Final weekend was ye olde county honest right here in Vermont and, in fact, we had been on the scene to cuddle cows (for those who’re Kidwoods) and look askance at cows (for those who’re Littlewoods). The county honest additionally gives a panorama of consumerism. A lot to purchase, so little time! Annoying, however a implausible alternative to observe cash administration with our kids, presently clocking in at ages 5 and seven. Fortunate for us, the county honest isn’t the one venue the place we’ve been capable of broach the thrilling matter of cash with our youngsters these days.

Annoying Cases of Child-Directed Consumerism We’ve Come Throughout Just lately:

- Museum present retailers: WHY DO THESE EXIST???

- The Scholastic E book Truthful: once more, WHY?!?

- The County Truthful: I’m much less outraged at this one, however nonetheless mildly irritated

Our Answer? Bust Out The Household Cash Philosophy

In every of those kid-directed-marketing experiences, we fall again on our “household cash philosophy,” which sounds much more formal and spectacular than it’s.

It’s truly fairly easy and transient:

Mother and pa pay for the whole lot you want, together with: clothes, shelter, toys, books, video games, healthcare, and admission to locations like museums and county gala’s. We even present meals!

You, little one, are then welcome to spend your individual cash on discretionary gadgets, together with, however not restricted to:

1. Particular snacks/meals/treats exterior of what mentioned father or mother has supplied.

A terrific instance right here is dessert at a restaurant. Mother and pa pay for the meal however it’s essential to pay to your personal dessert if you need one.

2. Trinkets and toys at such locations because the county honest and museum present store.

Mother and pa pay for admission to the museum and honest, however if you need a memento, it’s a must to purchase it with your individual cash.

3. Books from the Scholastic E book Truthful.

Mother and pa give you a home FULL of books from the library and used e book gross sales. If you wish to order one thing from the e book honest, it’s a must to use your individual cash.

These are the three essential shopper choices for our ladies since we don’t actually store anyplace besides the grocery retailer. However these three present loads of avenues for cash classes.

How Does A Child Pay for These Extras?

We provide our youngsters the chance to do chores frequently with compensation at honest market worth. Dad and mom are open to negotiation on a chore worth/chore bundle if little one feels the proffered quantity is inadequate. For instance: Kidwoods lately reduce a cope with me that if she organized the entire kitchen cupboards and drawers in at some point, I’d pay her a lump sum of $10. Deal, child.

Right here’s our present listing of chore choices (which rotate seasonally and with little one capability ranges):

- Sorting the entire clear laundry into baskets for every member of the family

- Folding the entire clear towels, rags, and so forth

- Placing away mother and pa’s laundry (Kidwoods is superb at this and I’m prepared to miss the often mis-filed shirt for the comfort. We did lose an individual’s ski sock for a number of weeks earlier than discovering it was within the cleansing rag field, so this isn’t an ideal system, nevertheless it’s adequate. )

- Accumulating the entire trash in the home

- Sorting the recycling

- Organizing drawers, cupboards, the pantry, the tupperware, and so forth (Kidwoods is a pure organizer and excels at this, though the draw back is that she then scolds members of the family who don’t preserve it organized. I’ve identified to her that that is truly job safety)

- Cleansing that I don’t usually hassle to do (washing the outside of kitchen cupboards, washing home windows, and so forth)

- Dishes: washing, placing away, loading of dishwasher, and so forth

- Miscellaneous chores that crop up

Chores are solely paid if the job is finished to completion and with minimal grownup help. For instance: you can’t empty the home trash cans however spill 40% of the contents on the steps and declare mission completed. It’s important to return to the scene of the incident and choose up every particular person trashlette you dropped. Only for instance.

Our ladies undergo phases with chores–some Saturdays find yourself being a chore dash and the women clear out my pockets. Different days, nobody desires to do any chores for any worth at any time in anyway. That is superb, however the ladies are conscious that not doing chores = no spending cash for them.

Every day Unpaid Work

Our youngsters even have each day unpaid chores, that are simply a part of life in a household. These embody issues like: placing away your individual laundry (I solely pay them in the event that they put away MY laundry), accumulating eggs from the chickens, taking out the compost buckets, cleansing their rooms, making their beds, cleansing up their toys and ephemera, clearing the desk, and so forth. The differentiation is between chores they do to assist themselves (corresponding to placing away their very own laundry) and chores that assist the household (corresponding to organizing the kitchen cupboards). They receives a commission for the latter however not the previous. I all the time surprise if I’m utilizing latter and former accurately… Right here’s hoping I did.

Cash Training: Begin Tremendous Easy & Tremendous Fundamental

I view our youngsters’ monetary training as a scaffold–I’m not instructing them about investing for retirement but as a result of that’s too summary for a 5 and a 7 12 months outdated. As an alternative, I’m instructing them depend totally different denominations of cash, learn costs on gadgets, comparability store and work for cash. My husband and I’m going out of our option to clarify the rudimentary idea of how cash works in our society. We regularly reiterate the next:

Mama works and is paid cash for her work. She then makes use of that cash to purchase the issues that we’d like and wish for our household, corresponding to groceries, garments and toys.

