At Tidal … The ETF Masters: Launch, Handle, and Develop Your ETF. We’re an award-winning, full service ETF platform managing 183 ETFs in partnership with 68 issuers and answerable for $29bn+ AUM. Construct Your ETF.

At ETF Architect … Wish to simply create an ETF? Construct, launch, and handle it with us. An Inexpensive, Turnkey, and Clear White Label ETF Platform. Find out how we’ve helped revolutionary companies create new ETFs, convert individually managed accounts (SMAS), mutual funds, and hedge funds into ETFs, and faucet the ability of our platform to decrease prices and streamline operations for current ETFs. Create Your ETF. (Right here’s a wonderful presentation.)

At ETC … ETF-in-a-Field™. Our turnkey platform supplies the whole infrastructure wanted to rework your funding thought right into a stay technique. Work with our skilled crew to carry your ETF to market in as little as 3 months. Let ETC deal with all the small print when you construct curiosity in your mental property and establish capital to fund your ETF thought. We’re prepared to assist launch your ETF. Get Began.

These companies have every seemingly leveraged their expertise in creating their very own ETFs. I do know that for a truth with ETF Architect, which is run by Wesley Grey and the great of us at Alpha Architect. They then supply different cash managers the chance to carry revolutionary funding methods to market, however with out these managers needing to ascertain their very own advisory agency or registered funding automobile.

So, in precept, some actually sensible individuals who simply wish to give attention to their methods and never the executive and advertising and marketing points of the ETF market have a “turnkey” channel to take action.

