The 2020s are already midway over.

Loopy proper?!

That’s what I’m alleged to say as a middle-aged individual, even with the data that father time is undefeated.

It’s exhausting to imagine we’re 5 years faraway from the beginning of the pandemic. We’ve lived by a wild half-decade within the markets in that point.

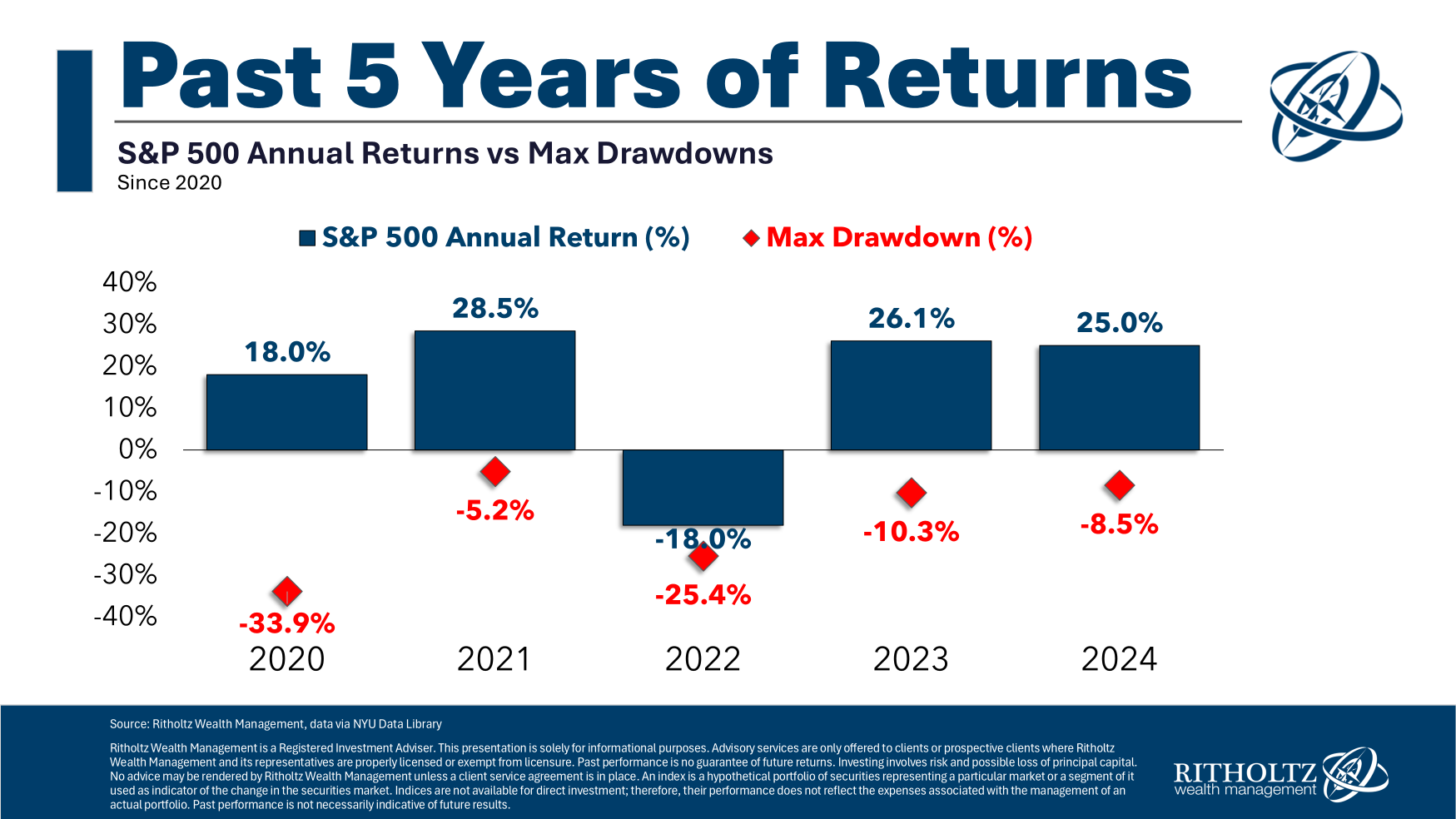

Yearly within the 2020s has seen an enormous transfer. Right here’s a have a look at the year-end returns together with intra-year drawdowns this decade:

Huge strikes throughout.

An enormous crash in early 2020 was adopted by an enormous restoration that noticed shares rise by almost 20% at year-end. Then we had a near-30% return in 2021 which was adopted by a bear market in 2022. In 2023 there was a ten% correction however the inventory market nonetheless rose 26%. A 25% achieve adopted that in 2024.

There have been no “regular” or “common” years to talk of this decade. Yearly has skilled huge swings increased or decrease and generally considered one of every.

And this five-year run adopted a +31% 12 months in 2019. 2018 completed the 12 months down 5% however there was a close to 20% drawdown to get there. And 2017 was +22%.

Volatility is usually related to losses but it surely works in each instructions. The 2020s have been full of draw back and upside volatility. Fortunately, most of it has been to the upside.

It’s simply that the cycles this decade appear to happen sooner than they did up to now.