This is as simple as to appear ridiculous, however I inform you, it’s revelatory for a kindergartener. Children don’t go round interested by the truth that adults are paid to do their jobs. Nor do they contemplate {that a} automobile filled with groceries represents a sure variety of hours labored. By breaking down this equation for them, we’re working to demystify and simplify this bizarre grownup world of cash. These tremendous primary explanations additionally take away judgement, bias, stress and anxiousness round cash. We’re simply laying out the info in order that our youngsters perceive how the world operates.

Loads of dad and mom concern that speaking about cash is inappropriate for teenagers or that it’ll trigger youngsters to be concerned in regards to the household’s wellbeing, nevertheless it’s all in how and what you share. There’s no want for my husband and I to carry the women into our investing methods at this stage simply as there’s no must put the burden of constructing a family price range on them (but).

I do know that is sinking in on some degree as a result of Kidwoods lately introduced me with a “e book” she’d written about my job. I generally let her learn a e book in my workplace whereas I work in order that she has some sense of what I do after I’m in right here typing away at my keyboard. The salient components of her e book learn as follows:

“…her job is to assist different individuals with their cash. She does numerous conferences. The conferences are very boring. However they’re actually essential. They drink espresso and tea. They’re critical however type.”

She nailed it. Though I’d disagree with the evaluation that my conferences are “boring”…

Typically, I’m making an attempt to demystify cash for the youngsters and assist them view it as what it’s: a instrument. Cash is just not standing, self-worth, emotional wellness, happiness or contentment. Cash can definitely be used to purchase these issues–to an extent–nevertheless it’s only a instrument like every other. Train, good meals, sleep, water, security–these are additionally instruments that may provide help to obtain these desired ends.

You Are Accountable For Your Personal Cash

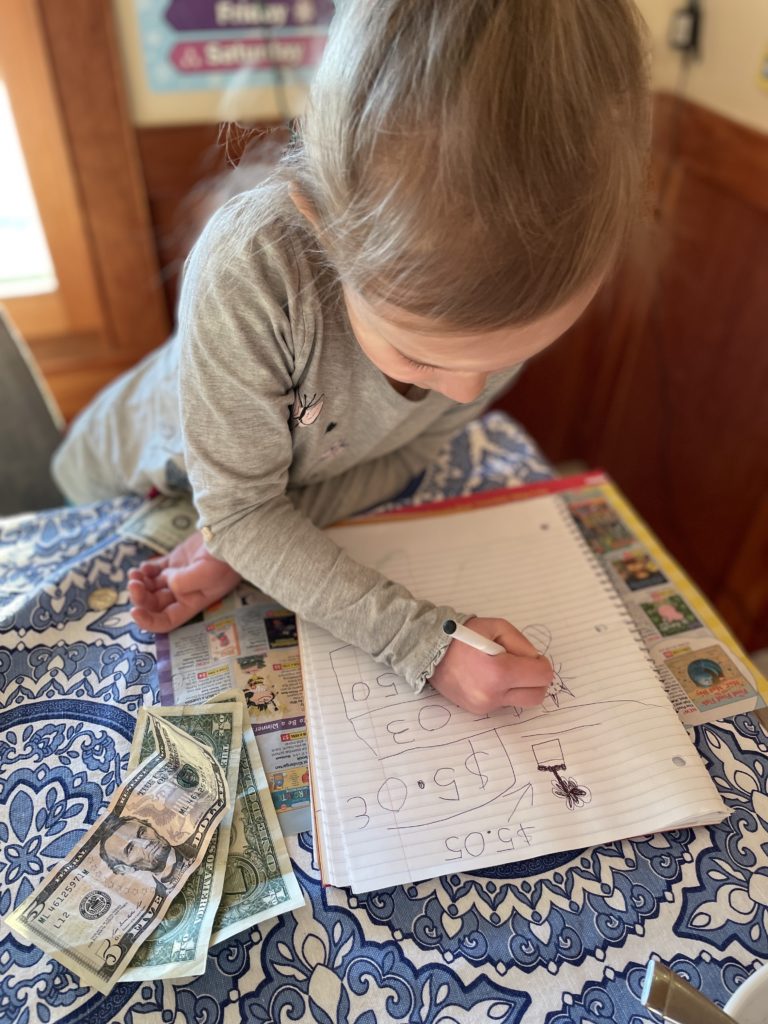

One other pillar of those early cash classes is the truth that our youngsters are answerable for conserving observe of their very own cash. The ladies every have their very own pockets and purse, through which they (are imagined to) retailer the proceeds from their chores. Kidwoods (at 7) is best at this than Littlewoods, however each are getting the dangle of the concept cash shouldn’t be stuffed into the underside of your stuffy basket. Or within the memorable occasion of my good friend’s son: crumpled up and thrown into the trash.

