A month in the past, Michael and I had been speaking in regards to the epic bull market, and I requested him the place the euphoria was:

Markets had been rocking, however the sentiment didn’t match the good points fairly but.

Sentiment can change in a rush. It feels just like the election was a spark that appears to have awoken the animal spirits.

Simply have a look at some current headlines:

Look, I’m not saying that is the dot-com bubble 2.0 once more1 however there’s pleasure within the air once more for buyers. And I’m not simply speaking about sentiment surveys.

Right here’s a narrative from Bloomberg this week:

And the lede:

The “animal spirits” being set unfastened by the financial insurance policies of President-elect Donald Trump will ship the S&P 500 to 10,000 by the tip of the last decade, in keeping with veteran strategist Ed Yardeni.

To be honest going from S&P 6,000 to S&P 10,000 by the tip of the last decade is an annual acquire of round 11% per yr. Add in some dividends and we’re speaking 12% per yr or so. That’s increased than most predictions however not a grand slam by any means. Nonetheless, that’s a reasonably aggressive stance contemplating the S&P 500 is up one thing like 16% per yr for the previous 15 years.

The Wall Avenue Journal says buyers are betting on a melt-up:

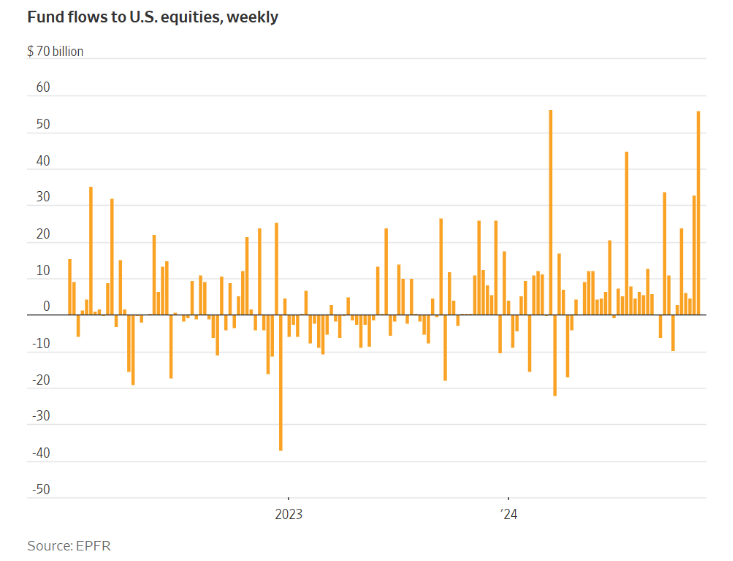

Persons are betting with their wallets:

We simply noticed the second-biggest influx to U.S. equities since 2008. We’ve been in a bull marketplace for a while now but cash simply retains coming.

One among my favourite components of studying the Journal is once they interview regular buyers. Right here’s one from this text:

Joe Johnson, 37, stated he has waded into sizzling shares together with Nvidia, Tesla and a crypto play, MicroStrategy. His portfolio has swelled this yr, and he’s feeling so good in regards to the market that he’s occupied with pouring his money pile into shares. He’s eyeing such industrial giants as Caterpillar and Deere, which he believes will profit from a robust financial system.

“I’m bullish available on the market,” Johnson stated. “The euphoria everyone seems to be feeling is warranted.”

I’d be mendacity if I stated these sorts of anecdotes didn’t make me just a little nervous.

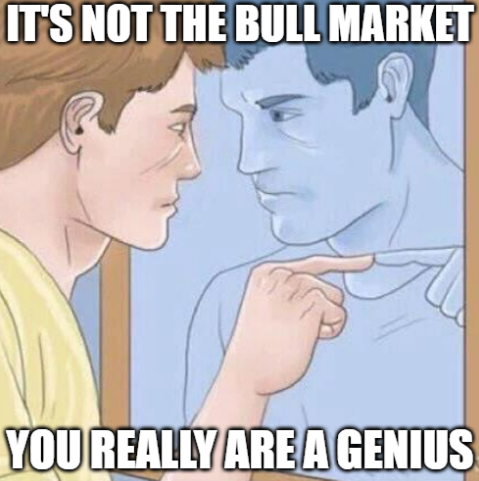

Bull markets make you’re feeling invincible. Everybody looks like a genius in a bull market.

Markets are all the time and endlessly cyclical. So are investor feelings. You by no means wish to get too excessive or too low as a result of the market may be unforgiving to those that go to extremes.

Nevertheless, I wouldn’t dare make any predictions based mostly on headlines, flows or investor actions.

Whereas it’s true the pendulum swings forwards and backwards, it could actually go a lot additional in both path than you assume. This bull market has made many clever individuals look very dumb by making an attempt to foretell when it’s going to come back to an finish.

I personally desire a bull market that climbs a wall of fear. As soon as everyone is within the pool I get just a little nervous.

Timing the market is notoriously tough however it’s in all probability not a foul time to rebalance and guarantee you might have an asset allocation in place you’re feeling snug with throughout each bull and bear markets.

And simply because the markets are getting just a little loopy doesn’t make them any simpler to foretell.

As Meir Statman as soon as stated, “The market could also be loopy, however that doesn’t make you a psychologist.”

Michael and I talked about market sentiment, ETF shopping for patterns and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

So A lot Cash All over the place

Now right here’s what I’ve been studying currently:

Books:

1But. Simply kidding. We nonetheless have a methods to go however I wouldn’t depend it out with the AI revolution coming.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.