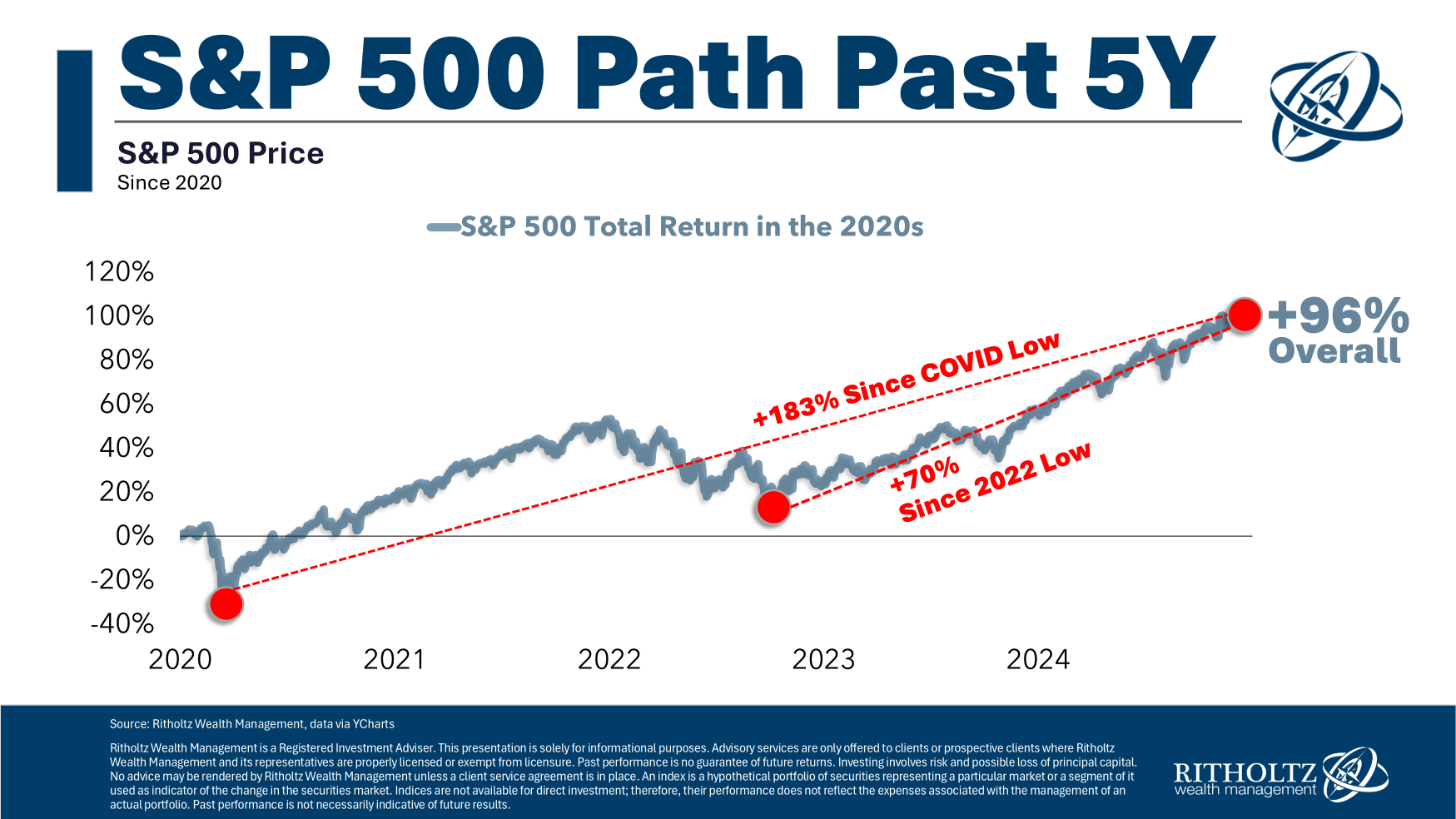

The S&P 500 is up almost 100% in whole for the last decade which is nice sufficient for 14.5% annualized returns. However have a look at the trail of the S&P 500 within the first 5 years of the 2020s:

We’ve seen huge beneficial properties from the pandemic and 2022 bear market lows. So whereas the beneficial properties this decade have been extraordinary, there have been two fantastic shopping for alternatives with a 34% crash in early-2020 and a 25% bear market in 2022.

Nobody can time these sorts of drawdowns with precision however for those who dutifully invested within the inventory market regularly you’ve made out fairly properly within the 2020s.

If you happen to put $500 a month into the S&P 500 each single month this decade you’ll have turned nearly $30,000 of contributions into greater than $45,000 by the top of 2024.

That’s ok for an IRR of greater than 17%! Not unhealthy.1

I don’t know what the remainder of the last decade has in retailer for traders within the U.S. inventory market. However with near-15% annual returns within the first half of the last decade, the S&P 500 would solely have to see 5.5% annual returns from 2025-2029 to complete the 2020s on the long-term common of round 10% per 12 months.

If you have already got a bunch of cash out there, you most likely hope returns will probably be even higher than that going ahead.

If you’ll be a internet saver within the years forward, you must hope for extra volatility and bear markets.

I’ll see you in 5 years for a post-2020s check-in.

Additional Studying:

Are U.S. Inventory Overvalued?

1Take a look at Nick’s DCA calculator right here.

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.