If You Need to Spend Your Cash, You Have To Bear in mind to Convey Your Cash

Mother and pa don’t preserve your cash for you, nor do they preemptively carry your cash locations for you (except you particularly ask us to take action). That is one thing we’re nonetheless engaged on and there’ve been fairly a number of tears over forgotten wallets. I would like the women to take full possession over their cash and do not forget that if we’re going someplace just like the county honest, they could need to carry their cash.

You can also’t lose your pockets. We had a close to crisis-level incident on the science museum present store earlier this summer season when Kidwoods misplaced her pockets. She’d gotten herself this far: earned the cash, put it in her pockets, remembered to carry her pockets together with her after which, proper in the mean time of buy, misplaced it. I had her go as much as the cashier to ask if anybody had turned in a shiny pockets with hearts on it and, lo and behold, they’d. Tears of aid flooded her tiny face and she or he gulped them again in an effort to buy the butterfly ring she’d spent roughly 3 hours choosing. This close to whole loss freaked her out however once more, supplied us with an ideal real-life instance of the significance of conserving observe of your stuff. She requested the way you get your a reimbursement for those who lose it and I needed to clarify to her that, typically, you don’t.

Why I Let Kidwoods Go Into Debt: You Can Solely Spend What You Have

That is maybe the hardest lesson of all and a lesson that numerous adults nonetheless battle to internalize. Eventually 12 months’s county honest, there have been inflatable unicorns on the market. Kidwoods fell deeply in love with a turquoise one and was adamant that she needed to spend her cash on this plastic horse with a horn. Because it turned out, the unicorn was $13 and she or he solely had $9. I advised her I used to be prepared to pay the additional $4, however that she’d should work off her debt. She agreed and clutched her unicorn with glee. As soon as house, the fact of “work off your debt” started to sink in. I defined that, since she was in debt, chores-for-payment weren’t non-compulsory till she’d re-paid the $4 I’d lent her. Chores had been now required. After a strong hour of labor, she remarked:

“It isn’t enjoyable to do chores to earn cash for one thing I’ve already purchased. This can be a lot of labor and I’m not getting something!”

This was, once more, a really primary lesson: don’t spend extra money than you could have. But it surely’s one thing youngsters should expertise for themselves. I allowed Kidwoods to enter debt as a result of I needed her to know the sensation she articulated above–that it stinks to work to pay for one thing you’ve already purchased. Me explaining debt to her within the summary would do nothing to assist cement this visceral understanding for her.

This occurred over a 12 months in the past and neither lady has gone into debt since. I’m not saying they gained’t ever go into debt sooner or later and I’m sure this lesson will should be repeated through the years. And that’s superb as a result of I feel permitting youngsters to enter debt exemplifies the essential parts of:

- Begin with very primary cash ideas

- Let youngsters expertise all steps of the method–optimistic and damaging–themselves

- Enfranchise youngsters to earn and spend their very own cash on no matter they need:

- They won’t have as a lot buy-in if it’s your cash

- Dad and mom appear to have an limitless font of cash and except youngsters have to make use of their very own cash, it’s a meaningless train for them

Plan Your Spending

Based mostly on this unicorn-induced debt expertise, Kidwoods is now far more conscious of how a lot cash she has and the way a lot she’s prone to want for any explicit spending sojourn. Over the summer season, we periodically went to pizza evening at a close-by farm the place we–the dad and mom–bought pizza for everybody to eat. The farm additionally sells desserts, however the dad and mom weren’t going to buy any. Kidwoods determined she’d begin shopping for her personal desserts. She knew the worth of the dessert (mercifully it by no means modified and was all the time $7) and she or he knew she’d share it together with her sister.

Initially, Kidwoods paid for the dessert herself and shared it with Littlewoods. After a number of weeks, nevertheless, Kidwoods identified that she was incomes and spending all of her cash on a dessert that was additionally benefiting Littlewoods. Not having a leg to face on on this argument since she had certainly been consuming half of those desserts, Littlewoods agreed they may cut up the worth. A secondary disaster ensued when Kidwoods famous that $7 can’t be divided evenly. A terrific alternative to re-visit counting coin denominations! We additionally had the women go as much as the counter to order their very own desserts, pay for them and produce them again to the desk by themselves.

In all of those cases, I’m making an attempt to enfranchise our youngsters to handle every step of the method on their very own:

Incomes cash, saving cash, planning purchases upfront, after which executing the acquisition in actual life (as independently as potential).

Up Subsequent: A Financial savings Account!

What we’ve but to convey to them in a significant method is the idea of long-term financial savings. My subsequent cash lesson plan is to open up a Financial institution of Parental Models that may pay curiosity on their financial savings. To this point, the women spend nearly the entire cash they earn, which is okay. They wanted to first be taught these very primary parts of incomes, counting cash and spending. Now, I feel Kidwoods is able to study rates of interest and some great benefits of saving. I’ll let you know the way it goes!