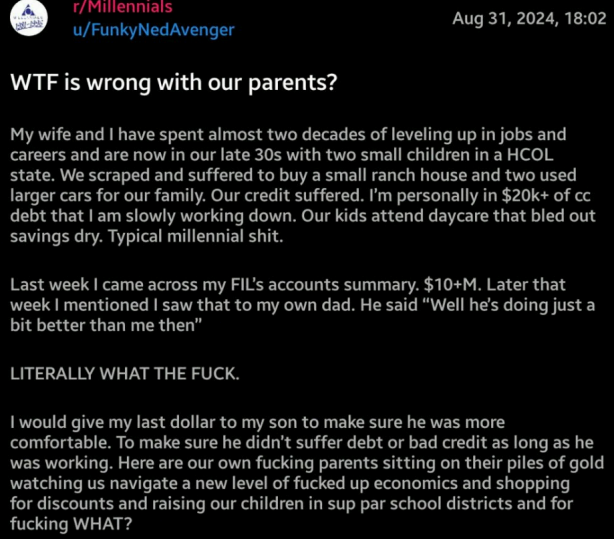

Right here’s one such instance from a Reddit publish:

This man is NOT pleased. His mother and father and in-laws have hundreds of thousands of {dollars}. He’s struggling financially and want to faucet into that inheritance early.

Look, I don’t know all the small print right here. Possibly the mother and father are blind. Or possibly this man is unhealthy along with his funds they usually’re making an attempt to show him a lesson.

Whoever you facet with on this type of factor, this story makes it clear there are some generational variations in how child boomers and millennials view household cash.

I want to share some ideas on these generational variations.

These are overgeneralizations that don’t embrace everybody from these teams however that is what I’ve noticed by my experiences with household, pals, friends, purchasers and readers in relation to cash variations between child boomers and millennials:

Child boomers. The mother and father of child boomers didn’t have almost as a lot cash. Retirement was nonetheless a comparatively new idea for the Biggest Technology. Lots of them died of their 60s or 70s as a result of they smoked and didn’t have the identical healthcare sources we have now at present.

The Biggest Technology lived by the Nice Melancholy. There have been no handouts. They taught arduous work and the worth of a greenback. Though child boomers ultimately turned customers, shortage was the mindset drilled into them by their mother and father.

Nobody actually talked about cash in household circles, and most child boomers in all probability didn’t get a lot assist from their mother and father.

To be truthful to at present’s younger folks, the price of housing, childcare, and schooling was a lot decrease again then, so folks didn’t want as a lot assist from their mother and father.

If there was any household cash, the inheritance got here when the mother and father handed away. I feel older generations view inheritance as one thing that happens after you die as a result of that’s the way it’s all the time been.

Millennials. Younger folks face greater prices than prior generations in some ways, however we additionally lead extra extravagant life.

Millennials spend far more cash than child boomers on the similar age. We drive nicer automobiles and want larger, extra opulent homes (I blame HGTV). We journey greater than our mother and father did. How many individuals do you know rising up who took household holidays to Europe? Now, it looks as if everybody does it. We additionally shell out more cash for higher expertise that makes our lives simpler. We pay up for comfort.

Millennials spend method extra on their children.

Daycare is the massive one, after all. However there’s additionally journey sports activities which isn’t low cost. Children put on a lot higher-quality clothes. I by no means had a pair of Jordans rising up. Now it looks as if each child has a number of pairs. Mother and father don’t drive a station wagon or minivan anymore. Now it’s an $80,000 SUV though we have now fewer children than earlier generations.2

Each generations have a degree.

It’s costlier for younger folks as of late however a few of these greater prices come from the truth that we’ve turned luxuries into requirements.

Child boomers might need had it simpler in some methods, however they’d their very own issues to take care of and didn’t have the identical life-style we’re accustomed to at present.

My solely answer right here is for households to speak about cash extra typically. For those who need assistance along with your funds, you must ask for assist. Your mother and father aren’t mindreaders.

If there may be an inheritance someplace down the road, child boomers ought to speak with their youngsters about it. Inform them your plans. Be clear.

Higher communication is one of the simplest ways to keep away from an offended Reddit publish by a member of the family.

Michael and I talked concerning the generational push and pull between millennials and child boomers and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Millennials Are Changing into Boomers

Now right here’s what I’ve been studying these days:

Books:

1The life expectancy for a 78 12 months previous lady is roughly 90. For a 78 12 months previous man it’s 88. For a 60 12 months previous its 85 and 83, respectively.

2I’m all the time shocked to see the automobiles teenagers drive in our space as of late. None of my pals had good vehicles after we had been in highschool. As we speak these children drive luxurious SUVs. It’s insane. Get off my garden please.