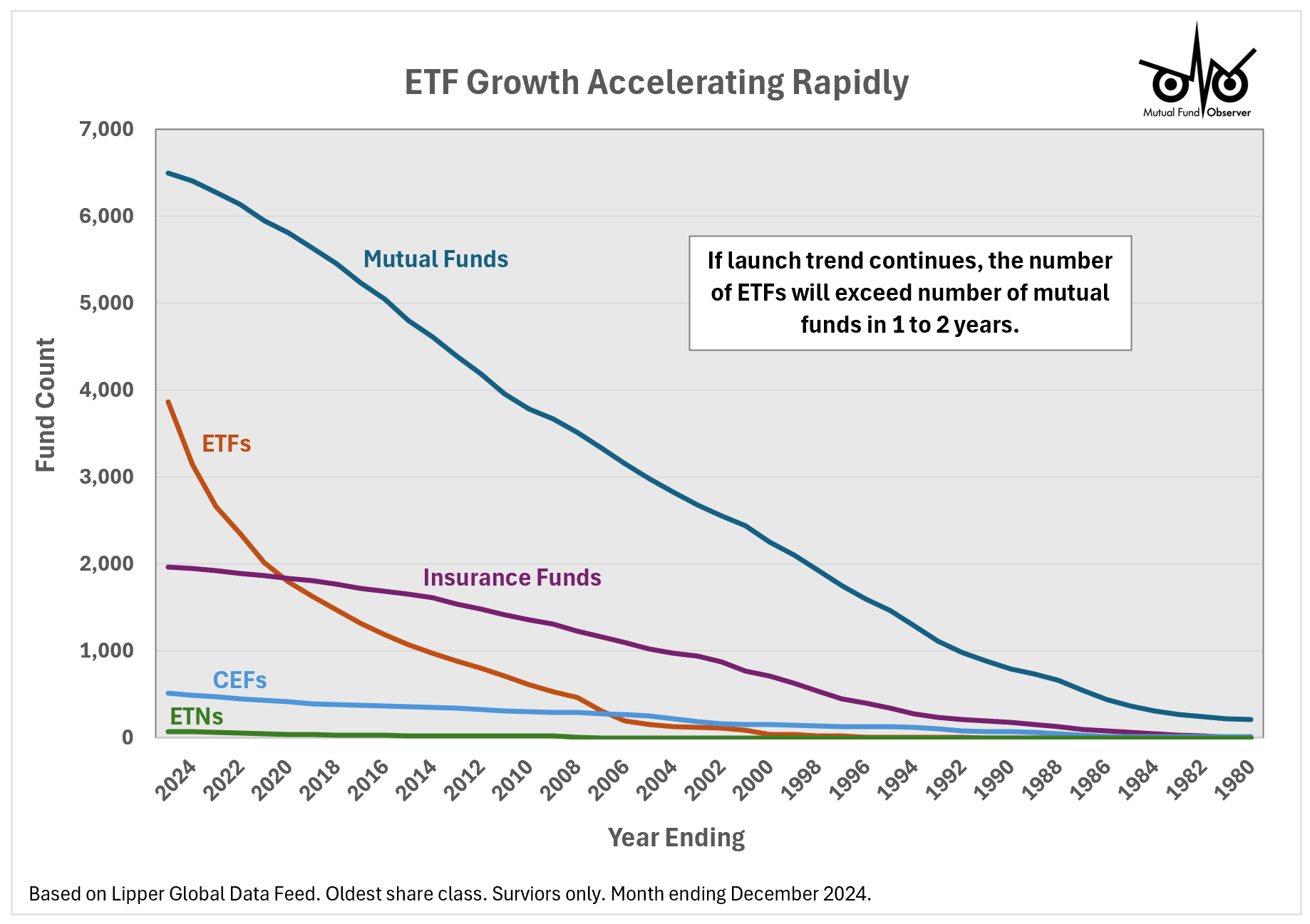

Then again, as we begin the brand new yr, there are about 3900 ETFs provided in US markets, or 100 greater than a month in the past and 600 greater than a yr in the past. Like wineries within the Paso Robles area of California’s central coast, anyone that may begin a vineyard does. What number of wineries do we’d like? As might be inferred from the graph beneath, if the launch pattern continues, the variety of ETFs will exceed the variety of mutual funds in 1 to 2 years. What number of ETFs do we’d like?

Morningstar experiences that in 2023, whereas 400 energetic ETFs have been launched, 100 closed, or 25%. The common life span for an energetic ETF was lower than 3 years, about half so long as passive ETFs. Clearly, the competitors is fierce, and in contrast to household wineries which run extra on pleasure than revenue, ETFs will shut in the event that they fail to draw belongings underneath administration. I think the ETF failure price will solely improve given the low price of entry. And what occurs when a fund closes? As Schwab experiences, a failed ETF is extra of an inconvenience than a major threat. Maybe likened to a referred to as bond. However between potential tax implications and price-to-NAV spreads given a run on an ETF, I think it’s not one thing any investor needs to expertise.

One other facet of the burgeoning ETF market is knowing who is definitely answerable for the technique? Whereas Empowered Funds LLC is listed as “The Advisor” for all 63 Alpha Architect ETFs, the funding crew correct solely manages eight (all with Alpha Architect of their fund names). Equally, the administration firm, metropolis, and state all present “Empowered Funds LLC, Havertown, PA.” However the folks really behind these methods are various: from Bridgeway to Analysis Associates to Cambria. What to name these of us varies as nicely. Generally they’re referred to as “subadvisors.” Generally “sponsors.” Generally “associates.” Generally there isn’t a identify or agency in any respect! Till you dig into EDGAR filings.

Ditto for the consolidating mutual fund market. When Natixis buys up Oakmark, however doesn’t rebrand the funds Natixis, ought to the “Fund Household” be referred to as Oakmark or Natixis? Ditto when Franklin Templeton buys up BrandywineGLOBAL, Clarion, ClearBridge, George Putnam, K2 Various and Martin Currie. Or when AMG acquires Harding Loevner, Parnassus, SouthernSun and Tweedy Browne.

Many fund homes established within the 1980’s, 1990’s, and 2000’s have already or are certainly being acquired. MFO really maintains its personal fund names record to assist distinguish who owns whom, however as you may see it’s more and more troublesome to maintain monitor. On the finish of the day, MFO tries to assist traders and advisors distinguish which funds or fund households are standouts, mediocre, or to be critically averted. David typically states that 80% of funds may disappear tomorrow and no person, besides the fund managers, would discover. They’re both redundant or inefficient or each.

To assist higher decipher, maybe just a bit, we’ve revamped the fund naming and fund household methodology on MFO Premium to try to focus extra on the folks implementing the technique and never the last word proprietor or mum or dad. We’ve additionally added “Fund Mother or father” and “Fund White Label” along with already established “Fund Household” and “Fund Subfamily” (e.g., Virtus KAR and Morgan Stanley Counterpoint International) metrics to MultiSearch, our foremost search instrument, and the MFO Fund Household Scorecard.